Best Robo-Advisors for Retirees

Updated:

Retirement Living takes an unbiased approach to our reviews. We may earn money when you click a partner link. Learn More

We tested several robo-advisors to determine how helpful they are for older investors. Here are the top six robo-advisors for retirees, based on financial planning capabilities, fee structure, and portfolio diversification.

- Great for Retirement Planning

- Retirement-focused investing

- Low fees

Vanguard Digital Advisor brings some of the lowest fees in the industry and some of the most targeted retirement planning using the company’s own popular ETFs.

- Great for Overall Experience

- Diverse portfolio options

- Low fees and account minimum

Betterment is one of the best robo-advisors for retirees, with a wealth of portfolio options suited to your goals. Features like tax-loss harvesting and account rebalancing are helpful, and the highly rated app is easy to use, no matter your skill level with tech.

Wealthfront

- Great for Customized Investing

- Diverse portfolio options

- Great welcome promo

Wealthfront has numerous hands-off portfolio options designed for your goals and risk appetite. The current promo offers no fees on the first $5K in assets under management.

Schwab Intelligent Portfolios

- Great for Large Investments

- Retirement planning tools

- No advisory fees

You’ll need $5,000 to get started with Schwab Intelligent Portfolios, but with no account management fees and lots of diversified portfolio options, it’s well worth the investment.

M1 Finance

- Great for Investing and Banking in One Place

- No advisory fees

- Pairs well with banking and borrowing features

M1 Finance is our top choice for an all-in-one solution to your finances, but it’s also great as a stand-alone robo-advisor. Choose from “pies” that represent the asset mix you’re interested in, and let M1 take care of the rest.

SoFi Automated Investing

- Great for No Fees

- Can invest with fractional shares

- Free access to human advisor

Beginners will love SoFi Automated Investing, thanks to its lack of account fees and free access to human advisors. SoFi’s portfolio options are notably limited, however, and there’s no tax-loss harvesting.

Gone are the days of either learning to invest your own money—or trusting someone in a suit to do it for you. Robo-advisors have become increasingly popular in recent years with younger folks and retirees. This automated investing software gives everyday investors access to technology to manage their own investments and be as hands-on (or hands-off) as they’d like, instead of working with a human financial advisor.

Robo-advisors use algorithms to invest your money based on the goals and risk tolerance you specify. The best robo-advisors for seniors offer easy-to-use tech (even if tech isn’t your thing), goals focused on your impending retirement (or the one you’re already enjoying), and low account management fees and minimums.

Our Experience Using Robo-Advisors

To write the most detailed analysis of robo-advisors available to seniors, Retirement Living created accounts with several of the brands below. We invested real money and built a real portfolio following the firm’s guidance and recommendations. Our team reviewed each robo-advisor’s setup process, account dashboard, portfolio mix, and overall user experience.

For investors who want many different investment options, we recommend Betterment. While investors with Vanguard have just four options, Betterment offers 13 different portfolio options to diversify using stocks and bonds for cryptocurrency, technology, climate, and more.

The ability to invest in alternative assets is key, as only a few in the industry have cryptocurrency options (Wealthfront and M1 Finance are others).

While most robo-advisors say they prioritize investor education, investing with a robo-advisor is (mostly) an online endeavor, and the tools and resources available to investors with each platform vary. Based on our analysis, we rate Vanguard’s robo-advisor services the most comprehensive when it comes to planning tools and investment projections as they pertain to retirement. Vanguard’s robo-advisor dashboard is the most basic but also the easiest to navigate.

Best Robo-Advisors for Retirees, Reviewed

Vanguard Digital Advisor

Great for Retirement Planning

If you’ve had a company 401(k) at some point in your life, you’ve likely heard of Vanguard. It’s one of the most well-known companies in the world of retirement planning, which makes it perfect for seniors and soon-to-be seniors who are prepping for retirement.

Vanguard Digital Advisor, its robo-advisor offering, is focused on retirement planning. It has a higher ($3,000) minimum assets to enroll and has more limited, retirement-targeted portfolio options. There’s less customization, as your money is invested in Vanguard’s own exchange-traded funds.

However, Vanguard is the household name in retirement planning. If that’s your primary goal in investing and you want a hands-off experience, the Vanguard Digital Advisor could be right for you.

Plus, Vanguard Digital Advisor has some of the lowest robo-advisor fees in the industry. And right now, Vanguard offers no advisory fees for the first 90 days. Use its online calculator to see how much Vanguard’s Digital Advisor will cost you. To test the calculator, we assumed an investment of $50,000, which qualified us for Vanguard Personal Advisor®, the hybrid advice service, and a maximum annual fee of $100.

- Fees: 0.20% to 0.25%

- Account minimum: $3,000

- Investment options: Stocks, bonds, ETFs

- Human advisor option: No

To learn more about our experience using Vanguard’s robo-advisor services, read our full Vanguard Digital Advisor review.

Betterment

Great for Overall Experience

Betterment is one of the all-around best robo-advisors (and was also the first to enter the market). There’s no minimum amount to get started, and you’ll pay a flat monthly rate of $4 until you reach a balance of $20K (or set up qualifying recurring monthly deposits into the account of $250 or more)—then it switches to 0.25% of assets under management (AUM).

Betterment is great for seniors of all experience levels. During our evaluation of the service, Betterment presented us with four recommended portfolio options based on our goals. (The company offers 13 portfolio options in total.) We liked how easy it was to choose a portfolio that aligns with our goals and let the robo-advisor take care of the rest. The Core portfolio features a diversified mix of stocks and bonds for safe investing, but you can also prioritize climate-friendly and socially responsible investments, if that’s important to you. You can also invest money in a Cash Reserve account to play it a little safer, depending on your risk appetite.

With tax-loss harvesting, automatic portfolio balancing, dividend reinvestment, an easy-to-use online platform and highly rated mobile app, and access to human advisors when you need them (for a high fee), Betterment is ideally suited for beginners—but it also offers options for investors who like to be a little more hands-on.

- Fees: $4/month or 0.25%*

- Account minimum: $0

- Investment options: Stocks, bonds, ETFs, cash, crypto

- Human advisor option: Available for a fee

*With $20,000 invested or recurring $250+ monthly deposits.

Learn more about our experience using Betterment’s robo-advisor service by reading our full Betterment review.

Wealthfront

Great for Customized Investing

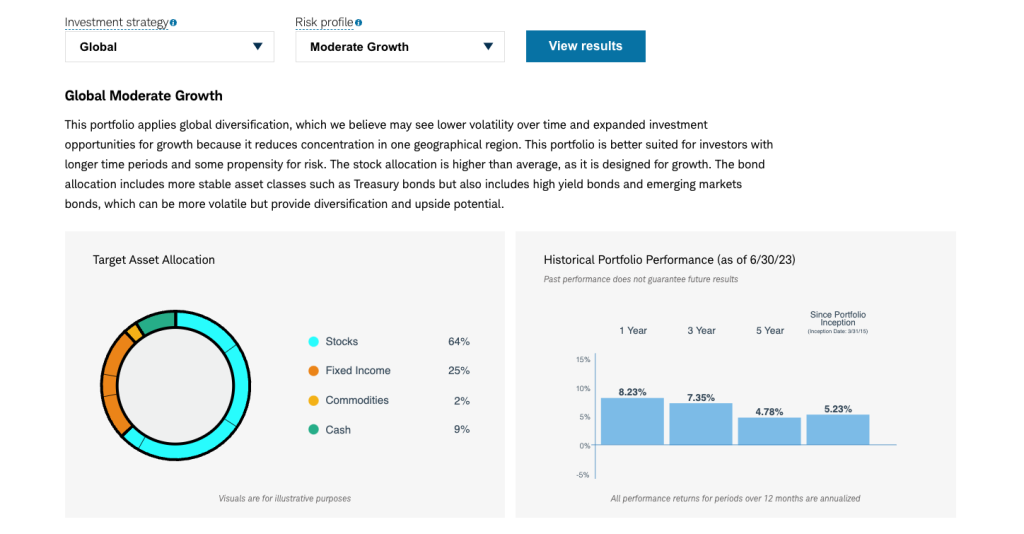

Like Betterment, Wealthfront lets you select from a wide range of investment options, including clean energy and tech, built around your goals and attitude toward risk. It’s a truly hands-off experience with some of the most customized investment options regardless of skill level—and all for just 0.25% AUM.

Features like automatic rebalancing and diversification keep your account guarded against risk, and tax-loss harvesting keeps your expenses down come tax season. The app is also highly rated and easy to use.

Wealthfront is currently running a great promo for new customers: Invest $5K for free when you open an account online.

- Fees: 0.25%

- Account minimum: $500

- Investment options: Stocks, bonds, ETFs, cash, crypto

- Human advisor option: No

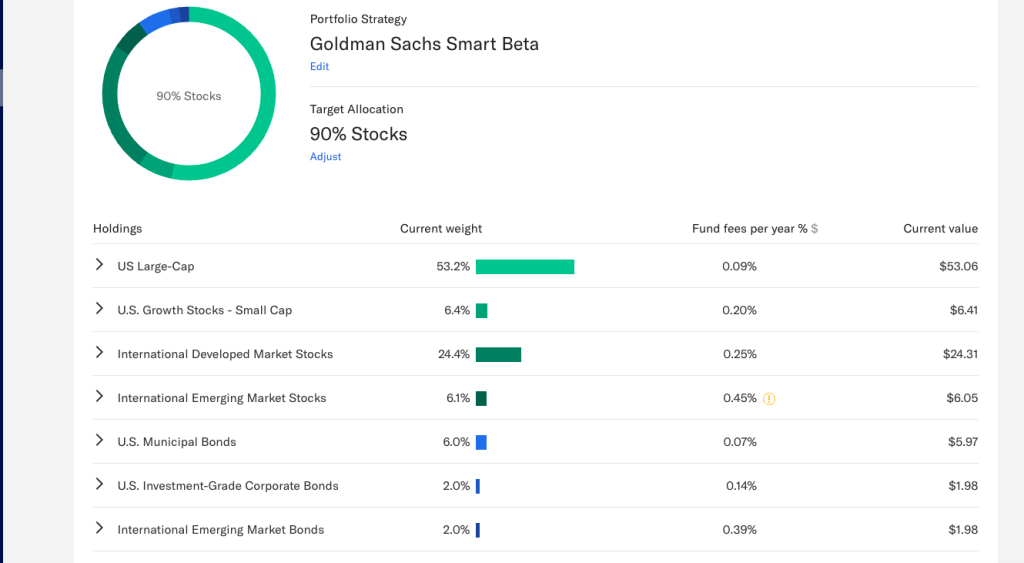

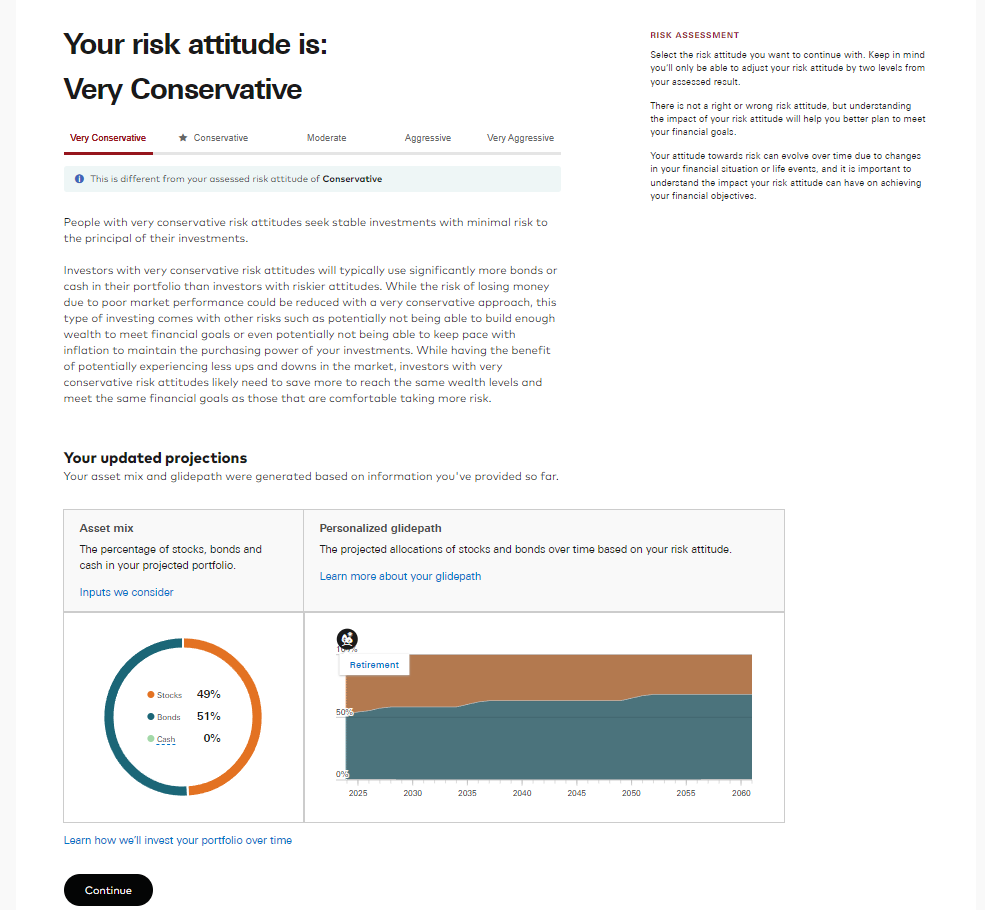

Schwab Intelligent Portfolios

Great for Large Investments

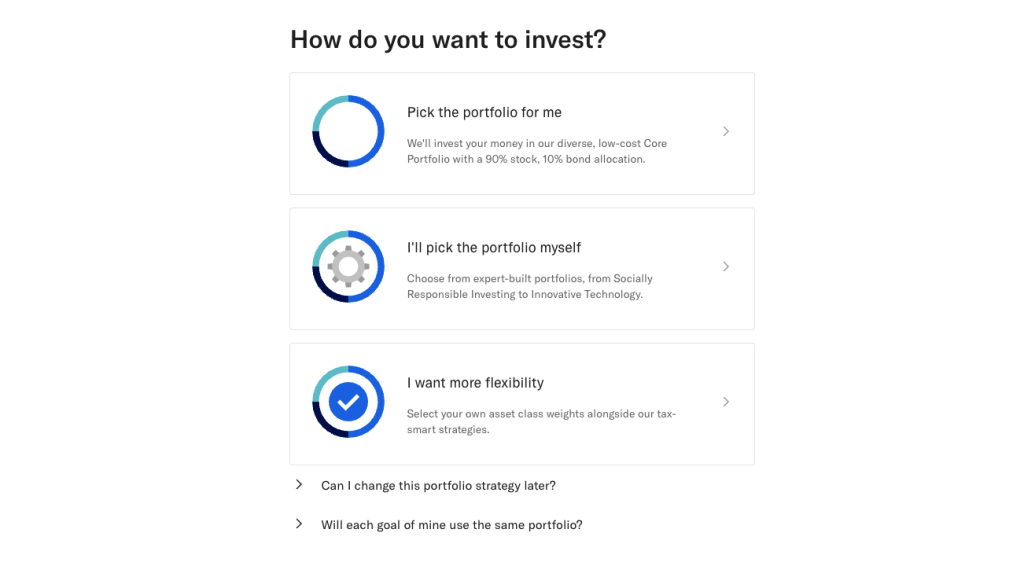

Charles Schwab is another big name in investing and retirement planning, which makes this robo-advisor ideal for retirement planning—a part of your portfolio will include Schwab ETFs. The account minimum is a little higher than Vanguard (it’s $5,000 here), but there are no account management fees to worry about.

Within the easy-to-use platform, you’ll have access to retirement planning tools and 24/7 customer support. You can also access a human advisor through a Premium account, but there are one-time and ongoing advisory fees.

Schwab Intelligent Portfolios is fairly customizable (80 variations), with multiple investment strategies, risk profiles, and ETFs. You’ll also get automatic rebalancing and tax-loss harvesting.

- Fees: 0%*

- Account minimum: $5,000

- Investment options: Stocks, bonds, ETFs, mutual funds, cash, CDs

- Human advisor option: Available for a fee

*No account management fees, but you’ll pay operating expenses on ETFs, which includes Schwab ETFs.

SoFi Automated Investing

Great for No Fees

SoFi Automated Investing scores big points for retirees for several reasons. First and foremost, there are no account management fees, meaning more cash stays in your account—and your wallet. You also get free access to certified financial planners to answer any questions you have.

As an online financial institution, SoFi is also known for its easy-to-use platform and mobile app, no matter your skill level with tech. Beginners can also invest more easily with fractional shares.

Portfolio options are limited, however, and there’s no tax-loss harvesting. Experienced investors and high-net-worth individuals may want to consider another platform.

- Fees: 0%

- Account minimum: $1

- Investment options: Stocks, bonds, ETFs, crypto, fractional shares

- Human advisor option: Yes

M1 Finance

Great for Investing and Banking in One Place

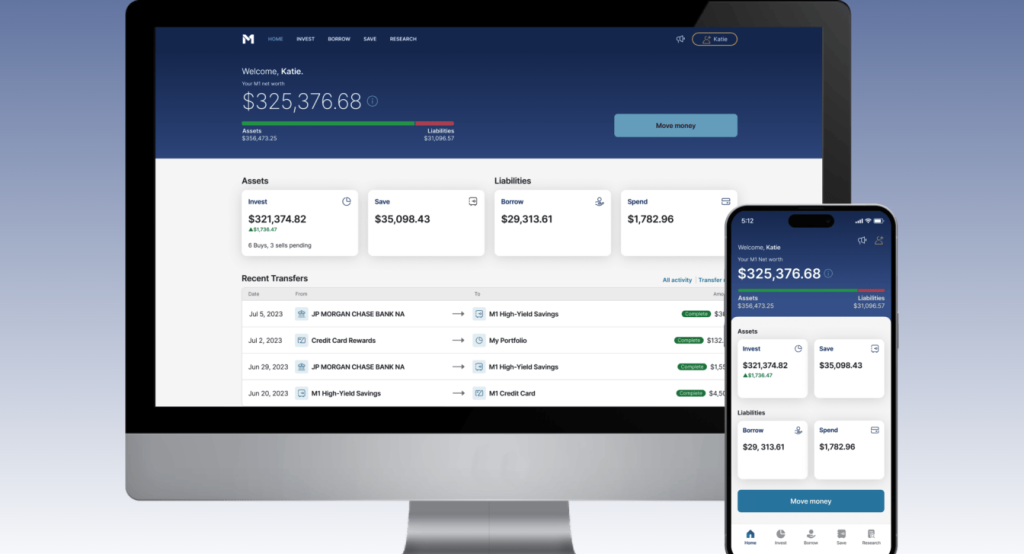

While we’re focused on the best robo-advisors, we’d be remiss if we didn’t mention M1’s excellent banking and credit options. That makes M1 an awesome all-in-one financial institution.

The investment portion of M1 Finance’s services allow you to invest in “pies,” which represent different investment strategies, with various “slices” representing different types of investments. You can select a prebaked pie that fits your risk appetite and goals, or you can design your own recipe. The extended analogy makes M1 one of the easiest platforms to comprehend.

M1 doesn’t charge any commissions or account management fees and offers automatic rebalancing, but it currently lacks tax-loss harvesting.

- Fees: 0%

- Account minimum: $5,000

- Investment options: Stocks, ETFs, crypto (separate)

- Human advisor option: Available for a fee

Our Research Methodology

To create a list of top-rated robo-advisors, the Retirement Living editorial team analyzed 12 data points and conducted 25 hours of research to give you a well-rounded review of each advisor:

- Account minimums

- Senior- and retirement-related options

- Account fees

- Portfolio mix and account types supported.

- Customer support

- App availability and ease of use

- Automated services, like auto rebalancing

- Tax-loss harvesting

- Access to a human advisor

- Brand reputation with customers

- User experience

To create the most authentic evaluation of the best robo-advisors, the Retirement Living editorial team created accounts with several of the brands below. We invested real money and built a real portfolio following the firm’s guidance and recommendations. Our team reviewed each robo-advisor’s setup process, account dashboard, portfolio mix, and overall user experience.

Because robo-advisors operate an online business and require customers to access their investment accounts virtually, we also prioritized companies that offer easy-to-use apps, as evidenced by mobile app ratings. We also analyzed each company’s financial planning capabilities as they relate to retirement and investing. Then, we sourced feedback and reviews from real consumers and talked with financial experts to narrow down our original list of the six best robo-advisors.

Retirement Living writers and editors evaluate robo-advisor reviews annually, and we frequently contact providers to update changes to their services, offerings, and fees.

What to Consider When Choosing a Robo-Advisor

When evaluating the best robo-advisors for retirees specifically, we look for a few things:

Low Fees and Account Minimum

One of the hallmarks of the best robo-advisor is their low fees. Some platforms, like SoFi Automated Investing, don’t charge any fees at all. Retirees on a fixed budget who don’t want to see too much of their investments turn into payments to their advisors should look for a low-cost robo-advisor.

However, it’s also important to consider how the fees may change as your investment amount increases. For example, our editorial team found that Betterment’s management fees could be steep for those with lower balances. For example, a $10,000 balance would incur costs of $48 per year, or 0.48%, which is twice Betterment’s advertised rate for digital accounts, which is 0.25%.

Similarly, if you are just starting to learn about robo-advisors and don’t want to go “all in” right away, it’s important to find options that have low account minimums. High-net-worth individuals in retirement, however, may be less worried about this. The best robo-advisors for high-net-worth investors should instead offer more diverse investment options.

Diversification

Diversification is crucial at every stage of investing. Traditionally, younger investors might take on riskier investments, and as you near retirement age, you may move toward more stable options. A good robo-advisor should recommend investments—and risk levels—based on your retirement goals.

Automatic Rebalancing and Tax-Loss Harvesting

Two key features of the best robo-advisors are automatic rebalancing and tax-loss harvesting. Not every robo-advisor offers these; if they’re important to you, make sure the platform has these functions before investing.

- Automatic rebalancing: The robo-advisor balances your asset allocation automatically, without your input, so that it continues to align with your goals.

- Tax-loss harvesting: The robo-advisor will sell investments at a loss to offset gains from other investments.

Access to Human Advisors

In some instances, being able to chat with a human still has a lot of value—for making the right decisions and for your peace of mind. However, only some robo-advisors make this possible. If you want to try out a robo-advisor but still want access to human advisors when you need them, make this a top priority in your search.

Robo-advisors like Betterment offer access to an advisor for a fee, while Schwab Intelligent Portfolios and M1 Finance include this in their service.

Easy-to-Use Technology

The algorithms that fuel robo-advisors are complex, but the apps that make them accessible to everyday investors shouldn’t be. Read online reviews of various platforms to get a sense for how easy they are to use, both on a computer and on a mobile device, like a tablet or a phone. Only consider robo-advisors that other seniors have overwhelmingly labeled easy to use.

How Much Do Robo-Advisors Cost?

Robo-advisors cost between 0.25% and 0.50% of assets under management (AUM), though it can go higher or lower. This is slightly lower than the typical fee (1% to 2%) charged by human financial advisors.

Keep in mind: That’s the average base cost of a robo-advisor. In some cases, you can pay an additional fee to consult with a human advisor, and in others cases, like with robo-advisor investment platform Acorns, you’ll pay a flat monthly rate as opposed to AUM. There may also be commissions. Some robo-advisors might be completely free; they generate revenue through other avenues, including payment for order flow and margin lending.

Robo-Advisors vs. Hybrid Advisors vs. Traditional Advisors

Traditionally, robo-advisors cut out the traditional human advisor aspect. Instead, investors work through an online platform and allow the software to manage the investments based on the specified goals, preferences, and risk appetite. Notably, traditional advisors often use algorithms similar to the ones robo-advisors are built on.

Increasingly, some financial institutions are offering access to human advisors as part of their robo-advisor package—sometimes for free but usually for a fee. This is considered a hybrid robo-advisor: You still primarily use the software to manage your investments, but you can consult with a human advisor as needed.

| Robo-Advisor | Hybrid Advisor | Traditional Advisor | |

| Human Advice | No | Yes | Yes |

| Fees | Generally lower | Moderate | Generally higher |

| Best For | Moderately experienced investors Retirees who want to take the guesswork out of choosing investments | Beginner investors who want more control over investments and help finding ways to minimize tax liabilities | Novice investors who need more help or aren’t good with emerging tech |

FAQs

When are robo-advisors a good option for retirees?

Robo-advisors are a good option if you’re interested in a low-cost option for investing but don’t have a lot of knowledge yourself. It can be a good way to feel you have some control over your decisions—but still know an algorithm designed around your wants and needs can handle the finer details.

If you regularly like to ask questions and get advice from a human advisor with a background in finance, however, a robo-advisor might not be for you. Instead, consider a traditional advisor—or at least a hybrid advisor.

Are robo-advisors safe?

Robo-advisors are as safe as investing with a real human advisor. You must always assume risk when investing in the market; some decisions pay off, and some decisions can hurt your finances. The best robo-advisors offer features like account rebalancing and tax-loss harvesting to help minimize risk and keep your investments diversified.

Robo-advisors are also registered investment advisors; this means they have a fiduciary duty to clients to make decisions with their best interests in mind.

Which robo-advisors have tax-loss harvesting?

Many of the best robo-advisors off tax-loss harvesting. On our list of the six best robo-advisors for retirees, four offer this feature: Betterment, Wealthfront, Vanguard Digital Advisor, and Schwab Intelligent Portfolios.

Summary: Best Robo-Advisors for Retirees

- Vanguard Digital Advisor – Great for Retirement Planning

- Betterment – Great for Overall Experience

- Wealthfront – Great for Customized Investing

- Schwab Intelligent Portfolios – Great for Large Investments

- SoFi Automated Investing – Great for No Fees

- M1 Finance – Great for Investing and Banking in One Place

Bottom Line

Robo-advisors are a unique type of financial advisor that allow you to be as hands-on or as hands-off as you’d like. Generally cheaper than traditional human advisors, robo-advisors are best for investors with mild to moderate interest in portfolio management and a knack for navigating tech. If you’re preparing for (or already in) retirement and are looking for a change, consider switching to a robo-advisor.