Best VA Loan Lenders

Updated:

Retirement Living takes an unbiased approach to our reviews. We may earn money when you click a partner link. Learn More

VA home loans give active and veteran military members key benefits when it comes to buying a home. Read on to learn about getting a VA home loan.

- Great Online Experience

- Competitive rates

- Multiple lenders

LendingTree is the leading online loan marketplace offering home loan products like new home loans, mortgage refinance loans and reverse mortgage loans. LendingTree partners with multiple trusted lenders to help you get the best rate possible.

Bank of America

- Great Customer Service

- Wide offering of financial products

- Competitive rates

Bank of America offers a range of refinancing options including FHA, VA, and cash-out refinancing, along with fixed- and adjustable-rate loans.

VA Home Loans Lenders 2024

We evaluated 10 well-known U.S. Department of Veterans Affairs (VA) mortgage lenders, and after an in-depth review found four of the top options. We analyzed consumer reviews, government data and industry insights during our evaluation, and five lenders stood out from the competition: NBKC, Bank of America, New American Funding, Veterans First Mortgage and Guaranteed Rate.

In this guide, we’ll explore what a VA loan is, how they work and their benefits. We’ll also evaluate VA mortgage lenders so you can get started with finding a lender to finance your home.

Top VA Loan tips:

- Review your credit score. The minimum credit score for getting a VA loan is 620 (580 for some lenders)

- Realize you can include up to $6,000 for energy-efficient improvements in your VA loan

- Cut your debt-to-income ratio to around 41 percent to increase your chance of getting a VA loan

Tips for a Wise Buyer

There are subtle differences between a VA loan and a conventional loan and differentiating an exceptional VA mortgage lender from an average one can be difficult, so we’re here to simplify your search for the best lender of this type. Before we do that, let’s take a look at four tips to help you find the ideal VA mortgage lender.

Review your credit reports

Most VA mortgage lenders will check your credit score; a three-digit number used to evaluate your creditworthiness. Credit scores range from 300 to 850. An Excellent or Exceptional score (reporting agencies use different terms) is around 800. A good credit score is over 700, and 579 or lower puts you into the Very Poor range. The average credit score in the United States is 687, according to a recent analysis of 330,000 mortgage applications conducted by Governing.com. Additionally, the Governing study showed mortgage applicants’ credit scores declined in most states year over year.

You are entitled to a free copy of your credit report every year from the three reporting bureaus: Equifax, Experian and TransUnion. Alternatively, go to AnnualCreditReport.com to get all three free credit reports at once, although there are advantages to reviewing a report from one of the three bureaus every four months to stay on top of your credit rating. If you find errors on any of your credit reports, notify the reporting bureau immediately.

To improve your credit score, you should pay off outstanding debt as quickly as possible and use an identity theft service to make you aware of someone applying for credit using your personal information. Credit Karma and other credit monitoring services enable you to check your credit score for free with recommendations for increasing your score.

Get Pre-approved for a VA Loan

There are many reasons to consider loan pre-approval. First, completing the pre-approval process enables you to identify any potential financing or VA eligibility hurdles before launching a home search. It also allows you to estimate the amount of money you can spend on a home. Perhaps most important, loan pre-approval ensures you can enter the real estate market with home financing in hand.

During the loan pre-approval process, a VA mortgage lender will review your employment and income histories and review your home-buying goals.

A lender may request information about your desired loan amount, bank accounts and other assets. They’ll also conduct a credit check.

To shop around for the best VA loan terms, submit applications with multiple lenders and select the best home financing option based on your individual needs.

Budget for Closing Costs

A VA mortgage lender establishes the interest rate of each loan, which varies from lender to lender. As the home buyer, you’ll likely pay closing costs related to an appraisal, state and local taxes, credit checks and other items. The seller may pay some loan closing costs, but the amount cannot exceed 4 percent of the loan. Another cost is a funding fee, which is applied to a loan amount and varies based on a borrower’s military category, down payment and other factors.

The amount you pay for a home is unlikely to match your initial offer unless you have cash available for closing costs. Budget for these costs and get a quote from the lender that includes a cost breakdown before you set your closing date. Keep in mind, even though a down payment isn’t required for a VA loan, there are advantages to putting money down on a VA loan at closing.

Work With an Expert Real Estate Agent

In 2016, the National Association of Realtors reported that 88 percent of homebuyers worked with a real estate agent to find a home. Real estate agents are easy to find, yet not all of these housing market professionals understand how VA loans work. Hire a real estate agent who specializes in VA loans and you’ll streamline your house search.

A real estate professional who knows the ins and outs of VA loans can help you find your ideal residence, negotiate a home purchase price and establish a home sales contract. Your agent should understand the intricacies of the VA loan process and know how to structure a home purchase agreement to help you save time and money.

Our search for the best VA mortgage lenders

- We reviewed VA mortgage lenders based on our expert-guided buying criteria

- We crafted an extensive list of VA mortgage lenders

- We provided you with the best VA mortgage lenders for consideration

VA Lender Reviews

Following our evaluation, we selected the four best VA mortgage lenders: NBKC, Bank of America, New American Funding, Veterans First Mortgage and Guaranteed Rate. These lenders combine industry knowledge with a broad assortment of VA loan options to surpass borrowers’ expectations.

We used the VA’s mortgage lender loan volume reports to identify the top VA mortgage lenders regarding loans guaranteed, average loan amount and other criteria.

To refine our search, we accessed VA mortgage lender ratings and reviews from Consumer’s Advocate, U.S. News & World Report and other industry-leading publications.

Finally, we examined VA mortgage lenders based on our wise buyer criteria. We removed VA mortgage lenders from our search if they failed to provide information on their website about pre-approval and qualifications. We also eliminated lenders from consideration if they did not offer online tools and resources to help borrowers estimate VA loan costs.

NBKC VA Loans

Great Lender |

NBKC has been helping veterans purchase and refinance their homes through the VA home loan program since 1999, and has helped thousands of veterans secure financing. As a top VA lender, NBKC stands out for its commitment to veterans.

The company earned our Best Overall primarily because of it no origination fee approach to VA lending. On top of that, the company’s streamlined closing process helps veterans to quickly get the funds they need to purchase their home. The typical VA loan with NBKC closes in less than 30 days.

Screenshot: NBCK Testimonial.

NBKC has an excellent reputation, with lots of satisfied customers. The company also has an “A+” rating from the BBB, a 5-star rating from BankRate and a 4.9 rating from Zillow.

Bank of America VA Loans

Great Qualification Flexibility |

Bank of America ranks second among the most significant U.S. banks regarding assets. It partners with 47 million individuals globally and offers VA loans with low down payment options and flexible credit and income requirements.

Screenshot: Bank of America FAQ

With Bank of America, you can receive up to 100 percent financing with a VA loan. Bank of America also offers VA loans with as little as $0 down; these loans are available to qualified borrowers who prefer to pay a higher VA funding fee at closing. On the other hand, borrowers who make a five percent down payment as part of a Bank of America VA loan are eligible to receive a reduced funding fee.

If you have concerns or questions about VA loans, you should have no trouble connecting with Bank of America’s VA loan experts. The bank’s lending specialists are available via phone and online chat, or you can request a call back from a BOA lending specialist or meet with a specialist at a local branch. If you need advice about how much money to put down on a home, Bank of America provides mortgage down payment guidance. And for those who plan to purchase a house for the first time, Bank of America offers many tips for first-time homebuyers.

New American Funding VA Loans

Lowest Fees |

New American Funding is a family-owned lender. The New American VA loans are some of the best available, featuring low-interest rates and fees. In some instances, New American borrowers may be exempt from the funding fee on a VA loan. New American offers no down payment, pre-payment penalty or monthly mortgage insurance premiums on VA loans.

Screenshot: New American funding options.

New American has plenty of resources to teach home buyers about VA loans. The lender’s website provides full details about VA purchase and refinance loans, definitions of standard VA loan terms and online tools and resources for borrowers from all military branches.

Veterans First Mortgage VA Loans

Great Customer Service

Great Customer Service |

Founded in 1985, Veterans First Mortgage has a track record of going beyond the call of duty to assist borrowers. Veterans First has served more than 100,000 veterans and families to date, providing over $21 billion in home loans. This lender has a 9.6 out of 10 TrustScore from Trustpilot, a score that reflects providing excellent service and personalized customer support.

Screenshot: Veterans First Mortgage service options.

Veterans First Mortgage makes it simple for borrowers to apply for a VA loan. You can start your application online or call Veterans First to speak with an experienced lending professional.

Veterans First Mortgage has received multiple five-star reviews based on its customer service and industry expertise. The mortgage lender often helps borrowers take the guesswork out of VA loans, and by doing so, speeds up the loan application and approval processes.

Guaranteed Rate

Great Online Experience |

Guaranteed Rate may be best-known as the provider of the world’s first digital mortgage, and when it comes to VA loans, Guaranteed Rate delivers impressive online support.

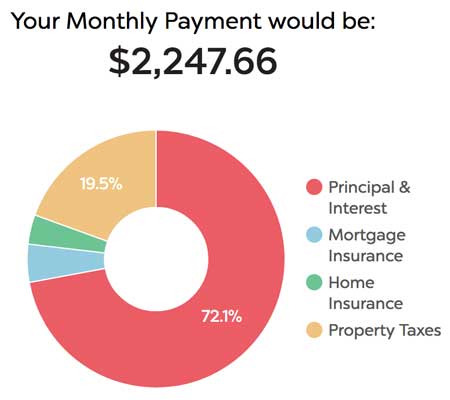

Screenshot: Guaranteed Rate Online Chart.

Guaranteed Rate’s online resources are unmatched by other VA mortgage lenders. You can get pre-approved for a VA loan from any computer or mobile device and with Guaranteed Rate’s online prequalification process, you can find out if you are eligible for a VA loan in just a few clicks. The online FAQ section helps borrowers determine whether this type of loan is the right choice.

Guaranteed Rate provides both VA purchase and refinance loan options. It has a 95 percent customer satisfaction rating, and 94 percent of customers say the lender made it easy for them to obtain a loan. A Net Promoter Score (NPS) of 82 percent backs the claim of high customer satisfaction; comparatively, the average NPS in the banking industry is 38 percent.

VA Loan Rates and Benefits by Lender

Getting a VA mortgage gets you a few benefits that aren’t available with other loan types. Benefits include no down payment, no monthly PMI, limited closing costs and lower interest rates. The following chart highlights key features of our top four VA mortgage lenders.

| NBKC | Bank of America | New American Funding | |

|---|---|---|---|

| Rates | 15-Year Fixed as low as 4.1% | 15-Year Fixed As low as 4.2% | Low 15-Year Fixed rate and fees. Quote available online |

| Qual- ifications | Minimal. No loan defaults last 12 months. | Flexible guidelines | Minimal credit levels. Sufficient income. |

| Down Payment | 0%-1% down | No down payment for qualified borrowers | No down payment required |

Additional VA Lenders

Veterans United Home Loans offers VA home loans and VA refinancing options. Read our comprehensive Veterans United Home Loans review.

Related VA Loan Lenders Resources

Readers of this VA Loan Lenders guide content also found these related articles to be helpful.

How to Avoid VA Loan Scams

According to a recent AARP report, veterans are twice as likely to be targeted for fraudulent loans as civilians. It is important to know be aware of scams if you have a VA loan or are interested in applying for one.

6 Ways to Get the Best VA Mortgage Rates

Getting the best mortgage rate is one of the top goals for anyone getting a home loan. If you’re interested in a VA home loan, check out 6 ways to get the best VA mortgage rate.

Mortgage Options for Veterans

Veterans have some of the best mortgage options available. From low interest rates to no down payments, a VA loan comes with many benefits. As a veteran, if you’re in the market for a loan, make sure you check out all of your options.

More Related Articles

Frequently Asked Questions about VA Loan Lenders

What is a VA loan?

The Veterans Administration guarantees VA loans. In other words, if the borrower defaults on the loan, the VA repays the lender. The VA approves lenders for participation in this program, designed to help returning service members buy a house. Read in detail what VA loans are.

How is a VA loan different from a traditional mortgage?

It may be easier for a military veteran or active service member to qualify for a VA loan than for a traditional mortgage. A conventional home loan requires a down payment, a VA loan does not. The fees associated with VA loans also are lower than those of traditional mortgages. Moreover, if a borrower can no longer make payments on a VA loan, the VA will negotiate with a lender on a borrower’s behalf.

Who is eligible to receive a VA loan?

The following people are eligible for a VA loan: veterans who meet requirements regarding length of service, active duty service members who have served a minimum period, certain National Guard members and reservists and certain surviving spouses of deceased veterans. Read more about VA loan eligibility and requirements.

What are the criteria for a VA loan?

There is no maximum debt ratio for a VA loan, but a lender must provide compensating factors if a borrower’s total debt ratio exceeds 41 percent. Also, there is no credit score requirement for a VA loan and while there is no maximum amount you can borrow with a VA loan, the VA loan program will only guarantee (pay the lender for a defaulted mortgage) up to a certain amount. Read about VA loan limits for 2018.

If I get a VA loan, will I still need money for a down payment on a home?

A borrower can obtain a VA loan without a down payment. Approximately 90 percent of homes purchased with VA loans did not require a down payment. But sellers rarely cover all home closing costs. In all likelihood, you’ll also need money for a home appraisal, home inspection and other home buying fees.

What should I expect during the VA loan process?

VA mortgage lenders offer home financing for eligible applicants. A lender will need to provide a certificate of eligibility (COE) to verify your eligibility for a VA loan. You can obtain a COE via eBenefits, an online service provided by the VA and Department of Defense, or a lender may request a COE on your behalf.

Once you meet with a VA mortgage lender, you can learn about its loan interest rates and terms. Consult with several lenders to find the ideal VA loan.

Can the VA help me if I’m struggling to make my loan payments on time?

Yes. The VA offers free access to loan technicians who can help a borrower retain his or her house and avoid foreclosure.

Concluding Thoughts on VA Loans

Bottom Line:

VA loans offer many benefits, but you should always review a VA mortgage lender’s terms and conditions.

Millions of veterans and service members can obtain a VA loan. The advantages of a VA loan include no down payment requirements, low interest rates and limited closing costs. Not all VA loans are identical, and the VA mortgage lender you select effects your home financing.

We chose three VA mortgage lenders after performing comprehensive evaluations and research. With our recommendations, we hope to help you get the financing you need to make your homeownership dream come true.

Best VA Loan Lenders

| VA Loan Lender | Best For | |

|---|---|---|

| 1 | LendingTree | Great Online Experience |

| 2 | NBKC | Great Lender |

| 3 | Bank of America | Great Qualification Flexibility |

| 4 | New American Funding | Lowest Fees |

| 5 | Veterans First Mortgage | Great Customer Service |

| 5 | Guaranteed Rate | Great Online Experience |