Whether you find yourself in a financial emergency and need cash or simply can’t afford to continue to pay your premiums, if you are 65 or older or have a terminal or chronic illness, you may be eligible to sell your life insurance policy in a process known as a life settlement.

How Much Will You Receive from a Life Settlement?

It’s hard to calculate exactly how much you’ll receive from a life settlement. Companies decide what they are willing to pay by considering how much the policy is worth and how much they‘ll have to pay in premiums (calculated by multiplying your life expectancy with your premium rate). Generally, you can expect to receive somewhere between 20 and 60 percent of the death benefit on your policy; you can expect to receive more if your life expectancy is short, the premiums are low, and/or the policy is worth a great deal of money.

Taxes on Life Settlements: Proceeds from selling your policy up to the amount you’ve paid in premiums are tax-free but beyond that, you may be taxed as income or capital gains. For instance, if you’ve paid in $50,000 in premiums and then sell your policy for $100,000, your $50,000 profit will be taxed. On the other hand, if you do not sell the policy, any death benefit from your life insurance policy will be tax-free for your beneficiaries.

The Life Settlement Process

Choosing a Broker or Provider: You can sell a life insurance policy through a broker or a provider. A broker can help you find the provider who will pay the highest amount of money for your policy, or you can bypass the broker and go straight to a provider. Both options have pros and cons; skipping a broker and selling directly to a provider will save you some money in broker fees (broker commissions can be as high as 30 percent of the proceeds from the sale), but may cost you if you end up getting a bad deal from the provider you choose.

Selling Your Life Insurance Policy: Once you’ve decided if you want to use a broker or provider, you’ll start the process by providing them with information from your life insurance policy and your medical records. At this point, a broker finds potential providers to buy your policy, who will decide how much they are willing to pay based on how long they expect you to live.

Whether you’ve gone through a broker or not, at this point the provider decides if they want to make an offer on your policy. If you receive an offer, you can decide if you want to accept it and sell your policy or, if the offer is not sufficient, you can try shopping your policy around to more potential buyers.

Once you have an agreeable offer, you’ll sell your policy by making the buyer the new owner of your policy in exchange for their payment (make sure you have received the payment and that it has cleared before making them the new policy owner).

After You’ve Sold Your Policy: After you’ve sold the policy, the provider continues to pay premiums on it. They may require you to check in with them periodically, so they know you are still living, and when you die, they receive the insurance benefit.

Alternatives to Life Settlements

Viatical Settlements: If you have a terminal illness with 24 months or less to live, you may be eligible for a viatical settlement. You also may qualify if you are chronically ill and require assistance in the activities of daily life, like showering and dressing. Viatical settlements are similar to life settlements, but the proceeds from most viatical settlements are tax-free, and many providers will pay a higher settlement for viatical settlements than life settlements. The point of a viatical settlement is for the terminally ill person to benefit from the proceeds while alive.

Surrendering Your Life Insurance Policy: You may also consider surrendering your policy to your insurer. To start this process, you simply call your insurer and let them know you want to surrender the policy. You may receive a portion of its cash value. This may be an option if your policy value is too low to find a buyer, but keep in mind that surrendering a policy usually results in a lower payout than a life settlement.

Accelerated Death Benefit: You may be able to receive 25 to 90 percent of your death benefit in advance of your death. You must continue to pay premiums on the policy until your death, but you’ll retain control over the policy and any remaining benefits will go to your beneficiaries. This is only an option if you already have this rider in place on your life insurance policy.

Staying Safe When Selling a Life Insurance Policy

Selling a life insurance policy can be risky. Watch out for these pitfalls and predatory practices:

- You may become ineligible for any type of government assistance, including Medicaid if you sell your policy. The government views a life settlement as income.

- Be sure you choose a broker who is licensed through your state and check the National Association of Insurance Commissioners database to be sure they haven’t had complaints filed against them.

- Do not accept offers to sell your policy from solicitors, who often send mail suggesting you’ve been prequalified to sell.

- Ask your financial advisor or insurance company for recommendations for life settlement brokers or providers.

- Get multiple bids on your policy and remember that you don’t have to accept any of them. Be particularly wary of any brokers or providers who try to rush your decision. You can decide if and when you want to sell your policy, on your own terms.

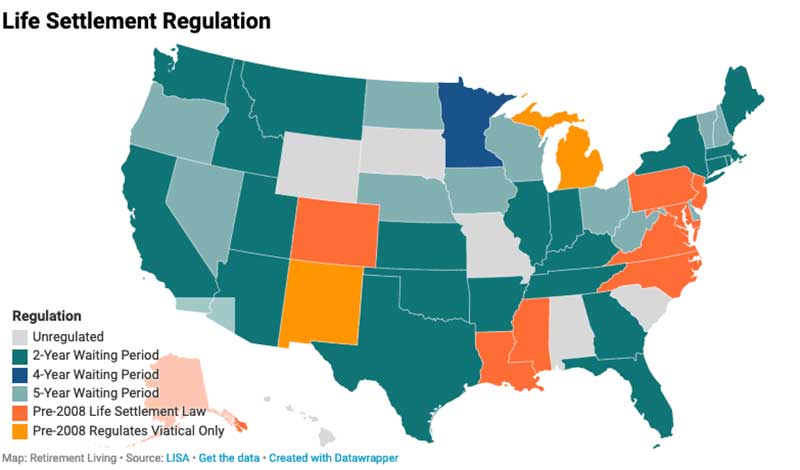

It’s important to know, 43 states and Puerto Rico have life settlement laws and regulations. Wyoming, South Dakota, Missouri, Alabama, South Carolina, Washington D.C. and Hawaii are unregulated. Regulated states require a waiting period before you can sell your life insurance policy.

Life Settlement Companies

There are many companies that buy life insurance policies. Choose one with a strong reputation for offering the highest amount to settle with policyholders. Below are some of the most well known.

-

Magna: Magna is one of the country’s most trusted Life Settlement providers and is know for their speed and efficiencies. Magna provides customers with a Life Settlement calculator on their website to give customers an expectation of what their life insurance policy may be worth.

Visit Site

-

Life Policy Solutions: Life Policy Solutions was established in 1999 to help customers sell their life insurance policy for cash. Life Policy Solutions is a leading life settlement broker that works with a large network of licensed life settlement companies and providers. With more than $1 Billion in policy sales, Life Policy Solutions is a reliable option for customers who are seeking to maximize cash offers.

-

Coventry: Coventry is a Fort Washington, Pennsylvania provider offering simplified settlements for policies of $100,000 to $500,000. They also have two options for payment: either you can receive cash for your settlement or you can retain a portion of your death benefit in exchange for selling the policy to them.

-

Ovid Life: Ovid Life is a brokerage based in San Francisco, California. They deal with both viatical and life settlements for whole life, universal life or convertible term life policies of $100,000 or more. Their clients receive an average of 22 percent of their policy’s death benefit in settlements.

-

Harbor Life Settlements: Based in Austin, Texas, Harbor Life Settlements is a provider offering payouts up to 40 percent of your policy value with no hidden fees. It promises payouts within weeks. You can use their website tool to get a free estimate of the value of your policy.

Bottom Line

Before choosing to settle your life insurance policy remember to consult with your lawyer or a properly licensed financial institution. Make sure you’re aware of the confidentiality policies of everyone involved, get quotes to ensure you’re getting a fair price and make sure you understand the tax implications of your life settlement.