Peachtree Financial Solutions Structured Settlements Review

Peachtree Financial Solutions is one of the largest structured settlement companies in an industry that reached $1 billion in revenue in 2019. The company is a top pick in our Best Structured Settlement Companies Guide because the website thoroughly explains the process of selling your settlement to the company.

Beyond structured settlements, the company also buys payments from annuities and lottery winnings. Peachtree Financial’s most common buyouts are personal injury, medical malpractice, and wrongful death settlements.

Pros

- Each client gets a dedicated representative

- The Peachtree Promise enhances customer service

- Pays via check or direct deposit

Cons

- Up to six months between initiating a contract and receiving the payment

Structured Settlement Services from Peachtree Financial

Peachtree Financial provides a way for individuals with periodic payments (typically monthly) from a structured settlement to sell all or part of those payments in exchange for a lump sum payout. This cash may be used to pay down debt, buy a home, start a business, or for any other reason.

Peachtree guides consumers through the process of selling a settlement and obtaining the court approval required to do so. The company does not offer financial, legal, tax or investment advice and encourages clients to seek advice from specialists in these areas before pursuing a structured settlement sale.

Peachtree Financial Structured Settlement Process

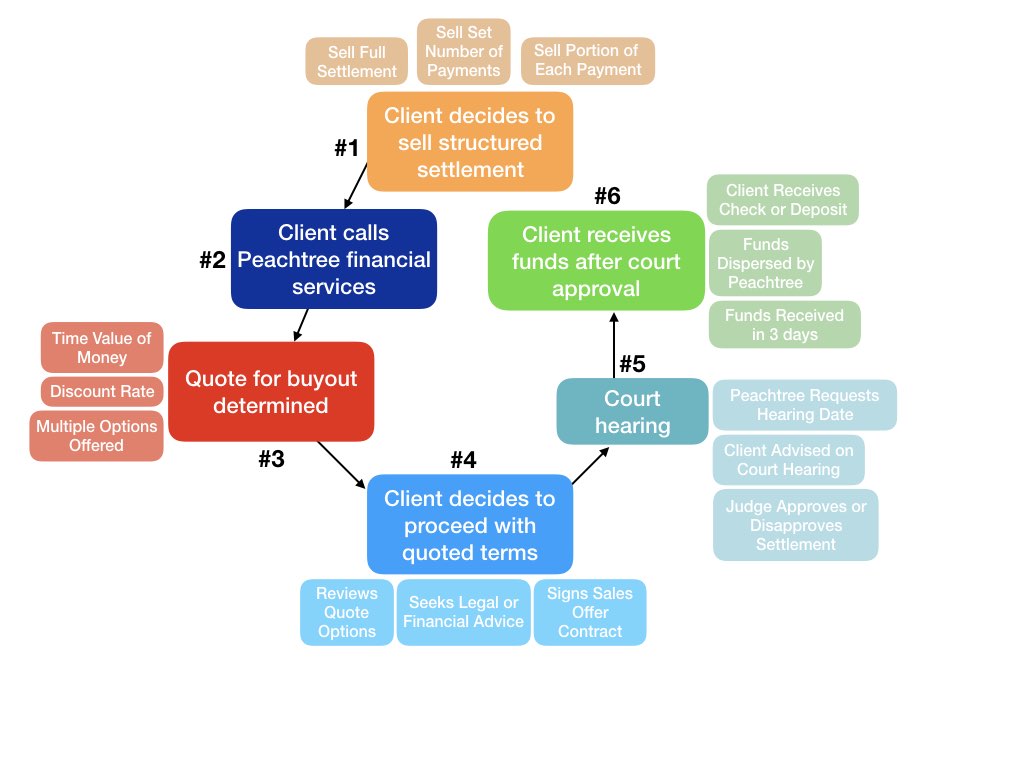

You can read the details about Peachtree’s process for purchasing a structured settlement on the company website so you know what to expect before you contact the company. The chart below represents the buyout process, options and decisions.

Peachtree Financial assigns one person to work with a client throughout the settlement purchase process. You do not have to explain your case every time you call because you work with only one representative who knows your case details.

The sale process can take months to finalize, but involves five steps:

- Client decides to sell structured settlement

- Client calls Peachtree financial services

- Quote for buyout determined

- Client decides to proceed with quoted terms

- Court hearing

- Client receives funds after court approval

Peachtree Financial Structured Settlement Purchase Options

With Peachtree Financial, you can sell all future structured settlement payments at once, or use a partial sale option to get one payout from the company while maintaining monthly income from the settlement. No structured settlement company pays dollar for dollar to purchase the payments. The company turns a profit by discounting the value of the payments, discussed later in this review. For example, you may sell $100,000 of the payments to a structured settlement company for $90,000.

- Complete Buyout: Peachtree Financial purchases all of your remaining settlement payments.

- Limited Number of Payments: You can sell some of your future payments if you need cash soon but do not want to lose the security of your regular structured settlement payments. For example, a consumer with a 40-year structured settlement suffers a life-threatening illness 10 years into receiving the payments. With 30 years left on the settlement, Peachtree Financial can buy the last 15 years of payments from the client, so they have enough money to pay medical bills. The client continues to receive settlement payments for 15 years, and then Peachtree takes over the final 15 years worth of payments.

- Portion of Payments: The client can sell a part of each monthly payment. Someone receiving a $1,500 monthly structured settlement payment can sell $500 of that payment each month. In addition to the lump-sum amount from Peachtree Financial, the client receives $1,000 from the structured settlement each month going forward.

What Does Peachtree Financial Pay for Structured Settlements?

The offer Peachtree Financial makes to buy a structured settlement varies based on several factors, including time value of money calculations and inflation adjustments, so quotes differ for each client. These formulas vary between structured settlement companies and are not standardized.

Peachtree Financial does not advertise a discount rate range, which is the percentage subtracted from a settlement’s value so the company can make a profit. We found the industry average discount rate to vary widely from 7% to 29%, and you’re getting a good deal at 10% or lower.

Peachtree Financial Solutions Structured Settlements Complaints

Peachtree Financial Solutions maintains an “A+” rating with the Better Business Bureau with four complaints, all closed, over the past three years. Two of those complaints were from consumers requesting to stop receiving advertisements from the company and had nothing to do with settlement buyouts. Over 100 customer ratings on ConsumerAffairs award Peachtree Financial an almost perfect 4.95 out of 5 stars. ConsumersAdvocate rates Peachtree Financial a 9.3 out of 10 stars, noting the company’s excellent customer service.

Peachtree Financial Solutions Structured Settlements FAQ

-

How long does it take to complete a structured settlement sale to Peachtree Financial Services?

Peachtree Financial attempts to settle structured settlement buyouts 60 to 90 days after receiving a completed sales contract from the client. However, it may take longer to finalize selling your structured settlement, depending on how long you have to wait for a court date. -

Do I need a lawyer to be able to sell my structured settlement to Peachtree Financial Services?

Some states require you have legal counsel before selling a structured settlement. Even if your state has no requirement, we recommend speaking to a lawyer about your plans. -

Do I have to appear at the court hearing to sell my structured settlement to Peachtree Financial Services?

Yes, you must be at the hearing in person to tell the judge why you want to sell your structured settlement annuity. This requirement is for your protection. -

Can I sell my settlement to Peachtree Financial Services if I sold part of it to another company?

Yes, you can sell a part or all of the remaining settlement regardless of having sold some of the annuity in the past. -

My settlement requires one person to receive payments. Can I still use the Portion of Payment option to sell to Peachtree Financial?

Some insurance companies only pay one entity at a time, and Peachtree has a solution so you can still sell your settlement. In these cases, Peachtree receives the payment, keeps their portion according to the buyout agreement and sends the remainder to you via a passback payment. The entire process happens very quickly, so you aren’t left waiting for your money. -

Can a judge deny the sale of my structured settlement to Peachtree Financial Services?

While most structured settlement buyouts get approved, the judge can deny the agreement if he or she feels that selling is not in your best interest. Reasons may include the judge determining you will have a greater need for the money in the future for ongoing medical bills, lack of genuine financial need or a history of financial mismanagement.

Conclusion

While selling a structured settlement may not be right for everyone, doing so is sometimes the best option if you need a large amount of money sooner rather than later. Be sure to seek independent legal and financial counsel before deciding to sell an annuity such as a structured settlement. If selling is a solution for your needs, Peachtree Financial Services provides one-to-one customer service to make the process less stressful, and the company is ranked highly by previous clients. Most structured settlement companies issue a check, but if you prefer direct deposit, Peachtree can do that.