Preserve Gold Review

A family-owned and operated business, Preserve Gold caters to both first-time and experienced investors. The company can help you set up a gold IRA or buy precious metals for physical possession. Customers have lifetime account support from a dedicated wealth preservation specialist. They will also have access to exclusive market research and analysis.

Pros

- Lower minimum investment requirement

- Will price match competitor pricing

- Competitive buyback program

Cons

- Limited fee information online

Gold and other precious metal IRAs are an investment and carry risk. Consumers should remain alert to claims that customers can make a lot of money in these or any investments with little risk. As with any investment, you can lose money. Past performance is not a guarantee of future performance results. Consumers should also gain a clear understanding of the fees associated with any investment before agreeing to invest.

Preserve Gold Features

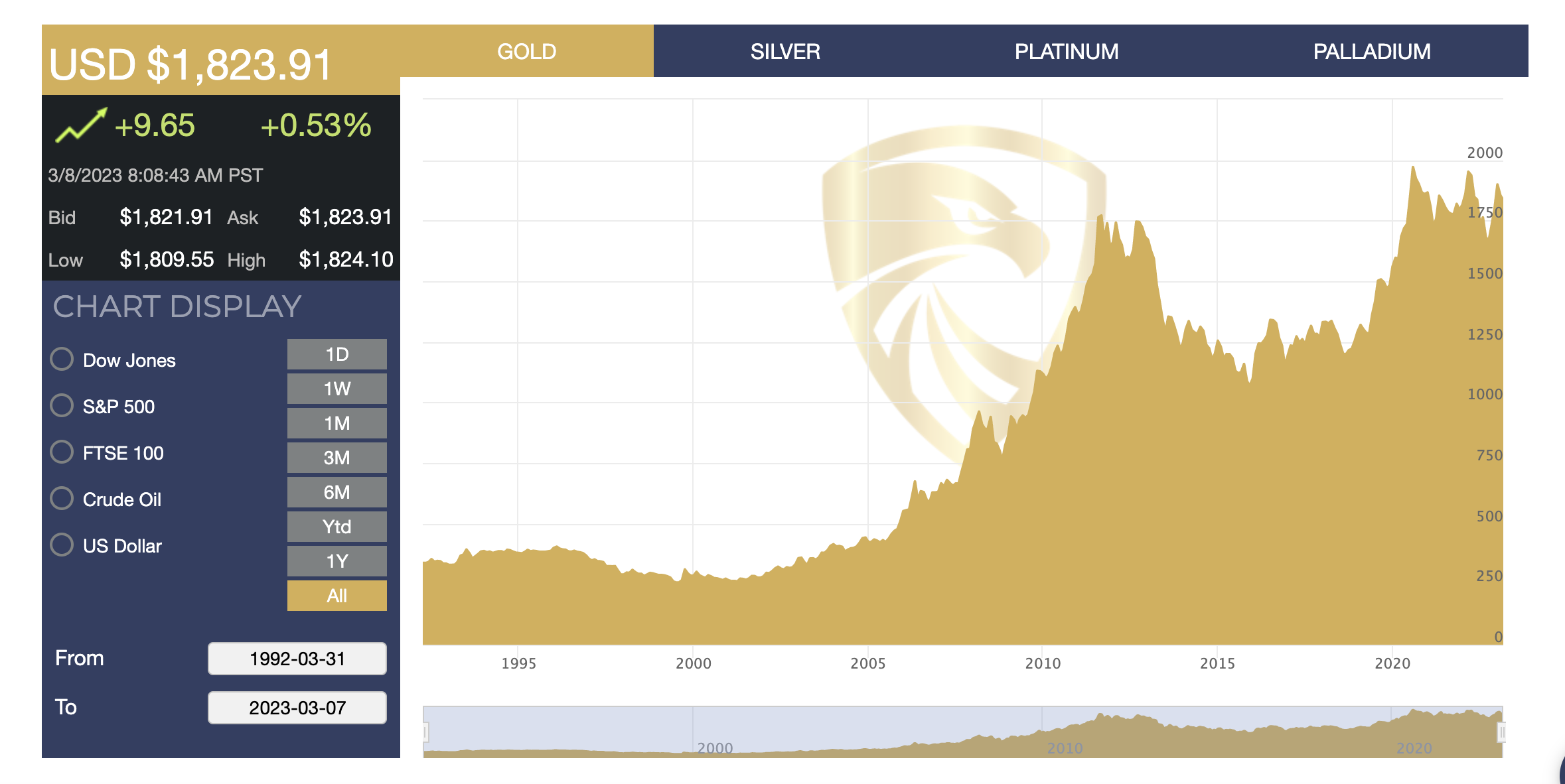

Preserve Gold is a full-service precious metals IRA dealer that has an extensive catalog of gold, silver, platinum, and palladium coins and bars available for purchase. Customers can browse current precious metal pricing on its website.

Preserve Gold offers various promotions for new customers. The current promotion, available at the time in which this article was written, is for $25,000 in free gold and silver to qualified investors:

- Metals: Gold, silver, platinum, and palladium bars and coins

- Minimum investment: $10,000

- Fees: Setup, annual account maintenance

- Storage options: Texas Precious Metals Depository, Delaware Depository, International Depository Services

If you’re just starting to explore the gold market and its potential for investment, Preserve Gold has several eBooks, informational kits, and market outlooks available for download on its website. Gold IRA experts constantly update this information. Based on the products you are interested in and your investment goals, Preserve Gold specialists can also suggest educational materials tailored to you.

Starting a Preserve Gold IRA

You can open a self-directed IRA with Preserve Gold in three steps. First, you’ll chat with a precious metal specialist. Preserve Gold’s trained experts follow a “no-pressure sales strategy” to answer your questions and help you select the right metals for your IRA.

Next, you’ll file paperwork. Once your paperwork is complete, the funds will automatically transfer to your account within three business days. Lastly, you’ll buy your metals and choose where to store them—either at home or in an IRA-approved vault.

Eligible gold IRA accounts include:

- Traditional IRA

- Roth IRA

- Traditional 401(k)

- Roth 401(k)

- Thrift Savings Plan (TSP)

- 403(b)

- 457(b)

- Simplified Employee Pension (SEP)

- Savings Incentive Match Plan for Employees of Small Employers (SIMPLE)

- Tax-Sheltered Annuity (TSA)

Preserve Gold Costs

To understand the fees associated with opening a Gold IRA, we asked a Preserve Gold representative for an explanation. Preserve Gold does not charge any fees, but its IRA custodians, Goldstar and Horizon, do. Goldstar charges an account setup fee of $50 plus an annual fee of $175. Horizon has a $200 setup fee and a $200 annual fee. Preserve Gold will pay the following fees for you in certain instances:

- IRA rollovers of $20,000+: Account setup fee is waived

- IRA rollovers between $50,000 and $99,000: Account setup and annual fee waived for one year

- IRA rollovers between $100,000 and $249,999.99: Account setup and annual fee waived for two years

- IRA rollovers of $250,000+: Account setup and annual fee waived for three years

Those who choose to store their gold in a depository get free shipping and insurance. Preserve Gold’s buyback commitment also includes zero liquidation fees.

Preserve Gold’s current new customer promotion (as of March 2023) includes up to $25,000 in free gold and silver given as 1% of your overall order. For example, if you purchase $1,000,000 in gold or silver as a new customer, you would get $10,000 in free gold or silver. If you purchase $2,500,000, you’ll get $25,000 in free gold or silver.

Preserve Gold Distributions

When you’re ready to withdraw from your IRA, you can take possession of your physical gold. To avoid penalty, you must wait until you are 59 1/2 years old to liquidate the metals in your IRA or take possession of them.

At age 72, you must take the required minimum distribution. With a Gold IRA, you can take RMDs “in kind,” meaning that you have the physical precious metals sent directly to you. You can also choose to sell the precious metals and take distributions in cash.

We used Preserve Gold’s required minimum distributions calculator to estimate RMDs based on several typical IRA account balances.

| IRA Balance | Age | Estimated Annual RMD |

|---|---|---|

| $50,000 | 72 | $1,824.82 |

| $100,000 | 72 | $3,649.64 |

| $150,000 | 72 | $5,474.45 |

| $200,000 | 72 | $7,299.27 |

Our Experience With Preserve Gold

Overall, our experience with Preserve Gold was positive. Most importantly, we liked that the company website displays interactive price charts that depict the current spot price of precious metals. This is a great feature that can help customers gauge investment potential. We also found the publicly available required minimum distribution calculator to be a helpful tool. These elements of transparency make Preserve Gold a great company for first-time investors and seasoned professionals who want to make a plan and budget for their investments before buying.

While the website lacks detailed information about fees, company representatives were quick to respond to our inquiries with cost details. Compared to other gold companies, Preserve Gold offers more incentives and savings.

To get the true customer experience, we requested an informational investors kit, which is available to those who submit contact information. We browsed two detailed and informative eBooks that clearly explained how to invest properly in gold. We also found the regularly updated market outlook (the latest 2023 version is coming soon), which details how inflation and the macroeconomy can affect the gold market, to be helpful. For investors who are looking for more tailored information, Preserve Gold specialists can share educational materials specific to their unique portfolios.

Preserve Gold Complaints

Reviews for Preserve Gold echo the company’s commitment to lifetime customer support and education. Preserve Gold has a 4.4 out of 5 rating on Trustpilot. Several reviewers praised Preserve Gold specialists for their timely follow-up customer service after the sale. The Better Business Bureau gives the company an A- rating and 4.9 out of 5 stars, with no complaints on record.

Preserve Gold FAQs

What metals does Preserve Gold offer?

Preserve Gold sells IRA-approved gold, silver, platinum, and palladium in physical form. You can also buy these precious metals for home possession.

What are the typical Preserve Gold fees?

Preserve Gold custodians charge setup and annual fees of up to $200 each, though Preserve Gold will waive these fees for a limited time, depending on the rollover amount.

Can I keep my Preserve Gold metals at home?

While you can keep precious metals at home, they may be best kept in an IRA-approved depository vault that protects your assets against loss or damage.

Where is Preserve Gold stored?

Though you can securely store your gold in a depository of your choice, Preserve Gold works with Texas Precious Metals Depository in Shiner, Texas; Delaware Depository in Wilmington, Delaware or Boulder City, Nevada; and International Depository Services in Dallas, Texas or New Castle, Delaware.

Does Preserve Gold buy back coins?

Yes, Preserve Gold’s buyback commitment includes zero liquidation fees for existing customers.

Conclusion

Preserve Gold is a reputable gold IRA company for investors of all experience levels. You can chat with one of the knowledgeable, friendly company specialists to learn more about how to invest wisely.