What is Synthetic Identity Theft?

Updated:

Retirement Living takes an unbiased approach to our reviews. We may earn money when you click a partner link. Learn More

You’ve probably heard of identity theft which is when a fraudster steals your social security number, name and address. But synthetic identity theft is an especially insidious and difficult to detect form of identity theft. The financial industry has become increasingly savvy in detecting traditional identity theft, so criminals have upped their game – developing more sophisticated tactics to steal your hard-earned cash.

According to the Federal Trade Commission, synthetic identity theft is the fastest growing and one of the most difficult types of identity theft to detect. Plus the number of occurrences has surpassed traditional one-person credit fraud. A study by ID:A Labs states that the number of cases has increased more than 100 percent since 2010.

Great for cybersecurity support

Aura Identity Theft Protection

- Plans can include members of different households

- Investment account monitoring

How Synthetic Identity Theft Works

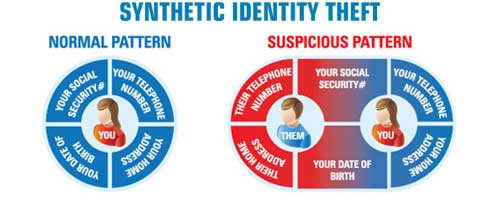

Unlike traditional identity theft which consists of stealing an individual’s personal information, a synthetic identity is comprised of information from several sources. The fraudster uses a combination of credentials, so the information is not associated with any one person. Some of the information is true, while the rest may be fabricated.

All information is combined to form a new, fake identity. For example –a social security number may be valid – an address may be real, but the name, social security number, address and date of birth do not match. This combination of real and fake information makes up a new identity.

The fraudster then uses this new identity to open new credit card accounts, obtain loans and buy good and services. Because there is no clear victim the fraudster can remain undetected for months or even years until suddenly they spend to the maximum limit and disappear. Some fraudsters will carefully nurture a synthetic identity for years to achieve higher credit limits and then cash out. This means larger losses for the financial lender.

Why should I worry about synthetic identity theft?

When your social security number is used by a fraudster, a sub-file is created. This sub-file is attached to your current credit file and contains additional credit information which is tied to your social security number, but lists the wrong name and address. As a result, negative fraudulent information is linked to you. If you have a good credit rating but have negative information in the attached sub-file, this can impact your ability to obtain credit.

Because the sub-file isn’t usually found by the lender, it usually won’t show up in a credit report. In addition, a fraud alert or credit freeze won’t stop synthetic identity theft. Why? Because these solutions only affect your main credit file.

Due to months or years of secrecy, it can take longer to discover that your credit has been compromised. By this time, the fraudster has charged thousands in debt and disappeared. Eventually, creditors will research the theft which will lead them to you. Synthetic identities are used to commit fraud, launder money, or to support criminal or terrorist activities.

Warning Signs of Synthetic Identity Theft

Be aware of these four warning signs to guard against synthetic identity theft.

- Your monthly credit card statement lists a small, unauthorized transaction.

- You’re contacted about an account that you never opened.

- If a collector contacts you about a debt that isn’t yours, this may be a sign of synthetic identity theft. If this occurs call your bank and report the incident to the authorities.

- Another indicator of synthetic identity theft is suspicious aliases on your credit report. This may be an indication of criminal activity. Contact the credit bureaus.

Tips for Preventing Synthetic Identity Theft

Below are measures you can take to help greatly reduce the chances of being a victim of synthetic identity theft.

Only give out your social security number when required. When filling out paperwork at the physician’s office, don’t fill in your social security number – they don’t need it. You can monitor your social security number on the Social Security Administration’s website.

Unfortunately, some identity thieves may be people you know, or a person hired to do home maintenance chores such as a handyman or house cleaner. Keep all important papers hidden or store them in a safe.

Perform regular checks on your credit with the top three credit report bureaus – Experian (1-888-EXPERIAN), Equifax (1-800-685-1111) TransUnion (1-800-916-8800).

Sign up for an identity theft protection plan such as LifeLock or IdentityProtect. Some plans provide a service to monitor the dark web which is where a lot of information used in synthetic identity fraud is found.

If you regularly receive pre-approved offers of credit or insurance in the mail, it’s a good idea to stop delivery of these offers. The Fair Credit Reporting Act allows credit reporting companies to include your information on distribution lists. These lists are accessed by creditors and insurers to make firm offers of credit and insurance.

If you suspect that your identity has been stolen contact the above three credit reporting bureaus and ask for a 90-day fraud alert to be placed on your file. For proven cases of identity theft, with proper documentation, a seven-year fraud alert can be placed on your account.

Compare Top Identity Theft Protection Companies

Protecting Your Child from Synthetic Identity Theft

Protect your child’s social security number from fraudsters by making it difficult to find. Shred any paperwork that has your child’s number listed and keep tabs on any company or individual that has access to the number. Give out your child’s SSN only when required. For example, when putting your child on your phone plan, customer service does not need your child’s social security number to make the change. For optimal protection, consider freezing your child’s credit.