Best Gold Dealers

Updated:

We evaluated 30 well-known gold dealers, and after careful review, identified the ten best choices.

- Competitive Pricing

- More metal for your money

- New accounts receive free shipping

Orion Metals Exchange is an affordable precious metals dealer that provides direct pricing, low management costs, as well as a variety of services, including an easy-to-set-up IRA account.

- No Fee for Life IRA

- Highly-rated with ConsumerAffairs

- No management fees

With a fast turnaround for new accounts (24-hour setup) and a simple 3-step process to begin, Patriot makes Gold IRAs simple to start and affordable to manage.

- Great Service

- Fees waived with minimum IRA

- Personalized customer service and education

With a low annual management cost and a reputation for good customer service, Lear Capital is a great option for individuals interested in a precious metals IRA.

- Great Gold Dealer Marketplace

- Free online comparison tool

- Product suggestions based on data, statistics, and algorithms

The Metalsmart tool is the first company to allow consumers to source and compare offers from highly-vetted, top-rated gold dealers. Consumers can view real-time pricing estimates and choose the best company to buy from. This can help customers to save up to 15% on gold and silver prices by eliminating high dealer markups.

- Great portfolio simulator

- Live gold prices online

- Transfer fees waived for IRA investments over $50,000

Open a gold IRA with the help of a trained specialist or buy physical precious metals for home storage directly on the website. Premier Gold’s unique data-backed investor simulator tool can help you learn how adjusting your portfolio allocations can affect your annual returns.

- Great Buyback Plan

- IRS-approved storage options

- Buy-back commitment

American Hartford Gold specializes in Gold and Silver IRAs and buying and selling gold and silver for physical possession. It uses a three-step process for acquiring precious metals for physical delivery, Gold IRAs or a precious metals IRA.

- Great Mobile App

- 24/7 access to manage assets

- Low fees and competitive prices

Invest in vaulted precious metals through an online account without the hassle of holding and storing your assets. Liquidate or take possession of physical assets when it’s right for you.

- Great free storage

- Informative website with investment tips

- Competitive buy-back policy

If you roll over $50,000 or more to a Priority Gold IRA, they’ll waive your storage and administrative fees. The dealer is highly rated by both consumer and business sites, and you’ll be assigned a representative to guide you through the investment process.

- Great Customer Service

- Specializes in retirement accounts

- Great buy-back options

Gold Alliance’s team is equipped with both financial and precious metals experts. Gold Alliance is known for client satisfaction.

- Great Online Education

- Fees waived on transfers $50,000+

- $10,000 min. investment

Birch Gold Group specializes in Precious Metals IRAs and strives to provide customers with the right information so they can make the appropriate decisions for their financial future. Precious metal offerings include Gold, Silver, Platinum and Palladium.

- Unique Investor Workshops

- Workshops provide education with consultation

- Broadest investment range

Monetary Gold buys precious metals directly from the source to keep prices down. The brokerage offers an expanded range of investments via registration with the world’s largest derivatives marketplace. Monetary Gold provides workshops and individual consultations, so clients understand markets and investment options.

- Flexible Pricing

- 15+ Precious metal options

- Gold, silver, platinum

With nearly 20 years of service, Oxford Gold Group has consistently partnered with individuals as they look to grow their investment portfolio in gold & silver products.

Gold and other precious metals are an investment and carry risk. Consumers should be alert to claims about high returns or low risk with precious metals or other assets. As with any investment, you can lose money, and past performance is not a guarantee of future results. Consumers should also obtain a clear understanding of the fees associated with any investment before agreeing to buy.

Gold Dealer Reviews

After careful evaluation, we selected our picks for the best gold dealers: Orion Metal Exchange, Patriot Gold Group, Monex, Oxford Gold Group, American Hartford Gold Group, VaultUS Gold, and Monetary Gold. Each of these companies stood out above and beyond the competition.

Orion Metal Exchange Review

Great Service |

A precious metal industry leader, Orion Metal Group sells IRA-eligible Gold American Eagles plus other U.S., British and Canadian coins. Nonretirement purchases can be stored in an insured-storage vault or delivered with insured home delivery. If you want to keep your gold, silver, or other precious metals at home, Orion Metal Exchange will help you choose the right type of in-home safe to secure these assets.

- Metals: Gold, silver, platinum and palladium (coins and bars)

- Shipping: $39 flat rate

- Storage: Yes

- Displays pricing: Yes

Investors will like Orion’s no-fee buyback policy, which ensures customers can receive the market value of their metals. The company has a $10,000 minimum purchase requirement but runs frequent special offers for free gold and silver.

For more information, read our full Orion Metal Exchange review.

To contact Orion Metal Exchange, call 888-607-4685 or request a starter kit online.

Patriot Gold Group Review

Great Personalized Service |

Patriot Gold is a dealer-direct company, so you won’t pay typical fees for gold and silver bullion or coin purchases. This feature undoubtedly benefits the consumer, but the website lacks information about fee amounts, account minimums, and other details. You will have to contact them before signing up to learn more.

Patriot Gold Group is a full-service gold dealer. The owners of the company have over 50 years of combined experience in buying and selling gold. Clients work directly with these specialists to purchase gold, silver and platinum coins and bars to fund IRAs or other investment portfolios.

- Metals: Gold and silver (coins and bars)

- Shipping: Free

- Storage: Yes, through depository partners

- Displays pricing: No

Patriot Gold Group is a full-service gold dealer, but it doesn’t offer online purchases. The company’s owners have over 50 years of combined experience in buying and selling gold. Clients work directly with these specialists to purchase gold, silver, and platinum coins and bars to fund IRAs or other investment portfolios. Patriot Gold Group fights to change how consumers have historically interacted with gold dealers by offering high levels of education and service throughout the process to ensure a positive experience. For these reasons, the company has retained clients for years.

To get a quote or learn more, visit Patriot Gold Group’s website or call (844) 524-9001.

Oxford Gold Group Review

Customized Investments |

There is no one-size-fits-all investment strategy at Oxford Gold Group. The dealers stress the importance of investing based on individual client needs. Oxford Gold Group was founded on the belief that all people should have an opportunity to invest in gold and other precious metals.

- Metals: Gold, silver, platinum, and palladium (coins and bars)

- Shipping: Free for certain orders

- Storage: Yes

- Displays pricing: No

Oxford Gold Group provides clients with the information required to make sound financial decisions. The specialists can help with planning for financial security for future generations and current goals.

The managing partners at Oxford Gold Group assist all levels of gold investors. The company also works with gold collectors. Oxford Gold’s brokers will provide comprehensive education and guide you through the process from start to finish–whether you buy gold or not.

To get a quote or learn more about the brand, visit the Oxford Gold Group website or call (888) 200-5586.

Metalsmart Review

Great Gold Dealer Marketplace |

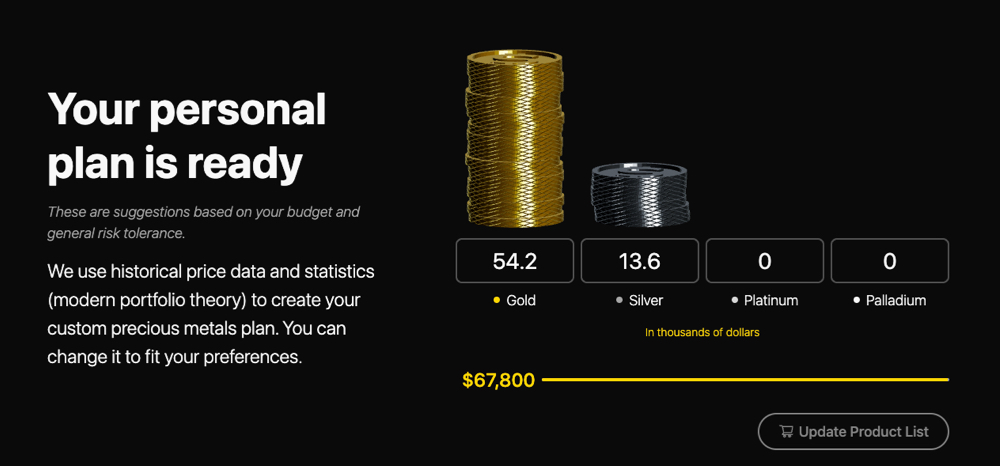

Metalsmart’s innovative online platform allows consumers to create personalized precious metals plans based on their budget and investment goals. Consumers can then compare quotes from multiple dealers and choose a reputable dealer to buy from.

The company uses real-time data to display pricing estimates at every step of the process and allows you to source quotes from multiple dealers. By forcing dealers to compete for your business, Metalsmart claims that consumers can save 15% on gold and silver.

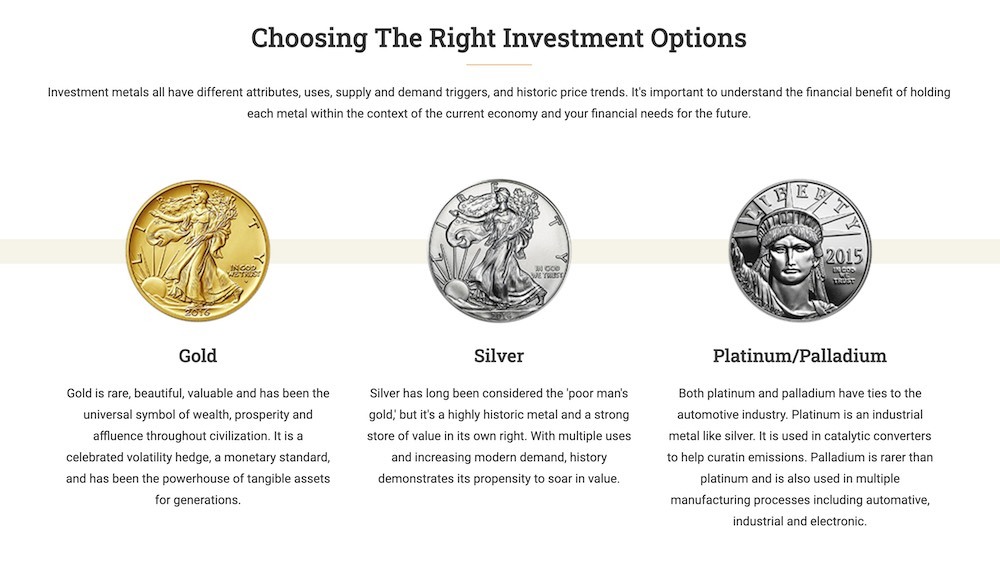

- Metals: Gold, silver, platinum, palladium (bars, rounds, coins)

- Shipping: Varies by dealer

- Storage: Varies by dealer

- Displays pricing: Yes

In addition to its comparison tool, Metalsmart will recommend an investment portfolio that you can use as a starting point to add or delete precious metal products according to your preferences. You can choose from a long list of gold, silver, platinum, and palladium products, including collectibles, and then source competitive quotes from multiple dealers to find the best deal. Metalsmart’s platform is free to use, and they will only share your contact information with companies you want to explore further.

Try the online comparison tool to explore gold dealer pricing, or read our full Metalsmart review to learn more about our experience testing the platform.

American Hartford Gold Group Review

Great Service |

If you like the sound of working with a family owned and operated gold brokerage, consider American Hartford Gold. This company works with families and individuals looking to invest in gold, silver and platinum. You can take possession of the gold or hold it in a self-directed IRA, Thrift Savings Plan or 401(k) for the self-employed.

- Metals: Gold and silver (coins and bars)

- Shipping: Not disclosed

- Storage: Yes, to your chosen depository

- Displays pricing: No

American Hartford Gold helps its clients use gold assets as a hedge in their investment portfolios. While it doesn’t display current premiums, it does show current market information as well as historical data.

American Hartford Gold sells high-quality metals. The company backs up sales with a 100% satisfaction and money-back guarantee. Customers also benefit from a gold buyback program with no additional liquidation fees.

To get a quote or learn more about the brand, visit American Hartford’s website or call (877) 672-6779.

Monetary Gold Review

Unique Investor Workshops |

Monetary Gold is one of the few dealers that buy precious metals directly, thus enabling them to bypass middleman commissions. The company is one of three gold brokers in the U.S. registered with CME Group, the world’s leading derivatives marketplace. This distinction allows the company access to the broadest range of investments.

- Metals: Gold, silver, platinum, and palladium coins

- Shipping: $30

- Storage: Yes, through depository partners

- Displays pricing: Yes

Monetary Gold emphasizes client education and has 50 years in the precious metals dealer business. You can consult one-on-one with a broker and attend workshops to help you understand your investments.

To get a quote or learn more about the brand, visit Monetary Gold’s website or call (844) 207-6614.

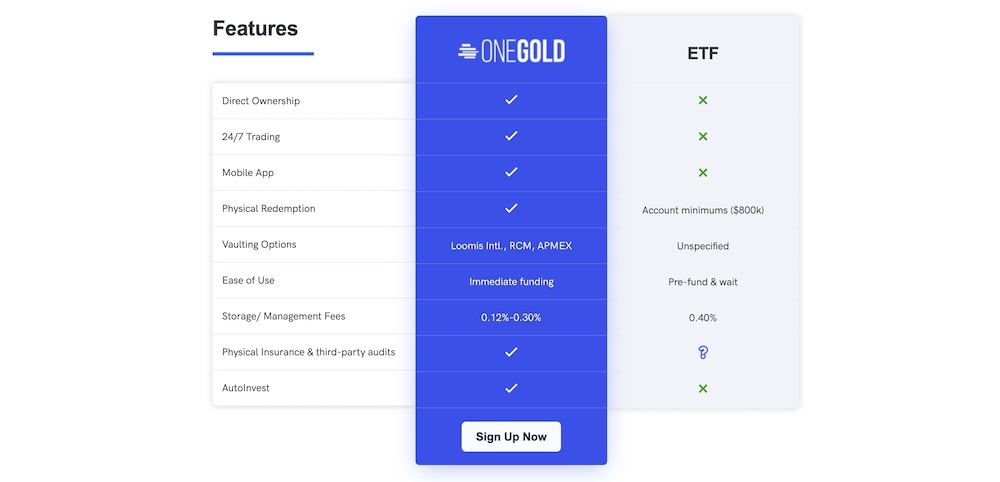

OneGold Review

Great Mobile App |

OneGold buys investment-grade precious metals directly from wholesalers, allowing them to pass savings to investors. OneGold charges fewer fees than other gold dealers and sells gold, silver and platinum with just a small premium over spot. The company was founded by APMEX, a trusted precious metals leader, and Sprott, one of the biggest names in the alternative asset investment industry.

- Precious metal options: Gold, silver, and platinum (coins and bars)

- Shipping: Free

- Storage: Yes, through depository partners

- Displays pricing: Yes

A free online account gives you 24/7 access to your precious metals. If you opt to take physical possession of your holdings, you can redeem your funds for coins, bars, or rounds online via APMEX drop shipping. To learn more about the brand, visit read our full review.

VaultUS Gold Review

Great Personalization |

VaultUS Gold sells gold, silver, platinum, and palladium coins. Whether buying gold for personal use or to fund an IRA, VaultUS Gold advisors tailor their recommendations to your investment goals, budget, and risk tolerance using historical data to make data-informed suggestions.

You can browse VaultUS Gold’s precious metals selection online, but to start the process of buying the coins, you’ll need to fill out a form with your contact information.

- Precious metal options: Gold, silver, platinum, and palladium (coins and bars)

- Shipping: Free

- Storage: Yes, through depository partners

- Displays pricing: No

If you want to sell your investments, VaultUS Gold offers a buyback commitment. They will purchase your metals at a price based on current market conditions.

Read our full VaultUS Gold review to learn more.

Monex Review

Cutting-edge Technology Service |

Since opening in 1967, Monex has grown much bigger than the small shop it started as. The founder still works alongside his son and two daughters, but now the company employs a large professional staff with a reputation for reliable and fair prices.

- Precious metal options: Gold, silver, platinum, and palladium (coins and bars)

- Shipping: $20 per shipment, plus $1 per oz of metal for gold, platinum, and palladium bullion and coins; $85 per 1,000-ounce bar of silver.

- Storage: No

- Displays pricing: Yes

Monex offers cutting-edge tools for gold investors. A mobile app for iPhone and Android devices provides live bullion and coin prices, market indicators, charts, indexes and more. Monex customers can use the app to get customized price alerts on their phones.

To learn more about Monex, read our full review.

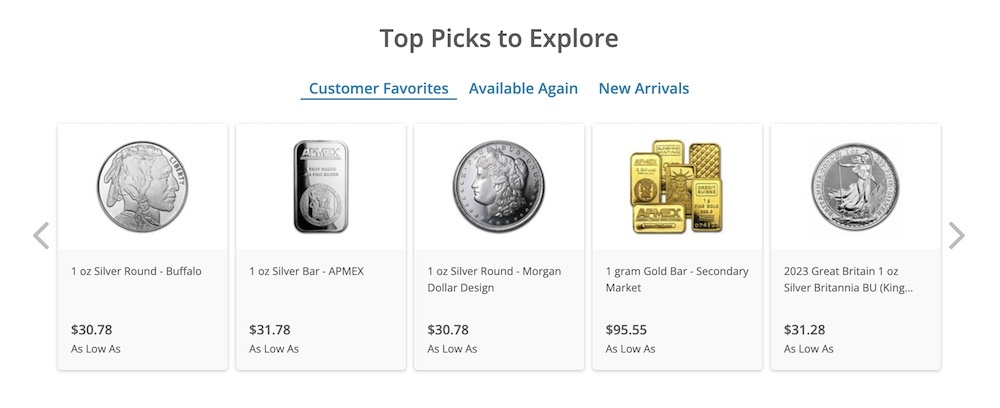

APMEX Review

Great Online Brokerage |

If you’re a gold enthusiast or investor looking for a variety of gold, consider buying online from APMEX. American Precious Metals Exchange offers gold from these mints: U.S., Royal Canadian, Perth, Royal and Mexican. The APMEX gold product mix includes ancient and medieval coins, lunars, foil notes and others among the usual IRA-approved and collector’s gold.

- Precious metal options: Gold, silver, platinum, palladium and rare currency (coins and bullion)

- Shipping: Free for orders of $199 or more

- Storage: Yes

- Displays pricing: Yes

APMEX prices are slightly higher than other gold dealers, but their unique programs and broad selection make up for the cost. Another key advantage is APMEX’s free shipping on orders over $199. Orders under $199 are charged a $9.95 shipping fee, but orders over the amount get free shipping. Insurance is included on all shipped packages, and no minimum order is required.

APMEX’s AutoInvest program lets you buy gold with recurring purchases to take advantage of dollar-cost averaging. You can buy gold in increments over time to benefit from an average spot price. The APMEX Gold IRA rounds out the company’s precious metals products.

Premier Gold Review

Great portfolio simulator |

Premier Gold is a precious metals dealer whose specialists can help you diversify by rolling over funds to a gold IRA or purchasing precious metals for physical possession. Its business model is based on repeat business and referrals, supported in large part by transparent investor education.

- Metals available: Gold, silver, platinum, palladium

- Minimum IRA investment: None (dealer recommends $50,000)

- Fees: Setup, annual maintenance (for gold IRAs)

- Storage options: Brink’s Global Services, Delaware Depository, International Depository Services, A-M Global Logistics

View historical price charts for gold, silver, platinum, and palladium, as well as live spot prices on its website. Shipping is free to all states except California.

Read our full Premier Gold review to learn more.

Priority Gold Review

Great free storage |

Premier Gold lists its gold and silver inventory online, but it doesn’t list the prices. Instead, you’ll choose an investment amount between $10,000 and $100,000 before adding the metal to your cart. The company has a competitive buy-back process and a lowest price guarantee.

- Metals: Gold, silver, platinum, palladium

- Minimum investment: $10,000

- Fees: Storage, shipping, processing

- Storage options: Brink’s Global Services, Delaware Depository, International Depository Services, A-M Global Logistics

Customers praise Priority for its customer service and guidance throughout the investment process. Its website is also full of educational information, including an investment glossary of terms and a real-time price chart you can use to compare the current price of gold to the U.S. dollar, S&P 500, Oil, or Dow Jones to learn how gold is performing.

Read our full Priority Gold review to learn more.

Our Research Methodology

To identify top gold dealers, we analyzed 10 data points to give you a well-rounded review of each provider. We sourced feedback and reviews from real consumers and consulted with finance experts. We also considered these features:

- Licensure and credentials

- Fees, such as premiums, shipping, and storage costs

- Access to educational information and investment resources

- Customer service and support availability

- Industry reputation

- Storage options

- Minimum purchase requirements

- Options for precious metals

We also requested starter kits, when available. Several gold dealer companies give starter kits to interested investors who want to learn more information. We wanted to narrow our list to those that would answer your questions right away, either with a live chat representative or an easy-to-use informational request form. Companies that responded within two days (or sooner) stayed on our list.

We checked complaints and fraud accusations using the Commodity Futures Trading Commission RED list, Better Business Bureau ratings and complaints history, and the variety of precious metals sold.

Basically, we followed our own buying tips to uncover the best providers. Companies that obscured their prices, had difficult or confusing policies and procedures, and/or limited investment and storage options were eliminated. The result of our analysis is the best gold dealers for you, a friend, or a family member to consider.

Our Experience With Gold Dealers

The Retirement Living content team spent several days contacting gold dealer companies to ask questions about the investment process and product details. When available, we asked them to send us starter kits we could analyze and learn from. We had to offer our name, email address, and phone number to receive a digital copy of a starter kit, but our requests were granted quickly.

In instances where companies did not offer an informational kit, we used the live chat feature. Each company asked for a name, email, and phone number to enter a live chat, but we found all company representatives very responsive and knowledgeable, answering all of our questions in full.

Orion Metal Exchange

Orion Metal Exchange stands out among our list of best gold dealers because it displays real-time metal prices directly on its website—not all competitors do the same.

Oxford Gold Group

We found Oxford Gold Group’s investor kit most helpful and effective for engaging new customers. They sent us a 15-page PDF full of relevant information about precious metals, the storage depositories they partner with, and ways to diversify our portfolios with different metals.

Our experience with each company was positive overall. Moving forward, we’d love to see the gold industry become more transparent as an industry standard. Obscuring pricing information from website visitors makes it difficult for potential investors to accurately gauge their investment potential and budget for additional fees that come with buying, selling, and storing gold. Companies that prioritize transparent pricing and fees online can secure a competitive advantage with consumers.

Source: Getty

Source: Getty

What Is a Gold Dealer?

As the name suggests, gold dealers buy and sell gold and other precious metals to investors, financial institutions, and secondary retailers. Some dealers are large online firms with the capital required to buy and sell significant quantities of gold. Requirements vary, but if a firm orders more than 1,000 ounces of gold at a time, the U.S. Mint will deem the firm an Authorized Purchaser that can then buy or sell to others.

You may also find reputable local gold dealers that hold state or county licenses to buy and sell (we’ve listed a few below by city). If you choose to buy or sell with a local dealer, you won’t have to worry about shipping and insurance policies that larger online dealers.

How to Find a Reputable Gold Dealer

- Gold is not a get-rich-quick investment. Plan to hold it long-term in your portfolio.

- Trust your gut. Steer clear from gold dealers who make you feel uncomfortable.

- Know the fees. Dealer markup, storage, and other charges can add up.

- Invest for the right reasons. Don’t invest in gold based on fear of stock market fluctuations.

The best gold dealers willingly explain the fees and investment programs they offer. Work with a precious metals broker who will take as much time as you need to explain how to buy gold. Your gold dealer should help you select the right metals and tell you if there are better options for your portfolio than gold.

Research each gold dealer’s reputation by checking the Better Business Bureau, the U.S. Mint, and National Futures Association’s BASIC database. The U.S. Mint, and National Futures Association’s BASIC database. The U.S. Mint maintains a searchable database of authorized coin sellers and the NFA will tell you whether a firm or individual has been the subject of any disciplinary actions. You should also study consumer reviews to get a feel for how they conduct business.

Top Gold Dealers of 2024

- Competitive Pricing – Orion Metal Exchange

- Great Personalized Service – Patriot Gold Group

- Customized Investments – Oxford Gold Group

- Great Gold Dealer Marketplace – Metalsmart

- Reliable Guarantees – American Hartford Gold Group

- Unique Investor Workshops – Monetary Gold

- Great Mobile App – OneGold

- Great Portfolio Simulator – Premier Gold

- Great High-value Insurance – Regal Assets

- Great Personalization – VaultUS Gold

- Cutting Edge Technology – Monex

- Great Online Brokerage – APMEX

How Much Does Gold Cost?

The price of gold fluctuates daily. As of January 2024, the spot price of gold was just over $2,042 per ounce. When buying gold for physical possession or to store in a gold IRA, you must also account for dealer premiums. Based on our research of top gold dealers, premiums can add hundreds to your final price.

You may also incur transaction costs, such as commissions and storage fees, which will reduce the amount of gold you acquire for your budget.

For example, based on a gold price of $2,042 per ounce, you can get approximately 24.49 ounces of gold with a $50,000 investment. This, of course, does not account for premiums, fees, and price fluctuations.

Gold Dealer Scams

We researched the Federal Bureau of Investigation’s list of tactics used in investment fraud schemes to help you avoid getting into a dangerous situation. Steer clear of deals offering “no risk” or “low risk” gold investments and consistent or guaranteed returns. While most people need assistance to buy the right gold for their objectives, the purchase process is not difficult. The FBI suggests avoiding complicated gold-buying procedures that are challenging to understand.

Other gold scams surrounding precious metal coins and bullion include:

- Misrepresenting standard gold bullion as rare metals with inflated prices

- Pressuring you to buy gold at any time, but especially when prices are high

- Storing your investments at the dealer’s facilities with no way to access your holdings

- Offering offshore gold storage (research this option carefully before storing assets in any offshore location)

- Selling counterfeit gold below market rate on eBay and other online marketplaces

- Showing fear-mongering infomercials that encourage you to call the dealer

- Using political, religious or social values to quickly establish trust on a personal level early and create a false sense of confidence

Ryan Sullivan, investment advisor and owner of the registered investment advisory firm, Off the Beaten Path Financial, says investors can discern between reputable gold dealers by quickly researching current gold prices online first. “A good thing to do before buying any gold or precious metal is to check the spot price and compare the difference against whatever the item is being sold for (the premium price). If there is a large differential, then something may be amiss.”

| Reputable Gold Dealers | Gold Dealers You Should Avoid |

| Get to know you and your investment goals | Pitch a sale based on how much gold a celebrity or well-known financier owns |

| Explain the best options for your needs | Pressure you to “buy now” |

| Sell high-quality bullion and coins | Pawnshops and jewelry dealers selling items with undetermined precious metals content |

| Have an excellent reputation with consumer agencies | Businesses operating as crafted metal dealers |

| Explain the inevitable fluctuations in gold prices and risks | Tell you gold will always increase in value |

| Work with you to make an affordable investment | Offer dealer-sponsored loan programs to make it possible to buy gold |

Gold Dealers Near Me

- Albuquerque, NM

- Anaheim, CA

- Anchorage, AK

- Arlington, TX

- Atlanta, GA

- Austin, TX

- Aurora, CO

- Bakersfield, CA

- Baltimore, MD

- Boston, MA

- Chandler, AZ

- Charlotte, NC

- Chicago, IL

- Chula Vista, CA

- Cincinnati, OH

- Cleveland, OH

- Colorado Springs, CO

- Columbus, OH

- Corpus Christi, TX

- Dallas, TX

- Denver, CO

- Detroit, MI

- Durham, NC

- El Paso, TX

- Fayetteville, AR

- Fort Wayne, IN

- Fort Worth, TX

- Fresno, CA

- Gilbert, AZ

- Greensboro, NC

- Henderson, NV

- Honolulu, HI

- Houston, TX

- Indianapolis, IN

- Irvine, CA

- Jacksonville, FL

- Kansas City, MO

- Las Vegas, NV

- Lincoln, NE

- Long Beach, CA

- Los Angeles, CA

- Louisville, KY

- Lubbock, TX

- Madison, WI

- Memphis, TN

- Mesa, AZ

- Miami, FL

- Milwaukee, WI

- Minneapolis, MN

- Nashville, TN

- Newark, NJ

- New York, NY

- New Orleans, LA

- Norfolk, VA

- Oakland, CA

- Oklahoma City, OK

- Omaha, NE

- Orlando, FL

- Philadelphia, PA

- Phoenix, AZ

- Pittsburgh, PA

- Plano, TX

- Portland, OR

- Raleigh, NC

- Riverside, CA

- Sacramento, CA

- San Antonio, TX

- San Diego, CA

- San Jose, CA

- San Francisco, CA

- Santa Ana, CA

- Seattle, WA

- St. Louis, MO

- St. Paul, MN

- St. Petersburg, FL

- Stockton, CA

- Tampa, FL

- Tucson, AZ

- Tulsa, OK

- Virginia Beach, VA

- Washington D.C.

- Wichita, KS

Frequently Asked Questions About Gold Dealers

Can I invest in gold without buying gold bars or bullion?

Yes. There are many ways to invest in gold, such as gold mining stocks, exchange-traded funds, mutual funds and other options.

Do I have to pay taxes on the gold I sell?

Federal tax laws require precious metal dealers to report when a customer sells bulk gold or silver by filing form 1099-B with the IRS. Gold dealers must also report any cash payments of $10,000 or more.

Are all gold coins valued the same per ounce?

The amount of precious metal in a gold coin is the primary determinant of value, according to the Federal Trade Commission. Each coin is different, and the price of a certified gold coin depends on the coin’s weight in gold, its availability, and its condition. The U.S. Mint produces gold, silver and platinum coins for investment purposes, guaranteeing weight, precious metals content, and purity.

Will my gold dealer tell me when to buy or sell?

No. A good gold broker will teach you about the gold market and help you compare the merits and pricing of various gold investments, but gold dealers are not financial advisors. The decision to buy or sell gold rests on your research and judgment—legitimate gold dealer websites will include this disclaimer in their website and marketing materials.

Can I store gold at home?

Yes, you can store gold at home (gold IRAs must be stored in a facility). If you choose at-home storage, be sure to keep your investments in a safe and protect them with homeowners insurance.

Related Gold Dealer Resources

Gold Dealers Statistics

This article examines the gold supply chain and includes statistics related to the commodity’s extraction, retail and repurposing.

Concluding Thoughts on Gold Dealers

If it sounds too good to be true, it probably is.

Ignore gold dealers with unending special pricing and look for a dealer that prioritizes customer education. Ethical dealers will listen to you and avoid pressuring you to make quick decisions. Always be on the lookout for precious metals scams. Consider one or more of our top gold dealers to reduce your research time.