Key Takeaways

- The average baby boomer believes they need $1,234,108 saved to retire comfortably.

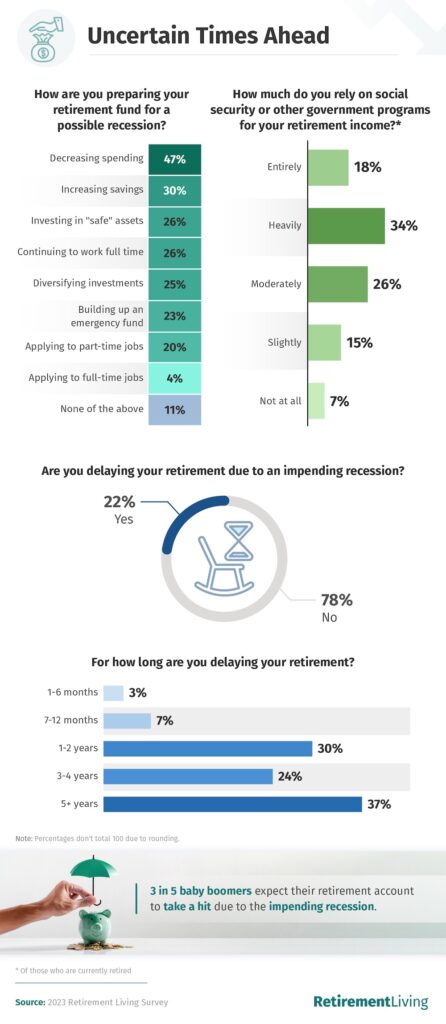

- 22% of baby boomers plan on delaying their retirement due to an impending recession.

- Nearly 1 in 5 baby boomers rely entirely on social security or other government programs for retirement income.

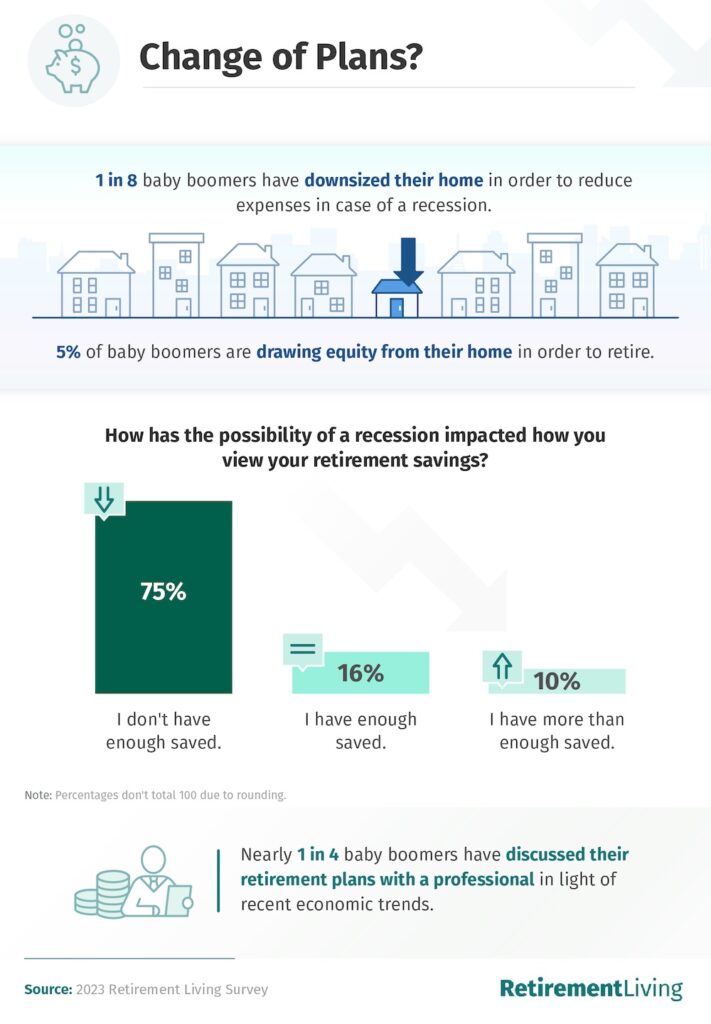

- 13% of baby boomers have downsized their homes in order to reduce expenses in case of a recession.

Is a Recession Coming in 2023?

The cost of just about everything is rising. Mortgage rates are climbing, and the Federal Reserve recently announced its ninth consecutive interest rate hike since March 2022. Though economists remain split on exactly when a recession will arrive, most agree that inflation surges mixed with rising interest rates and tighter credit conditions are a surefire recipe for a U.S. recession.

How has a possible recession impacted current retirees and people who are planning to retire soon? We recently surveyed 758 American baby boomers aged 59 and older to see how the shaky economic forecast has affected their financial outlook.

Baby Boomers’ Concerns About a Potential Recession

Do you ever wonder how your financial outlook compares to other hopeful retirees? If you’re concerned about an impending recession, it might help to know that you’re not alone in worrying about whether you have enough money stashed to last.

Many baby boomers (nearly 70%) expressed uncertainty over whether their retirement savings are healthy enough to carry them through retirement. While the average retirement savings of our participants came out to a little over $680,000, the majority said they’d feel more secure if they had around $1.2 million in the bank.

Moreover, most respondents expect their savings to last 13 years, despite concerns that they don’t have enough to feel comfortable. This might explain the growing notion that many Americans feel they may need to work longer to save enough for retirement. (A Gallup poll revealed last year that the average age at which U.S. employees expect to retire has risen from 60 to 66 since 1995.) The good news is that, so far, the economy is proving surprisingly resilient despite economic challenges, as consumers continue to shop in retail stores, dine at restaurants, and buy cars. Could these spending habits help delay a large economic shift for the worse? Retirees sure hope so.

Protecting Retirement Savings in a Recession

Potential retirees are responding differently to the odds of rocky financial waters ahead. Our survey revealed several tactics baby boomers are using to fortify their retirement funds.

While three out of five baby boomers said they expect the impending recession to impact their retirement accounts negatively, 78% weren’t planning to let it delay their retirement. Instead, most are accounting for the difference by decreasing spending or increasing their savings.

But more than a quarter said they plan to continue working full time (26%) or look for a part-time job (20%). Of those who will delay their retirement (22%), most plan to stay in the workforce for another five years or more.

Social Security and other government programs likely play a large role in many employees’ retirement plans. Over half of those surveyed said they depend on such programs for retirement income either “heavily” or “entirely.” While Social Security recipients enjoyed an 8.7% cost of living increase in 2023, experts advise that next year’s increase may not be so generous.

The Economy’s Impact on America’s Retirement Outlook

How has the possibility of a recession impacted baby boomers’ lifestyles and financial outlooks? Here’s what our survey participants had to say.

Even in perfect conditions, retirement planning is a life-changing decision – and one they need help making. More than one-quarter of baby boomers shared that the economy’s increasing unpredictability has led them to discuss their plans with a professional. Nearly 75% said they hadn’t saved as much for retirement as they would like, and 5% have even taken equity from their homes to fund their retirement. (If you’re considering a home equity loan, Retirement Living recommends that you carefully research the pros and cons of tapping into your home’s equity for cash, as these loans may not be the best choice for every homeowner.)

Preparing for an Uncertain Future

Overall, American baby boomers aren’t feeling very confident about retirement in light of recent economic conditions. While most don’t plan to let the recession completely derail their plans to retire, many are spending less money in favor of setting more aside for the future. If retirement planning worries you, don’t be afraid to reach out to a financial advisor to discuss the best options for your unique situation.

Methodology

Retirement Living surveyed 758 American baby boomers aged 59 and older about their financial plans. The online survey was administered through Connect Cloud Research and Prolific. Of those surveyed, 277 were already actively retired, 445 respondents identified as female, 309 identified as male, two identified as nonbinary, and two chose not to disclose that information.

Outliers were removed from the areas of the study that depict financial data by determining the figures within the interquartile range. Regarding the amounts respondents had saved or believed they needed to have saved in order to retire, only figures above the median were included to ensure a more accurate reflection.

In some cases, questions and answers have been rephrased for clarity and brevity. To help ensure accurate responses, respondents were required to identify and answer an attention-check question. Our survey data relies on self-reporting. Potential issues with self-reported data include, but are not limited to, telescoping, selective memory, and other attribution errors.

About Retirement Living

Retirement Living uses extensive research to provide resources for retirees, potential retirees, and their loved ones. In addition to retirement planning resources, Retirement living also publishes reviews of senior-related services, products, and communities that help retirees across the U.S. plan for a happy, healthy, and stable future.

Fair Use Statement

If you found the information here helpful, we invite you to share it for non-commercial purposes. In return, we ask that you include a link back to this page when doing so.