Retirees should watch out for scams

Scams targeting seniors have grown significantly in 2021.

“It is imperative that we detect and prevent senior financial fraud before criminals, who prey on our most vulnerable citizens, steal from and devastate them,” said Mike Rothman, president of the North American Securities Administrators Association (NASAA).

Some 29% of members say their agency has seen an increase in senior fraud cases and almost none have seen a decrease in complaints.

The greatest generation is a reference to those who grew up in the U.S. during the deprivation of the Great Depression, and then went on to fight in World War II.

Trust cautiously…

“We’ve discovered from the last 15 months that it’s not only a matter of retirees being targeted by a particular scammer but being taken advantage of by turning their trusting nature against them,” said Joseph Berg, director of the Alabama Securities Commission. “To most of the ‘greatest generation’ someone’s word was their bond.”

Seniors’ attitudes on scams

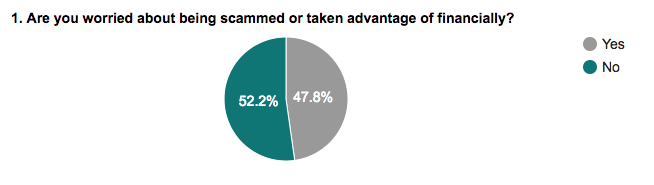

Despite the real threat of harm, the majority of seniors don’t feel threatened by scams. In a sample conducted by Retirement Living staff among seniors 65+ during September 2017, 52.24% of respondents answered “no” to the question “Are you worried about being scammed or taken advantage of financially?”

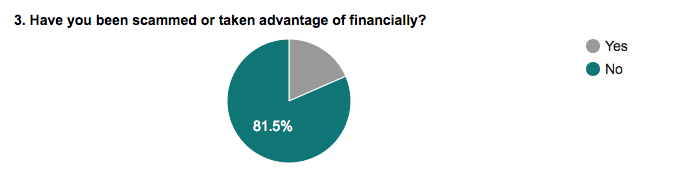

Not surprisingly, those who had been personally impacted by a financial scam were more than 4x more likely (81%) to be worried about being scammed again, compared to those who had not (19%).

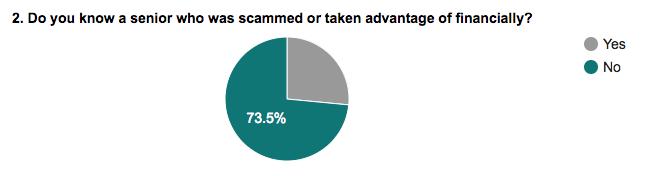

But most interestingly, those who reportedly knew someone who had been scammed were much less likely to feel worried themselves. Our explanation for this inverse knowledge-fear relationship may have to do with confidence level after learning about scams, a byproduct of learning about the unknown.

So in response and to raise awareness, we have identified the top 10 scams that plague senior citizens in retirement, along with examples for each.

Top 10 scams targeting seniors

Scam #1: Ponzi/Pyramid Schemes

In Birmingham, Alabama, a gentleman offered free tax work to a church whose members were largely 60 years and older. After he gained the trust of the congregation, he sold them shares in a pyramid, ponzi scheme by claiming that a portion of returns would be given to the church and that without buying into his guaranteed and secure investment plan, they could outlive their savings.

Beware of loaning friends large amounts of money in exchange for some larger future sum.

The fraudster also reportedly used scare tactics such as telling the faithful that their social security benefits would be cut off and that their healthcare costs would be too expensive for them. In some cases, ministers of certain churches have been convicted for complicity and promotion of such schemes.

“In this type of fraud it depends on the particular facts of each case whether the pastors, ministers or elders of the church were unwillingly taken in or became part of the con later on in exchange for compensation, love offerings or future promises,” said Berg.

Scam #2: International scams

Reportedly run by a U.K. company, Profitable Sunrise instructs investors to wire money to Eastern Europe in exchange for risk-free returns of up to 2.7% per day for periods of six months to two years. The company’s slogan is ‘Get Richer With Every Sunrise’ however neither the principals nor the proposed investments are registered with any State or Federal authorities. In all 50 states, the sale of unregistered securities is illegal unless the securities fall under a specific exemption. “The promises being made by this company appear to fall into the ‘too good to be true’ category,” said Patricia Struck, administrator of the Division of Securities.

Scam #3: Fake marriage schemes

Single, retired military veteran men who live in nursing homes and have no family are particularly vulnerable to marriage scams. Susan Hodges, a former nursing facility administrator, says she’s observed R.N.s who work in retirement homes marry these isolated, vulnerable veterans for their war pay and benefits. While the elderly veteran is living in the nursing home, Hodges alleges that their newlywed younger wives are eating off their pensions, living in their homes and driving their cars.

Scam #4: Affinity fraud

Scams that cater to a certain ethnic group such as Latinos, can strike any region of the country. These scams have also infiltrated fraternal organizations such as Kiwanis Clubs and Lions Clubs. This fraud occurs when a con artist manipulates the close relationship that one individual, such as a retired military veteran, has with another of the same group and uses that familiarity and trust to promote and sell unsuitable or fraudulent investment products.

Scam #5: Foreign currency swindle

The Securities and Exchange Commission (SEC) charged a Cache County, Utah man for soliciting investors in a fraudulent scheme involving investments in top secret Iraqi currency and oil contracts. John Scott Clark pled guilty to bank fraud, money laundering and illegal gambling.

Beware of get rich quick currency schemes

“These con artists are telling aging retirees that they can buy the Iraqi dinar for pennies and that it is ‘imminent’ that the dinar will be on par with the U.S. dollar and that they should load up now to earn a ton of money,” said Berg.

In the process, victims pay commissions, exchange fees or arbitrage fees to the seller.

Scam #6: Real estate scams

After a natural disaster, fraudulent promoters typically come along trying to sell damaged buildings or land lots allegedly available at rock bottom prices and that can be rehabbed or re-developed. Too often after the retiree has invested $5,000, $10,000, their entire savings or retirement account, it’s revealed that 46 others are on that mortgage list, which renders it worthless or in many cases the mortgage or land title doesn’t even exist. The elder generation tend to fall for fraudulent real estate scams due to the tangibility of land.

Scam #7: Securities fraud

An 86 year-old retired U.S. Air Force pilot and a 91 year-old retired World War II U.S. Navy veteran lost several hundred thousand dollars in a bogus investment opportunity offered by an attorney. An Alabama Securities Commission investigation revealed that both veterans were offered promissory notes in exchange for their money which was to be invested in real estate and medical technology ventures with an 8% to 12% return on their investments to be paid at a specified time.

“As long as there’s money around, there will be thieves”

“The first line of defense is for the investor to determine whether the offer is too good to be true.” The defendant pled guilty to three counts of securities fraud, was sentenced to 20 years imprisonment, split to serve five years in the state penitentiary and ordered to pay more than $4 million in restitution to multiple victims.

Scam #8: Guardianship abuse

Some 11 years ago, Hodges admitted three new residents who were different than others who lived at the nursing home where she worked. The seasoned administrator discovered they were wards of the state of Texas whose assets were under the control of a guardianship company after a Tarrant County Probate Judge deemed them incompetent.

“One lady told me the Court had stolen more than a million dollars from her bank account,” said Hodges. Since 2006, the licensed nursing facility administrator has noticed a rising number of the elderly enduring the same fate. “It seemed that the Court and the lawyers were complicit in the fraud,” said Hodges who is no longer working at a nursing facility but is instead working as a consultant and wrote a book about guardianship abuse called A Breach of Trust.

Scam #9: High yield prime bank accounts

Using complicated and reportedly phony documents, this scam promises retirees that they can participate in high yield prime bank investments connected to secretive accounts only available to the ultra high net worth families at Swiss, French, English or other overseas banks. Although prime bank accounts don’t exist, seniors aren’t often unaware of that fact. “It all sounds good at the point of purchase but promising a retiree that they will be able to invest and enjoy “no risk no loss” returns in the same ballpark as an ultra-millionaire is a scam,” said Berg.

Scam #10: Funeral scams

Criminals use funerals to scam seniors out of money and to perpetrate identity theft. Examples include scammers going to funerals in order to claim that the deceased owed them money, and then pressuring the deceased’s relatives to pay off the debt.

Scammers are getting more sophisticated

Additionally, scammers use funeral notices to steal identities by emailing a fake funeral notifications using real funeral home logos. These emails contain an attachment asking the recipient to open the attachment in order to see the funeral details. The victim triggers malware by opening the attachment, which enables the identity thieves to acquire personal information.

Stay vigilant

If you think you’ve been targeted by a scammer, you should contact local law enforcement. You can also contact the AARP’s ElderWatch team by calling 1-800-222-4444 (option 2) or going to www.aarpelderwatch.org.

To stay up to date on news for retirees and seniors, join our Retirement Living Newsletter.