Best Medicare Supplement Plans and Providers (Reviewed in 2024)

Updated:

Retirement Living takes an unbiased approach to our reviews. We may earn money when you click a partner link. Learn More

We evaluated 15 well-known Medicare Supplement insurance providers and picked the nine best options in 2024 based on coverage options, costs, and provider reputations.

- Great Savings

- Competitive pricing

- 20+ providers

United Medicare Advisors simplifies finding the right Medicare supplement insurance by providing tools to compare plan benefits and costs. The company provides options from over 20 providers to consumers across 45 states.

- Great Perks

- Nationwide availability

- Policy discounts

Humana offers Medicare Supplement Plans A through N in most states. Each Humana policy comes with benefits other companies don’t offer. Perks include discounts for using electronic payments, fitness programs and more.

- Great Network

- 95 million people covered

- Works with most providers

Cigna is an industry-leading Medicare Supplement insurance whose plans work with any provider that takes Medicare. Cigna offers plans for Part A through N.

- Great Advice

- Highly rated

- Helpful information

Mutual of Omaha is a leading Medigap provider whose members file fewer complaints than competitors. The company offers an impressive array of Medicare-related articles on its website explaining how to navigate the enrollment period, eligibility rules and how to use Medigap insurance.

- Most Widely-Used

- Automatic re-enrollment

- No referral necessary

Blue Cross Blue Shield provides Medicare supplement insurance and personalized, affordable health plans. The company serves nearly one out of every three consumers who buy health insurance. Around 95% of health care providers contract with Blue Cross Blue Shield companies.

- Great Portal

- User-friendly online portal

- Plans for international travel coverage

Aetna offers Medicare Supplement insurance plans offering coverage that works with Original Medicare (Parts A and B). Aetna’s website provides helpful information on plans in each state and convenient online policy management.

- Easiest to Compare

- Comparison Shopping

- Agent Interaction

SelectQuote is an online Medicare supplement insurance broker. The company helps consumers quickly find and compare policies.

- Fast Comprehensive Quotes

- Free plan options

- Learn on your own, or speak to an advisor

CoverRight provides everything you need to select insurance that covers the gaps in Medicare coverage. You can find everything you need online, and a licensed advisor is available by phone, email or chat to help. CoverRight offers quotes from over 20 insurance companies, and all services are free.

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE (TTY users should call 1 (877) 486-2048) 24 hours a day/7 days a week to get information on your options.

Our Research Methodology

To identify the top Medical Supplement (Medigap) insurance providers, we analyzed eight data points to comprehensively review each provider. We sourced feedback from real consumers and consulted with insurance experts.

Our editorial team also shopped for policies and analyzed each company for price transparency. Our research uncovered Medigap coverage for less than $60 per month.

To gauge each company’s reputation and helpfulness, we evaulated the latest data from The National Association of Insurance Commissioners (NAIC) and the American Customer Satisfaction Index (ACSI).

All in all, the Retirement Living editorial team considered these features:

- Cost data

- Range of plans available

- Healthcare coverage

- Service area

- Customer service availability

- Online reviews

- Company reputation

- Licensure

Basically, we followed our own buying tips to uncover the best providers. Companies that obscured their offerings, had difficult or confusing enrollment processes, and limited coverage options were eliminated. The result of our analysis is the best Medicare Supplement Insurance providers for you, a friend, or a family member to consider.

Medicare Supplement Provider Reviews 2024

We evaluated the best Medicare Supplement insurance plans, also known as Medigap insurance. After careful review, we identified the nine best Medicare Supplement insurance options for 2024: United Medicare Advisors, Cigna, Mutual of Omaha, Humana, Blue Cross Blue Shield, SelectQuote Senior, Aetna and AARP by UnitedHealthcare.

United Medicare Advisors

Great Savings |

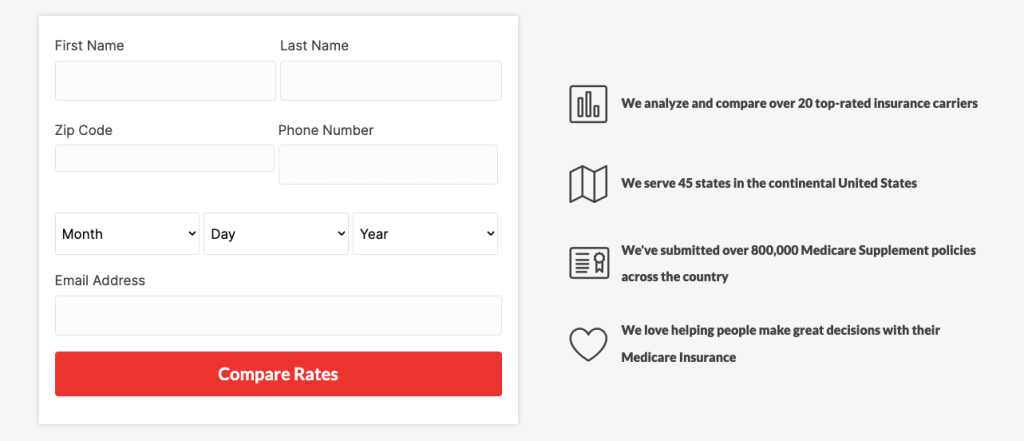

United Medicare Advisors is an independent insurance marketplace that helps you compare Medicare Supplement policies from multiple providers. The company works with over 20 plan providers in 45 states and has produced more than 600,000 policies. United Medical Advisors represents companies like Gerber, Aetna, Mutual of Omaha, Sterling, and Humana.

Licensed insurance agents will provide unbiased advice and tailor their suggested plans according to your needs. The website says consumers save $581 per year on average by switching to a new Medigap plan. Fill out the online form to have an agent call you.

- Plans offered: Plans A, B, C, F, G, K, L, N (availability varies by provider)

- Coverage: 45 states

- Customer service: Call to speak with a licensed agent or email [email protected]

Visit the United Medicare Advisors website to get a quote, or call 877-850-6440.

Read our comprehensive United Medicare Advisors review.

Medicare.net

Great Online Marketplace |

Screenshot: Medicare.net sample state search

Medicare.net is a one-stop shop for information about Medicare, Medicare supplement plans, Medicare Advantage, prescription plans and more. The company works with every major insurance carrier to provide real-time quotes by state and ZIP code. Information you’ll find on the Medicare.net website includes:

- Plans offered: Plans A, B, C, F, G, K, L, N (availability varies by provider)

- Coverage: All 50 states

- Customer service: Call to speak with a licensed agent

Click Medicare.net’s “Help me find the best plan” button for four choices: needs assessment, build your plan, current plan comparison and prescription drug coverage. Choose one of the four options to filter Medicare, Medigap and Medicare Advantage plans.

Visit their website to get a quote, or call (877) 959-4527.

Read our comprehensive Medicare.net review

Humana

Great Perks |

Humana, one of the largest health insurance companies, is on the Fortune 500 list and provides Medicare supplement plans in most states, including Washington D.C. and Puerto Rico. For plan year 2023, Humana expanded Medigap coverage to allow individuals to visit nearly 700,000 medical providers or facilities that accept Medicare patients nationwide.

The company boasts the highest health insurance rating from the American Customer Satisfaction Index, 77, which was awarded in 2022.

To get a quote, enter your zip code on the Humana website to see a list of Medicare supplement insurance policies available in your area. We like that Humana’s website is accessible and easy to use. Beneficiaries who enroll online get a 6% discount on monthly premiums.

- Plans offered: Plans A, B, C, F, G, K, L, N (availability may vary by location)

- Coverage: 49 states, plus Washington D.C and Puerto Rico; Not Virginia

- Customer service: Monday to Friday, 8 a.m. – 8 p.m

Humana Medicare Supplement policies come with unique perks for customers. These perks include meal delivery services, a Silver Sneakers® membership, prescription discounts, vision and hearing services, and a 24-hour nurse line. The program also provides savings on eye exams, contact lenses and glasses, over-the-counter prescriptions, and massage therapy.

To learn more about Humana’s policies, read our comprehensive Humana Medicare supplement insurance review or visit Humana online for a personalized quote.

AARP by UnitedHealthcare

Great Service |

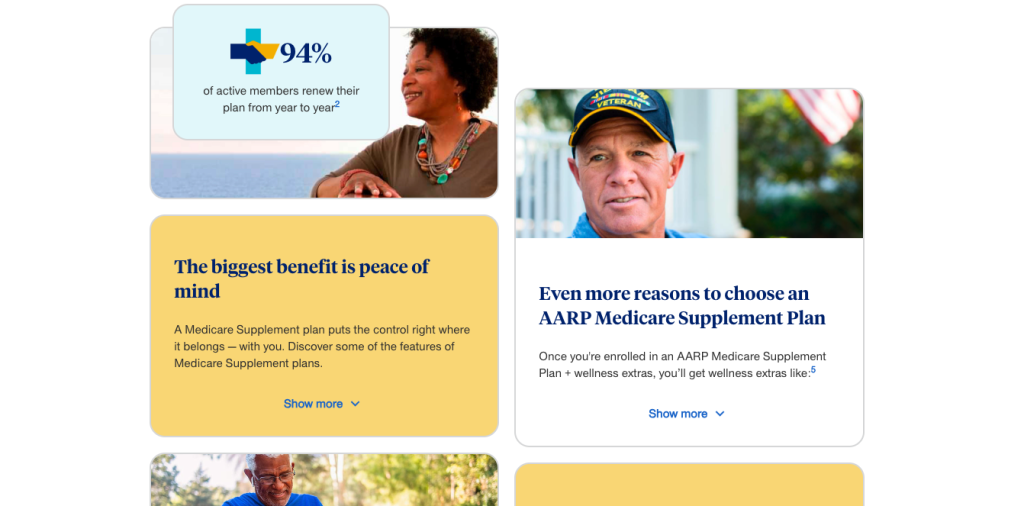

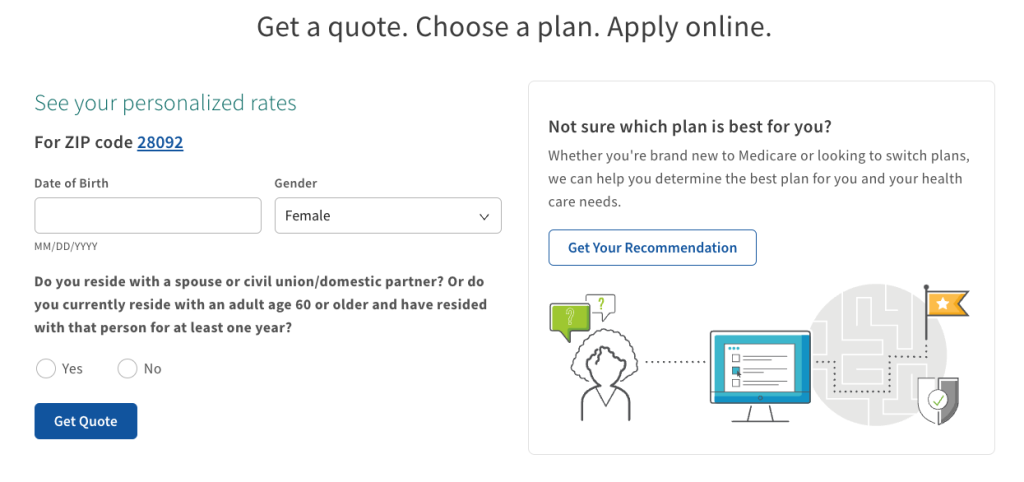

AARP offers Medicare supplemental insurance plans via UnitedHealthcare, the largest insurer in the nation. AARP earned a top spot on our list for its pricing transparency. It’s one of the few providers that will generate sample rates online without requiring any personal details (you will need to enter your zip code to see accurate rates).

Some plans also have several variations, which allows you to customize your plan down to the details. Part D (prescription drug) coverage and dental and vision benefits are available with certain plans. However, these “wellness extras” can get costly, and some competitors offer them for free

- Plans offered: Plans A, B, C, F, G, K, L, N (availability may vary by location)

- Coverage: All 50 states

- Customer service: Call an agent Monday – Friday 7 a.m. – 11 p.m. EST, Saturday 9 a.m. – 5 p.m. EST or use the online chat tool

AARP employs highly rated customer service agents who are equipped to answer questions about coverage options.

Read our comprehensive AARP Medicare Supplement Insurance review.

Mutual of Omaha

Great Advice |

Mutual of Omaha is an insurance and financial services company that offers Medicare Supplement Insurance in 49 states and Washington, D.C.. Its household discount is up to 12%, much higher than other providers. Qualifying members also get discounted dental services, as well as savings on wellness programs, hearing aids, and eyewear.

Our analysis of the 2022 National Complaint Index Report by the National Association Of Insurance Commissioners shows that members file few complaints about its policies at a rate well below the industry average. The company has an A+ rating from A.M. Best. Mutual of Omaha is recognized for its overall financial strength and ability to meet ongoing obligations to policyholders.

- Plans offered: Plans A, B, C, F, G, K, L, N (availability may vary by location)

- Coverage: 49 states, plus Washington D.C. Not Massachusetts

- Customer service: Monday to Thursday 7:00 a.m. – 5:30 p.m. CST, Friday 7:00 a.m. – 5:00 p.m. CST

We especially like how Mutual of Omaha publishes helpful information consumers can use to understand their enrollment period, eligibility rules, and how to use Medigap insurance.

Visit the Mutual of Omaha website to get a quote, or call (855) 264-2042.

Check out our comprehensive Mutual of Omaha Medicare Supplement review.

Blue Cross Blue Shield

Most Widely Used Insurer |

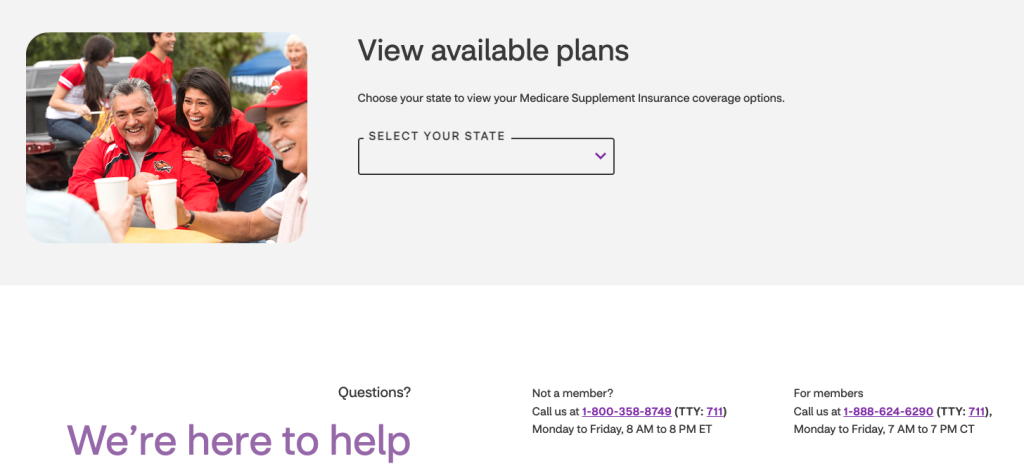

The Blue Cross Blue Shield Association includes 34 independent, locally operated Blue Cross Blue Shield companies. Its large, nationwide presence makes enrolling in a Medicare Supplement plan easier because it offers 10 plans across all 50 states. However, plan types and prices vary, and you’ll need to connect with the specific company that services your area for the most accurate information.

- Plans offered: Plans A, B, C, F, G, K, L, N (availability may vary by location)

- Coverage: All 50 states, plus Washington D.C. and Puerto Rico

- Customer service: Call a representative 7 days a week 8 a.m. – 8 p.m.

Enter your zip code on the BCBS website to find a list of BCBS affiliates in your area. You’ll need to provide personal details to see current rates, but we found its comparison tool to be more streamlined and informative than some competitors.

Plus, with Blue-to-BlueSM, you can change plans more than just once a year without having to answer additional health questions. Its plans come with Hearing aid benefits, and most plans include a fitness membership.

Visit the Blue Cross Blue Shield website to get a quote, or call (877) 630-2860.

Check out our comprehensive Blue Cross Blue Shield review

Aetna

Great Online Portal |

Aetna, a mainstream insurance company, also offers seven Medicare Supplement plans for seniors in many states (coverage is not available in all states).

Though Aetna provides policy pricing on the website, we found navigating it as a shopper a little tricky. Select your state, and you’ll get a PDF with sample policy prices. However, we like that customers can access Aetna’s extensive provider network for services. Household discounts may also be available and you can manage your policy completely online after enrolling.

- Plans offered: Plans A, B, F, G, N (availability may vary by location)

- Coverage: 37 states

- Customer service: Monday to Friday, 7 a.m. – 7 p.m. CST

Our analysis of the 2022 National Complaint Index Report by the National Association Of Insurance Commissioners suggests that members file more complaints with this company than some others on this list. That said, its customer satisfaction rating is above average for the industry.

Visit Aetna’s website to get a quote, or call (877) 394-2161.

Read our in-depth review of Aetna Medicare Supplement plans for more details.

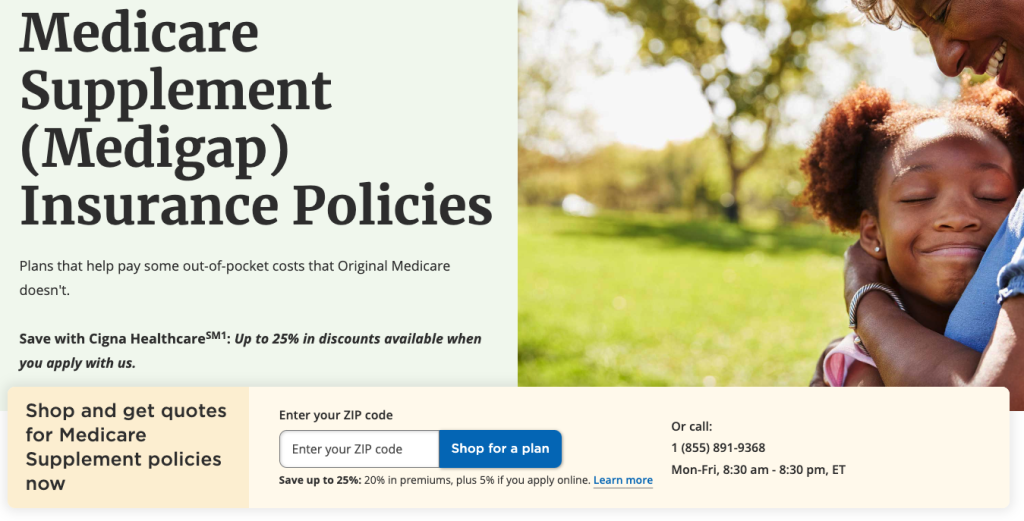

Cigna

Great Network |

Cigna’s healthcare network spans more than 1.5 million relationships with providers, clinics and facilities. The company is known for its competitive rates and additional no-cost programs available to its customers. Free online quotes are available for any of the company’s six Medigap plans.

- Plans offered: Plans A, F, G, N (availability may vary by location)

- Coverage: 48 states; Not Massachusetts and New York

- Customer service: Monday to Friday, 8:30 a.m. – 8:30 p.m. EST

Customers can save 25% on premiums if they enroll in some plans online, one of the largest discounts available. Cigna premiums can be higher than those offered by other insurance providers, but it offers discounts on health and wellness programs and access to the 24/7 Health Information phone line.

To learn more, read our full Cigna review.

CoverRight

Fast, Comprehensive Quotes |

CoverRight is a digital Medicare marketplace that helps you review Medicare Supplement plans from many major providers side-by-side. In just two minutes, you can receive a comprehensive quote from 20+ insurers to help you find a policy without conducting extensive research yourself. CoverRight partners with top companies like Nassau, Aetna, Mutual of Omaha, Anthemn, and Lumico.

- Plans offered: Plans F, G, N (availability varies by provider)

- Coverage: All 50 states

- Customer service: Call to speak with a licensed insurance agent Monday to Friday 8 a.m. – 10 p.m. EST, Saturday and Sunday 9 a.m. – 7 p.m. EST

CoverRight has a comprehensive online quote feature. After entering our personal details, email addresses, and phone numbers, we were able to compare 22 plans (for coverage in North Carolina) from several Medigap providers. Its comparison tool is also very helpful for comparing out-of-pocket costs against copays and plan benefits.

To learn more, read our comprehensive CoverRight review or visit the website for a quote.

SelectQuote

Easiest to Compare |

One of the biggest insurance marketplaces in the US, SelectQuote has various Medicare Supplement plans with many coverages and price options. Just enter your zip code to compare plans from highly-rated Medicare insurance companies like Humana, Kaiser Permanente, Cigna, WellCare, and more.

- Plans offered: Plans A, B, C, F, G, K, L, N (availability may vary by location)

- Coverage: All 50 states

- Customer service: Call a representative Monday to Friday 7a.m. – 5 p.m. CST

SelectQuote has a good online reputation from customers who give the marketplace 4.7 stars on Trustpilot. Its website is also full of helpful information about Medicare, such as changes to costs and out-of-pocket limits each year.

To learn more, read our full SelectQuote review. You can also call (855) 945-1225 or visit the website for a quote.

Additional Companies

Medicare.net is a Medicare Supplement and Medicare Advantage marketplace that is free to use. All Medigap plans are offered strictly based on your budget and health priorities.

TapTap Medicare is an online marketplace where shoppers can find gap insurance that works for their situation. The company works with more than 21 Medicare supplement and Medicare Advantage providers.

Tips for Choosing a Medigap Plan

While all Medigap plans offer the same medical benefits nationwide, the price of the plan will vary for each individual, and not every Medicare Supplement provider offers all plans.

Top tips for choosing a plan:

- Sign up for a Medicare Supplement policy during your Medicare Supplement initial enrollment

- Shop around to compare prices, coverage options, and provider reputation

- Don’t confuse Medicare Supplement (Medigap) with Medicare Advantage

1. Compare Exclusions and Deductibles

Every plan differs in terms of coverage and the deductible you must pay before these policies begin offering benefits. The best Medigap plan is one that balances costs and coverage. Generally speaking, policies that provide better coverage for medical care will cost more per month.

2. Understand How Pricing Models Affect Future Premiums

Medicare supplement insurance is priced using three rating systems. Consider how each model affects future costs. Ask insurance representatives about the method used for each policy you’re interested in buying.

- Community-rated policies charge the same monthly premium to all policyholders. Premiums may rise due to inflation, but not age.

- Issue-age-rated policies are priced based on age when the coverage begins. Premiums do not rise due to age and cost less if you purchase when you are younger.

- Attained-age-rated premiums are based on your age when you apply for the insurance. The cost may be low at first but rises with age.

Note: When creating this guide, we provided general summaries of the companies and their reputations. It’s important to include your zip code and demographic details when comparing insurance coverage and the options available in your community. For this, we recommend using Medicare.gov’s plan comparison tool or consult an insurance expert for advice.

3. Know Your Options During Open Enrollment

“While certain times are more advantageous for enrolling in Medigap, you can technically purchase a Medigap plan at any time,” says Roger Fishel, financial advisor and retirement planner at Roger Fishel Financial. “However, it’s important to know the specific enrollment periods and rules that govern Medigap plans to make an informed decision.”

Most people buy a Medigap plan during their open enrollment period—the 6-month window that begins the first day of the month you turn 65 or older and enrolled in Medicare Part B. But those who are still working and have creditable coverage with their employer may choose to delay. Those with certain health conditions and people receiving disability benefits can enroll at other times.

“Regarding open enrollment, keep in mind that most (but not all) insurance companies use 180 calendar days to determine enrollment windows, which can be less than six calendar months,” says Matthew Claassem, Medicare expert and CEO of MedigapSeminars.org.

Because enrollment best practices are determined individually, we recommend consulting an insurance expert for specific advice.

What Is Medicare Supplement Insurance (Medigap)?

Medicare is government-funded healthcare insurance for Americans age 65 and up, but the program doesn’t cover 100% of your medical expenses. Medicare Part A covers 80% of inpatient care in hospitals and skilled nursing facilities, and Medicare Part B covers 80% of outpatient care and medically necessary supplies. Medicare Supplement (Medigap) insurance covers the remaining 20% not covered by Medicare.

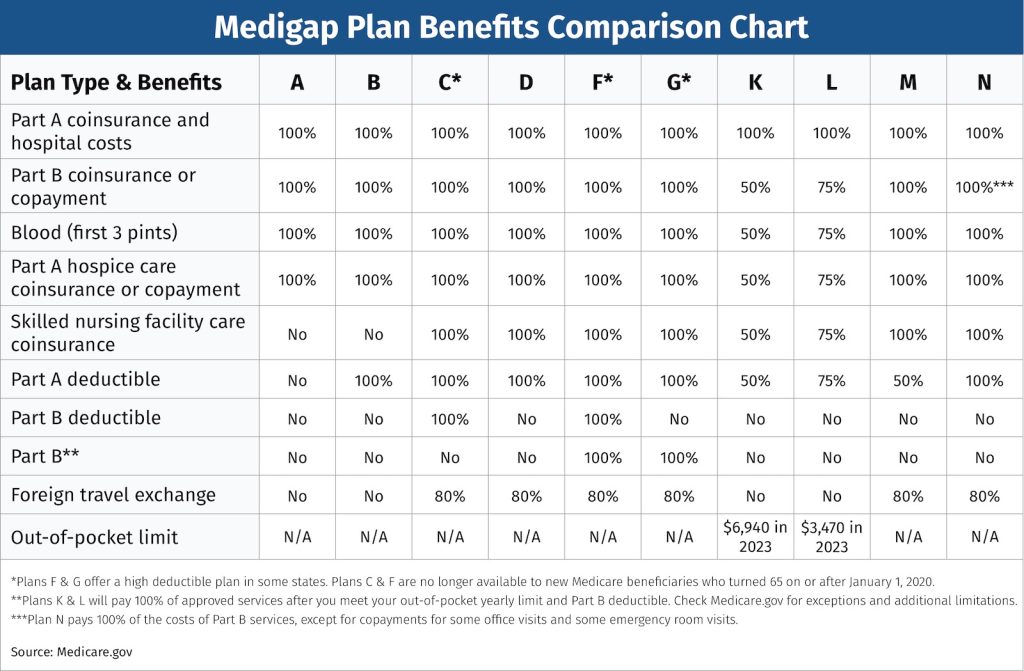

You are eligible to buy Medicare Supplement insurance during your Medigap open enrollment period if you are enrolled in Medicare Part B from a private insurance company. Medicare Supplement plans are standardized nationally—Plan K from UnitedHealthcare will have the same coverage as Plan K offered through Cigna. However, costs and the number of plans available vary by insurer.

What Do Medicare Supplement Plans Cover?

Medigap supplement plans cover the costs you’re still responsible for after Original Medicare Part A or B covers their portion. These costs can include:

- Deductibles

- Copayments and/or co-insurance

- Hospital costs beyond days covered by Medicare

- Skilled nursing facility costs beyond days covered by Medicare

Who is Eligible for Medicare Supplement Plans?

To be eligible for a Medicare Supplement plan, you must meet one or more of the following requirements:

- Already enrolled in Original Medicare Part A and Part B, but not a Medicare Advantage plan

- Age 65 and older

- Under 65 and receiving disability benefits

- Under 65 and diagnosed with amyotrophic lateral sclerosis (ALS)

- Under 65 and diagnosed with end-stage renal disease (ESRD)

- Under 65 and within their Medicare Supplement initial enrollment period (180 days of their Medicare Part B start date)

During this six-month timespan, you have guaranteed issue rights—also called Medigap protections—for a Medigap policy, which means an insurer cannot turn you down or charge higher premiums due to your medical history. You can still apply for a Medigap plan after the six-month window, but a provider can deny coverage or charge you more based on the medical underwriting of your application.

When to Buy Medicare Supplement Insurance

The best time to enroll in a Medicare supplement plan is within six months after enrolling in Medicare Part A and B.

Fishel states, “During this period, you have guaranteed issue rights, meaning that insurance companies cannot deny you coverage or charge higher premiums based on your health status. This is especially important if you have pre-existing conditions or a disability.”

You can still enroll outside the open enrollment period, but insurance companies can charge you higher rates or deny coverage based on your medical history. The only exception to this rule is if you lose other health coverage or if your existing coverage is being discontinued.

How to sign up for Medigap:

- Enroll in Medicare Part A and Part B. This step is required to purchase a Medigap plan. Once enrolled in original Medicare, there are no restrictions on enrollment periods for Medigap.

- Find insurance companies in your state by visiting Medicare.gov. Ensure the company is licensed to sell Medigap plans.

- Compare costs between providers. While the coverage will be the same, plan costs will vary based on the company as well as your geographic location, overall health, and age.

- Choose a Medigap plan that meets your needs and purchase your policy.

Benefits by Plan Type 2024

Each year, CMS adjusts the out-of-pocket (OOP) limits for Medigap plans K & L. For those enrolling in 2023 plans, those limits are $6,940 and $3,470. In 2024, the OOP limits will increase to $7,060 and $3,530.

** Check Medicare.gov for exceptions and additional limitations

The Most Popular Medicare Supplement Plans

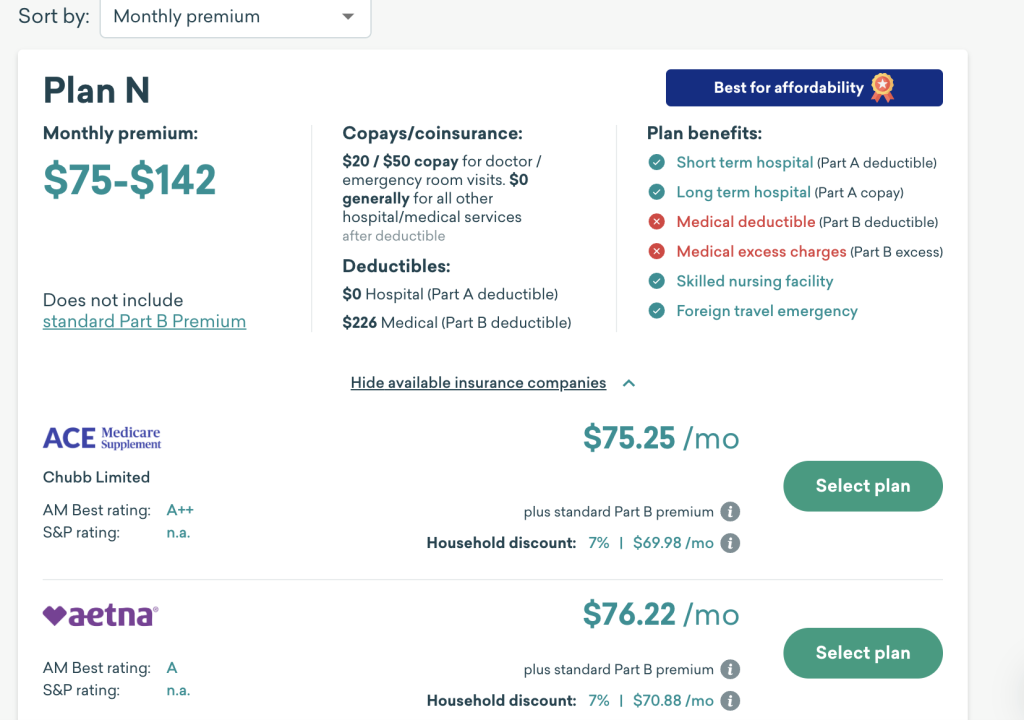

Medigap Plans F, G and N have high enrollment numbers and are the most popular types of Medicare Supplement plans. Plan K is the most affordable plan.

- Medicare Supplement Plan F is the most comprehensive Medigap option available because it covers 100% of medical expenses after Original Medicare pays its portion. However, the plan is no longer available to people new to Medicare.

- Medicare Supplement Plan G has become more popular with new enrollees, and it is most similar to Plan F. It provides 100% coverage on all Medicare-covered medical expenses after the Part B deductible is met. The monthly premium will be higher in exchange for more comprehensive coverage.

- Medicare Supplement Plan N is considered a good alternative to Plan G because it has a more affordable monthly premium. That said, it has up to $20 copays for doctor visits, and it doesn’t cover Medicare Part B excess charges. You might consider this plan if you are budget-conscious.

- Medicare Supplement Plan G-HD is the most affordable Medigap Policy. It covers 100% of your inpatient and outpatient Medicare care after you pay the $2,800 deductible for 2024. The $2,800 deductible is also your maximum out-of-pocket for inpatient and outpatient care for the calendar year. Original Medicare is your primary coverage and pays its share before you reach the supplement deductible.

Average Cost of Medicare Supplement Plans

The average monthly cost for a Medicare Supplement plan is just over $130, though average costs for individual plans vary based on your age, health, location, and provider. When considering these factors, Medicare Supplement plan costs can range from $35 to more than $460 per month.

To compare prices in your state, see our state-based Medicare Supplement guides below.

Generally speaking, you’ll pay the lowest premiums for plans with less coverage, like Plan K, Plan L or Plan G-HD. The least expensive plans for a 65-year-old female non-smoker might cost as little as $30 to $40 per month, but they’ll come with higher deductibles. On the other hand, plans that cover more, such as Plan F or Plan C, tend to have higher premiums.

When shopping for supplemental coverage, consider your healthcare needs now and in the future, as well as your current health status and your family history.

Medicare Supplement vs. Medicare Advantage

A Medicare Supplement policy is a supplement to Original Medicare coverage. It helps cover out-of-pocket costs like deductibles and coinsurance, and its consistent monthly premium allows members to accurately budget medical costs. Plus, members have more freedom to choose in-network doctors because supplemental plans cover all providers who accept Medicare.

While Medicare Advantage plans replace your Original Medicare with a privatized version, they also have vision, dental, and prescription drug coverage that make it a more all-in-one option. Most plans have a smaller provider network with potentially higher out-of-pocket maximums. In 2023, this is $8,300 for in-network health services and $12,450 for covered in-network and out-of-network services combined. For 2024, the maximum allowed out-of-pocket limit is $8,850 and $13,300, respectively.

David Walls, a Florida-based Medicare Broker and owner of D&D Insurance LLC, says there are a few reasons why someone might choose a Medicare Supplement plan over a Medicare Advantage plan.

“In my experience, customers who have many doctors have trouble finding a Medicare Advantage plan that works with their networks. If the customer travels a lot, such as living in an RV, networks would not be feasible. Finally, some customers want the peace of mind of not having copays, and can comfortably fit the Medicare Supplement premium in their budget.”

You can’t enroll in both a Supplemental plan and an Advantage plan. Medicare Supplement plans work alongside Original Medicare, not Medicare Advantage plans. So, you can not buy a Medicare Supplement plan if you are enrolled in a Medicare Advantage plan.

Read more: Best Medicare Advantage Plans

What about Medicare SELECT?

Some states also offer a Medigap policy called Medicare SELECT. While these plans typically cost less compared to other Medicare supplement plans, you must use only certain hospitals and doctors. Unless you require emergency services, these plans pay no benefits if you go out of the network.

Medicare Supplement FAQs

Do I have to purchase Medicare supplement insurance?

You are not required to buy Medicare supplement insurance. Without a Medicare supplement plan, you’re responsible for out-of-pocket costs, so it’s important to weigh your current and future healthcare needs to determine if Medigap is worth it.

When does Medicare Supplement open enrollment take place?

Medicare Supplement open enrollment is the 180-calendar-day period that begins the first day of the month you turn 65 or older and enrolled in Medicare Part B. Some insurance companies allow for a full six calendar months.

What if I’m 65 or older and still using my employer’s coverage?

If you’re working after age 65, you may choose to keep your employer’s health insurance coverage. Medicare Supplement open enrollment starts when you enroll in Medicare Part B, so you can delay enrollment until you retire. Just be sure your employer offers creditable coverage before delaying enrollment, says Walls.

“If your employer still offers ‘creditable coverage’ for you over the age of 65, you do not have to enroll in Medicare. I suggest talking to your HR department—even if they do offer creditable coverage for you after the age of 65, you may want to at least look at Medicare, because it’s often cheaper and/or better coverage.”

Can I get a discount on Medicare Supplement Insurance?

Yes, Medigap discounts vary by provider and plan. For example, you can get a cheaper rate if you are a non-smoker, live with another adult, and or pay annually or via electronic funds transfer. Other providers offer additional health and fitness perks alongside their insurance plans. When enrolling in a plan, always ask the company about discounts that may (or may not be) advertised.

Are all Medicare Supplemental insurance plans the same in every state?

There are 10 different plans available in the U.S., and federal law mandates that each plan carries the same coverage no matter where it is offered. That said, not all providers offer all plan types. For example, Mutual of Omaha only sells plans A, F, G and N.

The nationally standardized Medicare supplement plans are not available to Massachusetts, Minnesota, and Wisconsin residents. These states opted out of standardized plans and chose to offer their own plans they considered as good or better than the nationally standardized plans.

Is Medicare Supplement the same as Medigap?

Medicare Supplement insurance and Medigap are two terms used interchangeably to describe the same thing: extra insurance you can buy from a private company to help pay your share of out-of-pocket medical costs.

Conclusion

Bottom line: Medicare Supplement insurance coverage is one of the most critical health and financial decisions you make for retirement.

Talk to a representative and know your policy options before you buy Medigap insurance. Get the costs and benefits in writing. With transparent pricing, you won’t buy more coverage than needed or be surprised by steep increases later.

Buying a Medicare Supplement policy can be complicated. There are many choices available, and the right plan can significantly reduce medical costs. It’s ideal to have a friend or family member review the Medigap policy before you sign up.

| Expert Review | Company | |

|---|---|---|

| 1 | Great Savings | United Medicare Advisors |

| 2 | Great Perks | Humana |

| 3 | Great Network | Cigna |

| 4 | Great Advice | Mutual of Omaha |

| 5 | Great Online Marketplace | Medicare.net |

| 6 | Fast Comprehensive Quotes | CoverRight |

| 7 | Most Widely-Used Insurer | Blue Cross |

| 7 | Great Portal | Aetna |

| 9 | Easiest to Compare | SelectQuote Senior |

Medicare Supplement Companies By State

- Arizona

- California

- Georgia

- Illinois

- Massachusetts

- Michigan

- New Jersey

- New York

- North Carolina

- Ohio

- Tennessee

- Texas

- Virginia

- Washington

Related Medicare Supplement Resources

Readers of this Medigap guide content also read these related articles.

- Best Medicare Advantage Plans

- Do You Qualify for Medicare?

- Medicare Supplement (Medigap) Guaranteed Issue Rights

- How do Medicare Supplement Plans Work with Medicare?

- What Do Medicare Supplement Plans Cover?

- Do Medicare Supplement Plans Cover Foreign Travel?

- Medicare Advantage vs. Medicare Supplement Insurance Plans