EstateExec Review

Taking on the estate executor or personal representative responsibility is no simple matter. Estate executors must follow a probate process, find all of their deceased loved one’s assets, pay outstanding bills and file income taxes. EstateExec is an online app designed to help the executor of an estate follow all the correct procedures according to legal timelines. EstateExec saves hours of time and money and follows each state’s law to ease estate administration.

Pros

- Robust education to help estate executors understand the process

- Checklists to keep executors on track

- Compatible on all web browsers

- Manages, tracks and calculates distribution of estate assets

- Calculates executor compensation, which can be complex

Cons

- Does not save work as you go, but warns if you try to close the browser without saving work

Getting Started with EstateExec

Start an estate plan by creating an EstateExec account, then answer questions about states of residence for you and the deceased. View a video overview of how to use the app and enter some basic information. EstateExec provides detailed information about estate financials, making distributions, determining heirs and all things related to managing the estate.

Source: EstateExec

Select a topic from the left sidebar to read the information you need, or read the free Executor’s Guide to see how this process flows. The very top navigation provides access to your estates, the guide and tech support. Use the data input tabs located just below the top navigation to enter information about yourself, heirs, the deceased, assets, distributions and more.

The Timeline section organizes tasks by the first week, month and quarter, then calendar year and final tasks. There’s also a general tasks section with items related to resolving debt, taxes, valuing assets and asset disposal or sale. The estate timeline also lets you know the information you should gather before your loved one dies, if possible.

| Tasks | Checklist of duties with due dates. Items are categorized for filtering. |

| Executor | Expense log, mileage log, executor compensation. |

| Assets | Record and track estate assets, valuations, sale or distributions. |

| Debts | List of debts with amounts paid or forgiven. |

| Cashflow | Track transactions from the estate checking account. |

| Distributions | Record individual distributions of assets to heirs. |

Entering Data in EstateExec

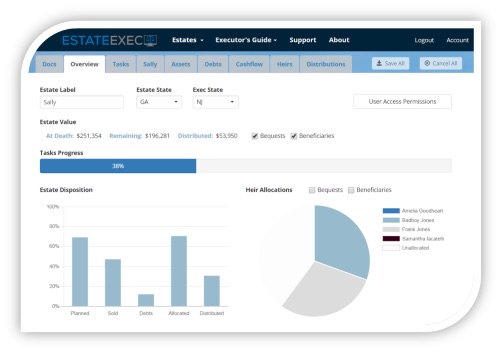

EstateExec calculates due dates for tasks after you enter the date of death. You enter data by clicking on the tabs at the top of the screen. Click on the Docs tab to choose a topic from the left navigation bar to learn about a procedure or what information to enter.

Source: EstateExec

- Overview: This tab shows your progress through closing the estate. You can see at a glance how far along you are working with assets and debts, allocating assets to heirs and completing asset distributions. You will find the tool for setting up view-only or edit access to the estate for one or more individuals here, as well.

- Tasks: This tab holds the entire estate-related task list with due dates and a notes section. Check off items as you complete them. You can easily add duties to this list.

- Executor: You may need to pay for services or items, or travel to work on the estate. Some executors receive compensation for their time. The Executor tab in EstateExec records these events and calculates reimbursements and compensation from the estate.

- Decedent: Enter information about the deceased person, such as their Social Security number, date of birth and death, and home address. EstateExec uses the address to find state-mandated tasks for the executor, or hide those that don’t apply.

- Assets: Record all assets and their value under this tab, such as bank accounts, vehicles, real estate, retirement accounts and personal property. Track when you sell assets or when they are assigned to an heir. AccountExec totals the value of assets when purchased, present value and the value when sold or distributed.

- Debt: List and keep track of the deceased’s debts here, such as credit card bills, outstanding loans and utility bills. EstateExec automatically totals the amounts owed, paid and forgiven by the creditor.

- Heirs and Distributions: List the names of heirs and the percentage of the estate and dollar amount allocated to each one under the Heirs tab. Record the distribution of assets under the Distributions tab, and EstateExec transfers the information to the Heirs section.

Managing Cash Flow with EstateExec

An executor must set up a checking account to track estate-related transactions. The Cashflow tab in EstateExec gives you a checkbook register to record transactions. EstateExec automatically enters the assets and debts you record elsewhere in the app, so there’s no duplication of effort.

The Cashflow section tracks total deposits, such as payouts from insurance companies, withdrawals and the account total. You can also enter transactions like transfers into and withdrawals from the estate.

EstateExec Costs

EstateExec costs $99. This price is a qualified estate expense, so the executor can use funds from the estate and does not have to pay out of pocket. EstateExec is free to families of fallen officers in the line of duty.

Where to Buy EstateExec

You can buy EstateExec on the company’s website. The site also provides a free trial, so you can click around the app to get a feel for how it works before you buy it. You can even get started with entering information, and you only pay if you decide to save your data and continue using EstateExec.

EstateExec Complaints

We found no online consumer reviews for EstateExec, but ScamAdvisor gives the app a 100% trust rating. EstateExec received in-depth coverage from The New York Times and Technolawyer. EstateExec top noted features are the ability to share estate data and reports with others and how the software automatically adjusts for the deceased’s and executor’s states of residence.

EstateExec FAQ

-

Can trustees use EstateExec to organize estate procedures?

EstateExec guides trustees, administrators, executors and personal representatives through their responsibilities. States use different terms for the person overseeing the distribution of assets after death, but there is very little difference in duties.

-

Can I export EstateExec data to a spreadsheet?

You will find the option to export data in CSV format for each table in EstateExec. Spreadsheets and other software can import CSV files.

-

How many estates can I track with an EstateExec license?

Each estate tracked requires an individual license. You pay $99 for each estate. Select the estate to work with from the Estates button at the very top of the app.

-

How long do I have access to an estate in EstateExec?

Each estate is available for five years, which is sufficient time to complete just about any estate transactions. To keep your records beyond five years, print PDF reports. You can filter rows and hide columns before printing if you wish. You can also export EstateExec data to the CSV format.

-

How do I share EstateExec information with others?

If you wish to share your data with heirs or an attorney, you have three ways to share permissions to the estate file. You can make EstateExec view-only so no one else can make changes, allow no access to anyone else or allow someone else to edit your data.

Conclusion

EstateExec guides executors through the legal requirements of managing assets, liabilities and heirs. The app adds and removes tasks based on state requirements, and does quite a bit of math automatically to enhance accuracy. EstateExec thoroughly explains all aspects of estate executorship in easy-to-understand terms and is reasonably priced.