How to Get the Best Mortgage Refinance Rate

Updated:

Retirement Living takes an unbiased approach to our reviews. We may earn money when you click a partner link. Learn More

Refinancing often helps homeowners reduce their monthly mortgage payments or pay off their home loans faster than ever before. The best mortgage refinancing option varies based on each homeowner, his or her finances, and other factors. Ultimately, it is important for a homeowner to understand the ins and outs of refinancing before searching for the best mortgage refinance rate. Learn about all aspects of refinancing then use the insight you gain to conduct an extensive search for the best mortgage refinance rate, and to make an informed refinancing decision.

Tips to Get the Best Mortgage Refinance Rate

While there is no guarantee that you will get the absolute best mortgage refinance rate, there are several things you can do to increase the likelihood of finding the best possible interest rate and help maximize your refinance savings. Here are five tips to help you get the ideal mortgage refinance rate.

- Boost your credit score– Your credit score plays a pivotal role in your ability to qualify for a low mortgage refinance rate. Banks and credit unions use an individual’s credit score to evaluate his or her creditworthiness. A credit score generally falls between 300 and 850, and the average score in the U.S. rose to 700 as of July 2017, according to CNBC. Credit score requirements to qualify for a home loan vary from lender to lender, and a high credit score likely will get you the best mortgage rate.

A credit score boost of around 100 points can lower your interest rate by more than 3 percent.

To increase your credit score, obtain a copy of your credit report from each of the three reporting bureaus. Experian, Equifax, and TransUnion all offer one free credit report each year, or you can get your reports from annualcreditreport.com. Some prefer to order a report from one of the credit bureaus every four months to check for reporting errors. If you find outstanding debt listed on your credit reports, pay it off as quickly as possible. Get in touch with any agencies that show wrong information on your credit report.

- Reduce your debt– Debt related to a car loan, credit cards, or other outstanding bills may affect your debt-to-income (DTI) ratio, a measurement used by lenders to analyze your refinancing qualifications. To calculate your DTI ratio, add up your monthly debt payments and divide this total by your gross monthly income.

A good rule of thumb is to keep your DTI ratio as low as possible. Pay off outstanding debt to improve your DTI ratio and, at the same time, you can make your loan application stand out to lenders to get the lowest interest rates.

Use a free online refinance calculator – You can find many free online mortgage refinance calculators. These calculators can help you determine how refinancing will impact your payments and monthly budget. Use an online refinance calculator to gain the insights, and you can map out your current and future mortgage payments. - Perform a comprehensive search – Many banks and credit unions are available, and each of these lenders offers a broad range of mortgage refinancing options. There is no need to settle for the first mortgage refinancing offer you receive. You instead should meet with a variety of lenders, find out what they can offer, and consider the advantages and disadvantages of each lender’s refinancing options.

Also, don’t hesitate to ask questions about refinancing any time you meet with a lender. Banks and credit unions employ knowledgeable mortgage professionals who are happy to educate you. These professionals can help you perform an in-depth assessment of various refinancing options so you can make the best decision.

- Choose the right loan term – A mortgage refinancing term should meet your needs both now and in the future. You will pay less each month for a 30-year mortgage but will pay thousands more in interest over time. A 20- or 15-year mortgage will cost more each month, but you will pay less interest, and if you plan to stay in the home, you will be free of the loan much sooner. Another strategy is to borrow on the 30-year term but make payments as if it were a 15-year loan. Should circumstances arise that make it difficult to make that payment, you can fall back on paying the lower required amount. By lowering the principle with extra payments, you will save significantly on interest and will build equity faster.

What Are the Benefits of Refinancing?

- Lower monthly payments: Homeowners frequently use refinancing to lower their monthly mortgage payments. The average mortgage debt for U.S. homeowners was $201,811 in 2017, according to credit reporting agency Experian. As homeowners search for ways to reduce their monthly mortgage expenses, refinancing may offer a viable option to budgeting more efficiently.

- Pay off the mortgage sooner: Another reason why homeowners may pursue refinancing options is to reduce the time to pay off a mortgage. An example is a homeowner who initially bought his or her residence with a 30-year loan and refinances to a 15-year mortgage with a lower interest rate after five years. Not only could the homeowner pay off the full balance of the mortgage sooner, but there’s also an interest-saving component to this strategy. The monthly payments would be higher due to the reduced term, but if the goal is to become debt-free, this will happen in a reasonable amount of time. If there were prepayment penalties with the original 30-year loan, the homeowner could avoid these by refinancing that loan.

What are the Disadvantages of Refinancing

Although it’s an excellent option for many homeowners, there are some disadvantages of refinancing as well. In some cases, homeowners pay more when they refinance a mortgage than they would with their initial home loan. Be sure to weigh the pros and cons of refinancing before applying for the new loan. You will want to perform the necessary calculations and research to determine if refinancing will help you accomplish your financial goals. Two main disadvantages of refinancing are:

- Applying for a new mortgage: Changes to your income and credit that occur since your original mortgage can affect your refinance. Lenders are more cautious with a refinance and scrutinize your credit report and other finances. This could lead to getting approved at a higher interest rate or not at all.

- Refinancing Costs: This might be the biggest obstacle associated with refinancing. Closing costs range from three to six percent of your loan balance. You are required to pay for an appraisal, application fee, title search fee, credit report fee and a loan origination fee. If you’re refinancing to an FHA loan, don’t forget about the possibility of PMI if you can’t out 20 percent down. PMI typically costs anywhere from 0.5 percent to 1 percent of your home loan annually. So if your mortgage is $250,000, PMI will be around $1,250 to $2,500 per year.

Why Is It Important to Get the Best Mortgage Refinance Rate?

Getting the best mortgage refinance rate is rarely straightforward. However, homeowners who allocate the necessary time to search for the best refinance interest rate may reap the benefits of their decision for years to come.

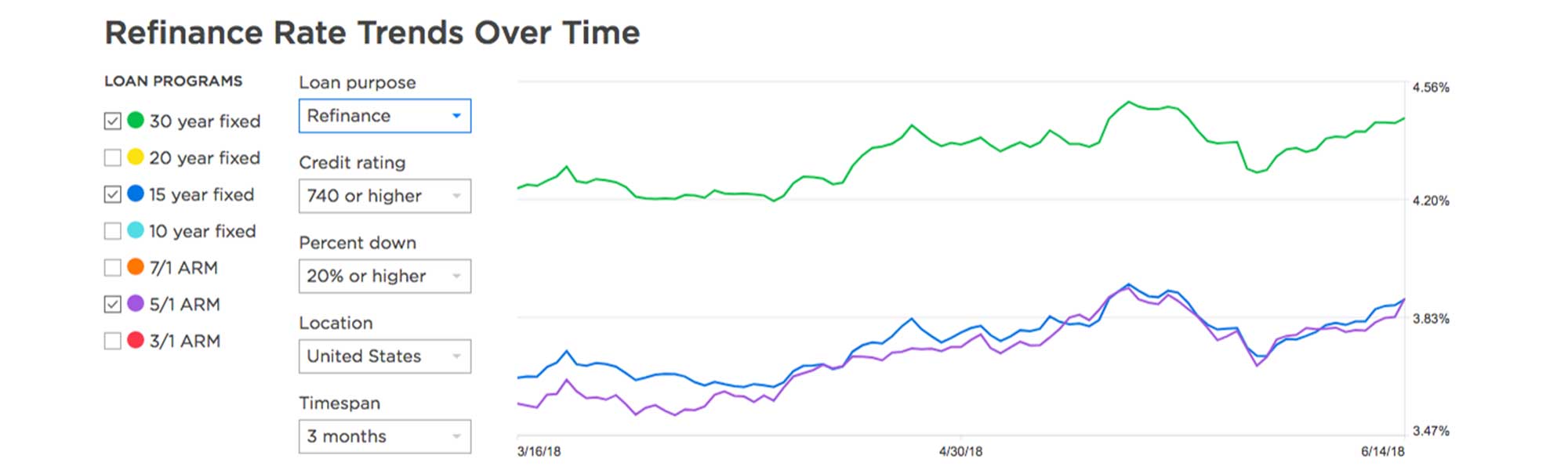

By conducting an in-depth search for the best mortgage refinance rate, you can find a lower interest rate to save as much money as possible on your monthly mortgage payments. You may be able to identify and track mortgage refinance rate trends over time as you do your research. You will then be better equipped to accurately predict when mortgage refinance rates will reach their lowest point and can plan to take advantage of the lower rates.

Of course, mortgage refinance rates fluctuate constantly. Real estate marketplace website Zillow reports the average 30-year fixed term refinance rate was 4.29 percent as of June 1, 2018, and the 15-year fixed-term refinance rate was 3.71 percent. These figures may rise or fall based on the U.S. housing sector conditions, homeownership rates, and other real estate market factors. Fortunately, a homeowner who studies the housing market can use the data gathered over time to find the best mortgage refinance rate.

Bottom Line:

Refinancing a mortgage is a popular option for homeowners who want to save money on their monthly mortgage payments or pay off their home loans as soon as they can. Not all refinancing options are created equal, and each option should be reviewed closely to avoid missing out on an opportunity to reduce payments or pay less interest while paying off the loan sooner. Always conduct a thorough search for the best mortgage refinance rate to get the most out of refinancing your home loan.