Best Reverse Mortgage Lenders

Updated:

Retirement Living takes an unbiased approach to our reviews. We may earn money when you click a partner link. Learn More

We evaluated 20 well-known reverse mortgage lenders, and after careful review, identified the seven best reverse mortgage companies in 2024.

- Great Closing Speed

- 30-day Turnaround

- Online Calculator

American Advisors Group puts its sole focus on reverse mortgage lending, so it’s focused on helping you access your home’s equity.

- Great Rates

- A+ BBB Rating

- Quick Closing

Community First National Bank offers personalized service for reverse mortgages and quick closing. The company offers FHA-backed Home Equity Conversion Mortgage and offers various fund distribution schedules.

- Great Mobile App

- Emphasis on Consumer Education

- 4 Reverse Mortgage Loan Options

Mutual of Omaha Reverse Mortgage is committed to educating customers to help them find the right loan for their needs. Consumers can learn about reverse mortgages and apply for a loan using the ground-breaking mobile app or the website.

- Great Guarantee

- Liberty Iron Clad Guarantee

- Online Application Process

Liberty Reverse Mortgage specializes in reverse mortgages, funding more than $7.5 billion in loans since its inception. It offers two types of reverse mortgage loans: standard HECM and HECM for Purchase.

- Great Service

- Excellent Customer Reviews

- Competitive Pricing

As a member of the National Reverse Mortgage Lenders Association (NRMLA), Finance of America Reverse has retailers licensed in 43 states and a wholesale division licensed in 42 states and Puerto Rico.

- Great Online Quote

- Detailed Online Quote Estimator

- 45-Day Close

Longbridge Financial offers HECMs, HECMs for Purchase, and jumbo reverse mortgages (known as the Longbridge Platinum program) up to $4 million. Get an estimate and close within 45 days of applying.

Reverse Mortgage Assist

- Great Tool

- Compare Quote for Multiple Companies

- Easy Information Quiz

Since 2018, Reverse Mortgage Assist has been helping customers connect with lenders to find the best rate for their reverse mortgage.

Movement Mortgage

- Great Nationwide Availability

- Can Speak With a Loan Specialist in Person

- A+ BBB Rating

Movement Mortgage offers HECM and HECM for Purchase reverse mortgages for homeowners who want to turn equity into cash to meet retirement needs. The company prioritizes high-quality service and lends in all 50 states.

Reverse Mortgage Company Reviews

American Advisors Group Review

Great Closing Speed |

American Advisors Group (AAG) excels in making funds quickly available, usually within 30 days from application submission to close. Not every applicant will get their reverse mortgage right away, but many of AAG’s satisfied customers mention fast closing times in their reviews. (One customer said the process from the first inquiry call until closing took about six weeks.)

AAG was acquired by Finance of America Companies (Finance of America Reverse) in 2023, effectively consolidating two of the leading providers of reverse mortgage loans. Prior to its merger, AAG’s sole focus on reverse mortgage lending is why it ranked as the number one reverse mortgage lender in the country, according to data from the Department of Housing and Urban Development. Customer reviews praise AAG’s educational resources and prompt service. The lender sources expert advice from community bankers, credit unions, retirement planners, and mortgage professionals to help its customers transform home equity into supplemental retirement income with the best possible financing.

- Loan amounts: up to $4 million

- Loan types: HECM, HECM for purchase, jumbo reverse mortgage, single-purpose reverse mortgage, and refinancing loans

- Credit score: 580

- States served: All states except MA

We requested a free info kit on AAG’s website and were pleasantly surprised at the number of educational resources made available to us. In addition to receiving a reverse mortgage eBook, we also got a guide tailored to children and caregivers with helpful tips on discussing reverse mortgage options with loved ones. We found this very helpful because getting a reverse mortgage is often a family decision that impacts the lives of spouses and heirs for years to come.

AAG is not very forthcoming about the fees associated with its loans, which makes budgeting for the reverse mortgage tough. However, it does offer an online calculator so you can get an idea of the loan amounts you qualify for. We tested this feature and found its calculator to be the simplest and fastest calculator in the bunch. Simply estimate your home’s value, add the age of the oldest homeowner, and list your current mortgage balance to get a loan estimate in seconds. This feature is great for homeowners and family members who are conducting initial research on reverse mortgages

Read our comprehensive American Advisors Group (AAG) review for more information.

Community First National Bank Review

Great Rates |

Community First National Bank offers the FHA-insured Home Equity Conversion Mortgage (HECM), which is the most common reverse mortgage. You can apply for a reverse mortgage loan at Community First National Bank by visiting a local branch, calling a representative, or filling out an online contact form.

- Loan amounts: up to $4 million

- Loan types: HECM, jumbo reverse mortgages

- Credit score: Not disclosed

- States served: Not disclosed

Community First National Bank has also earned the most customer reviews on Retirement Living—all of which are five stars. Customers praise this business for efficiency, professionalism, and kindness throughout the reverse mortgage process.

Read our full Community First National Bank review to learn about its reverse mortgage offerings.

Mutual of Omaha Reverse Review

Great Mobile App |

Mutual of Omaha offers four reverse mortgage solutions with no monthly payments. It streamlines the application process by offering a mobile app where you can upload photos and documents, as well as communicate with family members, financial advisors, and HECM specialists.

- Loan amounts: up to $4 million

- Loan types: HECMs, HECMs for Purchase, HomeSafe (jumbo reverse mortgages), refinancing loans

- Credit score: No minimum

- States served: All states except NY and WV

The information on the website is pretty generalized and lacks specifics on reverse mortgage fees, qualifying statistics, and who to contact to start the loan process. However, a six-page information kit is available for instant download on the website. To determine Mutual of Omaha’s credit requirements, we spoke with a company representative who told us that the company does not have a minimum credit score, but it is considered during the review process.

To learn more, read our full Mutual of Omaha Reverse review.

Finance of America Reverse Review

Great Service |

Finance of America Reverse (FAR) is licensed in 50 states and Puerto Rico and is a member of the National Reverse Mortgage Lenders Association. In 2023, FAR merged with American Advisors Group as part of the company’s “strategy to create a retirement solutions platform that helps older homeowners achieve financial goals in retirement,” a news release said.

If you need a reverse mortgage and are unfamiliar with the process, FAR is a good place to start. Its team of reverse mortgage specialists offers attentive support, and customer reviews rate the agents as knowledgeable and courteous. Most loans originated by FAR are government-secured HECM loans, but you can also get a jumbo reverse mortgage earlier (age 55 or more) using its HomeSafe option if you live in certain states.

- Loan amounts: up to $4 million

- Loan types: HECM, HECM for purchase, jumbo loans, Equity Avail retirement mortgage, home-sharing

- Credit score: 620

- States served: All 50 states (HomeSafe® only available in select states)

In addition to its commitment to customer education, we like FAR’s online reverse mortgage calculator that will help you run the numbers based on your home’s equity. This feature is especially helpful because you don’t have to submit contact information to get a funds estimate.

Read our full Finance of America Reverse review for more information.

Liberty Reverse Mortgage Review

Great Guarantee |

If you work directly with Liberty Reverse Mortgage, you will benefit from the Liberty Iron Clad Guarantee that promises to match or beat a competitor’s reverse mortgage. Plus, they’ll pay $500 of your closing costs if you don’t close your mortgage within 60 days of applying. Liberty requires a home appraisal. You’ll also have to pay the initial mortgage insurance premium at closing and annually over the life of the loan.

- Loan amounts: up to $1,089,300

- Loan types: HECM, HECM for purchase and refinancing

- Credit score: 600

- States served: All states except HI and NY

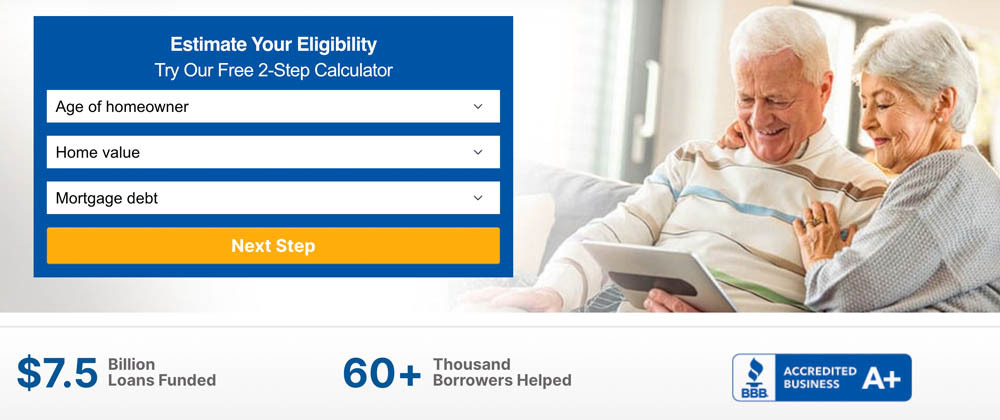

Liberty Reverse Mortgage offers two HECM loan options, for which you can apply online. The lender’s guarantee is its standout feature, but we also like the two-step online reverse mortgage calculator and its free eBook. We downloaded the product and found it straightforward, helpful, and transparent. However, we must warn consumers that Liberty cannot guarantee that brokers selling its loans will adhere to Liberty’s standards, so we suggest working with Liberty Reverse Mortgage directly.

Read our full Liberty Reverse Mortgage review to learn more.

Additional Companies

Reverse Mortgage Funding LLC, also known as RMF, is a direct reverse mortgage lender servicing more than 84,000 borrowers; however, the company filed for bankruptcy in February 2023.

One Reverse Mortgage was the reverse mortgage division of Quicken Loans/Rocket Mortgage, but the company halted operations in early 2020. Before the shutdown, One Reverse Mortgage was a top three national lender.

Easy Knock is a real estate investment company offering equity release programs. Easy Knock has two options for homeowners to access the value of their homes without moving.

Our Research Methodology

To identify top reverse mortgage providers, we analyzed 10 data points to give you a well-rounded review of each provider. We sourced feedback and reviews from real consumers, contacted lenders, and talked with mortgage experts to narrow down our original list of 20 reverse mortgage lenders. We also considered these features:

- State licensure and/or credentials

- Service area

- Loan options available

- Eligibility criteria

- Costs and fees

- Discounts

- Closing time frames

- Access to educational information

- Customer service availability

- Consumer reviews

We also reached out to companies and requested additional information that could help customers make a responsible choice, like context surrounding reverse mortgage fees and access to educational resources given to new customers.

Basically, we followed our own buying tips to uncover the best providers. Our favorite companies had a calculator on their site to get a quick sample quote, customer-centered service, and multi-state licenses. Companies that obscured their prices, had difficult or confusing policies and procedures, and/or limited loan options were eliminated. The result of our analysis is the best reverse mortgage companies for you, a friend or a family member to consider.

Some of the resources we used to determine our best reverse mortgage companies included:

- To verify licensing and credentials of reverse mortgage companies: Nationwide Mortgage Licensing System (NMLS) and National Reverse Mortgage Lenders Association (NRMLA)

- To verify accreditation and check for complaints against the business: Better Business Bureau (BBB)

- To understand reverse mortgage eligibility requirements and verify trusted lenders: U.S. Department of Housing and Urban Development and Consumer Financial Protection Bureau (CFPB)

Our Experience With Reverse Mortgage Lenders

Our experience with reverse mortgage companies was mostly positive. Our research showed that most lenders are upfront about reverse mortgage fees, the process for obtaining a loan, and its eligibility requirements. We’re also very pleased with the lenders’ commitment to customer service and consumer education.

Community First National Bank

Customer service is so important in the reverse mortgage industry, given its complexity and the government regulations associated with the loans. Community First National Bank gets our praise for customer service and satisfaction because it is the most reviewed mortgage lender on Retirement Living—it’s also the highest-rated. Customer reviews praise Community First National Bank for its respectful agents, fast closing speeds, and in-depth industry knowledge.

American Advisors Group (AAG)

Lenders prioritizing education throughout the process topped our list, especially regarding tax implications and future family responsibilities. AAG stood out for education because it was the only lender that gave us resources tailored to the reverse mortgage borrower’s family, heirs, and loved ones. This is important because getting a reverse mortgage is a decision that affects more people than just the borrowers. We found AAG’s resources helpful, thoughtful, and detailed.

How to Choose the Right Reverse Mortgage Company

The three most significant considerations for finding the best reverse mortgage company are to study each lender’s licensing and credentials, customer service, and program fees.

Top Tips:

- Confirm credentials via the National Multistate Licensing System (MNLS) lookup and the Better Business Bureau.

- Shop around to compare prices, programs, and who you want to work with.

- Understand your payout options and discuss them with your loved ones.

Before you commit to a reverse mortgage, you should know exactly what you’re getting. Ask lots of questions. Going into a transaction of this magnitude unprepared or without the right knowledge could cost you money in the long run. Fortunately, though, you can discuss these things during your required independent, third-party counseling before applying.

1. Check Licensing and Credentials

There are countless options for reverse mortgage lenders. You can weed out the suspicious ones by simply checking for reputable credentials. For example, limit your search to lenders approved by the Federal Housing Authority (FHA) if you’re looking for a HECM. Certifications and licensing requirements vary by state, but legitimate lenders will prominently display their credentials prominently online.

Look for a national reverse mortgage lender that guides you through the process and doesn’t resort to selling you additional services like insurance or annuities using high-pressure sales tactics. The NMLS database and the Consumer Financial Protection Bureau website can help you search for regulatory actions against the lender as well as recent enforcement actions involving the company.

2. Understand the Tax Implications

The money that you receive from a reverse mortgage is usually not taxable because they are considered proceeds from a loan, so it won’t affect your Social Security or Medicare benefits. However, the IRS will consider your funds “assets,” which could affect your eligibility for Supplemental Security Income.

The IRS doesn’t allow you to deduct interest on reverse mortgages until it is paid unless you use the money to buy, build, or substantially improve the home. But your upfront FHA mortgage insurance premium can be deductible depending on how you file your taxes. This is why it’s important to discuss these costs and reverse mortgage tax implications with your lender or tax advisor before signing a contract.

3. Estimate the Upfront and Ongoing Costs

Remember to budget for additional reverse mortgage fees, which will vary by the type of loan and lender you choose. At the start of the loan, you’ll pay the required counseling, origination, and appraisal fees. Most other closing costs can be financed into the loan. The most common upfront out-of-pocket costs that people overlook are any repair costs identified by the appraiser, which often need to be paid before the loan can close. So bring any major repair concerns to your loan officer before you start the process and pay for an appraisal.

Over the life of the loan, reverse mortgage borrowers are also responsible for paying long-term property costs like flood insurance and real estate and property taxes. (See below for related cost estimates.)

Before committing to a loan, ask the lender to provide a detailed explanation of the costs associated with a reverse mortgage, including what you’ll be required to pay out of pocket. Some lenders might be more affordable than others.

4. Ensure Protection for Your Spouse and Heirs

Your decision to take out a reverse mortgage loan could affect the family you leave behind, so include them in the decision-making process as much as you can—this could include putting the title in your spouse’s name, too, if it wasn’t at the time of purchase, to ensure the surviving spouse can maintain the existing loan structure without issue. While spouses who are not on the title can be added as “non-borrowing spouses,” giving them the right to continue to live in the home, they will lose access to any future loan proceeds or remaining line of credit if they’re not on the title.

You can also ensure the home will pass to your heirs in a will or a trust, by making sure anyone designated to make decisions on behalf of the estate knows how to contact the servicer at the final death for all their repayment options. They’ll need to do this within 30 days to avoid complications.

Top Reverse Mortgage Lenders of 2024

- Great Closing Speed – American Advisors Group (AAG)

- Great Rates – Community First National Bank

- Great Mobile App – Mutual of Omaha Reverse

- Great Guarantee – Liberty Reverse Mortgage

- Great Service – Finance of America Reverse

- Great Online Quote – Longbridge Financial

- Great Tool – Reverse Mortgage Assist

- Great Nationwide Availability – Movement Mortgage

How Much Does a Reverse Mortgage Cost?

The costs and loan limits associated with a reverse mortgage are highly regulated by the government. For example, The Federal Housing Administration (FHA) places yearly limits on the amount reverse mortgage companies can offer for Home Equity Conversion Mortgage (HECM) loans. The 2023 HECM home value limit for calculating maximum reverse mortgage loan amounts is $1,089,300.

Reverse mortgages also come with several fees, which will vary by the type of loan and lender you choose. Required counseling fees, origination fees, closing costs, and interest charges are just some of the costs associated with reverse mortgages.

As mentioned above, when you take out a reverse mortgage, one requirement is to continue to pay property taxes and insurance. If you can’t make these payments or have had trouble making these payments in the past, it may not disqualify you outright, but the lender may set aside funds upfront to pay these charges on your behalf, which could affect your loan proceeds.

| HECM Counseling | $125 – $199 (ask whether discounts or fee grants are available) |

| Origination fees | – The greater of $2,500 or 2% of the first $200,000 of your home’s value plus 1% of the amount over $200,000 – HECM origination fees are capped at $6,000 |

| Mortgage insurance | – Upfront charge of 2% – 0.5% annual fee of outstanding mortgage balance |

| Closing costs | Typically includes: – Appraisal ($575 – $750, depending on region) – Title search – Surveys – Inspections ($175) – Recording fees – Mortgage taxes – Credit checks |

| Interest | 6% – 11% depending on loan type |

| Service fee | Up to $35 per month if your lender charges one |

Types of Reverse Mortgages

There are several types of reverse mortgages that are better suited to certain circumstances. These include:

- Home Equity Conversion Mortgage (HECMs): Backed by the U.S. Department of Housing and Urban Development (HUD) and the Federal Housing Administration (FHA), HECM reverse mortgage loans allow you to access a portion of your equity based on the borrower’s age as well as the home’s value. You can borrow up to $1,089,300 (as of 2023) and choose an adjustable rate or fixed rate. These make up the vast majority of all reverse mortgages on the market and come with the most borrower protections, as they are highly regulated.

- HECMs for Purchase (H4P): This loan type helps you purchase a new home with a reverse mortgage. You might use this mortgage to find a home closer to family or one that better accommodates your needs as you age in place without depleting your liquid savings to pay all cash. Because this loan is a purchase and reverse mortgage all-in-one, H4P loans only incur one set of closing costs, which can save borrowers a lot of money when buying a home.

- Reverse Mortgage Refinance: If you already have a reverse mortgage, you can possibly refinance to take advantage of a lower interest rates, add a spouse to the mortgage, or access more cash as your home equity rises.

- Proprietary reverse mortgages: Also called jumbo reverse mortgages, proprietary mortgages are best for those who own higher-value homes or cannot do a HECM. You can get a jumbo reverse mortgage for up to $10 million properties, which is higher than the HECM’s federally-set borrowing limit. Private companies issue these loans, and the FHA does not back them, so it is critical to understand the terms and any limitations before doing one. Interest rates tend to be higher, and there are often minimum loan balances required, but the upfront costs can be less because there is no FHA mortgage insurance charged. Some states allow private reverse mortgages as young as age 55.

- Single-purpose reverse mortgages: This option is the least common reverse mortgage type, and it’s not available in every state. You can get a single-purpose reverse mortgage from state, local, and non-profit agencies. As the name implies, you can only use this loan for a single, lender-approved item such as necessary home repairs or property taxes. You’ll typically pay less in interest fees for this type of mortgage.

Qualifying for a Reverse Mortgage

Reverse mortgages have specific eligibility requirements. To qualify for a reverse mortgage, the youngest borrowers must be at least 62 years old, maintain the home as their primary residence, and have at least 40% to 70% equity, depending on the youngest owner’s age. While there are no formal minimum credit scores to qualify, some lenders will reject your application if you’re delinquent on debt or have a history of late payments.

As an added consumer protection, every lender will complete a financial assessment during the application process to determine your ability to pay any ongoing property charges like taxes, insurance, HOA fees, and upkeep, as well as general living expenses each month.

You can only borrow against your primary residence to be eligible for a reverse mortgage, and you have to wait at least one year if you have recently done a cash-out refinance on the property. Before submitting an application for processing, you must complete federally-mandated counseling to ensure you understand your borrowing responsibilities. You’ll also need an independent appraisal to assess the value and property condition. This may incur additional costs if repairs are mandated or if the lender or FHA determines a second appraisal is required.

There are also property restrictions for government-backed reverse mortgages. Your home must fall into one of these categories:

- Single-family homes

- Multi-unit properties with up to four units

- Manufactured homes built after June 1976

- FHA-eligible condos or townhomes

Private reverse mortgages, like jumbo reverse mortgages, have their own qualification requirements that vary by lender and loan type, but an experienced loan officer will be able to help you navigate your options.

Local Reverse Mortgage Companies

- Atlanta, GA

- Austin, TX

- Boston, MA

- Chicago, IL

- Denver, CO

- Fort Worth, TX

- Jacksonville, FL

- Los Angeles, CA

- New York, NY

- Orlando, FL

- Philadelphia, PA

- Phoenix, AZ

- San Antonio, TX

- San Francisco, CA

- Seattle, WA

- St. Louis, MO

Frequently Asked Questions About Reverse Mortgages

What is a reverse mortgage?

A reverse mortgage is a financial agreement between you and a lender in which you leverage the equity in your home in exchange for funds and/or line of credit. The lender distributes the funds in a lump sum, line of credit, structured monthly payments, or a combination of these three. You can use the funds from the reverse mortgage however you wish, such as to pay for home repairs, medical bills, groceries, or other unexpected expenses.

Unlike a typical mortgage, you won’t make monthly principal and interest payments. Instead, interest accrues on any amount borrowed and the loan balance becomes due when you pass away, move to another location, or sell the home. It’s common for people to use the money from the sale to pay back the loan, but as a great consumer protection, all reverse mortgages are non-recourse, meaning you won’t ever have to use any other assets than the house itself to repay it. If any equity is left after the repayment, the funds can go to you or your heirs.

Is a reverse mortgage giving away my house to the bank?

It’s a common misconception that reverse mortgage borrowers lose or sell ownership of anything, including the title and equity. When you take out a reverse mortgage, you leverage— not lose—the equity. You retain ownership of the home, but the lender would only forward with a forced sale or foreclosure if you do not uphold the terms of your contract or are required to foreclose on behalf of the county due to unpaid property taxes.

How do I get a reverse mortgage?

The reverse mortgage application process typically takes 30 to 45 days. If you’re eligible for a reverse mortgage and decide it’s the right decision for your family, you’ll start with a consultation with a licensed professional to get an estimate of how much equity could be available and a preliminary proposal. Weigh your options carefully to ensure you pick a reputable company. Before completing an application, you must meet with a HUD-approved mortgage counselor to get a HECM where they will review with you the proposal(s) you got to ensure you understand the terms and charges. Finally, you will complete your application, complete the home appraisal, and close on the reverse mortgage loan.

How do I receive the funds from my reverse mortgage?

It’s up to you to decide how you want to receive your reverse mortgage funds. You may receive the loan in a lump sum, as a monthly payment, or as a line of credit (or a combination of the three). Adjustable-rate reverse mortgages allow you to change the disbursement plan at any time, while fixed-rate reverse mortgages only have a lump sum option available at closing.

Why choose a reverse mortgage?

A reverse mortgage is a way to give you more financial freedom to convert home equity into spendable cash if you find yourself in need of additional funds. You won’t have to make payments on the loan as long as the loan is in good standing and you’re still eligible for your social security and Medicare benefits.

How much money can I get from a reverse mortgage?

The maximum loan amount anyone can access through a HECM is a percentage based on a maximum home value of up to $1,089,300 in 2023 (up from $970,800 in 2022). Many private lending companies offer proprietary, jumbo reverse mortgages, up to $4 million. Your loan amount depends on the value of your home, your age, and current interest rates. Most lenders can offer between 30% and 60% of available equity based on those factors.

Final Thoughts on Reverse Mortgages

If you need supplemental income or additional financial safety net during retirement, a reverse mortgage can help.

Remember to do your homework when it comes to choosing a lender. There are plenty of options out there, but ideally, you want to work with a company that specializes in reverse mortgages with a loan officer that is experienced with navigating the process. Reverse mortgage lenders that explicitly disclose their fees and rank high for customer service are safer choices.

Related Reverse Mortgage Resources

Readers of this reverse mortgage guide content also read these related articles.

Pay Attention to These Reverse Mortgage Scams

Take the apprehension out of purchasing a reverse mortgage by reading about these common reverse mortgage scams.

Do You Qualify for a Reverse Mortgage?

Unlocking a reverse mortgage could help your family financially during retirement. Find out if you fit all of the qualifications to apply.

What is a Reverse Mortgage?

What is a reverse mortgage? If you are looking for a way to extract capital from your largest asset, your home, find out more in the article.

More Related Articles

- How to Find the Right Reverse Mortgage Counseling Agency

- Steps to Retiring with a Reverse Mortgage

- How Are Reverse Mortgages Regulated?

- Reverse Mortgages and Taxes

- Best Jumbo Reverse Mortgage Lenders

- Reverse Mortgage Lending Limits

- Cost of a Reverse Mortgage: Common Fees and Rates

- How Long Does It Take to Get a HELOC