EverSafe Review

As older consumers become more reliant on the internet—and thus, more vulnerable to fraud and theft—EverSafe helps you keep your finances secure. EverSafe co-founder and CEO Howard Tischler partnered with Elizabeth Loewy to combine their years of experience in financial services and credit management to combat the financial exploitation of seniors. The result? A comprehensive, robust technology platform designed to protect the finances, credit, bills, and real estate of seniors and caregivers.

Pros

- 30-day free trial for every level of protection

- Senior-specific monitoring

- Caregiver support is included in its most affordable plan

- Responsive 24/7 customer service

Cons

- No medical identity theft protection

How EverSafe Works

EverSafe is a personal detection and alert system that monitors your bank and investment accounts, credit cards and credit data 24 hours a day by analyzing daily transactions. This monitoring identifies any unusual activity compared to your normal spending patterns. EverSafe’s process stands out from other identity theft services due to its personalized and senior-specific features. Features include:

- Monitoring with personalized alerts: EverSafe uses analytics to build a custom profile based on your financial history. Places you frequent and the types of items you frequently purchase are monitored. When the system detects irregular activity, you get a personalized alert.

- Family dashboards: All family members or a group of people you choose can be consolidated into one dashboard.

- Designated “extra set of eyes”: EverSafe lets you choose a trusted friend, family member, caregiver or professional to assist with monitoring.

- Specialized monitoring services for seniors: EverSafe’s technology is developed by experts in aging and fraud. Its age-friendly software supports guardians, powers of attorney, conservators and trusts.

If an unusual transaction occurs, the EverSafe system immediately alerts you and an advocate you designate. Your advocate can be anyone you trust, like a family member, friend, financial or health professional. EverSafe’s enhanced algorithms provide broad protection for seniors for powers of attorney, guardians, conservators, and trusts. If your identity is compromised, EverSafe manages the resolution process and helps you create a recovery plan to restore your identity.

EverSafe Plan Costs

EverSafe can monitor bank accounts, credit cards and retirement investment accounts for identity theft and data breaches for a monthly fee, or a quarterly or annual plan with discounts. The company offers three programs with increasing levels of protection:

| Plan | Features |

| EverSafe Essentials: $7.49 monthly | -24/7 coverage -Email, text, voice or app alerts -Caregiver support -Financial advocate alerts -Monitors financial accounts to detect erratic activity and fraud -Additional credit card monitoring to detect interest rate changes |

| EverSafe Plus: $12.99 monthly | Everything in EverSafe Essentials, and -Monitor financial accounts for missing deposits, unauthorized accounts -Automatic bank balance notices and fraud resolution support -Advanced credit card monitoring detects fraudulent activity, bill payments, new credit card accounts opened -Fraud resolution support -Identity theft service includes Dark Web surveillance and change of address monitoring -Identity restoration with $1 million insurance -One credit bureau files monitored |

| EverSafe Gold: $22.99 monthly | Everything in EverSafe Plus, and -Credit monitoring of files with the three major credit bureaus plus a quarterly credit report and credit score -Monitor investment accounts to detect erratic investment activity, elder fraud, asset allocation changes and investment pattern changes -Real estate monitoring |

EverSafe Free Trial and Discounts

EverSafe offers a 30-day free trial on all plans. Multiple payment plans are available with discounts for buying a quarterly or annual subscription.

- People aged 60 and over get a 20% discount

- Yearly subscribers get a 15% discount

- A family plan is discounted by 40%

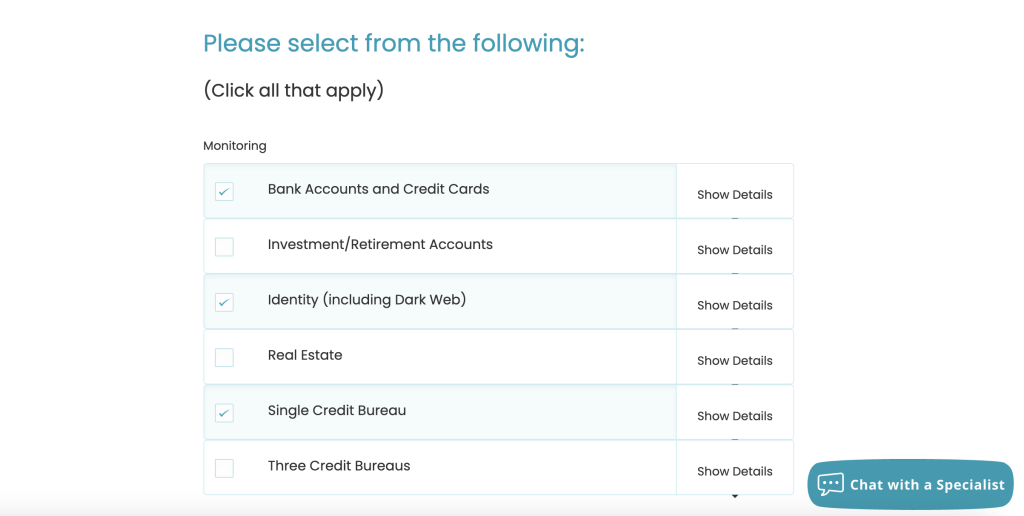

To start a free trial, EverSafe will ask you to choose the accounts you wish to monitor, such as credit cards, bank accounts, retirement and investment accounts, real estate, and your identity on the dark web. Then, you’ll determine who you want to monitor (i.e., yourself, someone else, or both). EverSafe will recommend a plan for you and include a 20% senior discount, if applicable.

EverSafe Customer Service

We called EverSafe customer service to get details about the products. The agent we spoke to was pleasant and knowledgeable and answered every question without a hard sales pitch. We believe EverSafe demonstrates its value enough during the free trial, so there is no need to push for a sign-up on the phone.

EverSafe Complaints

The Better Business Bureau (BBB) gives EverSafe an “A+” rating. It’s been accredited since 2013, and there are no complaints on file.

EverSafe is also the top-rated identity theft protection company on Retirement Living.com. One Philadelphia, Pennsylvania, reviewer says, “[EverSafe] does many things that other ID Theft companies do not. Their monitoring is based on your personal history, so it is much more comprehensive. And you can alert other people without them seeing your financial activity. Also, they answer the phone at all hours.”

Allsecurityreviews.com gives the company a 4.63 rating because they feel the basic plan should include more, but the site’s readers give EverSafe a 9.88 out of 10 rating.

EverSafe FAQs

How do I sign up for an EverSafe free trial?

Signing up for one of the free trials with EverSafe is easy. Start by visiting EverSafe’s website, where you can sign up for a free trial, chat with a specialist, or call the number on the website. Your protection will begin after you confirm your identity.

What can a thief do with my stolen personal or financial information?

Luckily, EverSafe helps protect your identity by monitoring financial accounts and alerting you and another person you choose the moment there’s suspicious activity. Here are the ways someone who steals your identity could use your information:

- Access your credit cards and other accounts

- Set up new loans or credit cards in your name

- Open utility and cellphone accounts

- Rent property

- Steal your tax refund

- File medical claims using your health benefits

- Identify themselves as you if arrested

How often does EverSafe monitor my accounts?

When you first sign up with EverSafe, the identity theft prevention service examines your past financial behavior to establish a profile of how you spend and save. Then, EverSafe analyzes daily transactions to identify activities outside your normal patterns. You and your advocate will receive an alert whenever suspicious activity shows up, like changes in spending, unusual withdrawals, missing deposits, irregular investment activity or late bill payments.

What happens if EverSafe discovers my identity or accounts were compromised?

If you are an EverSafe Plus or Gold member, the company will pay up to $1 million to help restore your identity.

Is it a hassle to cancel EverSafe?

Canceling your EverSafe account is easy. Email or call customer service any time you want to cancel your membership.

Conclusion

Identity theft is a big business, and protecting against this type of crime is a fast-growing industry. EverSafe results from personal experience with elder financial abuse, and the company keeps seniors and their families safe from fraud with the latest technology. Plan discounts make EverSafe affordable, so just about anyone can keep their retirement funds secure.