WiserAdvisor Review

WiserAdvisor has matched more than 100,000 individuals with a financial advisor since launching in 1998. They don’t actually employ advisors, which helps keep the matching service unbiased and independent.

WiserAdvisor has created comprehensive advisor profiles on their website for each financial advisor they’ve vetted and approved. Simply completing the WiserAdvisor intake form (a quick 10-question survey) will pair you with up to three financial professionals who suit your needs.

If you’re the kind of person who likes to make careful decisions about your money, you’ll appreciate the ability to search the advisor directory by location before submitting your information or reaching out to any matches. WiserAdvisor also maintains a large library of financial articles and blogs to help you plan your future.

Pros

- The Advisor Match Service is free to use

- Extensive financial information offered on their blog

- Six calculators to help with retirement, savings, and investing

- Free initial consultation with no obligation to hire

- Directory lists top advisors by state and major cities

Cons

- Other companies leverage a more detailed matching process

- No calculators for home buying, taxes, or banking

- No financial advisors in AR, HI, MS, MT, SD, VT, WV, WY

How WiserAdvisor Helps You Choose a Financial Advisor

WiserAdvisor will ask you 10 questions before matching you with up to three candidates who have the appropriate experience. Though you won’t be required to submit detailed personal information on the intake survey, you will need to submit basic information, such as your location and a rough estimate of when you’d like to retire, in order to find matches.

Once submitted, WiserAdvisor consultants get to work sourcing the best financial advisors for you. They’ll email you (or send a text, if you prefer) advisor names and other important information about your matches. The selected financial professionals will reach out to set up an appointment for a free consultation—but remember, you’re under no obligation to hire them.

You also have the option to do your own sleuthing using WiserAdvisor’s online advisor directory, which is organized by state and major city. Click on a name, browse their complete advisor profile to learn more, and contact them yourself. If you tell the pro you found them via WiserAdvisor, they’ll provide you with a free initial consultation.

Additional Resources Available to You

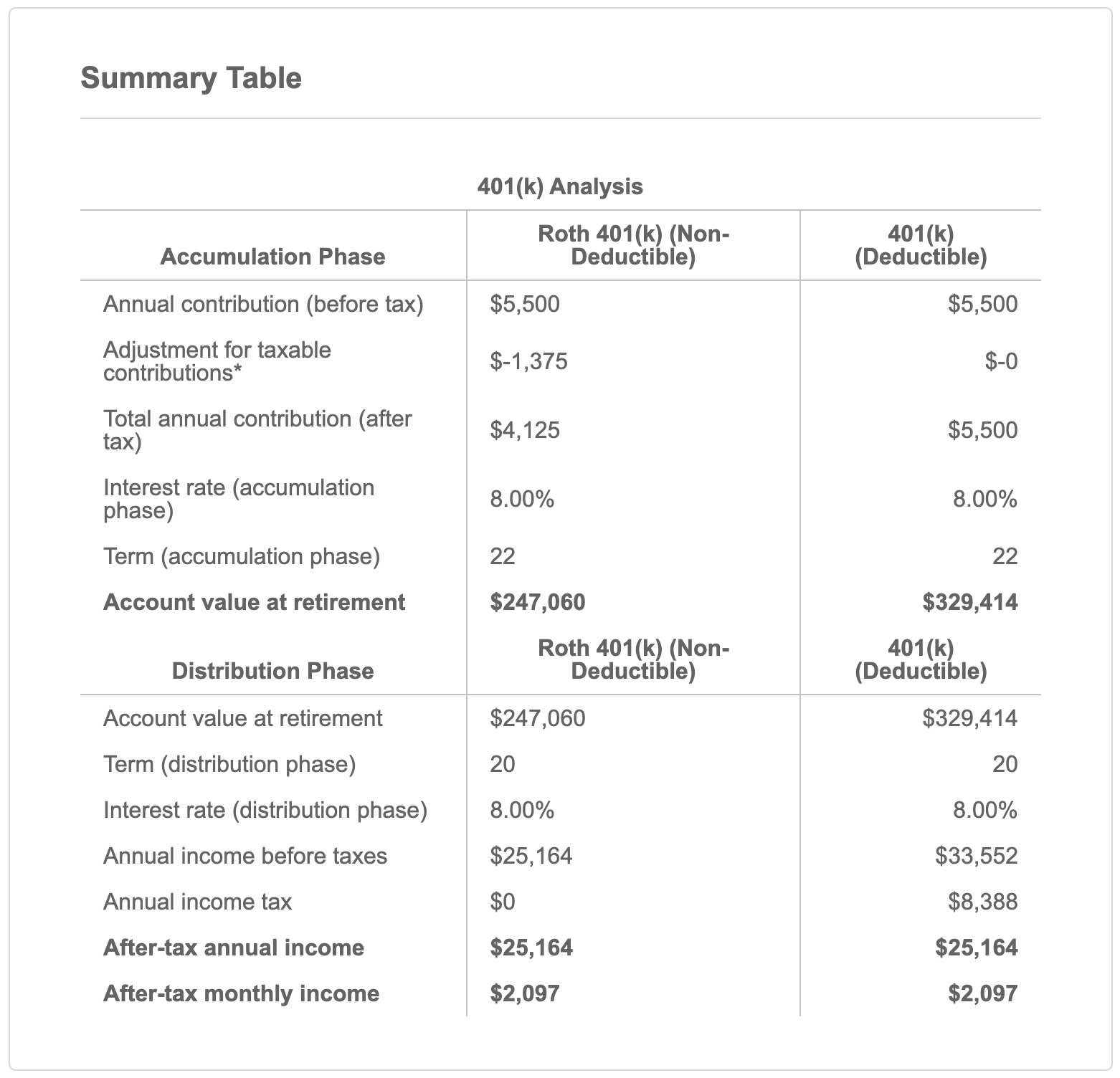

In addition to its matching tool, WiserAdvisor offers free access to several financial tools to help you with retirement and investment planning. Leverage their calculators to determine whether you have enough saved for your future financial goals and if your retirement savings are enough for your long-term goals.

| Retirement Guides and Calculators | Retirement Calculator Roth 401(K) vs. Traditional 401(K) Calculator Retirement Expenses Calculator Retirement Savings Calculator Inflation Calculator Savings Goal Calculator Retirement planning guides and checklists |

| Investing Guides and Calculators | Investment Return Calculator Savings Goal Calculator Strategies for wealth prevention and wealth creation Key trends for investing Important investment principles |

The Financial Advisor Screening Process

Experts who join the WiserAdvisor network must pass a three-step qualification process, which screens their years of experience, SEC/FINRA registration and records, and compensation criteria. All professionals on the network are fee-only or fee-based.

Financial advisors may specialize in:

- Financial planning

- Portfolio management

- Wealth management

- Retirement planning

- Educational planning

- Estate planning

- Business finances

Once matched, make sure to interview each advisor thoroughly. Some appropriate questions to ask a financial advisor include their money management philosophy, clients they typically work with, how they get paid, and years of experience in the field.

WiserAdvisor Costs

It won’t cost you anything to use the financial tools on the WiserAdvisor website. Your match to financial advisors and your initial consultation with them are also free.

For ongoing financial planning costs, the financial advisor you choose will get paid via a fee-only or fee-based structure.

| Fee-Only Advisors | Fee-Based Advisors |

|---|---|

|

|

Always ask whether your advisor is fee-based or fee-only. Both types of advisors have a legal fiduciary obligation to clients, but fee-only advisors do not have a conflict of interest between the advisor’s earnings and your financial account balances.

WiserAdvisor Complaints

WiserAdvisor reviews are positive overall. Based on more than 270 reviews, their Trustpilot score is 4.0 out of 5 stars at the time of publishing. Customers who offer positive reviews of WiserAdvisor appreciate their fast response times and the opportunity to interview candidates before choosing an advisor. They are not accredited by the Better Business Bureau.

Lower-rated reviews indicate that some customers felt pressured to choose an advisor during the interview process. Some reviewers had trouble matching with local advisors. However, this seems to be an issue regarding consumer inputs on the initial request form.

WiserAdvisor FAQs

What kind of information do I have to provide in the intake form?

WiserAdvisor only requires basic information to narrow down the selection of professionals who can best meet your needs. The matching tool is secure and private. On the intake form, you’ll provide:

- Zip code

- Phone number

- When you’d like to retire

- Whether you own a home or a business

- Your current household income

- Your current portfolio size

- Whether you currently have an advisor

- Where you prefer your advisor to be located

Can I research financial advisors before using WiserAdvisor?

Yes. The website provides a list of vetted financial advisors organized by state or major city. Each platform advisor has a complete profile that includes their experience, licensure, fee structure, services provided, type of clients served, and more.

How does WiserAdvisor choose financial advisors to include on its website?

Every advisor chosen for the platform is an experienced and highly-skilled professional who meets screening criteria: experience, advisor compensation (fee-based or fee-only), and licensing and disclosures with SEC/FINRA.

Can anyone use WiserAdvisor?

WiserAdvisor is available to anyone in the U.S. You can choose to work with a local advisor or expand your search more broadly and communicate virtually. The platform can connect you to professionals in all states except Arkansas, Hawaii, Mississippi, Montana, South Dakota, Vermont, West Virginia, and Wyoming.

Conclusion

WiserAdvisor’s free and secure platform matches you to the best financial advisor based on your needs. You can research the professional qualifications of each advisor and interview them about their philosophy before choosing the best expert for you. WiserAdvisor also maintains a robust library of free financial resources and calculators to help you manage your money effectively.