The Best Cities To Retire in 2024

Updated:

Retirement Living takes an unbiased approach to our reviews. We may earn money when you click a partner link. Learn More

We’ve all got our “non-negotiables” when it comes to deciding where we want to live during retirement. Some may prioritize affordability, while others may envision a retirement destination rich with culture and community. Still, a plan is a plan. And knowing the best cities to retire can help ensure your hard-earned dollars go further once you’re ready to put your plan into action.

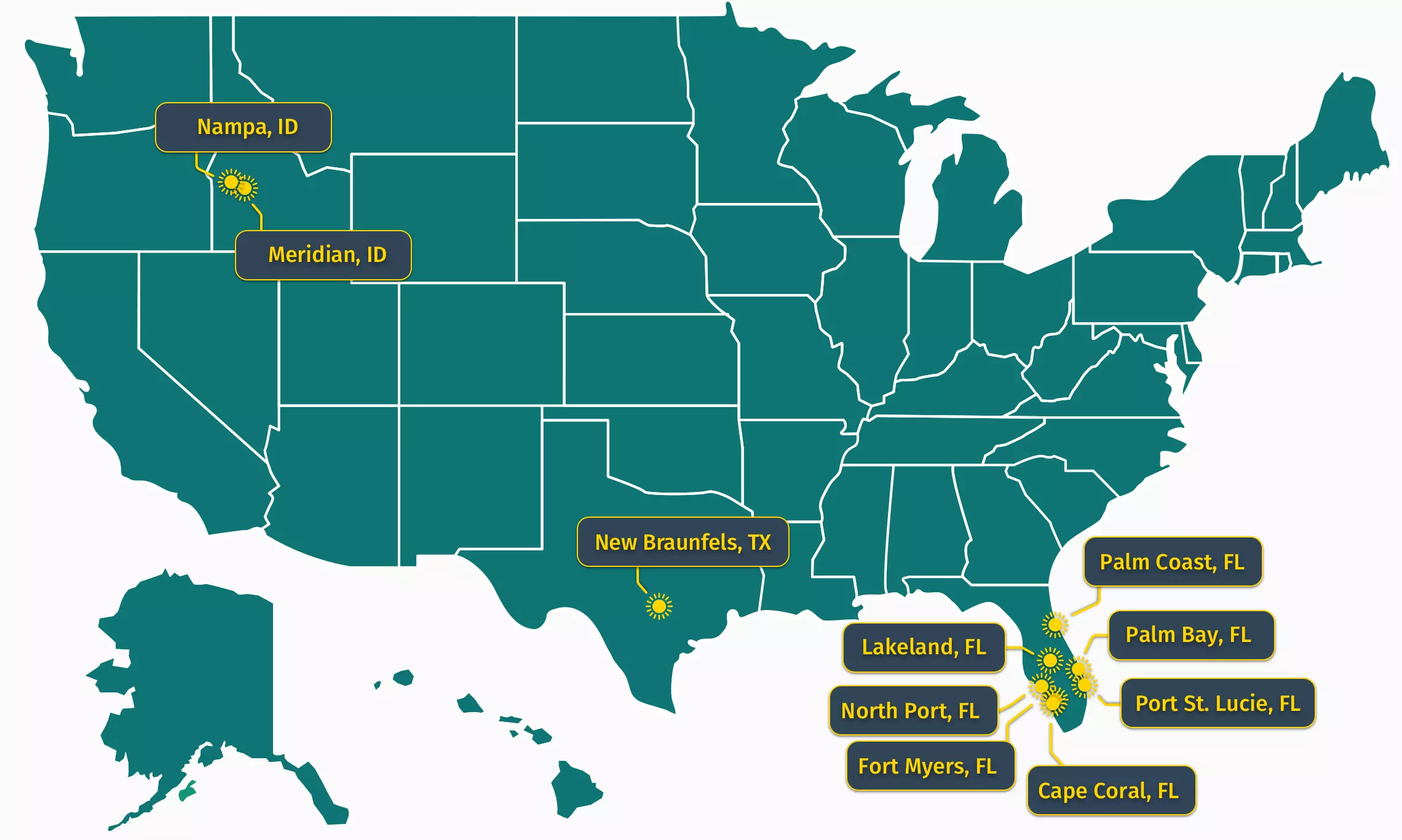

Below are the best cities to retire in 2024, based on an evaluation of 12 data points and feedback from more than 1,000 Retirement Living survey respondents. As usual, Florida cities dominate the list, but we welcomed a few newcomers this year. (Read our disclaimer about Florida and learn more about our methodology for finding the best cities to retire.)

Lastly, if you’d prefer to start with a broader search, check out our list of the best states to retire.

Now, let’s dive in.

The 10 Best Cities for Retirement in 2024

The cities listed below are a perfectly balanced mix of affordability, culture, and community.

10. New Braunfels, Texas

- Share of population 65+: 13.3%

- Retirement taxes: None

- Sales tax rate: 8.25%

- Median home price: $244,800

- Poverty rate: 7.7%

- Retirement Living score: 3.13

Just northeast of San Antonio lies a charming city in the Texas hill country named New Braunfels. This city with German roots shot up this year’s list because of overall affordability (it was ranked 38th in 2022). Home prices in New Braunfels are in the lower quarter of all cities we evaluated, and the state of Texas doesn’t tax retirement income. Plenty of Americans have taken notice, too. Since 2020, the population in New Braunfels has increased by 12.5%, more than all other cities we analyzed this year.

9. Lakeland, Florida

- Share of population 65+: 21.8%

- Retirement taxes: None

- Sales tax rate: 7%

- Median home price: $171,700

- Poverty rate: 15.1%

- Retirement Living score: 3.49

Lakeland, Florida, is located between Orlando and Tampa on Florida’s west coast. Its inland location means you’ll have to drive to the beach, but residents here are not without water views—the city boasts 38 lakes!

Lakeland has the most affordable housing prices of all Florida cities to retire on our top ten list. Retirees will have more money to explore their surroundings, like the Frank Lloyd Wright Museum at Florida Southern College, because Florida does not have a personal income tax and the state sales tax rate is just 7%.

8. Palm Bay, Florida

- Share of population 65+: 18.1%

- Retirement taxes: None

- Sales tax rate: 7%

- Median home price: $186,100

- Poverty rate: 13.1%

- Retirement Living score: 3.49

Let’s consider Palm Bay one of central Florida’s best-kept secrets. Palm Bay sits on Florida’s east coast between Jacksonville and Miami and is rich with nature preserves, lagoons, and waterways. Location aside, this city is also extremely affordable when comparing home prices against annual income. And if you want the option to work during retirement, several top defense contractors have offices in Palm Bay.

7. Nampa, Idaho

- Share of population 65+: 14.4%

- Retirement taxes: Partial

- Sales tax rate: 6%

- Median home price: $223,100

- Poverty rate: 12.8%

- Retirement Living score: 4.0

Real estate prices in Nampa, Idaho, are extremely reasonable, which is why it earned one of Retirement Living’s highest affordability scores. When compared to a nearby Idaho suburb also on this year’s list, Nampa’s home prices are 36% lower.

Nampa-based retirees gain access to 14 quality healthcare facilities around Boise, and at just 19%, the crime rate in Nampa is lower than the national average of 22.7%.

6. Meridian, Idaho

- Share of population 65+: 12.6%

- Retirement taxes: Partial

- Sales tax rate: 6%

- Median home price: $349,400

- Poverty rate: 6.8%

- Retirement Living score: 4.0

A mainstay on our yearly list of best cities to retire, Meridian, Idaho, offers natural beauty, miles of protected lands, and a reasonable cost of living—so much so that Meridian and the surrounding metropolises are among the fastest-growing in the country. Still, enough room remains for aging retirees looking for a place to land. Only 13% of Meridan’s population is over 65, even though the state does not tax Social Security or inheritances.

Seniors who flock to the Treasure Valley will enjoy a bounty of outdoor recreation and plenty of cultural enrichments, thanks to its proximity to the state capital of Boise.

5. Fort Myers, Florida

- Share of population 65+: 21.6%

- Retirement taxes: None

- Sales tax rate: 6.5%

- Median home price: $263,800

- Poverty rate: 16%

- Retirement Living score: 3.49

When asked to describe why they like living in Fort Myers, a Retirement Living survey respondent said, “It is comfortable and less busy than other areas of the state.” Case in point: its southern neighbor, Cape Coral, has two times the residents Fort Myers does.

Still, the Fort Myers population has jumped 10% since 2020, as people flock to the city in search of lower taxes and smaller crowds. The city has held a certain appeal for decades; even Thomas Edison and Henry Ford built their winter estates here. More than one in five Fort Myers residents are aged 65 and older.

4. Port St. Lucie, Florida

- Share of population 65+: 20.4%

- Retirement taxes: None

- Sales tax rate: 7%

- Median home price: $245,900

- Poverty rate: 8.3%

- Retirement Living score: 3.49

For the first time, Port St. Lucie cracks the top five on our list this year (it was ranked No. 9 in 2022). As the name suggests, Port St. Lucie has several rivers, canals, and intercoastal waterways nearby, home to manatees, river otters, and egrets. Aside from being a boater’s paradise, the city is also safe and affordable—only one other Florida city has a lower share of the population in poverty.

3. Cape Coral, Florida

- Share of population 65+: 24.4%

- Retirement taxes: None

- Sales tax rate: 6.5%

- Median home price: $255,700

- Poverty rate: 9.9%

- Retirement Living score: 3.49

Cape Coral boasts 400 miles of navigable waterways for boaters and waterbugs to enjoy. Seniors in this city also benefit from no taxes on retirement income and a lower local tax rate than surrounding metropolises. However, home prices here are higher than in other Florida cities that made our list. Feedback from a Cape Coral-based survey respondent supports this data, citing higher property taxes and rising costs overall as reasons for ranking their satisfaction with the city a 3 out of 5.

Still, Cape Coral is a top-three retirement destination because it’s one of the safest cities in Florida and the U.S.—its crime rate sits well below the national average.

2. Palm Coast, Florida

- Share of population 65+: 29.1%

- Retirement taxes: None

- Sales tax rate: 7%

- Median home price: $186,100

- Poverty rate: 13.1%

- Retirement Living score: 3.49

If you’ve traveled to Daytona Beach or St. Augustine, then you’ve likely passed through Palm Coast, Florida. Retirees looking for an affordable slice of solitude will find Palm Coast to have the perfect mix of relaxation and culture.

This coastal community has the highest density of seniors of all metropolises we evaluated—nearly three in 10 residents are over the age of 65. Even better, the crime rate in Flagler County continues to fall, reaching a 25-year low in 2020, according to the local sheriff’s office.

1. North Port, Florida

- Share of population 65+: 27.2%

- Retirement taxes: None

- Sales tax rate: 7%

- Median home price: $227,400

- Poverty rate: 5.6%

- Retirement Living score: 3.49

North Port, Florida, earns our pick for the best city to retire in 2024. Located about an hour north of Fort Myers and an hour and a half south of Tampa, this Sarasota County suburb offers plenty of nearby attractions to keep retirees busy. North Port borders the Myakka State Forest and some of Florida’s finest beaches are just 12 miles away.

As one Retirement Living survey respondent said, North Port has “great weather, convenient airport [access], and friendly people,” the perfect combination for an enjoyable retirement.

Top 50 Cities for Retirement

In addition to our top ten cities for retirement, there are 40 others we deem “honorable mentions.” The table below reveals the top 50 cities for retirement according to our data analysis for overall affordability and quality of life.

| Rank | City | Population Change (%) | Population 65+ | RL Affordability Score | RL Score Overall |

|---|---|---|---|---|---|

| 1 | North Port, Florida | 11.30% | 27.2% | 3.28 | 3.49 |

| 2 | Palm Coast, Florida | 8.82% | 29.1% | 3.86 | 3.49 |

| 3 | Cape Coral, Florida | 9.95% | 24.4% | 3.92 | 3.49 |

| 4 | Port St. Lucie, Florida | 10.78% | 20.4% | 3.58 | 3.49 |

| 5 | Fort Myers, Florida | 9.04% | 21.6% | 5.10 | 3.49 |

| 6 | Meridian, Idaho | 7.96% | 12.6% | 4.10 | 4.0 |

| 7 | Nampa, Idaho | 8.70% | 14.4% | 3.88 | 4.0 |

| 8 | Palm Bay, Florida | 7.03% | 18.1% | 3.33 | 3.49 |

| 9 | Lakeland, Florida | 5.14% | 21.8% | 3.24 | 3.49 |

| 10 | New Braunfels, Texas | 12.50% | 13.3% | 3.18 | 3.13 |

| 11 | Daytona Beach, Florida | 7.29% | 20.0% | 4.17 | 3.49 |

| 12 | Deltona, Florida | 3.32% | 16.2% | 2.94 | 3.49 |

| 13 | Boca Raton, Florida | 0.77% | 26.3% | 5.51 | 3.49 |

| 14 | Melbourne, Florida | 1.61% | 21.5% | 3.62 | 3.49 |

| 15 | Plantation, Florida | 4.16% | 16.5% | 4.42 | 3.49 |

| 16 | Suffolk, Virginia | 3.90% | 14.4% | 3.34 | 3.43 |

| 17 | Bethlehem, Pennsylvania | 2.47% | 17.9% | 3.19 | 3.26 |

| 18 | Hampton, Virginia | 0.55% | 15.3% | 0.32 | 3.43 |

| 19 | Buckeye, Arizona | 11.19% | 12.3% | 3.15 | 3.52 |

| 20 | Conroe, Texas | 10.02% | 13.5% | 3.29 | 3.13 |

| 21 | Frisco, Texas | 7.67% | 9.1% | 3.34 | 3.13 |

| 22 | St. Petersburg, Florida | 0.86% | 19.3% | 3.76 | 3.49 |

| 23 | West Palm Beach, Florida | 2.84% | 19.7% | 4.88 | 3.49 |

| 24 | Mansfield, Texas | 5.17% | 11.5% | 2.86 | 3.13 |

| 25 | Allen, Texas | 5.39% | 9.9% | 2.91 | 3.13 |

| 26 | Surprise, Arizona | 6.36% | 22.8% | 3.68 | 3.52 |

| 27 | Temple, Texas | 7.62% | 15.0% | 2.82 | 3.13 |

| 28 | Chesapeake, Virginia | 1.06% | 13.3% | 3.41 | 3.43 |

| 29 | Flower Mound, Texas | 2.57% | 11.1% | 2.75 | 3.13 |

| 30 | Missouri City, Texas | 2.71% | 15.2% | 2.61 | 3.13 |

| 31 | St. George, Utah | 6.33% | 22.7% | 5.41 | 3.38 |

| 32 | Naperville, Illinois | 0.35% | 13.3% | 3.19 | 2.68 |

| 33 | Woodbury, Minnesota | 3.93% | 12.0% | 3.11 | 3.6 |

| 34 | Concord, North Carolina | 3.58% | 12.3% | 3.15 | 3.69 |

| 35 | Cary, North Carolina | 2.70% | 12.5% | 3.55 | 3.69 |

| 36 | Goodyear, Arizona | 8.06% | 17.0% | 3.67 | 3.52 |

| 37 | Jacksonville, Florida | 2.02% | 13.9% | 3.49 | 3.49 |

| 38 | McKinney, Texas | 4.84% | 10.1% | 3.28 | 3.13 |

| 39 | South Jordan, Utah | 6.66% | 12.9% | 4.12 | 3.38 |

| 40 | Carmel, Indiana | 2.03% | 14.1% | 3.11 | 2.69 |

| 41 | Pearland, Texas | 0.76% | 10.9% | 2.52 | 3.13 |

| 42 | Round Rock, Texas | 4.87% | 9.5% | 3.25 | 3.13 |

| 43 | Gastonia, North Carolina | 2.58% | 15.5% | 3.37 | 3.69 |

| 44 | Fishers, Indiana | 2.46% | 10.2% | 2.53 | 2.69 |

| 45 | Blaine, Minnesota | 1.77% | 12.3% | 2.85 | 3.6 |

| 46 | Lehi, Utah | 8.93% | 5.5% | 3.84 | 3.38 |

| 47 | Henderson, Nevada | 3.73% | 19.7% | 4.60 | 3.44 |

| 48 | Lee’s Summit, Missouri | 1.79% | 15.1% | 2.51 | 3.47 |

| 49 | High Point, North Carolina | 0.73% | 15.6% | 3.09 | 3.69 |

| 50 | League City, Texas | 0.64% | 10.9% | 0.57 | 3.13 |

Retiring In Florida: A Disclaimer

Although our data ranked several cities in Florida as promising retirement communities—due in part to favorable legislation for seniors and retirees— it’s worth noting that the state has seen an influx of people moving there in recent years, and sometimes the data can lag the on-the-ground reality. In fact, more residents relocated to Florida in 2022 than to any other state in the country, with about 318,900 deciding to call the Sunshine State home. This population increase of nearly 2% is much higher than the 0.4% national growth rate recorded between 2021 and 2022.

Such growth has contributed to increases in the cost of living across many aspects of life, as evidenced by the Retirement Living survey respondents currently residing in Florida. Of the Florida-based residents who responded to our survey, 42.8% rated their satisfaction with the state a 3 or less out of 5 (more than 40% of those dissatisfied respondents rated their location a 1). The most common causes for concern were overdevelopment, rising insurance costs, and an increase in traffic.

Methodology

To help readers find the best cities for retirement, we evaluated all cities in the U.S. with populations greater than 80,000 residents. Then, we evaluated 12 government data sources, including the U.S. Census Bureau and the FBI, as well as Retirement Living’s internal resources and more. All data sources were available at the city level, except for the homelessness rate, which was collected at the state level.

To rank each city, we created an equation and standardized each metric so we could compare each data point equally. The data points and their corresponding percent weighting are as follows:

- Population growth (2019 – 2022): 20%

- Persons 65 and older: 10%

- Median monthly mortgage payment: 8%

- Median monthly rent payment: 6%

- Median household income (2022 dollars, adjusted for inflation): 8%

- Persons in poverty: 6%

- Population per square mile: 6%

- Homelessness per 10,000 residents (only state-level data available): 6%

- Sales tax rate, including local taxes: 6%

- Taxes on retirement income: 6%

- FBI crime statistics: 6%

That said, Retirement Living knows that data can only go so far, and what’s happening on the ground has the potential to greatly affect quality-of-life metrics in ways our data points cannot detect. To fill in the gaps, Retirement Living surveyed 1,075 people aged 55 and older across the U.S. and asked the following questions:

- Would you recommend your city (nearest metropolis) to a friend as a retirement location? Why or why not?

- Which of the following would you say is your most important consideration for determining where to retire: affordability, quality of life, access to health care, or something else?

- How satisfied are you with your retirement in your state, on a scale from 1 to 5, and why?

- Are you willing to move to a state with a more favorable retirement climate? Yes or no?

Fair Use Statement

If you found the information here helpful, we invite you to share it for non-commercial purposes. In return, we ask that you include a link back to this page when doing so.

Sources:

- The United States Census Bureau

- The 2022 Annual Homelessness Assessment Report (AHAR) to Congress, The U.S. Department of Housing and Urban Development

- Retirement Living survey data, November 2023

- Federal Bureau of Investigation Crime Data Explorer

- State Department of Revenue websites