American Hartford Gold Review

Gold IRAs are useful for diversifying retirement savings in a tax-deferred account. Experts at American Hartford Gold assist consumers throughout the buying and selling process of precious metals. The company’s industry experts deliver quality customer service backed by extensive historical investment data and current market research. American Hartford Gold is part of our list of best gold IRA companies because its dedicated precious metals specialists will guide you through a simple three-step process to set up a gold IRA.

Pros

- High priority placed on customer service, trust, integrity and compliance

- Client exclusive buyback program reduces liquidation fees

- Lowest price guarantee and complete disclosure of costs before final sale

- Free consultation with a precious metals specialist

Cons

- Coin prices not listed on site, must contact a representative

- No platinum or palladium for self-directed IRA

Gold and other precious metal IRAs are an investment and carry risk. Consumers should be alert to claims that customers can make a lot of money in these or any investment with little risk. As with any investment, you can lose money and past performance is not a guarantee of future performance results. Consumers should also obtain a clear understanding of the fees associated with any investment before agreeing to invest.

How to Open an American Hartford Gold IRA

To open a Gold IRA, submit the form provided on the American Hartford Gold website or call the number listed. A product specialist will help you complete the necessary paperwork to open a self-directed IRA. Next, initiate a gold IRA rollover or funds transfer to the new IRA. You can transfer many types of retirement savings accounts to an American Hartford Gold Precious Metals IRA, such as traditional and Roth IRAs, a 401(K), and a 403(B), among others.

Once you fund the gold IRA, speak to an account executive at American Hartford Gold for guidance in selecting IRS-approved precious metals for your account. You can buy gold and silver.

After age 59 1/2, you can liquidate a precious metals IRA by cashing out the funds or taking physical possession of the metals. American Hartford Gold recommends holding precious metals for at least five to ten years for optimum returns.

| Investment | Characteristics |

|---|---|

| American Eagle Gold Coin | Minted only with gold mined in the U.S.; easiest to buy and sell in the U.S. |

| American Buffalo Gold Coin | 24 karat, purest gold coin from the U.S. Mint. Carries a face value but trades at a higher value. |

| Canadian Maple Leaf Gold Coin | At .99999 purity, contains virtually no base metal. Gold mined in Canada. |

| 1 oz. Gold Bar | Includes MintMark SI security feature to prevent counterfeiting. |

| Valcambi CombiBar Gold or Silver Bar | Manufactured with breaking points and can be divided with 50 or 20 divisions per ounce. |

| American Eagle Silver Coin | The only silver coin allowed in IRA accounts, $1 face value, trades higher based on silver content. |

| Canadian Maple Leaf Silver Coin | 99.99% pure silver, holds face value for transactions but typically valued much higher for investment. |

| 10 oz. Silver Bar | .999 pure, various designs available from a variety of approved mints. |

American Hartford Gold Costs

American Hartford Gold does not charge fees to set up a gold IRA or roll over a retirement account to a gold or precious metals IRA.

The website publishes a catalog of its products for sale; however, prices are not listed in the catalog. Customers must speak to a representative for current pricing information.

Investors must pay an annual IRA fee of $75 for accounts valued at $100,000 or less and $125 for accounts valued at $100,001 or more. There is also an annual depository storage fee with the depository, which is usually a flat $100 charge.

Currently, the company is offering several promotions, including free insured shipping and up to $10,000 of free silver on qualifying purchases. The company offers first year IRA fees waived for purchases over $50,000, and three years of IRA fees waived for purchases over $100,000. AHG will typically cover storage fees for your first year and, in some cases, up to three years, depending on the account size. However, you can open an IRA through American Hartford Gold with $10,000. The minimum for cash purchases is $5,000.

Storage Options for American Hartford Gold

Because gold IRAs hold physical precious metals, the IRS recommends investors store the bars, coins or bullion in an IRS-approved depository. American Hartford Gold account representatives commonly recommend Brinks Global Services, International Depository Services (IDS) or Delaware Depository Service Company, which have locations nationwide. You can elect to keep your precious metals segregated from others stored at the depository.

American Hartford Gold BuyBack Commitment

Not all gold IRA companies offer a buyback plan, but American Hartford Gold does. The commitment allows customers to sell their precious metals while avoiding additional liquidation fees. American Hartford Gold will arrange the shipment before issuing a payment. Check with your account executive to see if you can take advantage of the “BuyBack Commitment.” You can save money on fees with added convenience if you are eligible.

American Hartford Gold IRA Customer Support

As a testament to their customer service, you will find plenty of general information about gold IRAs on American Hartford Gold’s website. If this is a new type of investment for you, the company makes precious metals catalogs available on the site, along with these resources:

- Expert analysis and fact sheets about gold and silver

- A wealth of gold market news articles

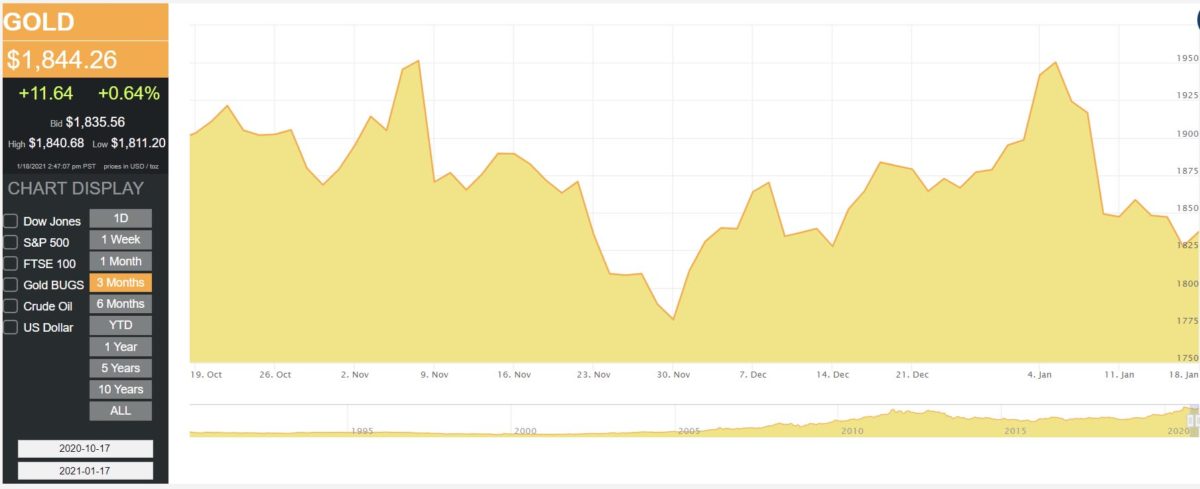

- Price charting tools for gold, silver and platinum

- Real-time gold, silver and platinum prices

Dedicated precious metals specialists offer best in class customer service and focus on your total satisfaction with the process. You are always welcome to call to ask questions, use the online chat to communicate with a representative, or complete a brief form on the website to receive a free investment guide via email. The guide has answers to common questions about purchasing precious metals and establishing a Gold IRA.

Our Experience With American Hartford Gold

Overall, our experience with American Hartford Gold was positive. While we had to offer our name, email, and phone number to enter the live chat or access a starter kit, company representatives responded quickly and answered our questions in full. We especially loved the “investor library,” which is available to online visitors, and gave us four eBooks explaining updated information for 2023. This includes tips for preparing for a recession and a guide for opening a gold IRA.

Moving forward, we’d love to see American Hartford Gold get more transparent regarding gold IRA fees. The company lists real-time metal prices directly on its website, but not all competitors do the same. Pricing information helped us accurately gauge our investment potential. Still, we found budgeting for additional fees that come with opening and maintaining a gold IRA difficult without speaking to a representative directly.

American Hartford Gold Complaints

American Hartford Gold is a trusted leader in the precious metals and Gold IRA industry, receiving an “A” rating from the nonprofit Business Consumer Alliance. It is Better Business Bureau accredited with an “A+” rating with more than 360 reviews. ConsumerAffairs also accredits the company; customer reviews average 4.9 out of 5 stars. American Hartford Gold has a 5-star Trustpilot rating with more than 1120 reviews.

The majority of complaints we saw against American Hartford Gold revolved around the fluctuating prices of precious metals and not the company itself.

American Hartford Gold FAQs

-

Do I own the physical precious metals in an American Hartford Gold IRA?

Yes, when you open a gold IRA or buy and store precious metals, you own the actual metals in their physical forms, such as bullion, coins or bars. -

Can I contribute toward an American Hartford Gold Precious Metals IRA like any other IRA?

Yes, you can purchase more gold or other precious metals at any time from American Hartford Gold to contribute to your IRA. Speak to your account executive or a product specialist to learn about annual contribution limits. -

How will I know if my Gold IRA is performing well at American Hartford Gold?

You will receive timely, accurate information about your gold IRA performance by talking with an account executive or product specialist. You also receive regular account value statements and can view real-time gold, silver and platinum price charts on American Hartford Gold’s website. -

What are the tax advantages to American Hartford Gold IRA?

You can invest in precious metals in a gold IRA using pre-tax or tax-deductible funds. Gold IRA gains grow tax-free, and consumers can withdraw from a gold IRA without penalties at age 59 1/2, only paying taxes on the amount withdrawn. Roth Gold IRAs are available and use post-tax dollars with no additional taxes paid upon withdrawal. -

Is there a set time frame for taking distributions from a Gold IRA?

IRAs all have required minimum distribution rules, and these rules apply to gold IRAs. The IRS requires you to withdraw a minimum amount each year from a gold IRA when you reach the age of 70 1/2. American Hartford Gold website has an easy-to-use tool for estimating your minimum distribution requirement.

Conclusion

Sound retirement planning is essential for a secure economic future. American Hartford Gold strives to lead clients to financial well-being by diversifying assets with gold IRAs or precious metals purchases. The company is well positioned to inform consumers about the benefits of investing in precious metals with industry-leading experts and quality customer support.

If you are interested in contacting American Hartford Gold, you can call 877-672-6779.