Despite Some Challenges, Medicare Advantage Beneficiaries Report High Satisfaction Rates

Key Takeaways

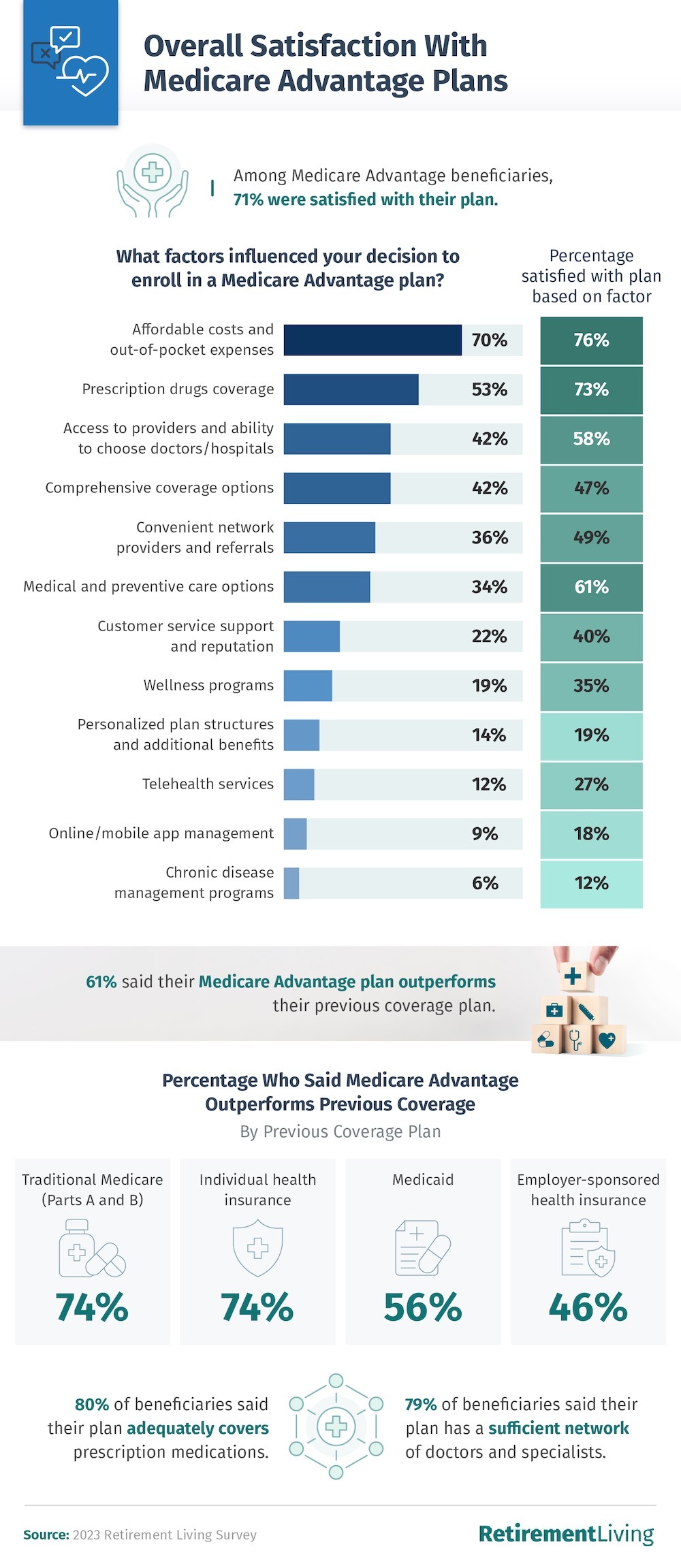

- 71% of beneficiaries are satisfied with their Medicare Advantage plan.

- Affordable costs and out-of-pocket expenses are the top reasons people enroll in Medicare Advantage.

- Over the past year, 1 in 10 beneficiaries believes they were overbilled for their Medicare Advantage plan.

- Almost 20% of Medicare Advantage beneficiaries had challenges receiving care due to delays caused by the prior authorization process.

Understanding Medicare Advantage Satisfaction

Healthcare is one of the biggest expenses for seniors; as such, enrollees need to get significant benefits from their chosen plan. One major plan available to seniors in the U.S. is Medicare Advantage, which offers additional benefits not included in traditional Medicare plans.

To better understand seniors’ experiences with Medicare Advantage, we surveyed 351 beneficiaries about their plans, including premiums, customer service, and provider networks. We also gathered satisfaction rates for various plan aspects and explored potential disadvantages. In the following guide, we’ll present our findings to help you decide if Medicare Advantage offers the right coverage for you.

Factors That Matter

There are many factors to consider when choosing a health care plan. Let’s look at some reasons individuals enrolled in Medicare Advantage, then compare those to current member satisfaction.

According to our survey results, most people enrolled in a Medicare Advantage did so in an attempt to save money and increase coverage. Of respondents, 70% enrolled for more affordable costs and out-of-pocket expenses, and 76% expressed satisfaction with those costs. Another 53% enrolled for prescription drug coverage, and 73% were satisfied with their prescription benefits.

Overall, 71% of beneficiaries were satisfied with their Medicare Advantage plan. Furthermore, 61% felt their current coverage outperformed their previous plan, including traditional Medicare Parts A and B, individual insurance plans, and Medicaid.

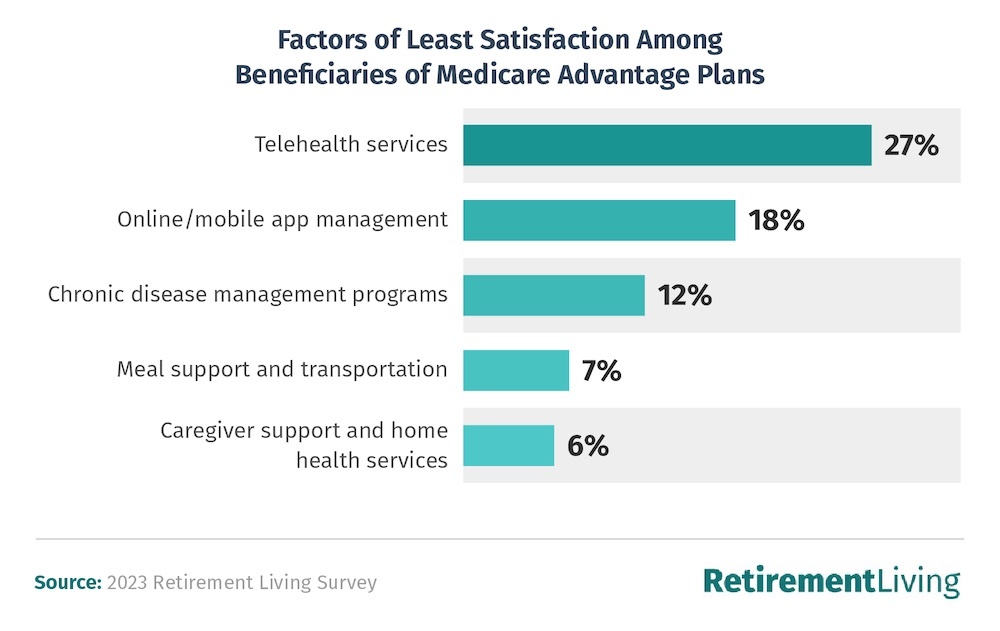

Despite the generally positive reviews, the program still lacks in a few key areas. Medicare Advantage members were less satisfied with their plan’s telehealth services (27%) and online and mobile access (18%). Medicare Advantage will want to improve these offerings to keep up with technological advancements in health care. As for medical concerns, only 12% were satisfied with their plan’s chronic disease management program, 7% with meal support and transportation, and 6% with caregiver support and home health services.

Addressing the Knowledge Gap for Beneficiaries

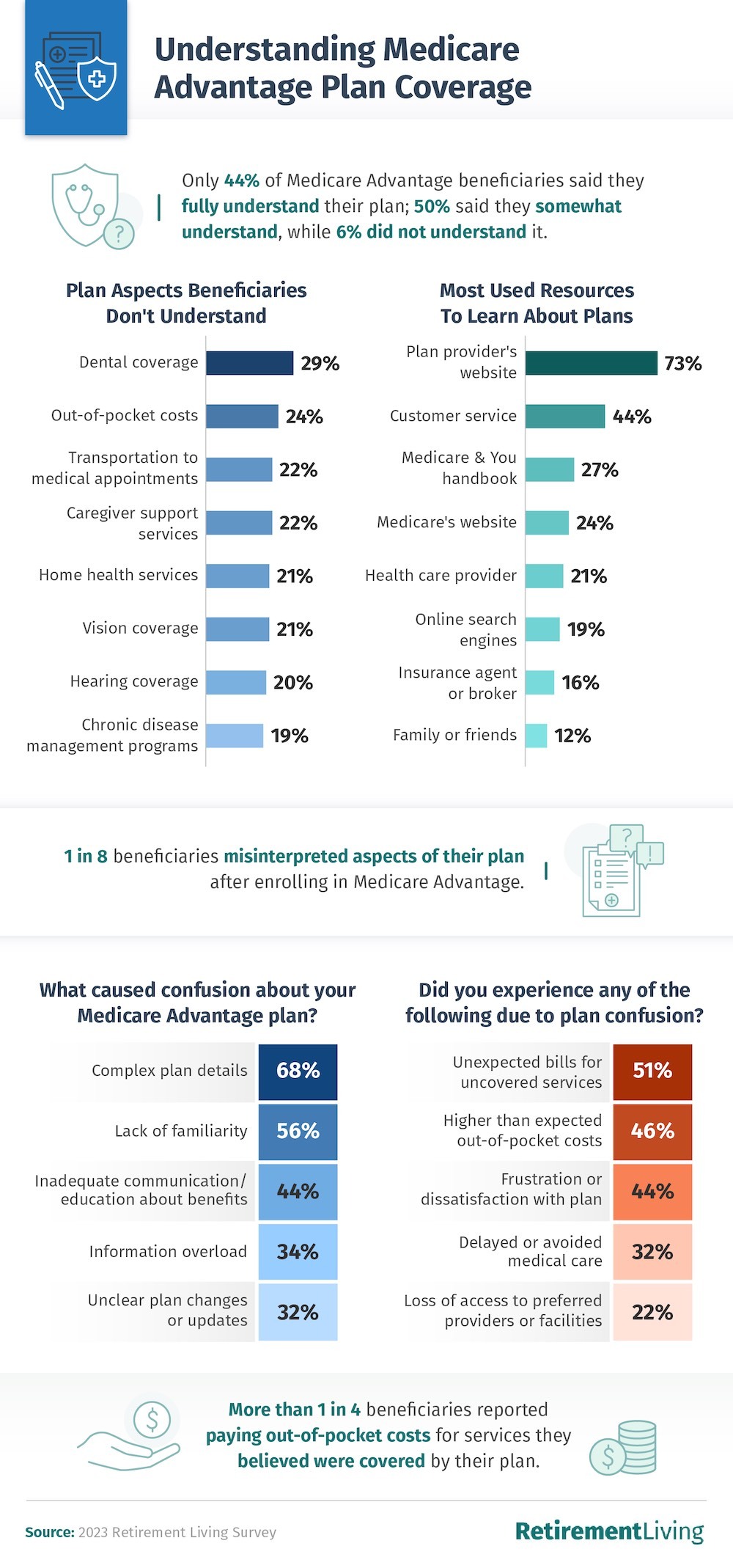

Navigating insurance coverage can be incredibly difficult, and some beneficiaries feel like they don’t know everything their plan has to offer. We asked Medicare Advantage members about their understanding of coverage and benefits to ascertain how easy the plans are to navigate.

Medicare Advantage plans did a pretty good job laying things out for beneficiaries to understand, as 94% of plan members felt they fully understood or somewhat understood their plans. Plan members were most likely to seek clarification about their dental coverage (29%) and out-of-pocket costs (24%). When coverage questions like these arose, 73% consulted their plan’s website, and 44% contacted the customer service department.

That said, feedback suggests there is still work to be done to make it easier for people to effectively leverage their benefits; over 25% of beneficiaries reported paying out-of-pocket expenses for services they believed were covered. To avoid these challenges and unexpected expenses, thoroughly study Medicare Advantage plans in detail before signing up. You can also rely on additional Medicare resources to fully understand coverage options.

Navigating Potential Disadvantages

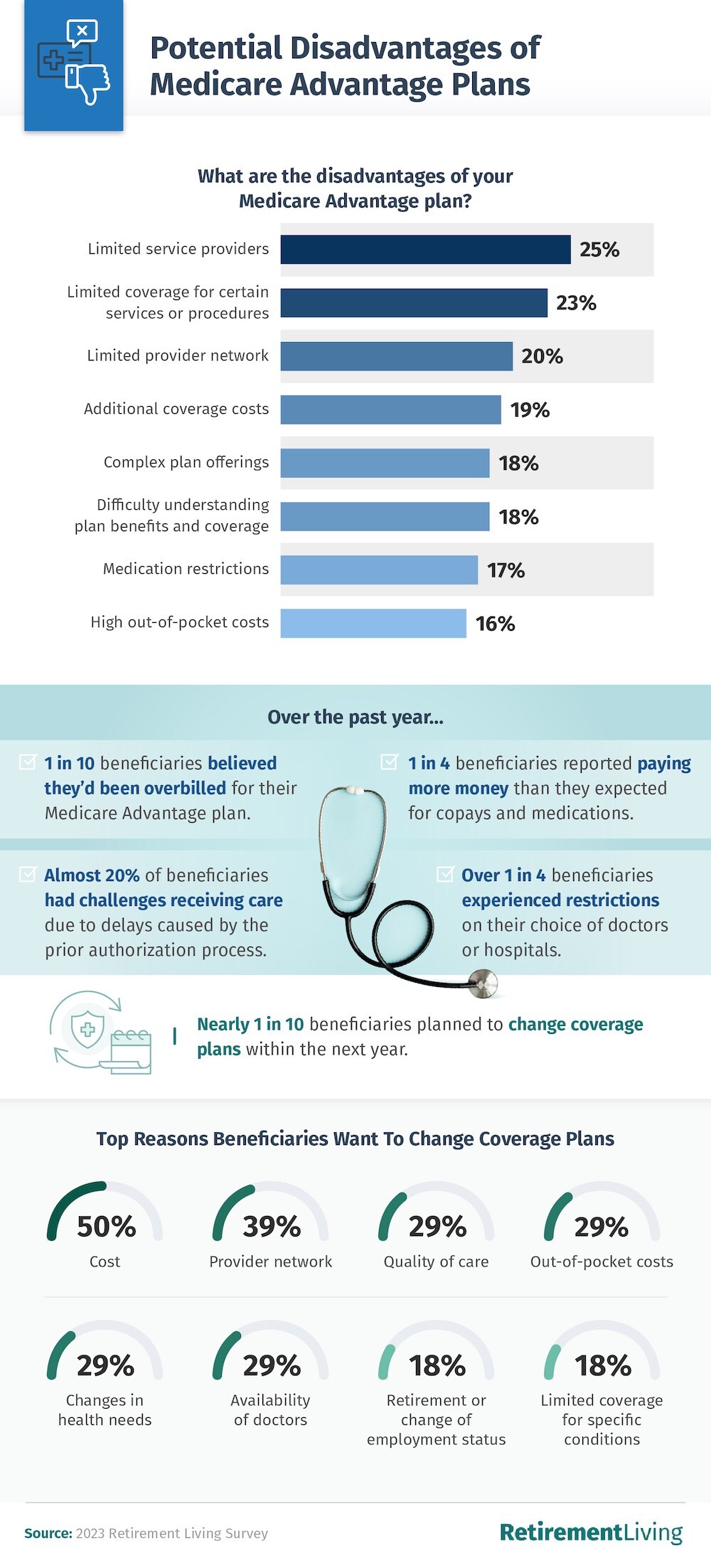

While Medicare Advantage offers additional benefits, there are some drawbacks to consider. We spoke with beneficiaries to gather some of the most noteworthy disadvantages of Medicare Advantage plans.

While most respondents were satisfied with their Medicare Advantage plans, around one-quarter of members were discouraged by limited service providers or coverage for certain procedures. A few members believed they were overbilled for their plan (just 10%), and 20% had challenges receiving care due to prior authorization process delays.

Despite some minor setbacks, only about 10% of current Medicare Advantage plan members expect to change health insurance plans within the next year. Among those beneficiaries, 50% wanted to switch because of cost and 39% because of a change to their provider network.

Some drawbacks of Medicare Advantage may be avoided by researching in-network doctors, provider networks, and hospitals before enrollment.

Medicare Advantage Challenges and Opportunities

While some Medicare Advantage plan members felt frustrated with their coverage, most enrollees expressed satisfaction with their benefits. Many even said Medicare Advantage outperforms their previous coverage. In most cases, enrollees could resolve their greatest sources of frustration with a better understanding of the plan’s offerings and details. Those interested in enrolling in Medicare Advantage should consult the plan provider’s website or contact customer service to learn more about coverage, benefits, and responsibilities.

Methodology

For this campaign, we surveyed 351 Americans enrolled in a Medicare Advantage plan. Among them, 57% were women, and 43% were men. The median age of respondents was 69 years old.

About Retirement Living

Retirement Living provides resources to help seniors make the best retirement decisions, such as senior living guides and retirement planning tools to help manage finances.

Fair Use Statement

Want to share something insightful or interesting in this article for non-commercial purposes? Feel free to do so, but please include a link back to this page so readers can access our full data findings and methodology.