Vanguard Digital Advisor

Updated:

Retirement Living takes an unbiased approach to our reviews. We may earn money when you click a partner link. Learn More

Vanguard Digital Advisor’s core offering is its user-friendly passive investment management using some of the best low-cost index funds in the industry. Since launching in 2019, Vanguard’s robo-advisor has expanded to offer tax loss harvesting and comprehensive goal planning for retirement. Its hybrid robo-advisor option, Vanguard Personal Advisor, includes access to human advisors for a slightly higher fee and higher account minimum.

Editorial Breakdown

Features and Tools

Fees

Investment Options

Ease of Use

Overall Rating

Bottom Line

In addition to its low-cost, low-risk investment options, Vanguard Digital Advisor also includes a robust set of goal-planning tools that make budgeting for retirement easy.

Vanguard Digital Advisor holds a firm spot on our list of the best robo-advisors thanks to its low-cost investment options and comprehensive goal planning and projection tools. While its robo-advisor portfolios offer less customization (your money is invested in Vanguard’s own exchange-traded funds) Vanguard is the household name in retirement planning. You’ll just need $3,000 to sign up.

Plus, Vanguard Digital Advisor has some of the lowest robo-advisor fees in the industry. And right now, Vanguard offers no advisory fees for the first 90 days. Vanguard also offers a second, hybrid robo-advisor option, Vanguard Personal Advisor, for those who prefer access to a human financial advisor. We evaluate both below.

Pros:

- Low management fees

- Human advisor access available with Vanguard Personal Advisor

- Respected industry reputation

- Extensive educational resources and tools

Cons:

- Higher account minimum

- Portfolio only includes Vanguard ETFs

Vanguard Robo Advisor Overview

| Feature | Vanguard Digital Advisor | Vanguard Digital Advisor |

|---|---|---|

| Account Minimum | $3,000 | $50,000 |

| Fees | 0.20% for all-index portfolio option 0.25% for active/index portfolio option | 0.35% for all-index investment option 0.40% for active/index mix option |

| Portfolio Mix | Vanguard ETFs | Vanguard ETFs |

| Accounts Supported | Individual and joint brokerage, Roth IRAs, Traditional IRAs, Rollover IRAs | Individual and joint brokerage, Roth IRAs, Traditional IRAs, Rollover IRAs, trusts |

| Tax Strategy | Tax-loss harvesting | Tax-loss harvesting, tax-coordinated portfolio |

| Automatic Rebalancing | Yes; triggered at 5% drift | Yes; triggered at 5% drift |

| Cash Management | No | No |

| Human Advisor | No | Yes |

| Mobile App | Yes | Yes |

| Customer Service | Phone: Monday to Friday, 8 a.m. to 8 p.m. ET | Phone: Monday to Friday, 8 a.m. to 8 p.m. ET |

How To Invest With Vanguard Robo-Advisor Services

Vanguard Digital Advisor: Robo-Advisor

Vanguard Digital Advisor is the company’s tried-and-true robo-advisor option. For every newly enrolled customer, Vanguard will invest your assets in a portfolio of different Vanguard exchange-traded funds (ETFs). Allocations are custom-matched to your age, risk tolerance, and other factors.

Portfolio options include all-index, active, environmental, social, and governance (ESG) options, and municipal bonds. Investors can customize and adjust these portfolios based on a specific goal or target date. The most common option is the all-index plan, a passive investment portfolio comprised of four Vanguard ETFs.

Vanguard Personal Advisor: Hybrid Robo-Advisor

With Vanguard Personal Advisor, part of your setup includes a consultation with a Vanguard Advisor where you’ll receive your customized investment plan.

Retirees especially should consider the Personal Advisor option, as your finance professional can consult with you on Social Security optimization, long-term care and medical costs, estate planning, charitable giving, tax efficiencies, Roth conversions, and trust services. This is in addition to the standard robo-advisor services offered in Digital Advisor.

For some, Vanguard’s $50,000 account minimum could feel steep, but it’s reasonable compared to Betterment’s $100,000 minimum for access to a financial advisor and Charles Schwab’s $25,000 minimum.

For robo-advisors with lower minimums, zero management fees, and human advisor access, you might consider M1 Finance or SoFi Invest.

How to Set Up a Vanguard Robo-Advisor Account

Vanguard’s robo-advisor works using a Vanguard brokerage account, so you’ll need to have one already to use Digital Advisor or Personal Advisor. (New users can sign up for a brokerage account before they create a robo-advisor account.)

Much of Vanguard’s account setup process is similar to that of other robo-advisors. You’ll provide basic information like your name, address, Social Security number, and banking information.

However, where Vanguard feels more developed than competitors is with its intake questionnaires, which outline financial scenarios to determine your current spending, risk tolerance, and goals.

The sign-up process takes about 25 minutes in total and is meant to help the robo-advisor build a proper allocation of stocks and bonds for your portfolio.

Vanguard Robo-Advisor Costs

Vanguard Digital Advisor charges no advisory fees for the first 90 days. After that, it activates a gross management fee of up to 0.20% or 0.25%, depending on the assets being managed. This includes the price of the ETFs for an all-index portfolio. Vanguard’s average expense ratio is 0.09% compared to the industry average expense ratio of 0.54%.

Plus, it just makes sense to invest in Vanguard ETFs directly from Vanguard. Vanguard’s all-in fee structure includes both the management fees and the ETF fees.

Alternatively, if you bought a Vanguard ETF from another robo-advisor, you would be charged a management fee in addition to ETF fees.

For example, robo-advisors such as Betterment and Wealthfront charge a 0.25% management fee plus another 0.08% to 0.15% or more in ETF fees (which often go to Vanguard anyway).

| Fee Type | Digital Account | Premium Account |

| Account Minimum | $0 ($10 minimum to start investing) | $100,000 |

| Fees | 0.25% of AUM for accounts with at least $20,000 $4 per month for accounts with less than $20,000 0.15% of AUM for accounts over $2 million | 0.4% of AUM for accounts with at least $100,000 0.3% of AUM for accounts over $2 million |

Education and Tools

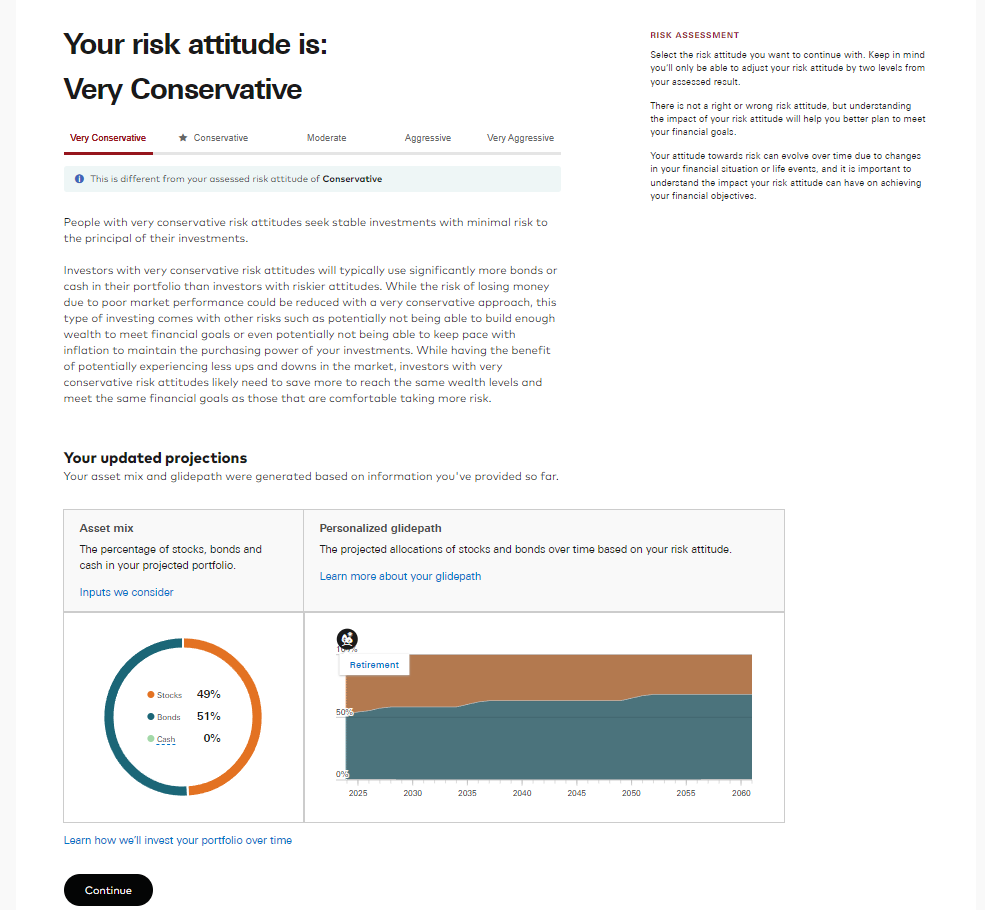

In addition to its investment portfolios, Vanguard has some of the most specific and actionable planning tools of all the robo-advisors we sampled. While some robo-advisors define your risk tolerance using a self-diagnosed range, Vanguard uses a robust risk tolerance tool with scenario-based questions to determine how you actually view investment risk.

At account setup, we completed a 10- to 15-minute intake questionnaire that inquired about our investment philosophy—almost like a personality test. For example, we were asked, “Does it make you anxious if your investments go down in a year?”

Vanguard will determine your risk level based on your responses. It uses risk tolerance to recommend an allocation of stocks and bonds, but we had the option to override its recommendation if we wanted to allocate using a different ratio.

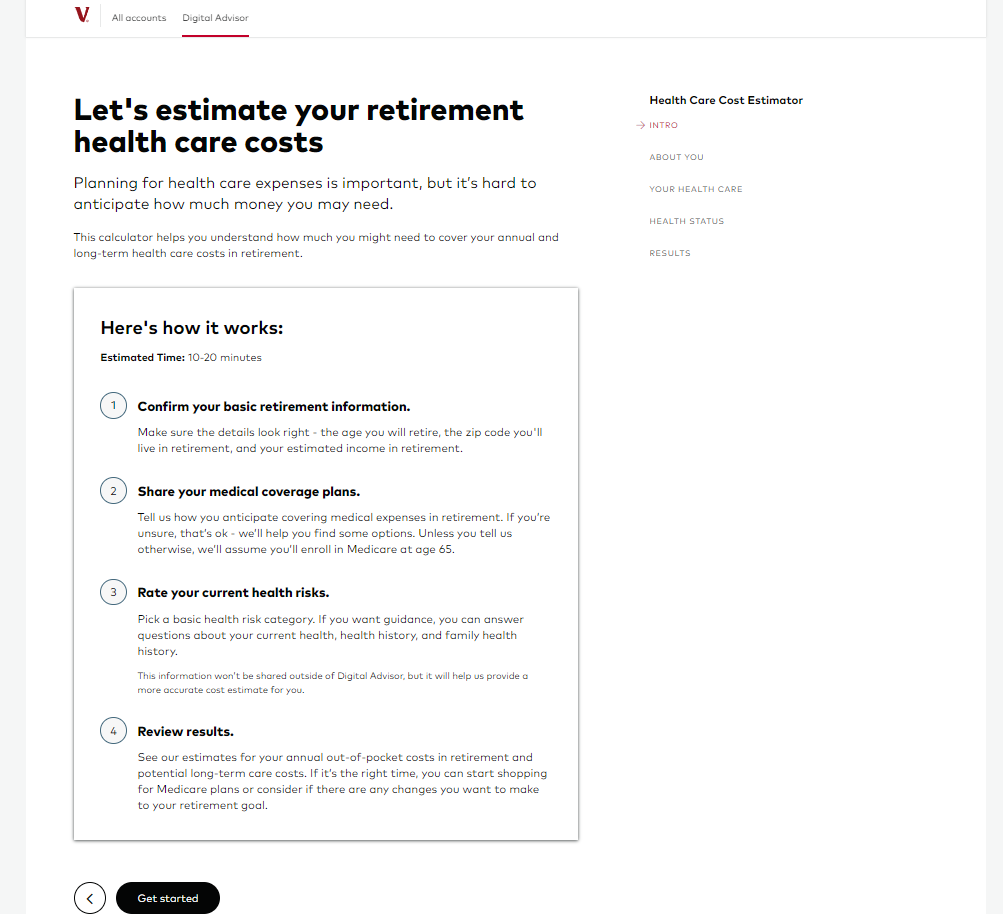

In addition, Vanguard offers a health care cost estimator, which helps create a budget that considers your potential annual and long-term health care costs in retirement based on your current health status and medical coverage. For example, this tool will assume you’ll enroll in Medicare at age 65 unless you tell it otherwise.

Our editorial team considers this one of the firm’s standout features, especially for older investors and those nearing retirement who want help setting a reasonable retirement and health care budget.

Vanguard Digital Advisor Complaints

A quick Google search will pull up several Better Business Bureau pages pertaining to Vanguard—none of them with particularly high marks from customers. Several complaints reference delays in transferring money to various accounts, while others cite their disappointment in losing money in their investments. Many customers have also faced hurdles in contacting customer service to resolve administrative issues.

We encourage investors to consider these complaints when choosing a robo-advisor, but it’s also important to understand that automated investing is just that—passive, repeat investments for a fee. You should read all disclosures and agreements before funding any accounts with a robo-advisor.

Our Experience With Vanguard’s Robo-Advisor

To provide the most thorough review of Vanguard’s robo-advisor service, the Retirement Living editorial team set up an account and evaluated its online experience and services.

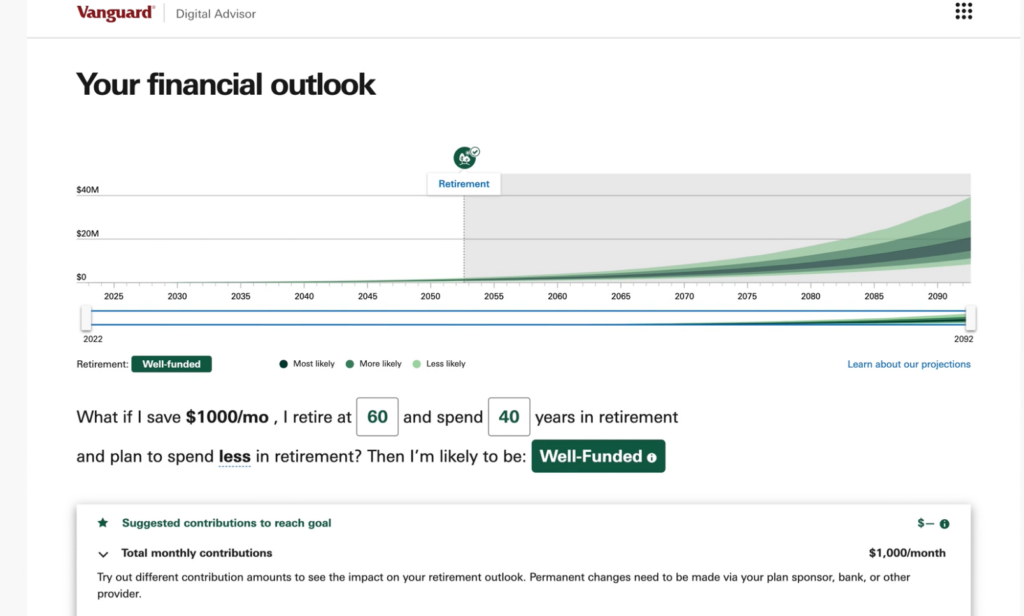

Vanguard has a great “projections” tool we can adjust in real time that allows us to see forecasts based on common factors in retirement, such as the age we retire, our household income, and our contributions. We liked that this simulation helped us answer the most fundamental questions investors ask, such as “Will my savings last as long as I need it to?” and “If not, when would I run out of money?”

However, this tool does not take into account health care costs, which feels like a missed opportunity. We’d like to see Vanguard find a way to integrate its health care cost estimator and retirement financial outlook tool for a more well-rounded view that mimics more closely the simulations a human financial advisor can run.

The projection tool was harder to find in our account dashboard compared to other robo-advisors we reviewed. Wealthfront’s dashboard was more user-friendly and developed, but we think that novice investors and low-tech customers might find Vanguard’s sophisticated, streamlined design less intimidating.

Lastly, when contacting customer support, we spoke to a live human on the phone—not a chatbot. Personalized customer service from a robo-advisor is an important but lesser-discussed component of digital investment management.

We think that seniors investing large sums of money with Vanguard will feel more comfortable knowing that a human is available for account support and troubleshooting.

FAQs About Vanguard

How does Vanguard help retirees?

Vanguard simplifies passive investment by opting for time-tested, low-cost ETFs that are most likely to perform well over time. For retirees hoping to pad their nest egg, this could be a great option. Also, with Vanguard Personal Advisor, older investors can get expert advice from a financial advisor who will also consider the results of their goal optimizer, health care estimator, and tax-harvesting strategies to ensure a well-funded retirement.

Does Vanguard charge a monthly fee?

Vanguard Digital Advisor charges no advisory fee for the first 90 days, followed by an annual fee of up to 0.20% or 0.25% of the assets being managed, depending on the portfolio. This fee covers the cost of all transactions, transfers, and rebalancing needed within your portfolio, as well as the expense ratios. The annual fee is up to 0.35% or 0.45% for Vanguard Personal Advisor.

How does Vanguard keep my investments safe?

Investment accounts include $500,000 of Securities Investor Protection Corporation (SIPC) insurance for missing funds as a result of broker error. Vanguard accounts are protected by website encryption, two-factor authentication for logging in, and fraud protection.

Can you work with a Vanguard financial advisor?

To work with a financial advisor, you must enroll in Vanguard Personal Advisor. Vanguard Digital Advisor does not include access to a human advisor.

Who can use Vanguard?

To use Vanguard’s robo-advisor services, you must be at least 18 years of age, a United States resident (or have a military mailing address), and have an existing Vanguard brokerage account. The minimum investment requirement is $3,000.

Conclusion

Vanguard is a smart automated investment option for those capable of investing at least $3,000. In exchange, you’ll get access to diversified automated portfolios meant to perform well over time, plus tax-loss harvesting, goal-planning tools, and ESG investments. Overall, Vanguard offers a lot of value in one affordable package.