There are several loan and grant programs that fall under the VA loan program. These include the three primary types of VA loans and two refinancing options. These are the standard purchase loan known as the VA loan, the cash-out refinance loan, and the Interest Rate Reduction Refinance Loan (IRRRL). The two refinancing options allow veterans and service members to refinance their mortgage while remaining in the VA program, and the IRRRL is the most commonly used.

VA Interest Rate Reduction Refinance Loan (IRRRL) Overview

The IRRRL is one of two VA loan refinancing programs. While the cash out refinance loan is intended to allow veterans to access home equity, the IRRRL is designed for getting a better interest rate than the original VA home loan. The IRRRL forbids cash back offers from lenders and is sometimes called a Streamline or VA Streamline loan. Like all VA loans, the Department of Veteran Affairs does not issue an IRRRL. These mortgage refinancing deals administered by private lenders who participate in the VA loan program. These lenders are banks, credit unions and other mortgage lending institutions. No lender is required to provide an IRRRL, and terms and interest rates vary between lenders.

IRRRL Quick Facts:

-

An underwriting package or appraisal package is required when applying for an IRRRL.

-

Money out of pocket isn’t required with an IRRRL. This is due to either including all costs in your new loan or making your new loan’s interest rate high enough so the lender can cover costs.

-

Your interest rate may increase if you’re refinancing from a VA ARM loan.

-

While a lender isn’t required to give you an IRRRL, you can choose any VA lender to process your IRRRL application.

-

Terms may vary so it’s highly recommended veterans contact several lenders.

-

You can not receive any cash from an IRRRL.

VA IRRRL and Property Eligibility

The IRRRL program is only available for use with refinancing the mortgage used with your initial VA loan eligibility. Your entitlement is the total the VA will guarantee on your home loan, not the amount of your mortgage approval. The formula for the entitlement amount is a bit different for everyone.

An IRRRL can’t be used on properties not currently financed under a VA loan. The property to be refinanced must also use your entitlement, not that of another service member or veteran, with one caveat: You could substitute your entitlement for the seller’s entitlement if you bought the home from another veteran by assuming, or taking over, his or her VA loan.

Because a VA loan is involved, the financing and borrower eligibility through the VA property assessment process is in place. You will not need to go through a new checklist of qualifications to ensure the property meets minimum property requirements. Likewise, there is no appraisal for an IRRRL. However, the occupancy requirements differ from the standard VA loan requirements. Other VA loans require you to live in the home as your primary residence, but with an IRRRL you only need to certify that you previously occupied the home at some point. Because of this rule, you could use the IRRRL to refinance a home to be used as a rental property, for example.

VA IRRRL and Certificate of Eligibility

Because you are reusing your eligibility for the original VA loan when you refinance with an IRRRL, a new Certificate of Eligibility (COE) is not required. Lenders will still need to verify that you used your eligibility on the current loan on the property. You can provide your lender with either your original COE to show that it has been previously used on the property, or use a copy of the email confirming your COE received from the VA.

Do I Have to Put Money Down With an IRRRL?

You can avoid paying closing costs upfront with an IRRRL by rolling all fees into the mortgage. The lender may also offer a higher interest rate instead of closing costs. However, VA regulations forbid cash back to the service member or veteran from an IRRRL. No lender should offer a refund from closing on the loan, explained below.

Can I Get Cash Back from an IRRRL, Skip a Payment, or Access My Home’s Equity?

No money can be received from the loan proceeds when using the IRRRL. Refunds from escrow are not prohibited as they are not actual loan proceeds. However, the VA considers refunds from escrow to be suspicious, and you should avoid this whenever possible.

Payment skipping is also prohibited when used to pull cash out of an IRRRL. However, some lenders defer payments for one to three months after closing and refer to the deferral as skipped payments. However, these “skipped payments” are moved to the end of the loan term, delaying payments without skipping or eliminating anything.

There have been many reports of unscrupulous lenders advertising false and predatory scams to veterans, including promising cash back at closing and skipping payments. The practice has become so prevalent that the VA and the Consumer Financial Protection Bureau issued a warning in November 2017, the first time the VA has ever released a warning of this nature.

To get cash out of a VA loan, apply for VA cash-out refinancing loan instead of trying to use an IRRRL. Your only other option is to refinance into a conventional mortgage and out of the VA loan program.

Refinancing Scams Targeting Veterans

Confusing the issue of refinancing with an IRRRL, or other VA refinancing offer, are predatory offers from less than reputable companies filling the mailboxes of veterans. These offers for refinancing often come in official-looking envelopes using logos similar to the VA’s or even wholly copying the VA’s logo and envelope design.

They sometimes use false or inaccurate regulation numbers on the correspondence inside to try to make claims look official. These refinancing offers are also sometimes designed to make the service member believe the refinance is required to protect benefits or access new benefits. They also sometimes say that your mortgage lender is changing and you need to fill out confirmation paperwork.

While loans are sometimes sold, these fraudulent offers are just an unsolicited sales pitch without any connection to your lender. Often these aggressive and misleading sales pitches begin showing up only a few months after the initial home purchase through a VA loan closes.

If you receive a refinancing offer that concerns you, call a VA loan specialist at (877) 827-3702. If you have problems with a VA refinance you can submit a complaint to the Consumer Financial Protection Bureau online or by calling (855) 411-2372.

Interest Rates Under IRRRLs

There are no guaranteed interest rates under IRRRL. Individual lenders determine interest rates using their requirements, such as credit score and debt-to-income ratio. However, the VA advises members to be aware that offers of low interest rates without details can be designed to mislead service members. A typical bait and switch tactic is to advertise a 15-year rate or adjustable rate mortgage rate with wording that makes it seem like a 30-year fixed rate offer. These unusually low rates are contingent upon the service member buying down the rate with discount point programs that are drastically overpriced and negate any rate savings.

Loan Limits Under IRRRLs

There are no loan limits on an IRRRL set by the VA to define how much you can borrow under the program. However, just as with the original VA loan, there are limits on the liability the VA will assume (your entitlement). Based on that liability guarantee, a lender may set their limits on what they are willing to loan. Though not required, most lenders offer loans up to four times the VA entitlement amount. The amount varies based on your credit, income, and the property itself. While the basic entitlement is $36,000, the amount of the VA guarantee varies by county.

Do I have to pay the VA Funding Fee with an IRRRL?

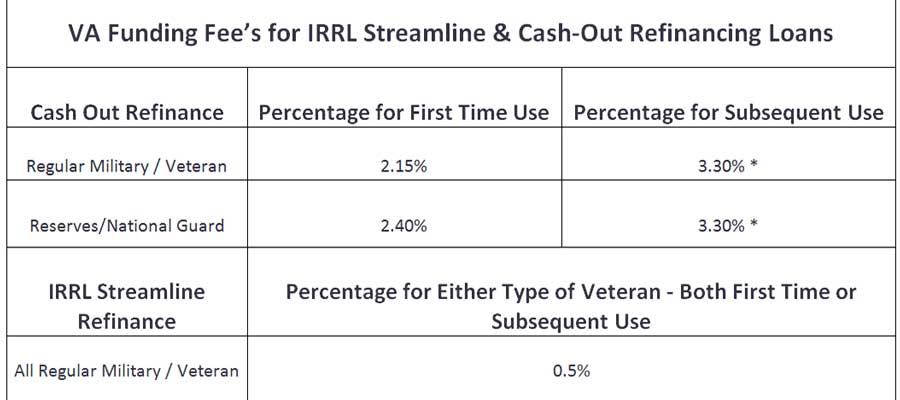

Yes, the VA funding fee applies to an IRRRL just as it does your original VA loan. However, the VA funding fee amount may be slightly higher in some cases. Your specific eligibility category and the number of times you have used the VA loan system will determine the VA funding fee. For example, veterans who receive VA disability money are usually exempt from the VA funding fee.

Second Mortgages and the IRRRL

Second mortgages can be tricky when using the IRRRL program. Second mortgages themselves cannot be refinanced using an IRRRL. However, the biggest issue with a second or subsequent mortgage is that the lender(s) holding the new mortgage(s) will have to agree to subordinate their lien, so the IRRRL is considered a first mortgage. If the holder of the second mortgage will not subordinate their lien, the veteran will have to pay off the second mortgage before they can use the IRRRL program.

Bottom Line:

IRRRLs are meant to offer you a lower interest rate when refinancing your VA loan. While a lower interest rate is a good thing, there are some things to be aware of with an IRRRL. Keep in mind, you can’t get cash out with an IRRRL, you’ll pay a funding fee and the IRRRL program has its own closings costs you’ll be responsible for. If you keep these things in mind, an IRRRL can be a great option for you.