Datalign Advisory Review

Datalign Advisory, LLC is a financial advisor marketplace that matches customers with pre-screened licensed professionals to help them reach their financial goals.

If you’re the kind of person who likes to make careful decisions about your money, you’ll appreciate the platform’s personalized and detailed approach to matching you with the right professional for your needs. While other marketplaces simply vet prospects based on location and portfolio size, Datalign pairs customers with financial advisors based on income, required services, time to retirement, and past experience with financial advisors.

Instead of matching with multiple advisors, you will match with one professional who best meets your criteria. Datalign partners with thousands of financial advisors nationwide who have a long history of helping clients with tax preparation, estate planning, and more. The platform is free to use, and you get a free consultation call with your match to determine if it is a fit.

Pros

- Detailed questionnaire leads to matches that are tailored to your unique needs

- Free to match with pre-screened advisors on the platform

- Free, no-obligation call with match

- Expertise ranging from retirement to insurance to estate planning

Cons

- No option to research potential advisors in the network ahead of time

- No online calculators or educational resources available

- No dedicated or obvious customer service contact information online

Datalign Advisory Services

Datalign Advisory’s business model is simple: customers use its platform to connect with a pre-screened, licensed advisor who fits their needs. According to the Bureau of Labor and Statistics, there are more than 260,000 registered advisors in the U.S., so it can take quite some time to sort through your options and find a professional specializing in your area of need. Datalign offers a timely solution to finding the right financial advisor for you. They thoroughly vet advisors and customers to curate a match based on detailed aspects of your financial situation.

Financial advisors may specialize in the following fields:

- Financial planning

- Portfolio management

- Wealth management

- Retirement planning

- Budgeting

- Insurance

- Tax planning

- Estate planning

- Business finances

Using a questionnaire, Datalign will match you with one advisor and give you the option to have him or her reach out to set up a free, no-obligation consultation. If you decide to work with the advisor, Datalign will step out of the picture and allow you and your advisor to move forward together.

How to Find a Financial Advisor With Datalign

he advisors in Datalign Advisory’s network have a range of specialties. Whether you opt for remote management or in-person services, the platform partners with advisors nationwide.

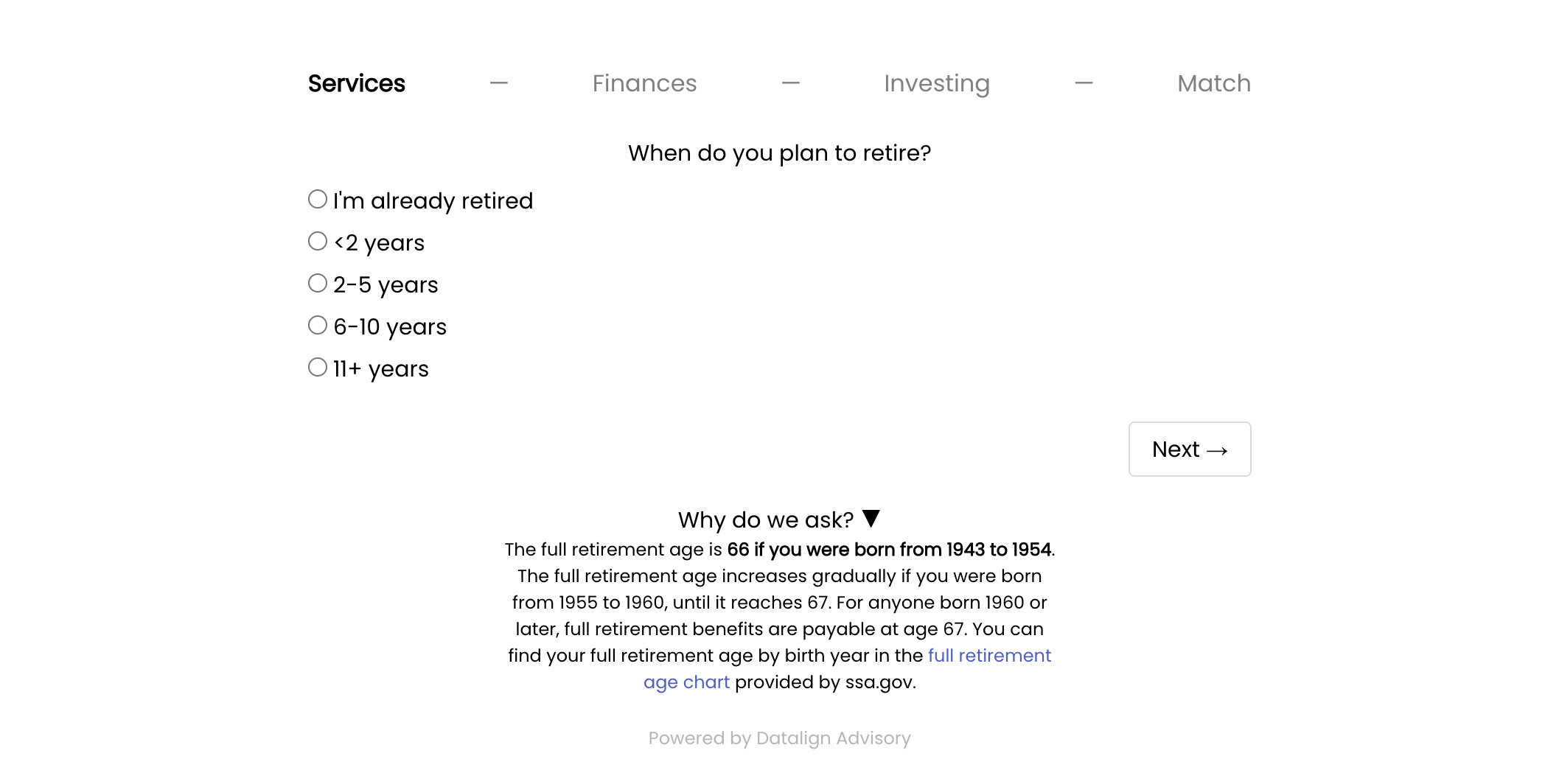

To use Datalign to connect with a financial adviser, you’ll fill out a detailed questionnaire on the website. You’ll answer 20 questions about your income, investment status, and current and future financial goals plus personal questions about your investment risk tolerance and asset allocations. This important feature of the platform helps to ensure you match with someone who is the best fit for you. For instance, Datalign won’t match a robo-advisor that specializes in setting up new portfolios for middle-income earners with a high-net-worth individual nearing retirement who needs help managing several investment streams.

Once you complete the survey and agree to let the recommended financial advisor contact you, Datalign presents you with one match. You can research this advisor while you wait for them to reach out. You are then offered a free, no-obligation phone call with the advisor to discuss your needs. Use this call to vet the advisor and to learn what financial advisors do and how they can help you set and achieve financial goals.

The Financial Advisor Screening Process

All experts who join the Datalign network must complete a detailed qualification process in which Datalign verifies the advisor’s years of experience, SEC or state registration and records, areas of expertise, and compensation criteria.

Datalign only accepts fiduciaries, which means the advisers on the platform are obligated under law to put your interests above their own and only recommend products that are in your best interest. Usually, this means the advisor operates using a fee-based pricing structure.

Still, you’ll want to conduct your own interview when you match with an advisor. Appropriate questions to ask a financial advisor might focus on their investment philosophy, the type of clients they typically work with, how they get paid, and their years of experience in the field.

Datalign Advisory Costs

It won’t cost you anything to use Datalign’s matching tool. The matching process and your initial consultation with the advisor are free. However, you’ll need to pay the advisor’s fees for the services they provide you if you do decide to hire them. All financial advisors on the platform are fee-based advisors.

| Fee-Only Advisors | Fee-Based Advisors |

|---|---|

|

|

Always ask whether your advisor uses a commission- or fee-based pay structure. Both fee-based and fee-only advisors have a legal fiduciary obligation to clients. Fee-based advisors can’t sell you an investment product that conflicts with your objectives, risk tolerance, needs, or long-term goals. Financial advisors that work on commission are held to the same fiduciary standard, but they must disclose commissions or bonuses in a Best Interest Contract Exemption (BICE).

Our Experience With Datalign Advisory

Because online information about Datalign Advisory is limited, we tested the platform’s matching tool and questionnaire ourselves. The questionnaire was intuitive, easy to navigate, and detailed.

Competitor marketplaces simply match you with a finance professional based on your location, income level, and portfolio size. Datalign digs deeper and examines the unique criteria that influence the type of advisor you need. It took us about four minutes to complete the 20-question survey. The survey is more in-depth than competitor qualification forms, and it’s worth noting that you cannot skip questions even if they don’t pertain to you.

One of Datalign’s core values is transparency. We liked that the survey included a “why do we ask” explanation under each question. This extra dose of user-focused transparency made us feel comfortable completing the form and confident in their commitment to finding us the best match.

After completing the survey, we were matched with only one advisor. This is another area where Datalign Advisory differs from competitors. We liked the targeted approach; researching one match felt less overwhelming than researching three or five, but we would have liked to have matched with a second option so that we could compare one professional to the other.

That said, Datalign gave us immediate results (we redacted the company information for privacy reasons). We could click on a link to view the advisor’s SEC profile and find contact information to email or call them. Upon review, we learned that our advisor is a fiduciary that has been registered with the SEC since 2016, charges flat-fee rates per client, and offers financial advice for the needs we selected (retirement planning and wealth management). Within seven minutes, we had an email from the advisor with more information on the company and an invitation to chat.

Overall, our experience was pleasant and helpful. If finding an advisor feels overwhelming to you, this is the type of targeted search you need. But if you like to shop around and conduct your own research, you might not like Datalign’s tailored approach to matchmaking.

Datalign Advisory Complaints

Datalign Advisory, LLC is registered with the SEC as a registered investment advisor (RIA). Datalign Advisory, LCC does not have a profile on Trustpilot or the Better Business Bureau. The venture was fully formed as its own entity in September 2021 and its principal owner is Impact Ready Holdings, LLC.

Datalign Advisory FAQs

What kind of information do I have to provide in the intake form?

Datalign only requires basic information to narrow down the selection of professionals who can best meet your needs. The matching tool is secure and private. On the intake form, you’ll provide:

- Zip code

- Email and phone number

- Age

- Marital status

- When you’d like to retire

- Whether you own a home or a business

- Your current household income

- Your asset allocation

- Your level of preferred risk

- Preferred relationship with your advisor

- Whether you prefer in-person help or remote management

Can I research financial advisors before using Datalign?

No. Unlike other advisor marketplaces that match you with several advisors, Datalign matches you with one advisor who best meets the criteria on your intake form. You’ll be able to research your Datalign match on the SEC’s Investment Adviser Public Disclosure website and the advisor’s own company site, but you will not be able to browse Datalign’s private database of professionals at any time. You should also conduct research on any financial advisor you locate through your own efforts.

How does Datalign choose financial advisors to include on its website?

Every advisor chosen for the platform is an experienced and highly-skilled professional who meets Datalign’s screening criteria: they are licensed fiduciaries in good standing with the SEC and state securities regulators who have vast experience in a range of investment strategies. Each advisor goes through an intensive interview process with Datalign to determine fit.

Is Datalign free to use?

You will be matched with pre-screened Datalign advisors for free. The no-obligation consultation with your match is also free. If you choose to work with the advisor, you’ll pay your advisor directly.

How does Datalign keep my information safe?

Datalign links to its privacy policy at various stages of the questionnaire. You must first consent to phone calls or emails for your match to contact you.

Can anyone use Datalign?

Datalign has in-person and remote coverage in all 50 states, so anyone in the United States can be matched with a Datalign advisor. The advisors have a regulatory obligation to ensure they are either registered or exempt from registration in the user’s state upon matching. Part of the platform’s matching process may entail matching a user to an advisor in their state.

Conclusion

Datalign Advisory’s free and secure platform matches you to the best financial advisor for your needs. Although the site lacks educational resources for someone who is new to working with an advisor, if you have some experience with financial advisors, you may enjoy Datalign’s streamlined approach. Their client-focused referral process makes it easy to conduct interviews with a recommended advisor so that you can understand their specialties and areas of expertise.