Guaranteed Rate Review

Guaranteed Rate is the company we named as having the Great Online Experience in our Best VA Loans Guide. It is one of the nation’s largest retail mortgage lenders with an origination volume of $19 billion in 2017. The lender differentiates itself from the competition with transparent fees, low rates, a very high level of service and technology that streamlines and simplifies the entire mortgage process.

Guaranteed Rate won the 2018 Best Online Mortgage Lender FinTech Breakthrough Award for its 100 percent secure digital lending platform. The lender offers conventional financing options as well as VA loans to allow eligible veterans to buy or refinance a home without private mortgage insurance or a down payment.

Pros

- Offers multiple mortgage loan options alongside VA loans

- Licensed to originate loans in all 50 states and Washington, D.C.

- Convenient online mortgage application and pre-approval

Cons

- Some states have no physical branches

Guaranteed Rate VA Loans

According to the U.S. Department of Veterans Affairs, Guaranteed Rate issued over $806 million in VA mortgage loans last year with a $308,063 average mortgage loan amount. Backed by the federal government, VA loans offer more flexibility and several advantages compared to other mortgages, making these loans an excellent option for those who qualify.

| Program | Features |

|---|---|

| VA Purchase Loan |

|

| VA New Construction |

|

| VA Energy Efficient Mortgages |

|

| VA Mortgage Refinance |

|

*Guaranteed Rate also offers conventional loans, FHA loans, jumbo nonconforming loans and interest-only mortgage loans.

How to Apply for a Guaranteed Rate VA Loan

Guaranteed Rate has 300 local branches across all states except Alabama, Arkansas and West Virginia, and no matter where you are, you can apply online by completing a form on the website. Enter the type of VA loan you are interested in, purchase price, down payment (if any), the state the property is located in, your name and email address. Most loans can be processed electronically, so you don’t have to leave your home other than to meet with a local representative to close on your mortgage.

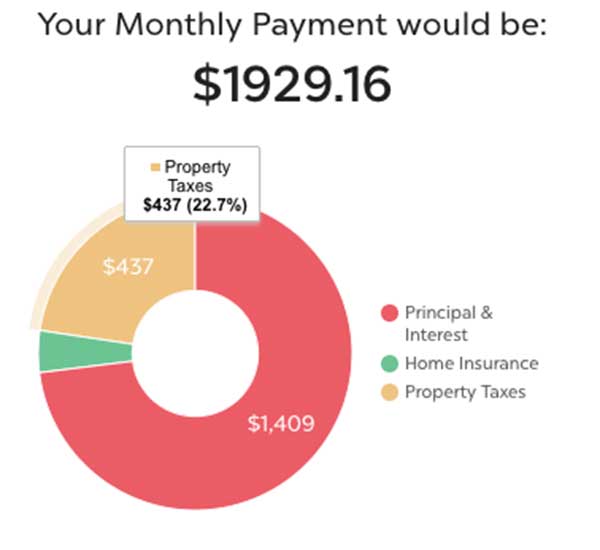

If you have questions before starting the application process, Guaranteed Rate lists a phone number and email address at the top of the form to get answers. You can look up the current day’s rates, use the mortgage calculator or the Knowledge Center on the website without entering any information.

Guaranteed Rate Mortgage Rate Comparison

Guaranteed Rate provides up-to-date mortgage rates for conventional, FHA and VA loans. Rates listed are within a few hours old. Below is an example of their mortgage rates side-by-side so you can easily compare.

Guaranteed Rate Complaints

Overall, Guaranteed Rate gets high marks from nearly every trusted consumer rating site, with customers speaking highly about the personalized service, ease of use and efficiency of the agents. The lender’s client satisfaction surveys since 2007 reflect an average of 95 percent customer satisfaction.

- Zillow readers give Guaranteed Rate 4.96 out of 5 stars with over 7,000 ratings

- Nearly 1,000 Lending Tree users give the company an even higher rating at 5 out of 5 stars

- ConsumerAffairs readers give the lender 1.8 stars with 33 ratings, but Guaranteed Rate staff responded to negative comments with an offer to speak directly to unhappy customers to resolve the problem.

- ConsumerAdvocate scores the company an 8 on a scale of 10

- The Better Business Bureau gives Guaranteed Rate an “A” rating with 149 customer reviews, and the lender is BBB Accredited

Guaranteed Rate VA Product-related FAQ

-

What are the eligibility requirements to receive a Guaranteed Rate VA loan?

Veterans who meet government requirements regarding length of service, active duty service members who have served for a minimum period, certain National Guard members, reservists and surviving spouses of deceased veterans are all eligible for VA loans. See VA Loan Eligibility and Requirements for details. -

What are the VA loan interest rates from Guaranteed Rate?

Guaranteed Rate lists daily interest rates for VA and all other loans on the website, so you can get an idea of what your rate might be. However, final mortgage interest rates depend on the amount of the loan, your credit and work history, your debt to income ratio and other factors. You will have to fill out an online loan application or contact a Guaranteed Rate representative to obtain a VA loan rate quote, which should be very competitive. -

How much are Guaranteed Rate VA loan closing costs?

Guaranteed Rate will show you all costs associated with your proposed mortgage, and the costs vary, so we can’t give you an estimate. Typically, closing costs on a VA loan consist of a loan origination fee (usually one percent of loan amount), loan discount points, credit report, appraisal fee, hazard insurance and real estate tax escrow, VA funding fee, title insurance and a recording fee. VA loan regulations allow the seller to pay these expenses, so you can write this into your offer to purchase. -

I don’t want to enter my information online. Can I still get a VA loan from Guaranteed Rate?

Yes, you can apply in person for a loan with Guaranteed Rate. Use the branch locator on the website to find the address and phone number for the closest branch, then call to schedule an appointment with a loan representative. If there are no branches located close to you, give Guaranteed Rate a call to start the VA loan process. -

How do I know a Guaranteed Rate VA loan is my best mortgage option?

To compare mortgages, use the Intuitive Loan Finder on Guaranteed Rate’s website by clicking on the red Let’s Get Started button at the bottom of the Loan Options page, then fill in the step-by-step details. You can also call a representative to compare VA loans to conventional mortgages. The VA loan has many money-saving benefits, but another type of loan may fit your financial profile better.

Conclusion

Our research shows Guaranteed Rate is a reliable company with excellent reviews from satisfied customers, both past and present. An easy to navigate website and loan agents who are personable and knowledgeable make the company worth considering for your VA mortgage loan needs.