Toberman Becker Wealth is an independent, fee-only fiduciary financial advisory firm in St. Louis, Missouri. As a fiduciary, the firm never receives commissions or sells any investment products or insurance—its only source of revenue is the client’s annual fee. Toberman Becker Wealth provides all types of families with retirement planning advice and fiduciary investment management. Craig Toberman, founder and certified advisor, designed the firm from the ground up. Along with Michael Becker, CFA, CFP®, Partner and Certified Financial Planner at Toberman Becker Wealth, the firm will prioritize transparent and sales-free financial planning.

Toberman Becker Wealth Investment and Advisory Services

Craig Toberman and Michael Becker of Toberman Becker Wealth are licensed to serve clients in Illinois, Missouri, and Texas. The firm prides itself on offering concierge-level service to its clients. To open or maintain an account, clients do not have to meet a minimum investment requirement. Toberman Becker Wealth’s primary service offerings include:

- Retirement planning

- Investment planning

- Tax planning

- Family business planning

Who Toberman Becker Wealth Serves

Toberman Becker Wealth is a fee-only financial advisory firm serving the St. Louis community. The firm offers financial planning and investment advisory services to both average-income and high-net-worth individuals as well as corporations or other businesses. Many of Toberman Becker Wealth’s clients are investors and business owners who are over the age of 50 and retired or planning for retirement. The firm does not require a minimum investment to open or maintain an account.

| Toberman Becker Wealth Overview | |

| Fee Structure | AUM |

|---|---|

| Fee Range | 0.75% annual fee |

| Assets Managed | $54,100,000+ |

| Minimum Assets | N/A |

| Number of Advisors | 2 |

| Address/Phone Number | 1741 S Big Bend Blvd St. Louis, MO 63117 (314) 783-9860 |

Toberman Becker Wealth Experience and Qualifications

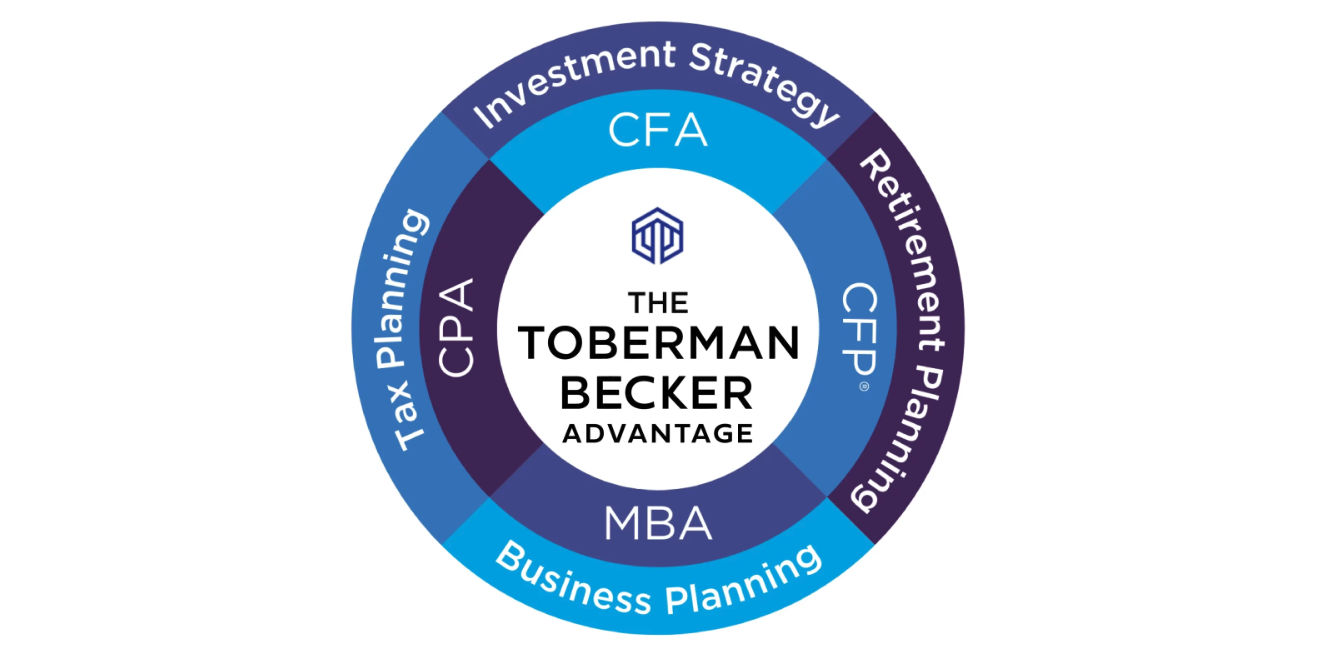

Craig Toberman is a Certified Financial Planner (CFP.), Chartered Financial Analyst (CFA), and Certified Public Accountant (CPA). He also holds a Bachelor of Science (B.S.) degree in Agricultural and Consumer Economics from the University of Illinois and a Master of Business Administration (M.B.A.) in Finance from Saint Louis University.

With over a decade of experience, Toberman has crafted custom financial plans for hundreds of families and businesses. Toberman has also lent his financial expertise to outlets like Bloomberg, CNN Business, FOX 2 St. Louis, and InvestmentNews.

Michael Becker is a Chartered Financial Analyst (CFA) charterholder and Certified Financial Planner (CFP). He holds a Bachelor of Science degree in Finance and Banking from the University of Missouri, Columbia, and his expertise is in investment management, behavioral finance, and retirement planning.

Both Toberman and Becker are members of the National Association of Personal Financial Advisors (NAPFA), Fee-Only Network, Financial Planning Association, and XY Planning Network.

Toberman Becker Wealth FAQs

What is Toberman Becker Wealth’s minimum investment requirement?

Toberman Becker Wealth does not have a minimum investment requirement.

What is the cost structure at Toberman Becker Wealth?

Toberman Becker Wealth offers fee-only advising. The firm charges clients a percentage of assets under management.

What is the investment strategy at Toberman Becker Wealth?

The firm takes a comprehensive investment approach that considers your goals, risk tolerance and capacity, time horizon, and preferred asset allocation. By considering the entire financial picture, Toberman Becker Wealth creates a more engaging, personalized experience. And because the firm is independent, it is not bound by sales quotas or institutional agendas that could influence the advice you receive from other professionals.

Does TToberman Becker Wealth work with clients outside of St. Louis?

Toberman Becker Wealth is licensed in Illinois, Missouri, and Texas. While most clients are in St. Louis, the firm can work with clients throughout the U.S.

How often does Toberman Becker Wealth meet with clients?

Because each family and investor has different needs, there is no set schedule—clients can request meetings on an ad-hoc basis or schedule recurring appointments. Toberman Becker Wealth suggests meeting as client circumstances change rather than planning meetings ahead of time.