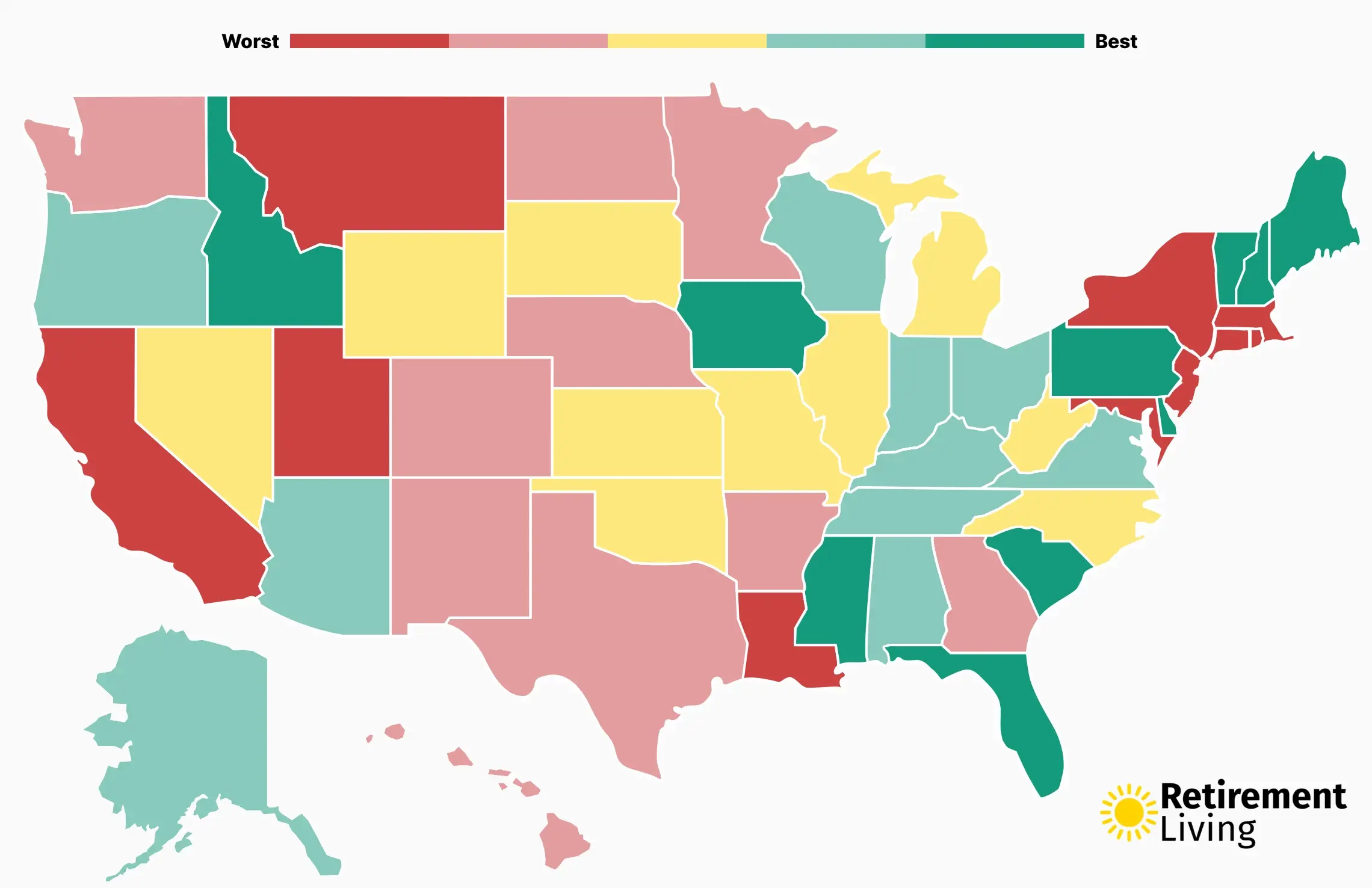

Best and Worst States for Retirement in 2024

Updated:

Retirement Living takes an unbiased approach to our reviews. We may earn money when you click a partner link. Learn More

When envisioning retirement, picking an affordable destination is an obvious, likely vital, consideration. But the truth is that your ability to “live comfortably” during retirement depends on several factors—what works for you may not work for your neighbor. Smart retirees will consider factors like retirement taxes, access to health care, crime statistics, housing costs, weather, and so many other things.

To help you plan the next stage of your life, Retirement Living gathered and evaluated 13 data points across three categories: cost of living, quality of life, and healthcare. We also surveyed more than 1,075 readers aged 55 and older to garner on-the-ground feedback about retirement in their state. Their opinions are reflected in the “RL Rating” for each state. (Learn more about our methodology for finding the best states to retire.)

Our specific rankings for each major metric will help you make a more informed decision. But keep in mind that moving is a big financial undertaking. We recommend consulting with a financial planner before relocating to another state.

But First: A Shift in Retirement Priorities

The 2024 list of best and worst states for retirement looks quite different than in years past. While factors like affordability and access to health care remain top of mind for seniors when choosing a place to live, consumer data sourced by Retirement Living suggests that current and future retirees in 2024 are even more focused on retirement-specific taxes and quality of life metrics.

A few takeaways from our response analysis of the Retirement Living survey:

- Nearly half (49.6%) of respondents said they’d be willing to move to a state with a more favorable retirement climate. Of those, 52% are retired and 48% are not yet retired.

- Population changes by state correlate positively with residents’ willingness to move, which suggests that people are acting on their wishes to find a more favorable retirement destination. For example, New York-based residents willing to move outnumbered those who are not two-to-one. The state also experienced the largest population decrease of all 50 states: -2.9%.

- Those who mention taxes and expenses in their responses are more likely to be willing to move to a more favorable retirement state. Coincidentally, these respondents all hailed from states ranked as the “worst” for retirement.

- Only 33% of respondents from our top three “best” states said they’d move to a more favorable state. This is compared to 60% of respondents currently living in the three “worst” states for retirement.

- Respondents cite “affordability” as their most important consideration for determining where to retire; however, this year’s data shows an increase in the number of people who rated “quality of life” as their most important factor. Thirty-seven percent of respondents chose “quality of life,” 39% chose “affordability,” 14% chose “health care,” and 10% chose “other.”

- That said, respondents across the country who deemed “quality of life” most important were more likely to mention the words “costs,” “taxes,” and “expensive” as aspects affecting their quality of life during retirement. This indicates that overall affordability is important in many aspects of life and is indeed a big factor in decision-making.

10 Best States for Retirement

Easy access to quality doctors, companionship opportunities, and lower tax burdens are just a few ways to guarantee a healthy and happy retirement. Our top 10 states for retirees shine when it comes to housing costs, state taxes, health care availability, and quality of living metrics. Specifically, our top states offer these advantages:

- Higher percentage of the population over the age of 65

- Greater affordability index when comparing median income and home prices

- Reasonable population density, which is a strong indicator of rising living standards and a better quality of life

- Higher Retirement Living (RL) approval ratings on a scale of 1 to 5, with 5 representing the highest recommendation

10. South Carolina

Almost one in five people in South Carolina are 65 and older. Higher percentages of seniors in a state are good indicators of retirement-friendliness, and our data supports this theory.

The Palmetto State experienced an influx of people this year, likely because it doesn’t tax Social Security benefits or pensions. South Carolina’s housing and transportation costs fall well below the national average, too.

What people like about living in South Carolina:

- “The cost of living is low and it does not require seniors to pay state tax.”

- “Good weather, low taxes, lots to do.”

- “Everything you need is close by. And even though it is getting more developed, there is still a small-town feel to it.”

South Carolina’s crime rating could be better, but retirees seem willing to overlook such metrics for milder winters and small-town charm.

| Criteria | Rank |

|---|---|

| Affordability | 33 |

| Quality of Life | 22 |

| RL Score (1–5) | 3.52 |

9. Vermont

More than 20% of Vermont’s population is over 65. The state’s abundant outdoor recreation opportunities and cultural activities make it easy for retirees to embrace an exciting lifestyle. With its rich history, gorgeous scenery, and ample access to hospitals and physicians, Vermont’s quality of life score reigns supreme. If an active lifestyle and access to great health care are important factors for relocation, Vermont could be the place for you.

Vermont’s crime rate has climbed a bit since last year, but it sits solidly in the top 10 in 2024. The state’s mid-range affordability factor and its tax breakdown will require some seniors to pay taxes on their retirement income. But the sales tax rate in Vermont is average, and many essential items like groceries and prescription drugs are tax-exempt, which helps lessen the blow.

| Criteria | Rank |

|---|---|

| Affordability | 23 |

| Quality of Life | 3 |

| RL Score (1–5) | 3.0 |

Read more: Taxes by State

8. Florida

No surprise here—Florida remains a top retirement destination for many reasons. First, the Sunshine State ranks as one of our most tax-friendly states for retirement. There are no estate, inheritance, or income taxes, and Florida doesn’t tax any retirement income. Pair that with year-round sunshine and ample access to quality hospitals across the state, and it’s easy to see why Florida is a “best-of” mainstay.

What people like about living in Florida:

- “We are happy. Prices are reasonable and lots of friends live here.”

- “Lower housing costs allow me to retire mortgage-free. Climate is also more attuned to my preferences.”

- “Great weather, convenient airport, friendly people.”

Benefits aside, it’s worth noting that over 318,900 people moved to Florida between 2021 and 2022. This population increase of nearly 2% is much higher than the 0.4% national growth rate during the same period.

Such growth has contributed to increases in the cost of living across many aspects of life. Responses from our Florida-based residents echo this notion, citing the most common causes for concern as overdevelopment, rising insurance costs, and an increase in traffic.

| Criteria | Rank |

|---|---|

| Affordability | 24 |

| Quality of Life | 8 |

| RL Score (1–5) | 3.49 |

Read more: Best Cities to Retire in Florida

7. Pennsylvania

Resident satisfaction trended downward overall in 2024, but Pennsylvania is one of the few states that earned a bump in consumer sentiment this year. Pennsylvania doesn’t tax any traditional types of retirement income; even other types of income are taxed at a low flat rate.

What people like about living in Pennsylvania:

- “Great health care systems and a good transportation system.”

- “No local or state taxes; reasonable cost of living in more rural areas.”

- “Pittsburgh offers an abundance of cultural venues.”

The state is home to several renowned hospital systems, such as Hospitals of the University of Pennsylvania, Penn Presbyterian, and Thomas Jefferson University Hospitals. And while the city of Philadelphia won’t win any awards for being crime-free, instances are less frequent in rural towns and smaller cities.

| Criteria | Rank |

|---|---|

| Affordability | 6 |

| Quality of Life | 10 |

| RL Score (1–5) | 3.26 |

6. Delaware

Taxes in Delaware can’t get much better for retirees; there is no sales tax and seniors can deduct a significant portion of their retirement income. Such favorable tax conditions could explain why such a large percentage of residents here are seniors (20.8%).

What people like about living in Delaware:

- “Low taxes and I can live near the sea.”

- “Good tax situation for retirement.”

Rent prices in Delaware are average, but its percentage of people in poverty is low. And while there are several large hospitals in the state, residents only need to travel a short distance to access other major health care facilities in Philadelphia and Maryland.

| Criteria | Rank |

|---|---|

| Affordability | 7 |

| Quality of Life | 21 |

| RL Score (1–5) | 3.2 |

5. Mississippi

There’s no shortage of small-town charm in Mississippi. Retirees searching for quaint and quiet places to settle should put the Magnolia State on their shortlist. Admittedly, the poverty rate here is substantial, which bumps it low on our “quality of life” ranking, but its growing senior population suggests a suitable retirement environment. Plus, survey respondents praised Mississippi so highly that it earned the highest RL Score of all 50 states.

What people like about living in Mississippi:

- “Overall affordability allows us access to most of the other positive attributes of retirement.”

- “Much cheaper cost of living and less crime.”

- “Many people retire here for the climate and affordability.”

Crime in Mississippi is one of the lowest in the nation. And when comparing home prices against average annual incomes, the state, once again, lands in the top 10—no state other than West Virginia has more affordable housing than Mississippi.

| Criteria | Rank |

|---|---|

| Affordability | 8 |

| Quality of Life | 39 |

| RL Score (1–5) | 4.5 |

4. Idaho

With a population increase of 5.4%, more people have moved to Idaho than any other state. Residents surmise that the boom has caused housing costs to spike, but with a median home price of $331,600, houses are still well below the national average of $412,000, according to the Federal Reserve Bank of St. Louis.

What people like about living in Idaho:

- “It’s beautiful here, and the people are so nice.”

- “Fresh air, beautiful scenery and sunsets, lower cost of living, and less traffic.”

- “It is a state with great adventures.”

Breathtaking mountain views aside, crime is low, and for retirees, a good portion of their Social Security benefits, pensions, and property taxes are exempt from income tax. For this reason, several cities in Idaho also earned a spot on our list of best cities to retire in 2024.

| Criteria | Rank |

|---|---|

| Affordability | 26 |

| Quality of Life | 7 |

| RL Score (1–5) | 4.0 |

3. Iowa

Iowa offers plenty of recreational activities for outdoorsy seniors, but that’s just a bonus when considering how affordable the state is. Home prices average just $181,600—much lower than the national average. For tax year 2023, Iowans age 55 and older are exempt from paying state taxes on retirement income (the state also doesn’t tax Social Security benefits).

What people like about living in Iowa:

- “The winters may be cold, but the sun shines nearly every day.”

- “Quiet, safe, and not so expensive.”

- “Iowa has the best health care.”

There’s a good chance you’ll meet new retirement-age friends, too, as more than 18% of residents are age 65 and older. With low crime and even lower levels of poverty, Iowa is known as one of the safest places to live; you can rest easy no matter where you choose to plant your roots.

| Criteria | Rank |

|---|---|

| Affordability | 5 |

| Quality of Life | 15 |

| RL Score (1–5) | 3.15 |

2. Maine

Maine barely misses the top spot because it levies higher income and property taxes than our best retirement state below. However, it has no local sales taxes—you’ll pay the same amount whether you settle in a quaint beach community or a bustling metropolis like Portland. Consider this one of Maine’s biggest benefits, as you could spend years exploring the state’s breathtaking landscapes and attractions.

What people like about living in Maine:

- “Expensive, but great relaxed living and not crowded.”

- “Great food and arts scene, as well as ocean views for walks.”

Maine also earns our praise for great access to healthcare professionals and low—really low!—crime rates. Plus, at 22.5%, Maine has the highest population of seniors in the country.

| Criteria | Rank |

|---|---|

| Affordability | 1 |

| Quality of Life | 13 |

| RL Score (1–5) | 3.0 |

1. New Hampshire

For the second year in a row, New Hampshire takes the top spot for U.S. retirement destinations. This four-season state allows residents to participate in various outdoor activities year-round. Seniors will have little issue building a network of retirement-age friends with similar interests—more than 20% of New Hampshire residents are 65 and older.

What people like about living in New Hampshire:

- “Four seasons. Mountains. Low population.”

- “No income tax or estate tax. No sales tax. A lot more freedom than other states.”

- “Some areas are touristy and crowded, but seniors get discounts on state park tickets, beach parking, and recreational events.”

Despite having one of the country’s highest real estate transfer taxes, many people are willing to overlook that metric in exchange for no state tax on retirement income and no sales taxes, which helps keep the Granite State affordable for all residents.

Housing prices rose year-over-year, but so did the average annual income, so New Hampshire’s affordability ranking actually improved this year. Independent living communities and health care resources are readily available in most areas, too.

| Criteria | Rank |

|---|---|

| Affordability | 1 |

| Quality of Life | 2 |

| RL Score (1–5) | 3.6 |

10 Worst States for Retirement

Common themes among the states that rank low for retirement living include high taxes, high crime rates, and inadequate health care facilities. Our readers’ opinions, gathered from our surveys, figure into our findings.

10. Massachusetts

If cutting down on your tax bill in retirement is a priority, you’ll want to look beyond Massachusetts. The state taxes most private pensions and 401(k) and traditional IRA withdrawals, as well as investment income. According to U.S. Census data, it has the third-highest home prices out of the 50 states.

Massachusetts is home to many physicians, and its crime rate is low enough to make retirees feel safe in the state—that is, if you can stand the colder winters. As one Boston resident put it, “the only thing good here is health care.”

| Criteria | Rank |

|---|---|

| Affordability | 42 |

| Quality of Life | 37 |

| RL Score (1–5) | 3.15 |

9. Montana

With the exception of Idaho, more people moved to Montana than any other state between 2020 and 2022. And one in five people are over 65. From a tax perspective, Montana doesn’t do retirees any favors—Montana places those who make more than $19,800 annually in its highest tax bracket, rendering the state unaffordable for most seniors.

If Big Sky Country beckons, be sure to choose your surroundings wisely, as many Montana towns impose a resort tax on goods and services.

| Criteria | Rank |

|---|---|

| Affordability | 17 |

| Quality of Life | 4 |

| RL Score (1–5) | 3.0 |

8. Rhode Island

For such a small state, Rhode Island sure crams a lot of people within its borders. The state boasts the third-highest population density rating in America.

Like many states on this list, Rhode Island struggles to accommodate retirees with fixed incomes. Its effective property tax rate is 1.53%, which could result in a hefty tax bill considering the high home values in the state. The state will also claim a chunk of your retirement income, including IRA distributions, which are fully taxable under Rhode Island law.

| Criteria | Rank |

|---|---|

| Affordability | 30 |

| Quality of Life | 33 |

| RL Score (1–5) | 2.0 |

7. Connecticut

Retirees who plan to rent their homes should cross Connecticut off their list of potential retirement destinations. The state has the 11th highest rental prices in the country. Connecticut’s lackluster affordability ranking is partly due to an unfavorable tax climate for seniors—especially property taxes.

None of our Connecticut-based survey respondents were actively retired, but 77% said they’d be willing to move away if it meant relocating to a more affordable state. That said, if your budget can handle it, Connecticut scores quite high for its access to quality doctors: sixth overall.

| Criteria | Rank |

|---|---|

| Affordability | 22 |

| Quality of Life | 20 |

| RL Score (1–5) | 2.91 |

6. Utah

Utah recently experienced one of the nation’s biggest population booms, a 3.3% increase since 2020. At first glance, this makes sense. Our data highlighted fewer impoverished residents in Utah than in all states except New Hampshire.

But with a closer look, retirees might find funding life in the Beehive State tough. No Utah-based survey respondent said they’d recommend retiring in Utah. “The taxes are too high here, particularly property taxes,” in the words of one respondent. Pair that with the ninth-highest median home value, and it starts to paint a picture of what retired life might look like in Utah.

Still, the natural beauty in Utah is hard to forget. If access to stunning mountain ranges and national parks is part of your retirement checklist, limit your home search to larger metropolises like Salt Lake City, where access to doctors is better.

| Criteria | Rank |

|---|---|

| Affordability | 48 |

| Quality of Life | 12 |

| RL Score (1–5) | 3.38 |

5. New Jersey

Despite favorable scores for health care and crime metrics, it seems residents are fleeing New Jersey in search of more affordable housing and smaller crowds. The Garden State ranks second worst for population density, suggesting that retirees may need to trade one of the state’s desirable beach communities for a rural one if space and traffic are a concern.

In New Jersey, the average effective property tax rate is 2.47%, which is the highest in the nation. Other retirement-friendly tax breaks are only available for higher-income earners. New Jersey taxpayers must make less than $150,000 per year to qualify for a tax exemption on some or all of their retirement income.

| Criteria | Rank |

|---|---|

| Affordability | 35 |

| Quality of Life | 47 |

| RL Score (1–5) | 3.13 |

4. Louisiana

It’s not all beignets and football in the Pelican State—Louisiana ranks as one of the worst states in the country for crime. And while home prices are lower here than in other states, a lower-than-average annual income and high local taxes make affording said homes tough.

Relocation could earn seniors exemptions on Social Security and pension plans, but we urge retirees to choose their Lousiana retirement destination carefully. Local sales taxes in some cities can add as much as 7% to the state sales tax rate. With an average state and local tax rate of 9.55%, residents could end up paying some of the highest sales tax in the country.

In fact, three in four Lousiana-based retirees cited costs and taxes as reasons for not recommending the state as a top retirement destination.

| Criteria | Rank |

|---|---|

| Affordability | 44 |

| Quality of Life | 48 |

| RL Score (1–5) | 2.93 |

3. Maryland

Even though almost 17% of Maryland’s population is 65 and older, our data analysis indicates it’s not the most desirable retirement destination.

Maryland scores well for access to physicians and a low crime rate, but it suffers in two other categories the elderly care about most: affordability and space to breathe. Housing data from the U.S. Census suggests home prices do not align with annual income. And Maryland has more people per square mile than almost any other state.

According to one survey respondent, “Maryland is known to be unkind to retirees regarding taxes.” Maryland levies taxes on estates and inheritances, as well as a partial tax on pensions, 401(k)s, and IRAs.

| Criteria | Rank |

|---|---|

| Affordability | 28 |

| Quality of Life | 43 |

| RL Score (1–5) | 2.47 |

2. New York

Median rent and home prices in New York are the main reasons the state falls so low on our list of best retirement destinations. Seniors will get a tax break on their Social Security benefits, but the savings ends there. New York has a state income tax and also partially taxes retirement account withdrawals and private pensions.

Such expenses could explain why the state has experienced a population decline since 2020. At -2.6%, more people have fled New York than any other state. The state received more “1” ratings than any other state, according to our survey results, with every respondent referencing taxes and high living costs as their reasons for disappointment.

| Criteria | Rank |

|---|---|

| Affordability | 46 |

| Quality of Life | 49 |

| RL Score (1–5) | 2.93 |

1. California

No matter how you stretch it, living in California is expensive. Median home values are the second-highest in the nation, as are gas and grocery taxes. Though Social Security is exempt, the Golden State fully taxes income from retirement accounts and pensions.

Our readers’ opinions echo the data. In fact, more than half of California residents cited costs as a determining factor for their lackluster ranking—only 36% of the survey respondents from California gave their state a 4 or higher. When asked whether they’d be willing to move to another state, 57% of all respondents said yes.

Still, it’s hard to ignore the allure of such a comfortable climate. If California’s year-round sunshine is too much to pass up, consider setting your sights on a smaller town in the state with housing options that fit your retirement budget. Access to quality health care is easy across California, so there’s no reason to limit your search to major cities if that’s your main concern. (If you’ve got your heart set on the Golden State, choose one of these 15 cities to retire in California.)

| Criteria | Rank |

|---|---|

| Affordability | 49 |

| Quality of Life | 50 |

| RL Score (1–5) | 2.82 |

Methodology and Sources

In our search to identify the best and worst states for retirement, we analyzed 13 metrics across three categories specific to retirees: cost of living, quality of life, and Retirement Living (RL) score. For each metric, we relied on government data sources, including the U.S. Census Bureau and the Federal Bureau of Investigation, as well as Retirement Living’s internal resources.

To rank each state, we created an equation and standardized each metric so we could compare each data point equally. The data points and their corresponding percent weighting are as follows:

- Taxes on retirement income: 8%

- Sales tax rate, including average local taxes: 8%

- Average home price: 8%

- Average monthly rent payment: 8%

- Median household income (2022 dollars, adjusted for inflation): 8%

- Persons 65 and older: 6%

- Persons in poverty: 6%

- Violent and property crime rates: 6%

- Population density (per square mile): 6%

- Population growth (2020 – 2022): 6%

- Number of hospitals per state: 6%

- Number of primary care doctors per capita: 6%

- Retirement Living survey responses: 20%

Government data only tells part of the story, and what’s happening on the ground has the potential to greatly affect quality-of-life metrics in ways our data points cannot detect. To fill in the gaps, Retirement Living surveyed 1,075 people aged 55 and older across the U.S. and asked the following questions:

- Would you recommend your city (or nearest metropolis) to a friend as a retirement location? Why or why not?

- Which of the following is your most important consideration for determining where to retire: affordability, quality of life, access to health care, or something else?

- How satisfied are you with your retirement in your state, on a scale from 1 to 5, and why?

- Are you willing to move to a state with a more favorable retirement climate? Yes or no?

Retirement Living Score: We surveyed our readers and received more than 1,075 responses. We asked our readers to rate their state for retirement, which provided us with anecdotal evidence of what it is like to actually retire in a particular state. This information amounted to 20% of the state’s overall score.

Cost of Living score: To evaluate the cost of living, we considered household income, home and rental prices, and tax data. We standardized median household incomes from the U.S. Bureau of Economic Analysis (BEA), average home prices from U.S. Census data, and state tax rates from each state’s Department of Revenue website. Each point adds up to 40% of the state’s final score.

Quality of Life score: To evaluate the quality of life, we considered affordability, as well as poverty, crime, and population characteristics (i.e., density, number of people aged 65 and older, and population changes). We leveraged U.S. Census data to standardize the percentage of the population over 65, changes year-over-year, and the percentage of people in poverty. We analyzed crime statistics using FBI National Incident-Based Reporting System (NIBRS) data. We considered important health care metrics by evaluating access to hospitals and primary care doctors using the United Health Foundation’s America’s Health Rankings. This category amounts to 40% of the state’s overall score.

Fair Use Statement

If you found the information here helpful, we invite you to share it for non-commercial purposes. In return, we ask that you include a link back to this page when doing so.