Best Annuities

Updated:

Retirement Living takes an unbiased approach to our reviews. We may earn money when you click a partner link. Learn More

Annuities are a great way to generate income during retirement. Read about the best annuity companies, tips for investing and more.

- Great Marketplace

- Compare top annuities

- Low fees

Annuity Gator is an annuity marketplace, allowing customers to compare to annuities to find the best option. Independent annuity professionals provide honest advice, better products and personalized products for your situation.

- Great National Coverage

- Broad National Coverage

- Multiple Financial Tools

Based out of Baltimore, MD, Facet is a financial planning firm with national registration. Facet helps members of all budgets achieve their goals of financial freedom. Facet’s network of CFP® professionals can assist in the growth of your retirement, savings, wealth planning, or investment accounts.

AIG Direct

- Competitive pricing

- Custom plans available

- High coverage amounts

Some AIG plans do not require a medical exam, and you can also choose several term lengths. AIG offers guaranteed issue whole life insurance for those between the ages of 50 and 85.

- Great Asset Accumulation

- Affordable deferred fixed annuities

- Trade and rebalance without penalty

Fidelity offers three classes of annuities. If you own an annuity and want to switch it to Fidelity, you can get a tax-free, low-fee exchange with their Personal Retirement Annuity.

- Quick & Simple Process

- Rates starting at 3.15% APY

- Fully digital application process

Gainbridge is a modern insurance agency that allows individuals to purchase annuities through a fully digital process. Customer support representatives are highly rated, licensed representatives available to help with any questions. Gainbridge annuities are issued by Guggenheim Life and Annuity Company.

- Top Financial Strength Rating

- High financial strength rating

- Live customer service representatives

MassMutual has one of the best financial strength ratings in the industry. It offers five types of annuities and is best for those who are new to annuities and how they work.

- Great Technology

- Fixed and income annuities

- Easily compare annuity rates in real-time

Blueprint Income specializes in simple fixed and income annuities and delivers the best digital experience in the industry. Blueprint Income is appointed to sell products from more than 30 insurers. The company has hundreds of reviews and is rated 4.8/5.0 stars by an independent third-party site.

Compare Top Annuity Companies

From 401(k)s to multiple types of IRAs like Traditional, Roth and even Precious Metals IRAs, there’s no shortage of retirement planning options for you to look into. Annuities are another great option you might not know much about but can help you with having a steady income during your retirement. Let’s take a look at what annuities are, how they work and the top three annuity companies on the market.

We selected the three best annuities companies after researching and evaluating 20 of them. We stacked their ratings from independent companies, benefits, commissions, fees and the financial health of the insurance companies that back the annuities against each other for our evaluations. The annuities companies that ranked highest are AIG, Fidelity and MassMutual. In this guide, we will discuss the types of annuities, share tips for choosing one that will fit your needs and we’ll share our detailed evaluations of the top annuities companies. You will also find helpful frequently asked questions about annuities in this guide.

Top tips:

- If you buy an annuity when interest rates are low, you’ll get less value overall. Wait to buy until rates increase

- You can transfer all or a portion of your 401(k) or IRA into an annuity

- Look for and pay attention to words like “surrender charges” and “withdrawal rates” in the contract

Tips for a Wise Annuity Buyer

Investing a lump sum with one of our best annuity companies today will lead to a steady monthly cash stream in the future. As with any investment, it is essential to be informed and to understand the costs and the income. Wise investors research the market, annuity companies, types of annuities available, benefits and risks as well as the fees and commissions. The ins and outs of some annuities are so intricate that even the most seasoned investor can find themselves scratching their head wondering what the best choice is.

What Is An Annuity?

If you’re new to annuities, start with knowing what this type of investment is: cash invested as a lump sum to produce a monthly income stream for life or a fixed period. The monthly income starts right away if you buy an immediate annuity, or in the future, if you buy a deferred annuity. A deferred annuity provides more substantial payout than an immediate annuity since the backing insurance company has more time to invest your funds. Pension funds are annuities, although this retirement benefit is rarely offered by employers anymore. Social Security is another example of an annuity.

Who Should Invest In An Annuity?

Annuities are best suited those who have maxed out tax-deferred contributions to 401(k) plans and IRA plans. The Internal Revenue Service (IRS) defines the maximum allowable contributions to pretax 401(k) and profit sharing plans, and both Roth and traditional IRAs. According to the Insurance Information Institute, there are no limits on the amount that you can invest in an annuity.

IRA and 401(k) accounts have hardship withdrawal or loans features if you need money for medical care, education and some other expenses. An annuity is not as flexible; once you make a deposit, the contract locks into a surrender period of two to over 10 years where you will pay fees along with a tax penalty if you withdraw any of the money.

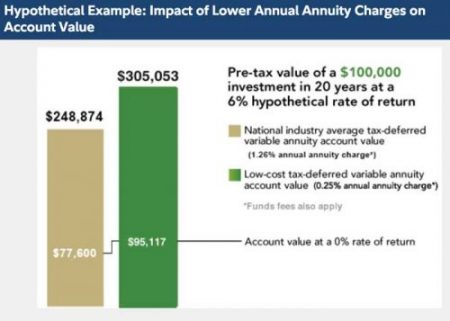

Annuities carry annual fees, transfer fees, expense risk charges and other fees. Investor.gov explains more about annuities fees with information from the Security and Exchange Commission (SEC). Be prepared to compare the expenses of retirement accounts or see an independent financial planner for guidance.

There are a few types of annuities, like tax-sheltered, singled life, or joint. Low-cost fixed or variable annuities are often the best option as a part of a retirement portfolio. Monthly payments will fluctuate with a variable annuity, while fixed annuities pay out one monthly amount. No annuity is protected or insured, but they are considered safe investments.

Annuity Types

There are two main types of annuities: Deferred and Immediate. Within these two main categories, your annuity can either be fixed or variable depending on whether your payout is a fixed sum tethered to the market’s overall performance, a group of investments or a combination of the two.

- Deferred Annuity – If you choose a deferred annuity, your money is invested for a predetermined period of time until you hit retirement and are ready to start making withdrawals.

- Immediate Annuity – With an immediate annuity, you’ll start getting payments sooner after you’ve made your initial investment. Immediate annuities are good for people approaching retirement age.

Another way to look at the two is, a deferred annuity accumulates money over time while an immediate annuity pays out fairly quickly.

Annuities And Income Taxes

The main upside to annuities is that they guarantee an income stream and are safe investments. You pay no income taxes until you start to receive payouts in retirement when your income should be lower. If you use pretax dollars from an existing IRA or 401(k) to buy an annuity, the payout will be fully taxed. If you buy an annuity with after-tax dollars, you will not pay taxes on the payout portion of your original investment, only the gains. Taxes are assessed at the regular income rate and not the capital gains rate.

The downside to annuities is that they are elaborate financial instruments that come with various fees and costs. You should seek professional assistance to help you choose the type that works best with your retirement portfolio and understanding future tax implications.

When to Invest In An Annuity

Experts will tell you an annuity is not the first or even second retirement investment you should make. Max out other retirement savings accounts that offer tax-deferral or contribution matching. As a general rule, you should be investing at 15 percent of gross income in these accounts before you consider an annuity. To determine eligibility for Roth and traditional IRAs, see the IRS retirement plan rules.

| Order of Retirement Fund Investments | |

|---|---|

| 1. Employer Plan with Matching | If your employer matches contribution to a 401(k) or 403(b) or other employer plans, contribute up to the maximum matching. |

| 2. Roth IRAs | Contribute to a Roth IRA with after-tax income (withdrawals are tax-free after the age of 59½). First, determine if you are eligible for a Roth. If you’re not eligible, skip to the next option. |

| 3. Employer Plan | Contribute the maximum allowed for the remainder non-matched portion of your employer-based plan. |

| 4. Traditional IRA | Withdrawals will be taxed at a lower rate since your income will likely go down in retirement. |

| 5. Annuity | Contribute to a tax-deferred annuity. You can invest in an annuity within an IRA if you prefer. |

- We searched and came up with an extensive list of 20 companies

- We evaluated annuity companies based on our expert-guided buying criteria: independent ratings, benefits and fees, commissions, and the financial health of the insurance companies that back the annuities

- We provided you the best annuities companies for consideration

Annuity Company Reviews

You can buy annuities directly from the insurance companies that issue them, or from independent brokers, banks and other financial groups. With over 40 major insurance firms issuing annuities and hundreds selling them, knowing where to start your search can be daunting. Luckily, we did the hard work for you. Our in-depth annuity analysis focuses on each company’s industry reputation, the variety of offerings and other criteria.

We researched the top 20 annuity companies, then narrowed the list to our top three based on specific criteria we set by extensive research of government and consumer information on investing wisely to get the best of both worlds — benefits now and benefits down the road. The result was a list of three of the best annuity companies.

After our evaluation, we chose the best annuities companies. Each of these companies stood out above the competition.

Fidelity Annuity Review

Great Asset Accumulation |

Founded in 1946, Fidelity is known as one of the world’s most successful retail investment services firms, known for many firsts in the industry. Fidelity was the first to offer a web-based wealth management platform, money market funds with check writing features and was the first mutual fund company with a website.

Fidelity offers three classes of annuities:

- Asset Accumulation: Fidelity Personal Retirement Annuity (minimum investment $10,000) or Deferred Fixed Annuities (minimum investment $5000).

- Asset Protection: For transitioning into retirement, Fidelity’s Deferred Income Annuities (minimum investment $10,000) and New York Life Clear Income Fixed Annuity – FP Series (minimum investment $50,000) are worth considering.

- Income Generation: If you’re already living in retirement and want to make sure you don’t outlive your money, Fidelity offers Immediate Fixed Income Annuities (minimum investment $10,000).

MassMutual Annuity Review

Top Financial Strength Rating |

With over 165 years of insurance and investments experience, MassMutual has one of the best financial strength ratings in the industry. Respected financial strength rating companies give MassMutual high marks. A.M. Best posts a superior A++ rating, Moody’s rating is Aa2 (excellent), and Standard & Poor’s rank is AA+ or very strong.

MassMutual offers five different types of annuities:

- Deferred Fixed Annuity: This option has a guaranteed fixed interest rate, tax-deferred growth and principal protection.

- Variable Annuity: This annuity option has tax-deferred growth potential, a range of investment choices but has a potential for loss in value.

- Fixed-Index Annuity: This option has tax-deferred growth or, if you elect the guaranteed lifetime withdrawal benefit, you can meet predictable income goals.

- Immediate Income Annuity: As the name suggests, this option is best for those with immediate income needs. Guaranteed income starts within 13 months of the issued contract.

- Deferred Income Annuity (DIA): This option is best for future income needs.

AIG Annuity Review

Great Industry Innovator

In the midst of the 2008 worldwide financial crisis, AIG became the poster child for everything the pundits said was wrong with Wall Street, insurance, banking, and economy when they accepted a $182 billion bailout from the U.S. government. Not quite five years later, AIG repaid that debt with an additional $22.7 billion from profits. The company invests in analytical tools as well as client-focused experts and has garnered a Business Innovation Award annually for the past eight years.

Today, nearly 2.5 million people trust AIG companies to help them prepare for retirement. AIG’s annuity products offer something for everyone regardless of whether you are in the early stages of saving, already in retirement, or somewhere in between.

- Polaris Variable Annuities Two options for Polaris Variable Annuities offer growth potential, family protection features, and a variety of optional retirement income protection features.

- Index Annuity Products This option is great for those who are planning for retirement or seeking guaranteed lifetime income. Three types of Index Annuity Products offer growth potential based in part on the performance of a market index.

- Assured Edge and American Pathway Annuities offer guaranteed interest earnings, protection from market volatility, tax-deferred growth and access to your money.

- American Edge Immediate and Deferred Income Annuities offer a predictable income stream with flexible payout options.

Related Annuity Resources

Readers of this Annuities guide also found these related articles helpful.

5 Mistakes To Avoid When Looking for Annuities

Read about the 5 mistakes you should avoid when exploring the annuity market.

Pros and Cons of Retirement Annuities

Are you interested in annuities for Retirement? Read about the pros and cons of Retirement Annuities.

Life Insurance vs Annuities

If you have been researching Life Insurance and annuities read more to learn about the similarities and differences between life insurance and annuities.

More Related Articles

Frequently Asked Questions about Annuities

I already have a 401(k) or an IRA so why should I consider an annuity?

According to the IRS, the maximum 401(k) contribution in 2023 for employees who participate in 401(k), 403(b), most 457 plans and the federal government’s Thrift Savings Plan is $22,500. The contribution limit for IRAs for 2023 is $6,500, or up to $7,500 if you’re age 50 or older. Since deferred annuities have no IRS contribution limits, you can invest as much as you want for retirement as a tax-deferred investment.

What are the two phases of annuities?

The two phases of annuities are the accumulation phase and the distribution phase. During the accumulation phase, you put money into the annuity with a lump sum, monthly payments or a combination the two. Your investment grows during this phase. The distribution phase, also known as the annuity phase or the annuitization phase, is when you start receiving payments from your investment.

What is a surrender period?

The surrender period is the length of time an investor has to wait to withdraw funds from an annuity without incurring some fees or income tax penalties. Depending on the contract terms, this can be years.

What happens to my annuity when I die?

What happens to an annuity after the death of the owner depends on several factors. The first and most important is whether or not the owner has a rider that allows the selection of a beneficiary, or death benefit clause. With the clause, the beneficiary (or beneficiaries) will have three ways to receive payments after the owner’s death.

What happens to my annuity when I die?

What happens to an annuity after the death of the owner depends on several factors. The first and most important is whether or not the owner has a rider that allows the selection of a beneficiary, or death benefit clause. With the clause, the beneficiary (or beneficiaries) will have three ways to receive payments after the owner’s death:

-

Lump Sum Distribution– beneficiaries receive the funds as a lump sum amount.

-

Non-Qualified Stretch– beneficiaries receive minimum payments stretched over their life expectancies.

-

Five-Year Rule– beneficiaries can withdraw amounts during a five-year period or withdraw the entire sum in the fifth year.

Without the clause, the funds revert to the insurance company.

When should I buy an annuity?

Once you determine that an annuity is a sound idea for your retirement portfolio, the earlier you buy into a deferred annuity contract, the higher the monthly income stream will be. A difference of 10 years between making a lump sum investment into an annuity can mean the difference of hundreds of dollars a month in income.

Conclusion on Annuities

Bottom Line:

Do your homework before investing in an annuity and take the time to read plan documents and to ask questions until you understand how the annuity you’re considering works.

You will need to know how much the investment will cost in fees and possibly penalties, and how much you can expect to receive once you retire.

Annuities are an investment option that can work well but are not appropriate for all retirement savings plans. Creating a tailored investment plan for you and your family is never “one size fits all” and should be methodically planned out with the advice of professionals.

The Best Annuity Companies

| Company | Expert Review | |

|---|---|---|

| 1 | Blueprint Income | Great Technology |

| 2 | Gainbridge | Quick & Simple Process |

| 3 | Annuity Gator | Great Marketplace |

| 4 | AgeUp | For Seniors & Their Families |

| 5 | Facet Wealth | Great National Coverage |

| 6 | Fidelity Annuities | Great Asset Accumulation |