Patriot Gold Group Review

Patriot Gold Group specializes in Precious Metals IRA facilitation. A Precious Metals IRA is a self-directed IRA holding physical metals such as gold and silver coins as retirement assets in an IRS-approved storage facility. Precious metals IRAs are often used to diversify retirement investments, although some use this type of IRA to offset concerns about a future devalued dollar.

Patriot Gold works with their customers’ IRA custodians (typically a financial institution) and storage facilities to make buying or selling assets smoother. In many cases, a transaction requires only a single phone call from the customer. Without this facilitation, the IRA holder would need to spend quite a bit of time coordinating communications with the custodian, the broker, the shipping company, and the vault company separately. Patriot Gold Group handles this process to ensure that all steps are completed correctly, after receiving instructions from the customer.

Pros

- Specializes in Precious Metals IRAs and understands the process involved

- Investor Direct pricing

- Established in 2016

Cons

- Must call or fill out a form on the website to get adequate information

Gold and other precious metal IRAs are an investment and carry risk. Consumers should be alert to claims that customers can make a lot of money in these or any investment with little risk. As with any investment, you can lose money and past performance is not a guarantee of future performance results. Consumers should also obtain a clear understanding of the fees associated with any investment before agreeing to invest.

How to Start a Patriot Gold Group Precious Metals IRA

If you already have a self-directed Precious Metals IRA, you can contact a Patriot Gold Group representative to transfer your account. As a full-service firm, they can set up the transfer over the phone, e-sign documents, and open the account within 48 hours. Setting up a new account is a similar process that starts with filling out the application on the Patriot Gold Group website or calling a representative.

Patriot Gold Group will assist you in setting up an IRA or rolling over an eligible IRA. After you pay your fees and your accounts are established and funded, you can begin executing trade orders with Patriot Gold Group. Purchase timelines depend on the speed at which IRA custodians transfer funds, as is the case with all Precious Metals IRA trades. We recommend discussing fund transfer time windows with a few potential IRA custodians before selecting one. Once funds are received, trades will be completed within 48 hours. After purchasing the precious metals, orders are shipped to the vault company for storage, per IRS regulations.

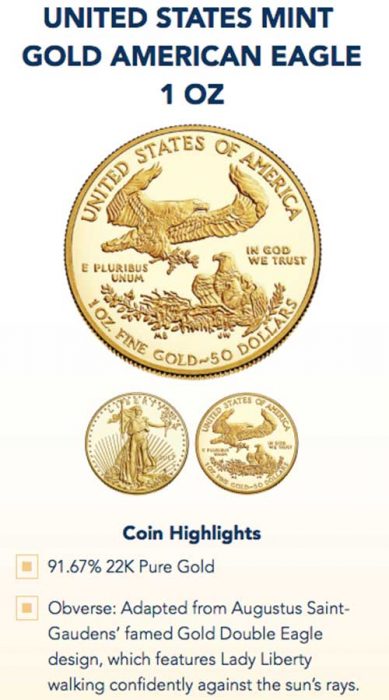

One perk Patriot Gold Group offers is investor-direct pricing. While some dealers add a percentage to the customer’s precious metals purchase as a fee, Patriot does not. We talked to a representative in February 2023 who explained the costs further. Gold RIA fees are tier-based. For example, Patriot Gold charges a one-time $225 setup fee for new Precious Metals IRAs but waives this fee for investments over $30,000. It also waives the first one to three years’ storage fees and reimburses the $260 first-year rollover fee. All IRA fees are waived for accounts over $100,000, while accounts over $250,000 can participate in the “No Fee for Life IRA.” This means Patriot Gold will pay shipping fees in and out of a depository or to your home. Custodians and storage facilities control their own fees, which are separate from Patriot Gold Group’s fees. Be sure to verify the fees for the types of transactions you intend to make through the IRA before setting up an account. Annual fees are due to the custodian for storage and insurance, and the amount of that fee depends on your account balance or transfer. Patriot Gold will work with any custodian, but they have an established relationship with STRATA Trust and Equity Institutional. We have noted some of their fees in the table below. Other custodial costs range from $5 to $250 for services such as taking a distribution from your IRA, document processing, terminating the account or making a wire transfer. While a wide variety of precious metals are available from Patriot Gold Group representatives, not all they sell are for IRAs. The Taxpayer Relief Act of 1997 limits metals allowable for self-directed or alternative-asset IRAs are limited to gold, silver, platinum, and palladium, as listed below: Silver: To be included in an IRA account, silver coins and bars must have a minimum fineness of .999 percent. Gold: To be included in an IRA account, gold bullion must have a minimum fineness of .995 percent with the American Gold Eagle being the only exception. Platinum and Palladium: Platinum for inclusion in an IRA must have a minimum fineness of .9995 percent. Patriot Gold sells precious metals in the form of bullion bars, bullion coins, and coins for IRA customers. As with most precious metals brokers, Patriot Gold Group also deals in coins and bullion that are available for purchase outside of a Precious Metals IRA. Some of these products are subject to specific reporting laws, so consumers are advised to understand the regulations attached to each purchase and the precious metals form they are considering. The parent company of Patriot Gold Group, Halt Gold Group, maintains an A+ rating with the Better Business Bureau (BBB). Patriot Gold does not have a separate listing with the BBB. Patriot Gold Group reviews on ConsumerAffairs show a five-star rating with only a handful of complaints out of the 128 reviews. Those complaints focus mostly on trading fee costs and coin value disputes. Facebook reviews total 4.4 out of five stars, and many customers used Google reviews to remark on how patient the representatives were when explaining Precious Metals IRAs. Do my precious metals have to be in the form of bars, or can they be coins? Can I choose any self-directed IRA custodian, or do I have to use Patriot Gold Group’s recommended companies? Can I choose any storage company, or do I have to use Patriot Gold Group’s recommended companies? Can I store my precious metals at home? Are the values of the precious metals I buy for my IRA guaranteed? Patriot Gold Group offers valuable assistance to those who are new to Precious Metals IRAs and to those who already hold this type of account. Self-directed IRAs containing assets like precious metals give consumers an option for diversifying retirement savings while receiving the tax benefits of a self-directed IRA. Patriot Gold Group facilitates the buying and selling of precious metals on behalf of the customer and coordinates transactions with the IRA custodian and with moving the assets to secure storage.

Patriot Gold Group’s value to the consumer is in time savings and avoiding hassles. With nearly 30 years in the precious metals business, they handle all of the paperwork and electronic tracking between custodian and vault to save the investor time and to ensure that the precious metals purchased are appropriate for an IRA. To learn more about Patriot Gold Group call 844-524-9001 or check out their website for a free information kit. Patriot Gold Group Costs

Minimum IRA Size

$50,000 minimum

Set Up Fee

$225 for investments under $30,000, otherwise free

Per-Transaction Fees

Depends on custodian. STRATA’s is $40 plus shipping

Storage and Insurance Fees

(depending on account balance)Strata Trust – $150, Equity Institutional – $180

Metals Available

Bullion and coins in gold, silver, platinum & palladium

Trading Hours

Monday through Friday, 7:30 a.m. to 5:30 p.m. PST

Patriot Gold Group Products

Patriot Gold Group Complaints

Patriot Gold Group FAQs

Only specific coins are approved for inclusion in precious metals IRAs. The IRS maintains a list of acceptable forms of precious metals for IRAs. Patriot Gold Group deals in both coins and bars for IRAs within IRS guidelines.

Patriot Gold Group works with any IRS approved self-directed IRA custodian within the United States. However, they do mention STRATA Trust Company and Equity Institutional as two of their choices in self-directed IRA custodian companies.

Patriot Gold Group works with two vault storage companies, DDSC of Delaware and Brinks Global. Patriot Gold Group can assist customers in getting accounts set up or contacting these companies for storage arrangements.

IRS regulations do not allow keeping your IRA-related precious metals at home or in a personal safety security box. An approved non-bank trustee or a bank must hold IRA assets within guidelines that restrict access and keep all precious metals segregated by the customer. These guidelines protect the investor so that the exact metals purchased are returned to that customer when they take a distribution from the account. Just like an IRA holding stocks, bonds or mutual funds, the access to the precious metals is restricted in specific ways to ensure legal deposit and disbursement transactions. Non-IRA precious metals purchases can be kept at home if the customer so desires.

Like all investments, the future value of precious metals cannot be determined or guaranteed. Prices rise or fall based on a variety of market influences. For example, the value of gold and silver rose significantly between 2000 and 2011, then experienced a downswing for the next few years before beginning to recover. Like most IRA investments, you will want to take a long-term approach to precious metals.Conclusion

19 Patriot Gold Group Reviews

Write Review