We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE (TTY users should call 1 (877) 486-2048) 24 hours a day/7 days a week to get information on all of your options.

Cigna Medicare Supplement Insurance Review

Medicare is the most common health insurance available to people at the age of 65 or older. This federal health insurance program is also available to younger individuals with certain medical qualifying conditions. Medicare covers at least 15 percent of the population, and many recipients carry a supplemental policy to cover the gaps in coverage the program provides. Medicare supplement insurance is also known as Medigap insurance.

Cigna Medicare supplement insurance is part of the well-known Cigna family of health insurance companies. Medicare supplement insurance through Cigna does not require an in-network doctor and works with any Medicare provider. Cigna works with an extensive infrastructure of health provider networks with years of experience in the health insurance field for its Medicare supplement insurance.

Cigna Medicare supplement insurance is broken out under several Cigna family companies depending on the location of the customer. Insurance exclusions and specifics may vary by state and the general information on the website, although you can research this information through their exclusions page. Because of their large healthcare insurance network, Cigna also offers supplement insurance options outside of traditional and regulated Medicare supplement plans. These include accident expense, cancer treatment, and lump sum heart attack and stroke coverage plans. They also offer Medicare Advantage plans for those who prefer a one-plan solution rather than Medicare plus a supplement policy.

Pros

- Works with any Medicare provider

- International coverage is offered under some plans

- Offers plans A, B, C, D, F, HD-F, G, and N

- Guaranteed renewal (except for nonpayment or misrepresentation)

Cons

- Does not work with all parts of Medicare

- Has a premium cost

- Only available in 38 states

How Cigna Medicare Supplement Insurance Works

Before you retired, you may have had secondary insurance. For example, you and your partner both had medical insurance. Your insurance was the primary and paid claims first, then your partner’s policy picked up much of the remaining bill as a secondary payer. Cigna Medicare Supplement coverage is much like secondary payer insurance in that it is designed to pick up costs that Medicare doesn’t cover and help with copays and coinsurance.

We discuss the various parts of the Medicare program below. Medicare Supplement Insurance works in combination with Medicare Parts A and B.

Medicare Costs Part A, B, C, and D and Cigna Medicare

When first signing up for Medicare, it is easy to feel lost with all the letter-assigned plans. Medicare labels each type of coverage with a letter and the term “part.” These are Part A, Part B, Part C, and Part D. Medicare supplement insurance generally works with Parts A and B, and not everyone is eligible for each part of Medicare.

Medicare Part A provides coverage for hospital-related expenses, like inpatient care, inpatient nursing, and related services and supplies. Hospice and home health services are also covered. For the majority of people, there is no cost for Medicare Part A as long as they paid Medicare taxes on income during their working years. In some cases, there is a small premium for those who did not work regularly but paid Medicare taxes for a defined amount of time. Medicare supplement insurance is designed to work with Medicare Part A.

Medicare Part B covers services related to your general medical care such as doctor visits, outpatient care, home health in some instances, and other medical services. Part B covers both medically necessary care and preventive care services, with a few exceptions. You will usually pay a monthly or annual premium for Medicare Part B coverage.

Medicare Part C is often called a Medicare Advantage Plan, and it effectively replaces Medicare Parts A and B. In other words, if you buy a Medicare Advantage plan you have Part C, not Part A or B; therefore, you can’t add supplement insurance on top of the plan. You can purchase a Part C plan from Cigna. Part C plans vary significantly in coverage options because federal guidelines allow insurers some flexibility on what their program must offer. While Medicare Parts A and B usually don’t require referrals, Part C plans may rely on insurance provider medical networks or referrals. Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), private fee for service, medical savings accounts (MSA), and special needs plans are all types of insurance offered under Plan C.

Medicare Part D covers prescription medications. Like Part C, this coverage is offered by private insurance companies for a premium and is not a government-backed entitlement. Part D insurance plans may have copays, coinsurance and deductible fees, but often reduce medication bills as pharmaceuticals costs continue to rise. Medicare supplement plans sold after January 1, 2006, can’t legally offer drug coverage, but you can buy a Part D plan and add Medicare supplement insurance.

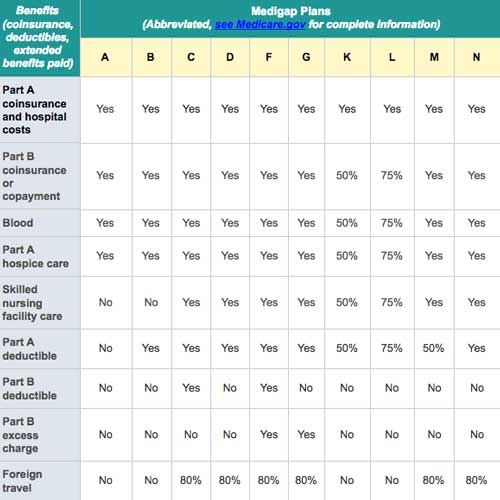

Medicare supplement insurance like Cigna’s can cover coinsurance costs and annual deductibles. The chart below explains those costs.

| Medicare Part | Premium | Deductible and Coinsurance |

|---|---|---|

| Part A | Medicare taxes paid at least 40 quarters (10 years): no premium. Medicare taxes paid between 30 and 39 quarters (40 years): $232 monthly. Less than 30 quarters: $422 | Annual deductible: $1,340. Coinsurance in effect, you pay a percentage of the bill depending on service. |

| Part B | $134 monthly. Those with higher income pay more, those on Social Security may pay less. | Annual deductible: $138. Coinsurance: 20% |

Cigna Medicare Supplement Plan Coverage

Medicare supplement plans are labeled with letters just as Medicare is, however, where Medicare uses the word “part” to define to define coverage levels, supplement plans use the term “plan” followed by a letter. That bowl of alphabet soup we mentioned earlier just got bigger.

There are 10 basic regulated Medicare supplement plans, lettered A through N, with Plan F having a high deductible option and sometimes being labeled as Plan HD-F. Cigna Medicare Supplement Insurance offers seven plans plus the high-deductible F option, although not all programs are available in every state.

There are far too many variables to outline every plan Cigna offers here, but each plan follows government regulations for coverage briefly outlined below in the chart. Plan A, F, G, and N are the most popular choices across all insurers. These are the lowest cost plans and also offer the most coverage.

Premiums for Cigna Medicare supplement plans vary based on beneficiary age, sex, and location, as is the case for most insurance.

State Differences for Cigna Medicare Supplement Insurance

Because state regulations on Medicare vary and Cigna Medicare supplement insurance is carried by different divisions of the company, not all coverage on the summary chart on Cigna’s website or Medicare’s website is available in each state. For example, Cigna Plan C in North Carolina does not cover Medicare Part B deductibles although it may in other states or under another underwriting company. It is essential to talk to a representative to get a personalized quote and plan description for you and your location before deciding on a plan.

Cigna Medicare Supplement Insurance Complaints

Cigna’s overall rating with the Better Business Bureau is an A+ with 435 complaints resolved in the last three years. The level of complaints is minimal when you consider that Cigna services nearly 100 million individuals across all their insurance lines. Reviewers on ConsumerAffairs rate Cigna Medicare supplement insurance 3 ½ stars out of 5 with the majority of commenters being quite pleased with the service. Complaints center around claims processing times or a misunderstanding of doctor networks.

Cigna Medicare Supplement Insurance Q&A

-

What is a copay?

A copay is a fee an insured patient pays to a health services provider like a doctor. These payments are generally small, with $10 or $25 being the norm. Copays are intended to reduce overuse of medical services by patients. These fees are not included in your total deductible calculation, and may also be excluded from the maximum out of pocket cost calculations. -

What is coinsurance?

Coinsurance is the percentage of health care costs that the beneficiary is responsible for paying after insurance pays its part. A typical coinsurance percentage is 20 percent, although the rate can vary depending on the medical service received. For example, emergency room visits may have a higher coinsurance percentage than family doctor visits. The contract between the insurance carrier and the medical care provider determines the coinsurance amount. Check your explanation of benefits (EOB) form from your insurance carrier to verify the amount you owe. That amount is almost always lower than the original charges. -

What is a deductible?

A deductible is the amount of money an insured patient must pay before insurance pays for any services. Like a copay, the deductible is a cost saving feature for insurance companies and helps to ensure that you seek medical attention only when you need it. The deductible helps to prevent frivolous charges by requiring the patient to take on some financial responsibility. For example, Medicare Part A has a $1,340 annual deductible that you must pay before Medicare pays for any services. As with coinsurance, be sure to consult the explanation of benefits (EOB) from your insurance carrier(s) before paying any bill. You only owe the amount for medical services on the EOB and at times the provider bills a higher rate. -

Does Cigna offer a Medigap policy?

Yes. A Medigap policy is another word for Medicare supplement plan. -

Can I use a Medicare supplement plan with my Medicare Advantage (Medicare Part C) plan?

No, Medicare supplement plans do not work with Medicare Advantage plans. However, you can swap from the Medicare Advantage plan to Medicare Parts A and B and then add a Medicare supplement plan. -

Can I use Medicare supplement plans with my Medicare Medical Savings Account Plan (MSA)?

No, an MSA is a combination of a high deductible Medicare Advantage plan (Part C) and a bank account. It is illegal for a provider to sell you a Medicare supplement plan if you have an MSA.

Conclusion

Cigna Medicare supplement insurance offers the strength of a large and respected company with locations across the country. Cigna also offers additional coverage options not widely available and can quickly help customers compare multiple options to find the best solution for them between Medicare supplement plans and Medicare Advantage. Several companies within the Cigna family underwrite the Medicare supplement insurance, so it is vital that customers speak to a specialist or obtain a written quote and plan detail through the website rather than only reviewing the chart of benefits on the website.