According to the most recent data:

- The number of U.S. adults ages 65 and older is expected to reach 73.1 million by 2030, or 21% of the population, as the last of the baby boomer generation ages. This is up from 16.9% in 2020 and just 8% in 1950.

- There are more than 819,000 residents in assisted living facilities nationwide.

- There are 30,600 residential care communities in the U.S. with 1,197,600 beds. Brookdale Senior Living, Inc. is the largest national assisted living community and has 1,066 facilities.

- The U.S. will need two million senior housing facilities for adequate living space by 2040.

- The national median costs for assisted living services are $4,500 monthly and $54,000 annually.

- About 66% of people use their own retirement and savings funds to pay for care. Americans spend approximately $60 billion to self-fund extended care.

Assisted Living Services

- 24-hour supervision and assistance

- Exercise, health and wellness programs

- Housekeeping and maintenance

- Meals and dining services

- Medication management or assistance

- Personal care services (such as Activities of Daily Living [ADLs])

- Transportation

- Healthcare services

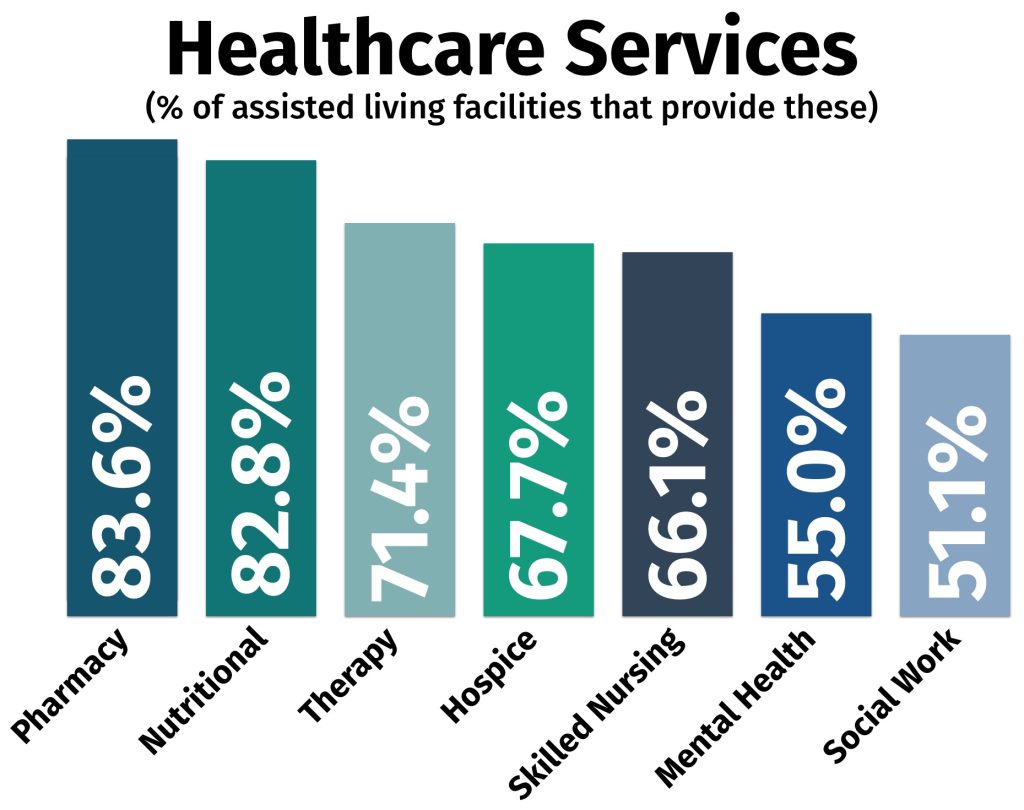

Not all assisted living facilities offer the same healthcare services. The following is a breakdown of the percentage of facilities that provide specific care:

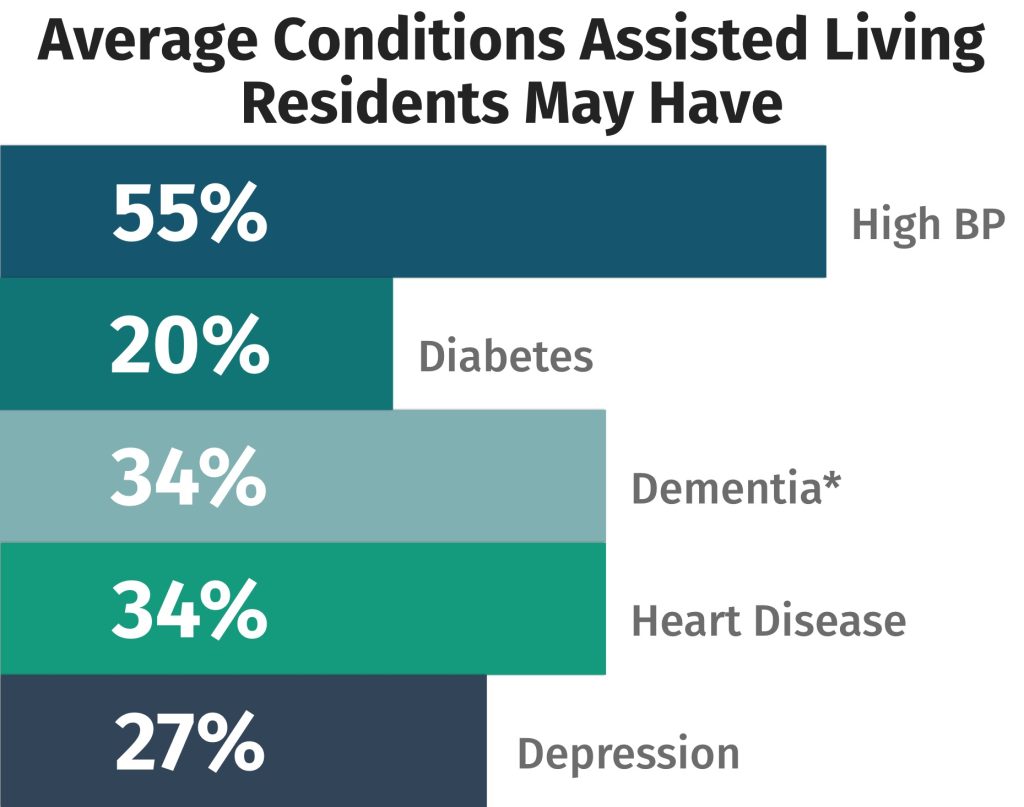

Common Conditions of Residents

*14.3% of assisted living communities have a dementia care unit, wing or floor designated while 8.7% of assisted living communities only serve adults with dementia.

Assisted Living Eligibility Requirements

Every assisted living center has different requirements, but generally speaking, applicants must meet the following conditions to apply to live in an assisted living facility:

- Need assistance performing at least 2 activities of daily living (e.g., dressing, eating, using the toilet, hygiene, transitioning from bed to chair)

- Have predictable and stable mental and physical health

Average Length of Stay

The median stay in an assisted living facility is around 22 months. Most residents (60%) transition to a skilled nursing center or another type of senior facility as care needs intensify.

- 13% of people use assisted living for an average of less than 1 year

- 35% of people use nursing facilities for an average of 1 year

Assisted Living Demographics

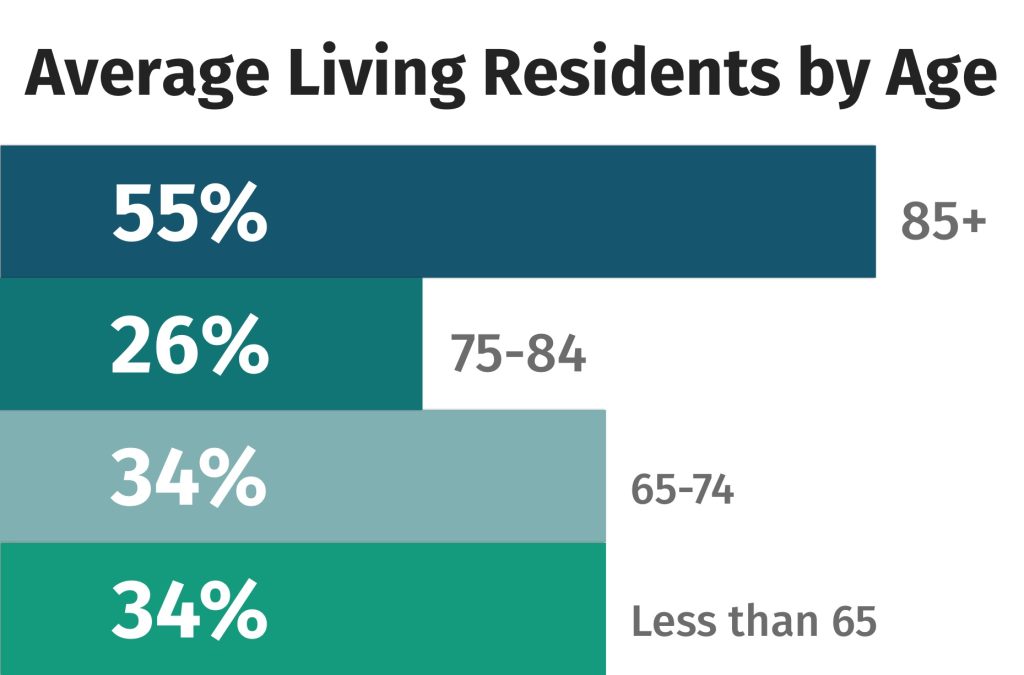

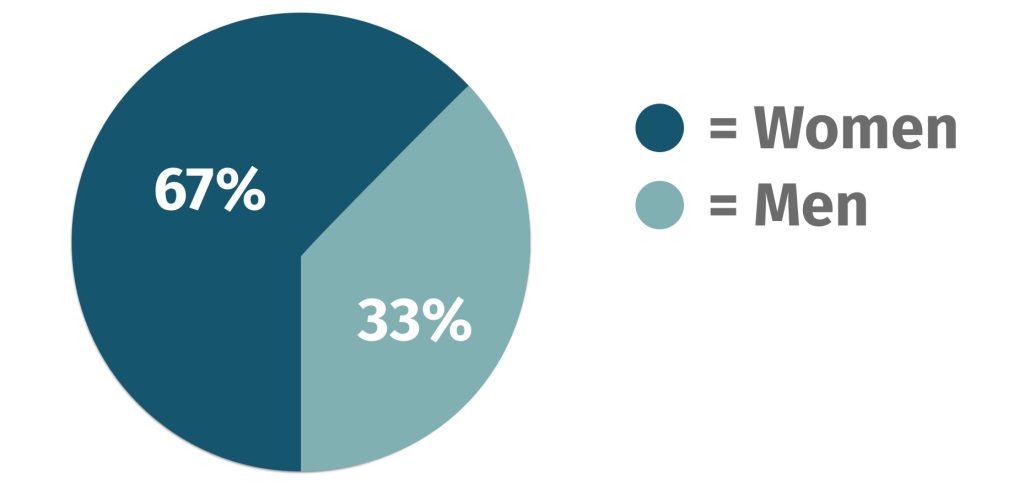

The majority of residents in assisted living facilities are white women in their 80s. They also commonly have have high blood pressure.

Age

Someone turning age 65 today has almost a 70% chance of needing some type of long-term care services and supports in their remaining years. One-third of today’s 65-year-olds may never need long-term care support, but 20% will need it for longer than 5 years.

Gender

Historically, there are more females than males in these communities. Women need care for longer than men (3.7 years vs. 2.2 years).

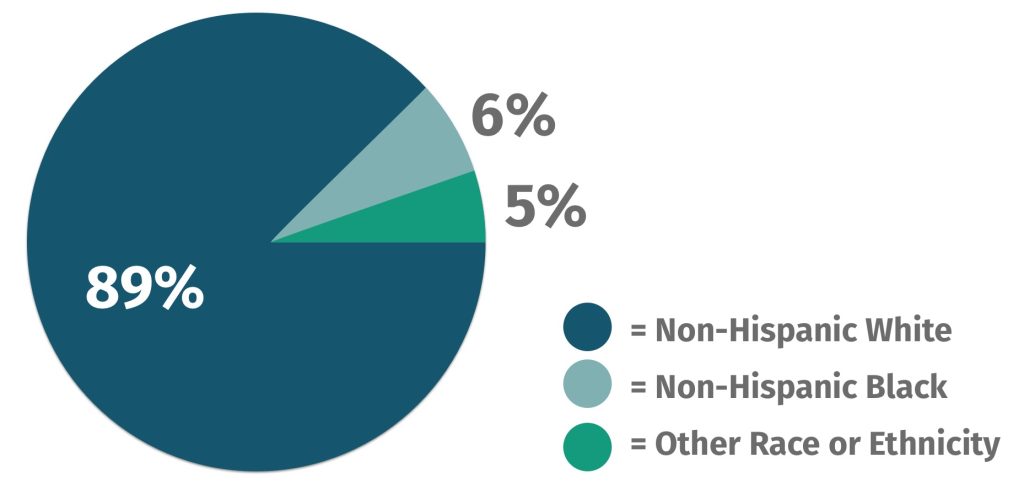

Race

Black older adults are less likely to move to assisted living and are more likely to move to a nursing home compared to white older adults. There are disparities in care for residents depending on their race.

Assisted Living Costs

The national median average of assisted living facility costs is $4,500 per month. This amount is expected to increase by 5.53% through 2030.

In general, the senior housing industry rent amounts increased by 5.3% in early 2023 compared to the end of 2022.

| Service | Monthly Cost | YoY Increase | Five Year CAGR |

| Assisted Living Facility | $4,500 | 4.65% | 5.53% |

| Nursing Home (Semi-Private Room) | $7,800 | 1.96% | 2.93% |

| Nursing Home (Private Room) | $8,910 | 2.41% | 3.25% |

| Memory Care | $5,625 | 4.65% | 5.10% |

| Homemaker | $26/hr | 10.64% | 5.39% |

| Home Health Aide | $27/hr | 12.50% | 5.92% |

| Adult Day Services | $78/Day | 5.41% | 2.78% |

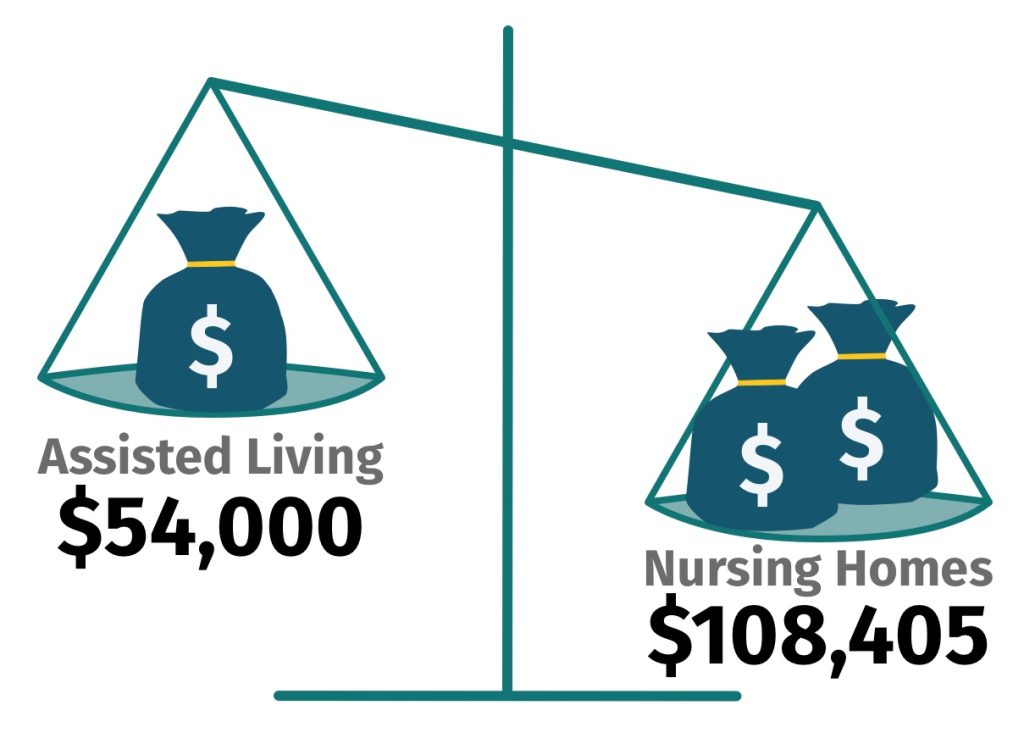

Cost of Assisted Living vs. Nursing Homes

- Assisted living = $54,000/year

- Nursing homes = $108,405/year for a private room in 2021

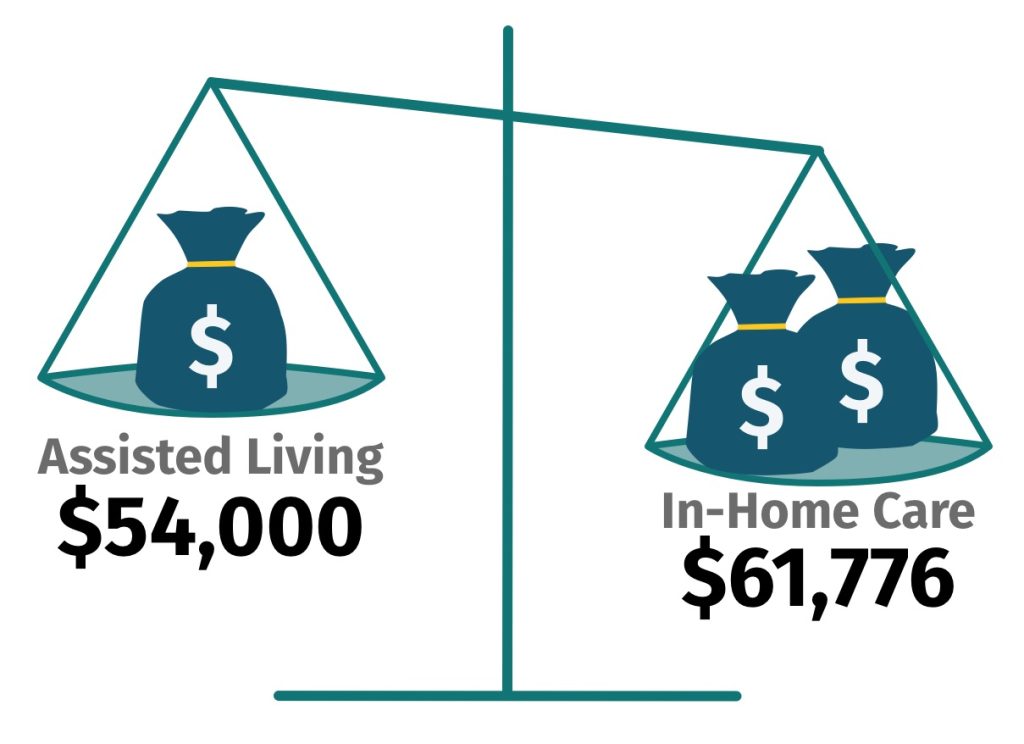

Cost of Assisted Living vs. In-Home Care

- Assisted living = $54,000/year

- Homemaker Services = $59,488/year*

- Home Health Aide = $61,776/year*

* Figures are based on 44 hours of care per week for 52 weeks.

Assisted Living Cost Factors

- Private rooms vs. shared spaces (kitchenettes, lounges, private bathrooms)

- Size of the facility and the amenities available (pools, pharmacies, community outings, dining facilities)

- Location (region, state, city vs. rural)

- Number of beds available. (The average number of licensed beds is 33.)

- Specialized services offered (e.g., occupational and physical therapy, memory care)

- Staff-to-resident ratio (National law mandates a ratio of 1:8, but there are no state regulations for assisted living staffing.)

Assisted Living Costs and Availability by State

| State | Monthly Costs | Number of Beds | Number of Communities |

| Alabama | $3,503 | 9,700 | 300 |

| Alaska | $6,830 | 1,800 | 100 |

| Arizona | $4,000 | 24,900 | 1,400 |

| Arkansas | $3,760 | 5,800 | 100 |

| California | $5,250 | 12,700 | 5900 |

| Colorado | $4,750 | 14,600 | 400 |

| Connecticut | $5,129 | 1,700 | 60 |

| Delaware | $5,995 | 2,100 | 30 |

| District of Columbia | $6,978 | 700 | 10 |

| Florida | $4,000 | 75,100 | 2,400 |

| Georgia | $3,535 | 25,200 | 900 |

| Hawaii | $5,735 | 5,200 | 300 |

| Idaho | $3,838 | 8,300 | 200 |

| Illinois | $4,488 | 31,000 | 400 |

| Indiana | $4,283 | 20,300 | 200 |

| Iowa | $4,367 | 1,700 | 50 |

| Kansas | $4,580 | 12,100 | 400 |

| Kentucky | $3,448 | 12,500 | 200 |

| Louisiana | $3,748 | 5,300 | 100 |

| Maine | $5,865 | 6,500 | 240 |

| Maryland | $4,900 | 17,500 | 900 |

| Massachusetts | $6,500 | 13,600 | 300 |

| Michigan | $4,250 | 36,500 | 1,700 |

| Minnesota | $4,508 | 30,600 | 800 |

| Mississippi | $3,500 | 6,400 | 100 |

| Missouri | $3,000 | 19,900 | 400 |

| Montana | $4,450 | 5,900 | 200 |

| Nebraska | $4,076 | 11,300 | 200 |

| Nevada | $3,750 | 4,200 | 200 |

| New Hampshire | $6,053 | 4,800 | 100 |

| New Jersey | $6,495 | 21,300 | 200 |

| New Mexico | $4,498 | 4,200 | 100 |

| New York | $4,580 | 35,500 | 500 |

| North Carolina | $4,010 | 39,000 | 900 |

| North Dakota | $3,391 | 5,300 | 100 |

| Ohio | $4,635 | 42,800 | 600 |

| Oklahoma | $3,855 | 10,500 | 200 |

| Oregon | $5,045 | 31,500 | 1,500 |

| Pennsylvania | $4,100 | 62,900 | 1,000 |

| Rhode Island | $6,826 | 3,900 | 50 |

| South Carolina | $3,612 | 12,300 | 300 |

| South Dakota | $3,350 | 4,600 | 100 |

| Tennessee | $4,105 | 17,400 | 300 |

| Texas | $3,998 | 48,700 | 1,300 |

| Utah | $3,500 | 7,100 | 200 |

| Vermont | $5,250 | 2,400 | 90 |

| Virginia | $5,250 | 26,400 | 400 |

| Washington | $6,000 | 41,500 | 2,000 |

| West Virginia | $4,160 | 3,600 | 50 |

| Wisconsin | $4,600 | 36,100 | 1,500 |

| Wyoming | $4,169 | 800 | 20 |

How to Pay For Assisted Living Costs

Does Medicare Cover Assisted Living Costs?

Medicare does not cover long-term care services and supports. However, it may help cover things within an assisted living facility, such as transportation to doctors’ appointments or some preventive health services.

Medicare Advantage and Medicare Supplement (Medigap) plans also do not cover assisted living costs.

Using Medicaid

For people with limited income and resources, State Medicaid programs can cover home and community-based services (HCBS), such as personal care and supportive services provided in assisted living communities. Medicaid does not pay for room and board costs.

To qualify for Medicaid in your state, you must:

- Reside in an assisted living facility that’s licensed for Medicaid. (48% of assisted living facilities are Medicaid certified.)

- Meet certain financial need requirements, which vary by state

- Demonstrate a need for assisted living

Using Long-Term Care Insurance or Life Insurance

Long Term Care Insurance (LTCI) funds can be used to reimburse long-term care expenses administered in your home or at an assisted living facility or nursing home.

- Annual premiums for a singles or couples policy range from $950 to $8,575, depending on the plan type, if you purchase a long-term care insurance policy valued at $165,000 at age 55. Costs can rise to as much as $9,675 if you buy the policy at age 65.

- The average claims amount paid is just over $142,000.

Life insurance policies that include chronic illness riders or long-term care riders, can leverage the policy to pay for assisted living. Policyholders could also access the accelerated death benefits or consider a life settlement.

Using Veterans Benefits

The VA does not cover the rent, which usually includes basic services. However, the VA may pay for some of the extra services the Veteran may need in an assisted living facility. Veterans may also be able to have the VA arrange for a health professional (e.g., a nurse) to visit and give them extra care.

The VA long-term care services include:

- 24/7 nursing and medical care

- Physical therapy

- Help with daily tasks (like bathing, dressing, making meals, and taking medicine)

- Comfort care and help with managing pain

- Support for caregivers who may need skilled help or a break so they can work, travel, or run errands

Some services are covered under standard health benefits if you’re signed up for VA health care. You may still need to pay a copay for some covered services.

In certain cases, some veterans may qualify for Aid & Attendance, a need-based monthly benefit offered to eligible veterans by the U.S. Department of Veterans Affairs (VA) that may be used to cover the cost of an assisted living facility.

Private Pay

Most commonly, Americans self-fund their extended care to the tune of $60 billion. Sixty-six percent of caregivers use their own retirement and savings funds to pay for care.

Are Assisted Living Costs Tax Deductible?

Some medical expenses associated with assisted living are tax deductible. Medical expenses that are more than 7.5% of your adjusted gross income (AGI) qualify for the medical deduction. Generally speaking, meals and lodging are not deductible.

To deduct a portion of assisted living costs on your taxes, you must meet the following criteria:

- Qualify as “chronically ill,” i.e., are deemed medically unable to perform two or more Activities of Daily Living (eating, transferring, bathing, dressing, and continence) without assistance.

- Need constant supervision because of a “severe cognitive impairment” such as Alzheimer’s disease.

- You receive a care plan from your doctor or the caregivers in the community.

In addition, some durable medical equipment and devices are also eligible, like hearing aids, oxygen equipment, and prescription medications.

Caregiver Statistics

Caregiver professions are in high demand, despite the large need for qualified caregivers in the industry.

There were 3,636,900 professional home health and personal care aides in 2021. By 2031, the caregiving profession is expected to grow by 25% (924,000 jobs), much faster than average.

Unpaid family caregiving is on the rise, with 80% of care at home being provided by unpaid caregivers—especially for aging seniors. More than 41.8 million unpaid caregivers care for people over the age of 50.

The Time Spent Caring for Loved Ones is Equivalent to a Part-Time Job

On average, caregivers spend 23.7 hours a week giving care to someone they don’t live with. This number rises to 34.7 hours a week if the caregiver lives with their care recipient.

More than half (60%) have intensive caregiving responsibilities that may include assisting with a personal care activity, such as bathing or feeding.

Who Commonly Takes On the Role of Caregiver?

- 14% of caregivers are 65+ themselves

- 48% of caregivers are women, 52% are men

- 54% of caregivers are between the ages of 25 to 54 with an average age of 51

16% of enrolled college students are caregivers to adults. Black and Hispanic college students are more likely than White and Asian students to be caregivers. They’re also more likely to be working while in school.

Caregivers, regardless of age, are more likely to be lower-Income and/or financially insecure. Many people juggle full-or part-time work in addition to their caretaking responsibilities. As such, workers in lower-income households are 54% more likely to be caregivers than those in higher-income households.

Caregiving is a Long-Term Commitment

The average length of time a caregiver provides unpaid care to a loved one is 4.5 years. The number of people providing care for five years or longer was 28% in 2020, though this number will likely grow as life expectancies rise.

Assisted Living Facilities and COVID-19

- Throughout the pandemic, COVID-19 cases were more common in assisted living facilities. More ALF residents with COVID-19 died compared to the general population, and long-term-care facility deaths made up over one-third of all U.S. deaths (including nursing homes, assisted living and other long-term care facilities).

- As of March 2021, about 8% of people who live in US long-term-care facilities died of COVID-19—nearly 1 in 12.

- The pandemic dropped senior housing occupancy rates by 9.2% as many people opted for alternative living arrangements.

- Assisted living costs increased as a result of COVID due to labor shortages (challenges with recruitment and retention of staff, high turnover), the need for increased trainings and regulations, and extra PPE costs.

Assisted Living Trends and Predictions

The Assisted Living Industry Will Continue to Grow at an Astonishing Rate

The U.S. assisted living facility market size was valued at USD 91.8 billion, and is expected to expand at a compound annual growth rate (CAGR) of 5.53% from 2023 to 2030.

The south region is estimated to register the fastest CAGR of 6.20% from 2023 to 2030, but the west region has the largest number of facilities in the country, with a market share of 41.38%. Texas is producing the largest number of new or improved facilities for senior residents.

Aging.com predicts the U.S. will need two million housing facilities for adequate living space by 2040.

Assisted Living Costs Will Rise

The industry predicts a five-year growth rate of 4.4%, which could increase the median national assisted living cost to $6,480 in 2028.

Luxury Senior Living Facilities Will Gain Popularity, Despite the Cost

Assisted living facilities don’t have to be dreary. Luxury facilities are on the rise. On average, luxury senior living costs about 30% more than non-luxury senior living communities. These life plan communities offer various levels of support in addition to luxury features, including independent living, assisted living, memory care and skilled nursing care—for a steep fee.

In addition to an entrance fee, residents will sign a long-term contract, with fees ranging from $100,000 to $700,000 or more. Inquiring residents must show proof of assets to move into these facilities, which many require personal wealth that exceeds $1 million.

The Need for Specialized Memory Care Options Will Grow

About 1 in 9 people (10.8%) age 65 and older have Alzheimer’s dementia, but only a small percentage of assisted living facilities are equipped to offer memory care. By 2025, the number of people age 65 and older with Alzheimer’s dementia is projected to reach 7.2 million, and 13.8 million by 2060. As a result, we predict a growing need for memory care-specific communities in the future.

Assisted Living Communities Will Integrate Technology to Improve Care

The Assisted Living Software Market—technology that helps manage the security, well-being, and satisfaction of facility residents—is expected to reach $234.47 Million by 2028, at a CAGR of 8.90%. This rapidly-growing market is in response to the need for higher-quality care, according to a report by Introspective Market Research.

Facilities and individuals with this software will use it to communicate with families and healthcare professionals, schedule appointments, allocate resources, and standardize patient data.