IdentityProtect.com Review

As the name suggests, IdentityProtect.com offers individuals and families comprehensive protection against identity theft. Its robust monitoring systems include scans, alerts, and defenses that keep your personal and financial information secure. The company offers assistance (and insurance of up to $1 million) should your sensitive personal information become compromised.

Your personal information is protected with 256-bit SSL (Secure Sockets Layer) technology, the most modern algorithm for encrypting data. “256-bit encryption” refers to the length of the key size — the larger the key size, the harder it is to compromise.

An IdentityProtect.com subscription allows you to track up to five Social Security Numbers, 10 email addresses, and 10 credit and debit cards. But you can only track one driver’s license. Its Ultimate Protection packages include credit monitoring from Experian and, if needed, identity restoration support from CSIdentity Corporation.

Choose from three subscription packages that are offered in monthly or annual terms. Every membership includes dark web monitoring and loss protection reimbursement (i.e., insurance).

Pros

- Can track multiple email addresses, credit cards, and SSNs with one account

- Up to $1M insurance protections

- Dark web monitoring

- Simple website design that’s easy to navigate

Cons

- No social media monitoring

- Credit monitoring only available in higher-tier plans

IdentityProtect.com Costs

IdenityProtect.com uses a membership pricing model with an option for monthly or annual payments. Costs depend on the type of plan you choose. Subscribers can cancel anytime by calling customer service or opening the chat feature within their member portal.

IdentityProtect.com Plan Types

IdentityProtect.com offers three subscription plans with varying protections, but all plans include the following services:

- $1 million identity theft insurance

- Dark web and internet monitoring

- Rapid email alerts

- SSN usage monitoring

- Change of address monitoring

- Lost wallet assistance

| Plan Type | Coverage | Cost |

|---|---|---|

| Basic |

|

$19.95 per month |

| Premium | All of the above plus:

|

$29.95 per month |

| Ultimate | All of the above plus:

|

$39.90 per month |

Cyber criminals anonymously buy and sell personal and financial information on the dark web. All IdentityProtect.com plans include dark web monitoring, which consists of continuously scanning the dark web for your information and notifying you of suspicious activity. For example, if your credit card number or email address is found circulating the dark web, IdentityProtect.com will alert you and prompt you to update your passwords and information.

Identity Fraud Financial Reimbursement

An IdentityProtect.com subscription provides financial protection against identity theft with a $1 million insurance policy — this kind of protection is standard across the industry. This policy reimburses you if you incur expenses while trying to recover your identity, such as hiring an attorney or a CPA.

You also can use these funds to cover costs like wages lost while attempting to recover your identity. In certain situations, this insurance will reimburse lost funds from a bank account — but beware: the policy’s fine print outlines some important exclusions, such as reporting timeframes, legal fees over $125 per hour, and more.

How to Enroll in an IdentityProtect.com Protection Plan

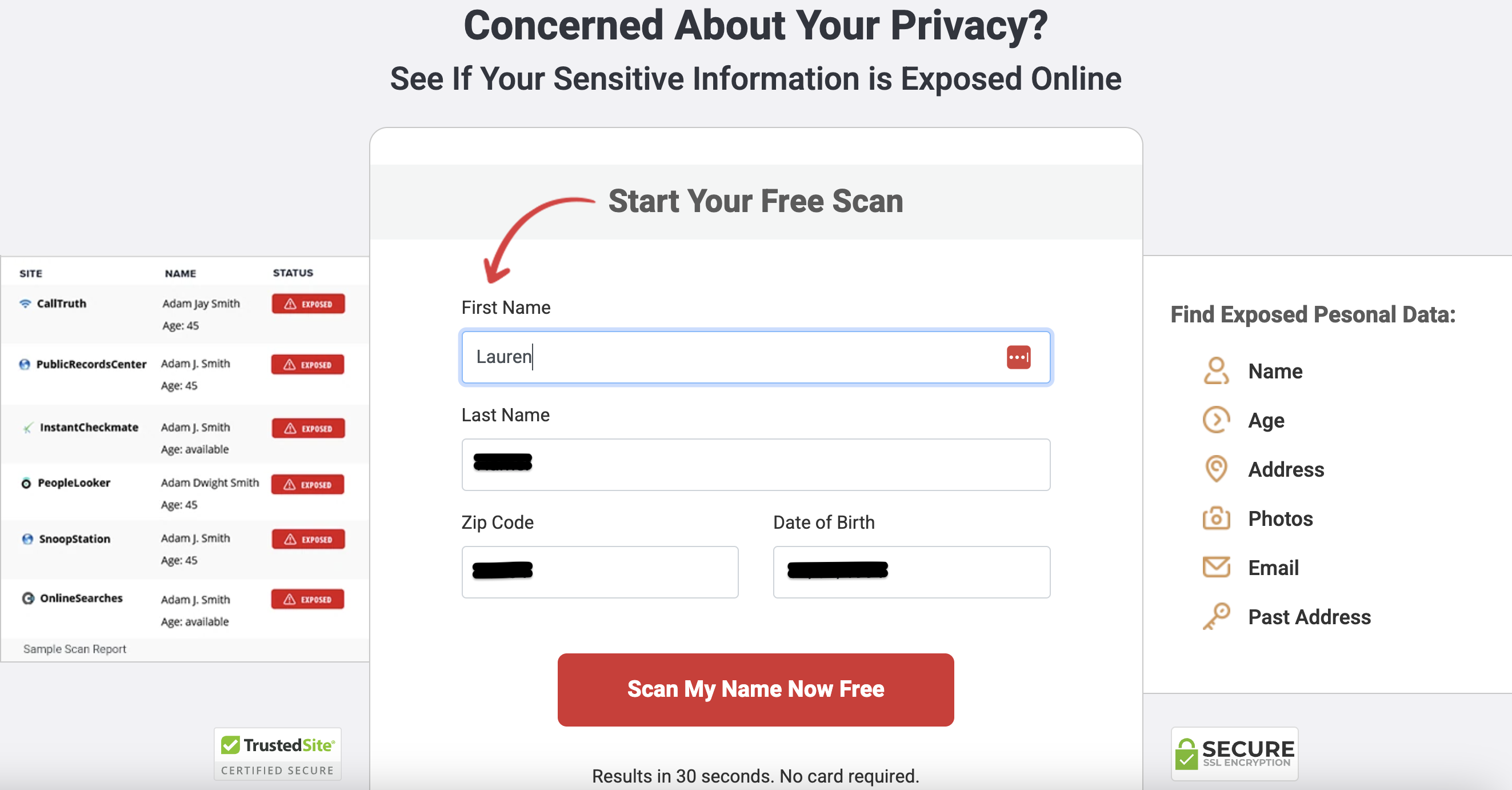

Interested users can sign up for a protection plan directly on the website. If you want to try the service first, IdentityProtect.com offers a free privacy scan (it takes just 30 seconds to scan your information) to show you whether your address, birth date, or phone number has been exposed.

Once you purchase a protection plan, the service will prompt you to complete the enrollment process to access your member portal. You will also receive a welcome email with your login credentials and other important information about your membership. You do not need to download any software to run this service.

An American-based customer service team is available to help you during these hours:

- Monday-Friday: 9 a.m. to 9 p.m. EST

- Saturday: 9 a.m. to 4 p.m. EST

- Sunday: 1 p.m. to 6 p.m. EST

Our Experience With IdentityProtect.com

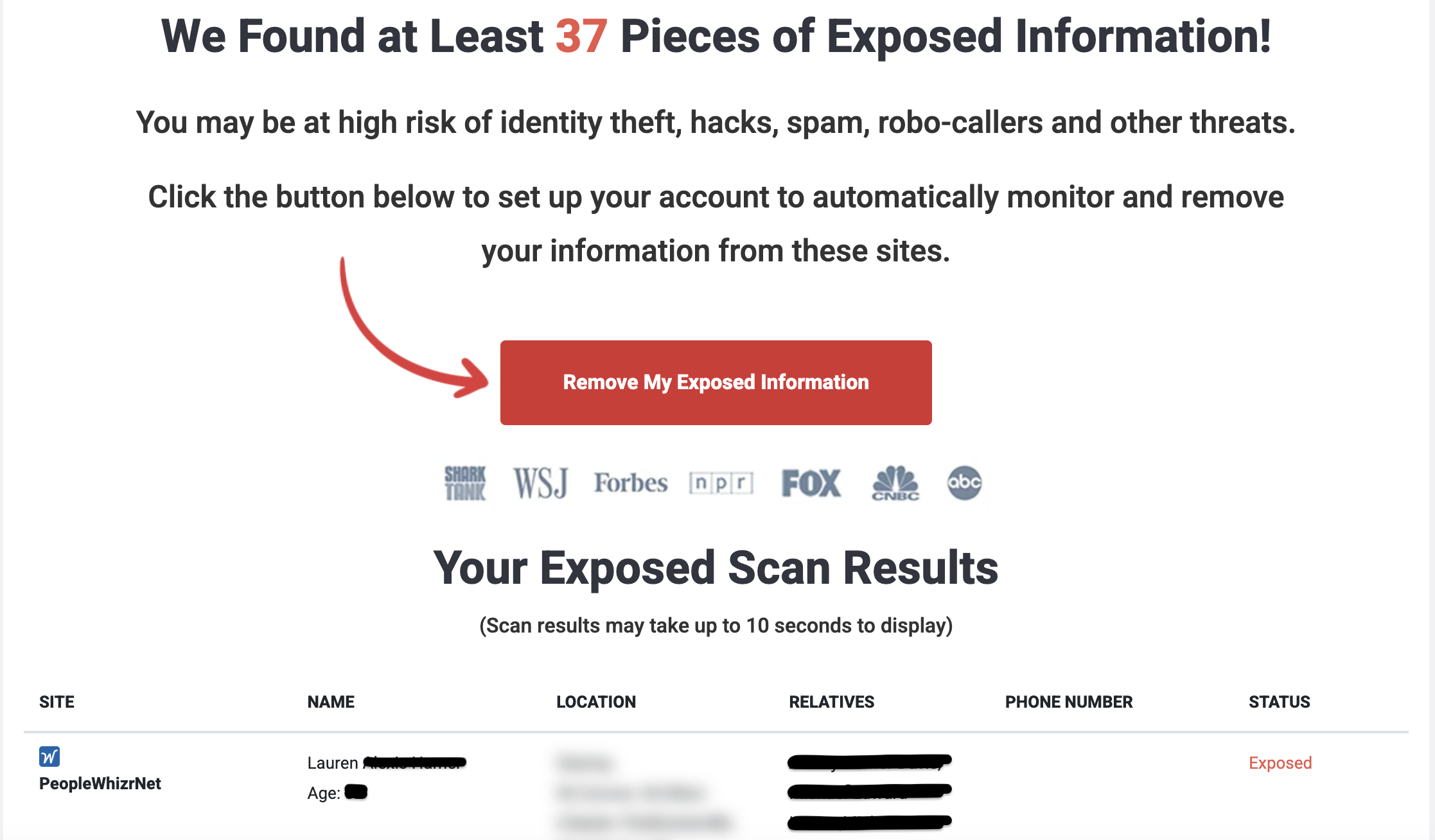

IdentityProtect.com is a newer company, so it doesn’t have the same name recognition or track record as other theft protection services. To conduct a more thorough review, we had IdentityProtect.com conduct a privacy scan and look for my information across hundreds of broker websites. I added my full name, zip code, and birthdate, and within 10 seconds, IdentityProtect.com amassed a list of 37 sites that had my information.

Several of the sites that pinged with my information were genealogy websites, but most of the others were broker websites. These entries also listed several of my family member’s information, which suggested to me the exposure threat is real.

As part of the trial, IdentityProtect.com offers to remove your information under its seven-day trial for $1. Customers will be billed $29.95 per month after the trial period ends. Competitor companies offer a longer, free trial period, but IdentityProtect will actually remove your exposed data from these sites during its week-long trial, which is a plus.

IdentityProtect.com is different than other identity protection services because they allow you to see detailed reports from more than one credit bureau. Your subscription includes credit score monitoring and reports from all three credit bureaus — TransUnion, Equifax, and Experian — at any time.

Overall, our experience was positive. The site scan was fast and the website was easy to navigate. It’s worth noting that you’ll need to fork over some sensitive information in order for the company to monitor your data, you’ll need to type your social security number and mailing address as part of your account setup. This is why using a service backed by high-level encryption is important. IdentityProtect.com follows the standard encryption protocols.

To add more information, you can enter it in the “monitored information” tab. Data you can track includes phone numbers, bank accounts, credit and debit cards, email addresses, and passport numbers, among other information.

IdentityProtect.com Complaints

IdentityProtect.com lacks brand recognition, so online reviews and feedback are limited on sites like TrustPilot and ConsumerAffairs. The company is not BBB accredited, and there’s an outstanding alert from the Better Business Bureau regarding a pattern of customer complaints that IdentityProtect.com did not respond to. That said, this alert is from 2014, so it’s likely the company made some adjustments to account for customer feedback.

Several online review sites praise IdentityProtect.com for offering standard industry features, such as insurance and credit monitoring, but note that the service lacks important features that competitors offer, like a mobile app and 24/7 customer support.

FAQs

-

How does IdentityProtect.com protect my information?

IdentityProtect.com uses 256-bit encryption to safeguard your account through your web browser. It continuously scours the dark web for your sensitive information and alerts you if action is necessary.

-

Can you try IdentityProtect.com for free?

For $1, you can try the service for seven days before the platform charges your card for the monthly service.

-

Does IdentityProtect.com guarantee identity theft protection?

No identity theft or online security service can give a 100% guarantee on protection against identity theft or cybercrime. However, all plans include top-level encryption and a $1 million insurance policy to help pay expenses in the event that you do become a victim of cybercrime. IdentityProtect.com will help recover your accounts if your information is stolen.

-

Are identity protection services worth the money?

There are several free ways to monitor your accounts and safeguard your information. If you’re willing to be proactive and keep constant tabs on your credit cards, payment accounts, and other sensitive data, you can thwart some attacks. But if you become a victim of identity theft, having insurance through a platform could help you get reimbursed for lost funds. These programs also monitor the dark web, which consumers can’t do on their own.

-

How do you report identity theft?

If you believe your identity has been stolen, the first thing you should do is freeze your credit and debit cards. Then, you should file an online report with the Federal Trade Commission. This secures your rights to have any fraudulent items removed from your credit. It’s also a good idea to place a fraud alert with all three of the major credit agencies, so they can monitor potential credit applications more closely.

If you receive an alert from IdentityProtect.com, you can access live chat at any time through their portal. You can also chat with a customer support agent during business hours.

Conclusion

While consumers have several options for more robust and affordable identity protection services, IdentityProtect.com offers a great solution for basic monitoring, alerts, and theft insurance. The interface is easy to navigate and you can monitor multiple pieces of data with one account. Visit the website to start your seven-day trial or call (855) 458-2412.