Many Americans spend their lives working hard in the hopes of being able to retire someday and adopt a more enjoyable and relaxing lifestyle. In the 1990s, the average age of retirement was 60, but according to a Gallup poll, that number has now reached 66 as many Americans are delaying their retirement. With the recent increases in fuel, food, and necessity costs plus a potential recession on the horizon, many retirement-age Americans are concerned about their financial wellbeing.

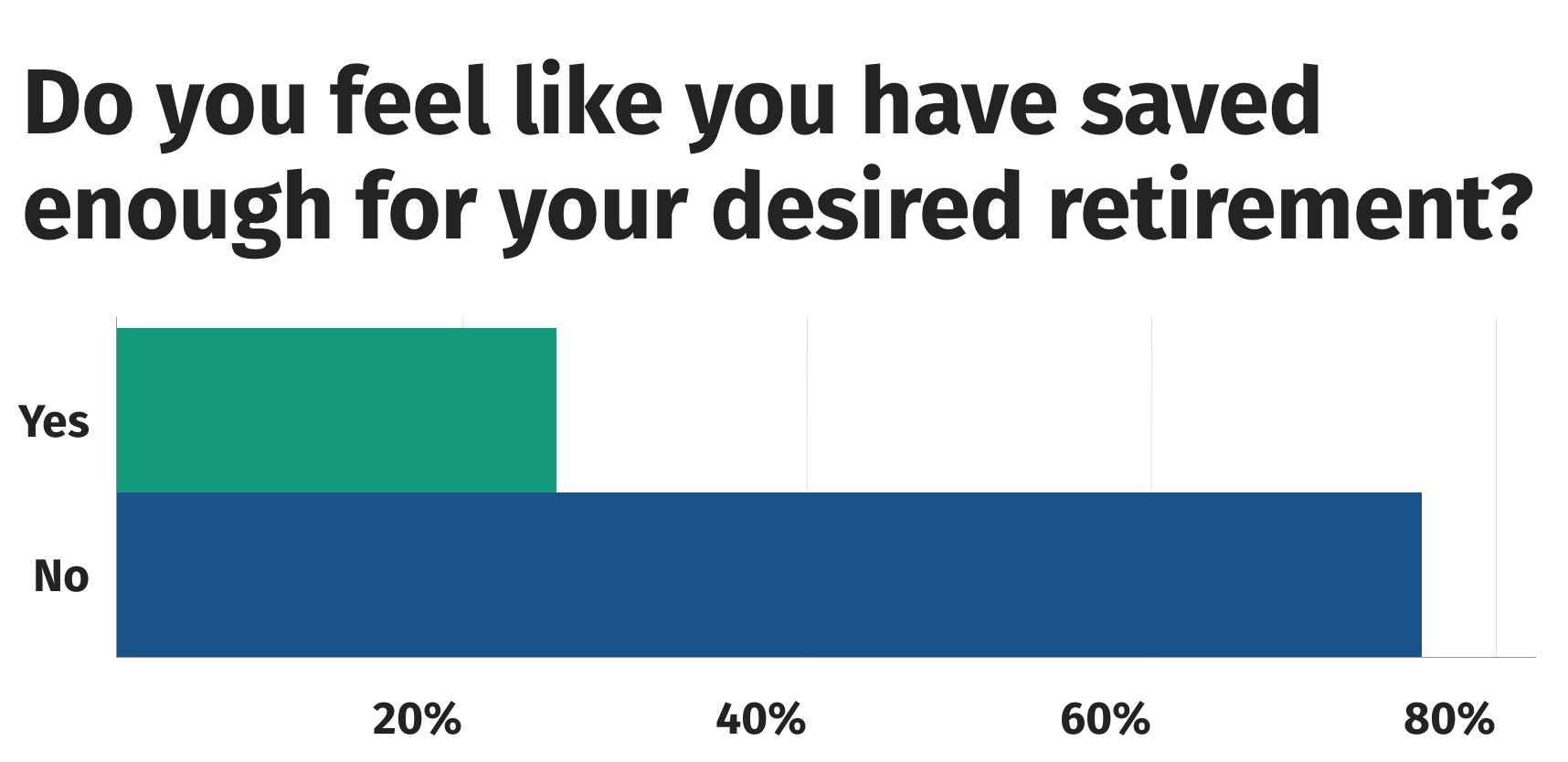

73% of Americans Do NOT Feel Like They Have Saved Enough For Retirement

Retirement Living recently conducted a survey of our audience and the results support what many other studies have found: the majority of Americans do not feel that they are financially prepared for retirement. With inflation at a 40 year high, many retirees are worried that their savings will not be able to sustain their ideal lifestyle with the recent rise in prices.

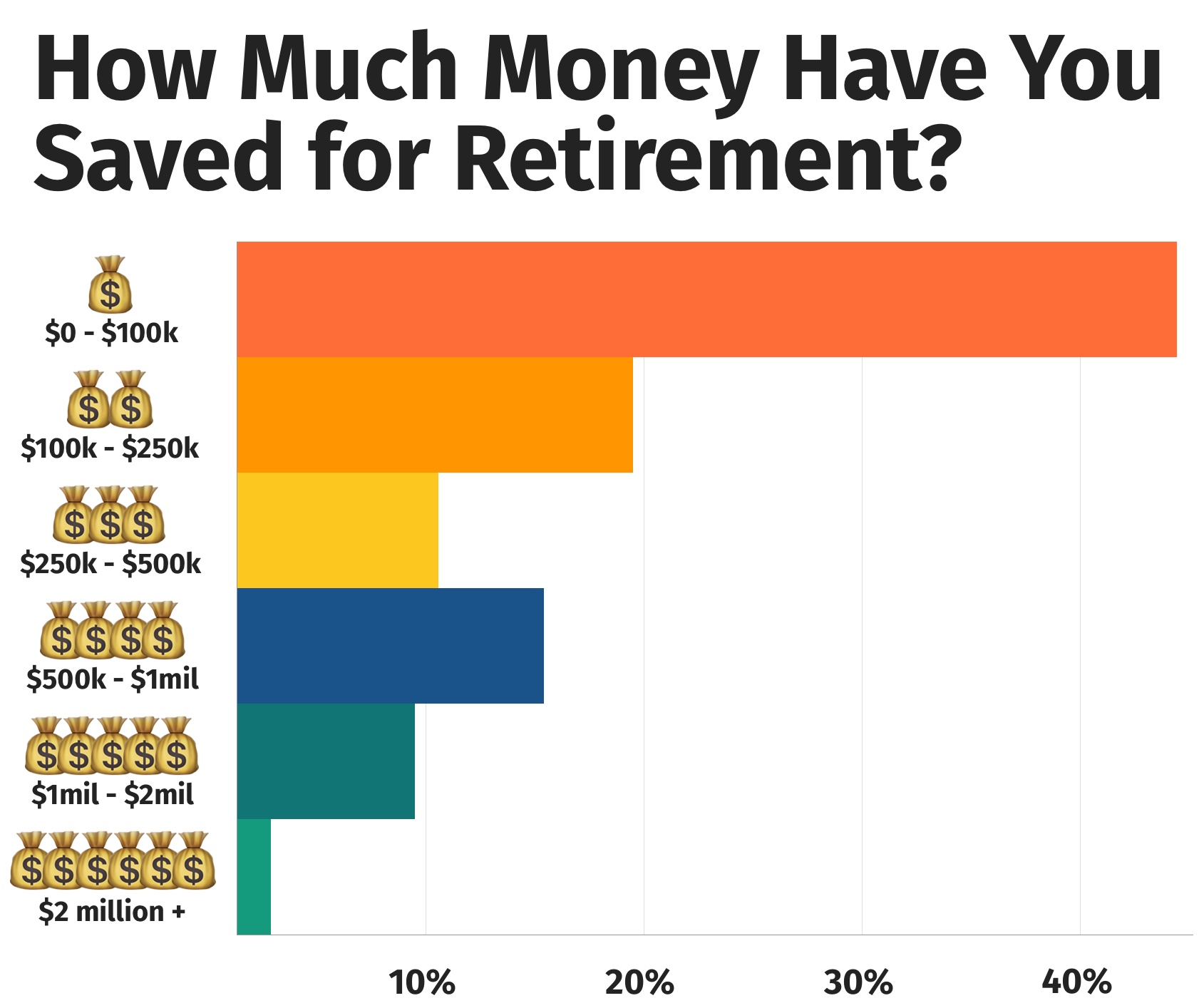

44% Of Respondents Have Less Than $100,000 Saved for Retirement

What we found in the survey is that respondents began saving for retirement in their mid-thirties (median age = 34) but that 44% of respondents report having less than $100,000 saved for retirement. 19% reported $100,000 – 250,000 in savings. 11% have $250,000 – $500,000 in savings. 15% have $500,000 – $1,000,000 in savings. 9% said that they have $1,000,000 – $2,000,000, and 1.5% said that they have saved more than $2,000,000 for their retirement thus far.

We asked those people who made investments in their retirement savings where they placed their money. Their diversification was as follows: – 76% Stocks, 52% Bonds, 17% Gold/Precious Metals, 7% Bitcoin, 44% Real Estate, and 6% High Yield Savings account. 38.6% stated that they worked with a financial advisor while 61.4% said they did not.

According to a TD Ameritrade Survey, there’s a growing trend of Americans who are dipping into their retirement funds early. A total of 44% of Americans aged 40 to 79 have have prematurely withdrawn funds from a retirement plan, including 46% of people aged 40 to 49 and 53% of people aged 70 to 79. The need to withdraw funds early may increase in the future as Social Security is only guaranteed to be funded until 2035. After that, unless something changes, it is only guaranteed to be three-quarters funded. This may cause monthly Social Security payments to decrease or to be unavailable for new retirees.

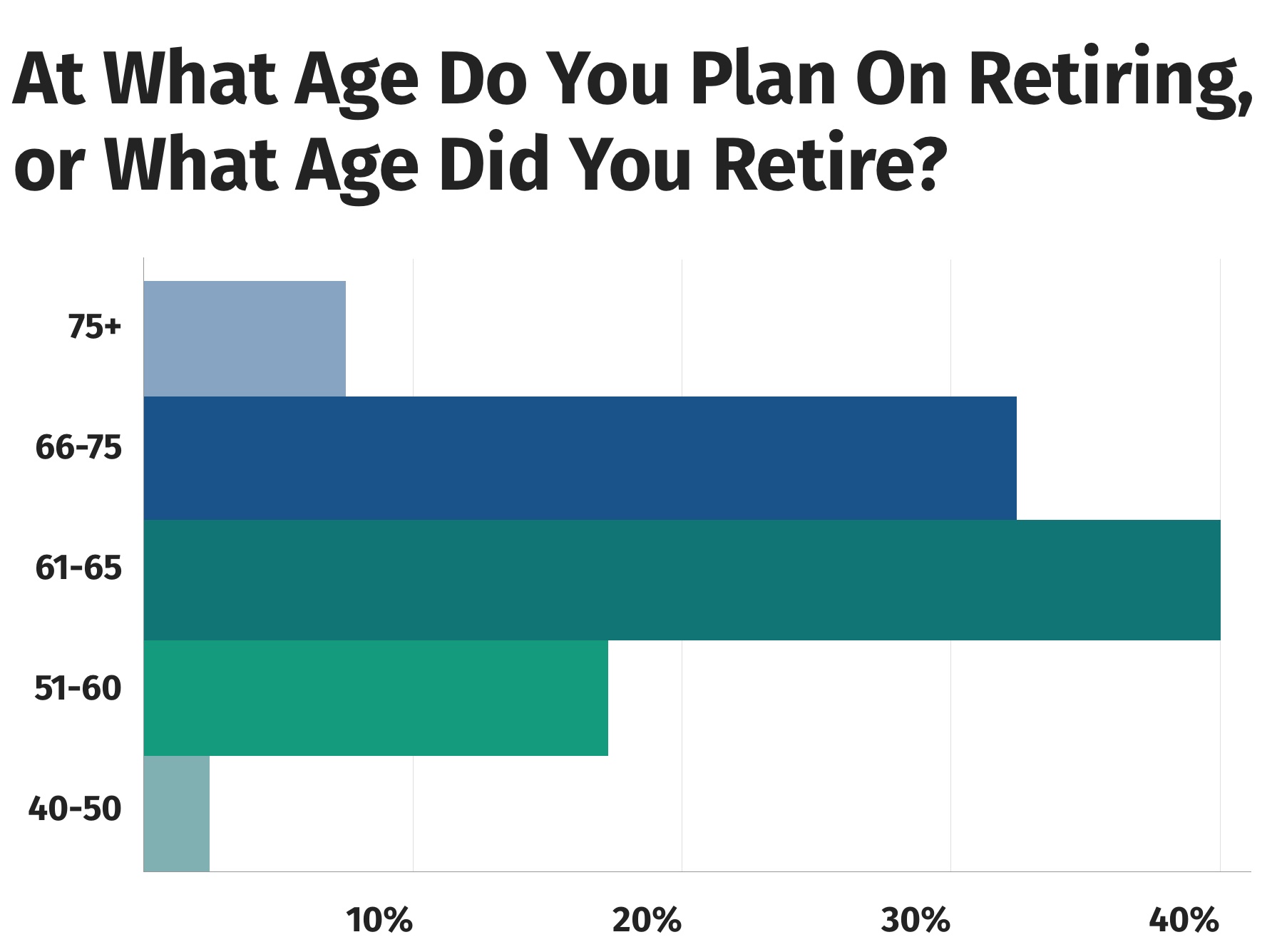

People are Retiring Later Than 65

While 17.5% of our respondents plan on retiring between age 51 and 60, the majority (40%) believe they will work until age 61 to 65. 33% believe they will retire between age 66 to 75, and 7% believe they will retire after age 75 or not at all!

The decision to delay retirement is not just a financial one. Many Americans believe that they need to stay active and that continuing to work will help both their bodies and their minds. Also, Americans are living longer, which means their retirement savings need to last longer. The average life expectancy is now 78.7 years as of 2018, compared with 73.7 in 1980.

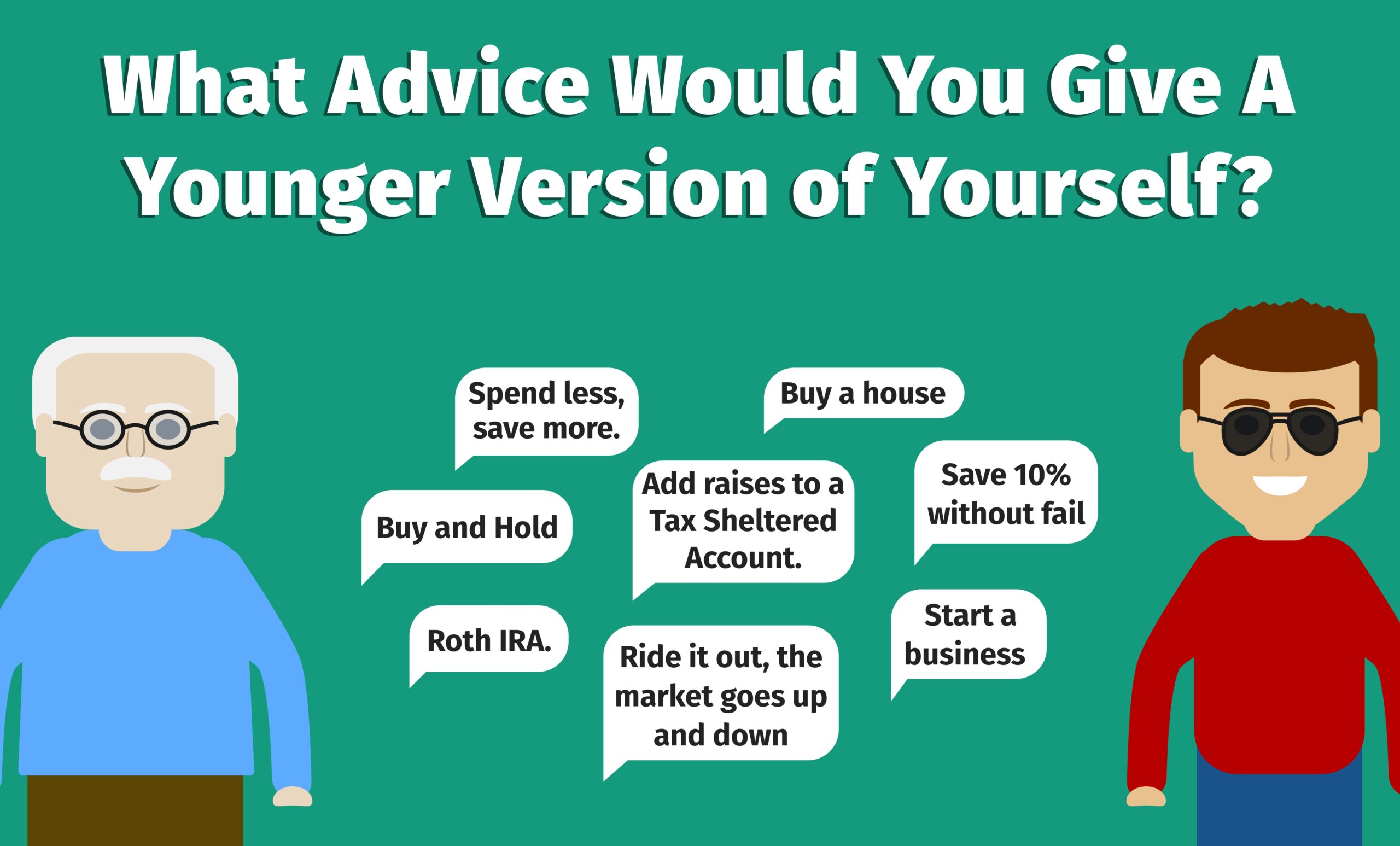

Retirement Recommendations from Our Respondents

- Buy and Hold

- Start Saving Earlier

- Save More

- Add raises to a Tax Sheltered Account

- Roth IRA

- Spend less, save more

- Buy Google

- Start as young as you can

- Be diligent about saving more

- Create a plan and stick to it

- Eat at home

- Don’t buy lavish things

- Invest the max annually

- Spend wisely

- Ride it out, the market goes up and down

- Do not get married

- Diversify

- Buy more real estate

- Finish your degree

- Save 10% without fail

- Buy a house

- Seek out advice

- Start your own business

While most of the suggestions involve spending less and saving more, there a couple of interesting recommendations. Which ones resonate with you? By adopting one or more of these recommendations, you may feel more prepared for retirement when that day comes.