Mortgage loans from the U.S. Department of Veterans Affairs, better known as VA loans, are available to qualified active duty service member and veterans. The loans have many advantages, such as no down payment or private mortgage insurance.

There is no maximum amount an eligible military veteran or service member may borrow using a U.S. Department of Veterans Affairs (VA) home loan. However, the VA loan program will only guarantee, or pay the lender for a defaulted mortgage, up to $453,100 for 2018 for one-unit properties in most areas of the United States, the Federal Housing Finance Agency (FHFA) reports. This loan limit remains in effect from Jan. 1, 2018 until Dec. 31, 2018.

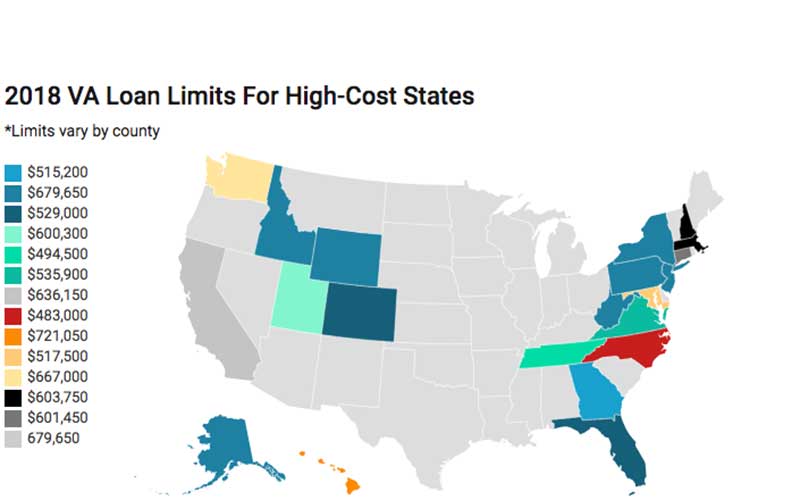

VA Loan Limits in High-Cost Areas

The Housing and Economic Recovery Act (HERA) requires VA loan limits to follow local-area median home value trends. Therefore, HERA allows for higher VA loan limits in areas where home values are higher than the national average.

If 115 percent of the local median home value exceeds the baseline loan limit – $453,100 for 2018 – the local loan limit is set at 115 percent of the median home value, according to HERA. The local limit cannot go beyond 50 percent of the baseline limit. Because of this, the VA loan limit in some regions of the contiguous United States is as high as $679,650 for 2018. The VA loan limit in these areas stays in effect until the end of the year.

Special Provisions for VA Loan Limits

FHFA applies special rules for baseline maximum loan limits of 50 percent or higher in Alaska, Hawaii, Guam, and the U.S. Virgin Islands. Since the baseline loan limit has increased for the contiguous United States in 2018, the baseline loan limit for these areas also has increased accordingly. In these areas, VA loan limits can exceed $679,650, and these limits are in effect until the end of the year.

VA Loan Limits for Multi-Unit Properties

HERA mandates the baseline maximum loan limits for two-, three-, and four-unit properties increase by the same percentage as the increase in the one-unit limit. The baseline maximum loan limit for two-, three-, and four-unit properties rose 6.8 percent between 2017 and 2018.

In most areas, the maximum VA loan limits for multi-unit properties for 2018 are $580,150, $701,250, and $871,450 for two-, three- and four-unit homes. Comparatively, in high-cost areas, the maximum VA loan limits for two-, three- and four-unit properties are calculated using 115 percent of the local one-unit median home value and multiplying this amount by 2-, 3-, and 4-unit multipliers. The result is then compared to the local ceiling loan limit. This formula ensures the maximum VA loan limit does not exceed the local ceiling loan limit.

How Are VA Loan Limits Determined?

FHFA uses median home value estimates from the U.S. Federal Housing Administration (FHA) of the U.S. Department of Housing and Urban Development (HUD) to assess median home values for its lending limits. Additionally, FHFA uses the Home Price Index (HPI) and HERA formula in its calculations.

HPI is used to measure the movement of single-family house prices in the United States. To provide an accurate indicator of house price trends across the country, HPI uses a weighted, repeat-sales index. HPI then measures average price changes in repeat sales or refinancing on single-family houses annually.

HERA requires the baseline loan limit to be adjusted annually to reflect changes in the national average home price. It specifies FHFA use an index to track average home prices for this reason. FHFA in May 2015 announced plans to use a seasonally adjusted HPI with expanded data for this purpose.

The VA pays up to 25 percent of your loan amount. Eligible veterans get a basic primary entitlement in the amount of $36,000. This makes the maximum loan amount $144,000 ($36,000 X 4). This amount can purchase a home in some parts of the country but to stay competitive, the VA began adding its guaranty amount with conventional financing loan limits, which is $453,100.

Keeping in mind the VA covers a quarter of your loan limit, a quarter of $453,100 is $113,275. To make housing more affordable the VA created a secondary entitlement ($113,275 – 36,000 = $77,275). This secondary amount is available if eligible veterans buy a home for more than $144,000.

| 2018 Conforming Loan Limits | ||

|---|---|---|

| Number of Units | Contiguous States | Alaska, Hawaii |

| One | $453,100 | $679,650 |

| Two | $580,150 | $870,225 |

| Three | $701,250 | $1,051,875 |

| Four | $871,450 | $1,307,175 |

| 2018 High-Cost Area Loan Limits | ||

|---|---|---|

| Number of Units | Contiguous States | Alaska, Hawaii |

| One | $679,650 | $1,019,475 |

| Two | $870,225 | $1,305,325 |

| Three | $1,051,875 | $1,577,800 |

| Four | $1,307,175 | $1,960,750 |

Benefits of VA Loans

VA home loans are available to millions of veterans and service members nationwide. There are many benefits associated with these loans, such as:

-

No down payment required: VA home loans don’t require a down payment on a house. However, a borrower may use a down payment to increase equity in the property and to reduce monthly mortgage payments.

-

Low interest rate: VA home loans allow a military homebuyer to purchase a home at a competitive interest rate. Plus, they often don’t require a homebuyer to pay private mortgage insurance (PMI).

-

Limited closing costs: The median down payment on a home purchase for first-time homebuyers was 6 percent in 2016, according to the National Association of Realtors (NAR). On the other hand, the average VA home loan closing costs fall between 1 percent and 5 percent of a home’s purchase price, Military VA Loan notes. Also, home sellers can pay all of a buyer’s VA loan-related closing costs up to 4 percent of a home’s purchase price.

-

No prepayment penalties: If a borrower decides to pay off a VA home loan early, he or she won’t have to pay any financial penalties.

-

Foreclosure avoidance advocacy: The VA backs its home loans with foreclosure avoidance assistance. Its team of home loan experts will work with a borrower and lender to avoid foreclosure.

Bottom Line:

VA home loan limits may vary based on your location. At the same time, not all VA loans are created equal, and the home financing option you select may have far-flung effects on your ability to acquire a great house at a budget-friendly price. With insights into VA loan limits for 2018, you can take the first step to craft an effective home buying strategy. As a result, you can use these insights to qualify for a VA home loan, narrow your home search to specific cities and towns, and enjoy a seamless home buying experience.