Best Critical Illness Insurance

Updated:

Retirement Living takes an unbiased approach to our reviews. We may earn money when you click a partner link. Learn More

We evaluated 22 critical illness insurance providers to find the most reliable companies. We researched coverage, ease of applying for insurance, customer service rankings, costs and more.

- Easy Application Process

- Low rates

- Instant quotes

Breeze will give you a critical illness insurance quote online in about two minutes. Rates are affordable and cover 11 critical illnesses, and you can tailor the benefit in $1,000 increments.

Aflac

- Fastest Claims Payments

- One Day Pay for a 24-hour turnaround on benefits

- No-Medical-Exam option

Aflac has been specializing in disability insurance for over 60 years. The company offers short-term disability coverage from three to 24 months, and you don’t pay for coverage while you are unable to work.

Mutual of Omaha Critical Illness

- Great Flexibility

- Term or lifetime critical illness coverage

- Return of premium benefit

Cover your entire family with any number of children with one fee with Mutual of Omaha critical illness insurance. The company also provides coverage for individuals. Policies are available for 10 to 30 years or for a lifetime.

Colonial Life Insurance

- Great Benefitrs Counselors

- A+ rating from Better Business Bureau

- Help you choosing the right coverage

Colonial Life has been in the insurance business since 1937 and has high marks for financial strength and customer service. Private consultations with benefits counselors help consumers choose the best level of coverage.

Liberty Mutual Critical Illness

- Great Customization

- Six coverage levels

- Apply online for instant approval

Liberty Mutual critical illness insurance gives you the option of buying coverage in amounts of $10,000, $15,000, $20,000, $25,000, $40,000 or $50,000. The broad range of benefit options helps you avoid buying more insurance than you need.

AIG Critical Illness

- Great High-value Benefit

- Benefit amounts up to $2 million

- Policy term from 10 to 35 years, or entire life

AIG Quality of Life Insurance pays a benefit for critical illness as well as chronic and terminal illnesses. If you don’t use the benefit before you die, your family receives a death benefit. AIG’s combined coverage usually costs less than buying life and critical illness insurance separately.

Compare Top Critical Illness Insurance Companies

Critical illness insurance pays for medical and living expenses if you are diagnosed with a severe illness like stroke or cancer. Medical costs in the United States are 50% more expensive per capita than any other country. Critical illness insurance pays for out-of-pocket medical costs your health care insurance doesn’t cover.

This guide explains what critical illness insurance pays for, how much it costs and whether you need critical illness coverage. You will also learn tips for choosing the best insurance for your financial goals.

We evaluated 22 critical illness insurance providers to find the most reliable companies. We researched coverage, ease of applying for insurance, customer service rankings, costs and more. Our six best critical illness insurance companies are Breeze, Aflac, Mutual of Omaha, Colonial Life Insurance, Liberty Mutual and AIG.

Top Critical Illness Insurance Tips:

- Critical illness insurance does not replace medical insurance.

- Use benefit payouts for anything, not just medical expenses.

- Understand preexisting conditions and other exclusions before you buy.

Tips for a Wise Buyer

Critical illness insurance pays a lump sum if you are diagnosed with a major illness. In 2021, the Affordable Care Act limited out-of-pocket expenses to $8,550 for individuals and $17,100 for families. These are hefty amounts to pay, particularly if you’re too sick to work. Critical illness insurance helps pay for the gap in medical coverage for specific diseases, which would otherwise result in enormous costs.

The medical conditions critical illness insurance covers vary between insurance companies. Some policies cover a few diagnoses, while others cover 25 or more illnesses.

| Cancer | Stroke |

|---|---|

| Heart attack | Kidney failure |

| Organ transplant | Paralysis |

| Coma | Major head trauma |

| Multiple sclerosis | Parkinson’s disease |

| Loss of speech, hearing or sight | ALS and other motor neuron diseases |

How Critical Illness Insurance Works

Critical illness insurance is also known as catastrophic illness insurance, critical care insurance or CII. The policies pay a benefit you can use to pay for living expenses and medical bills. Funds can replace lost wages or pay for traveling to receive treatments and in-home care. You can also use the benefit to pay for specialty medications or the additional cost of an out-of-network specialist.

Once you receive a covered diagnosis, critical illness insurance typically pays a lump sum directly to you. Some policies pay a monthly benefit as long as you are sick or recovering. Then you determine how to use the funds. You can pay for whatever you need: medical bills, mortgage, groceries and more.

Some insurance policies pay a percentage for specific illnesses. Many place a cap on the number of times you receive a benefit within a 12-month period.

What Critical Illness Insurance Doesn’t Cover

Review any critical illness policies you’re interested in purchasing to know what the insurance covers and what is excluded. Most insurance companies explain exclusions on the website, but you may find the information in the contract’s fine print.

We listed some exclusions below. These are uncovered medical conditions or activities leading to otherwise covered conditions. The list is a sampling of possible exclusions and does not represent exclusions in all critical illness policies.

| Health issues resulting from preexisting conditions occurring within a year or more | Participating in skydiving and other high-risk activities |

|---|---|

| Some rare forms of cancer | Benign brain tumor under a specified size |

| Melanoma | Some cancers diagnosed at stage 1 |

| Acts of war or military activity | Drug or alcohol use or addiction |

Most critical illness insurances have an effective date 90 days after you buy the policy. Limits and exclusions typically include a 12-month waiting period for coverage if you have a preexisting condition at the time you purchase the insurance.

Age and Critical Illness Insurance

A critical illness policy is usually guaranteed renewable for life as long as the policy is in force before age 65 to 70. Depending on how your policy is structured, premiums may increase with age.

Regardless of your age when you buy your insurance, the benefit will likely be reduced by half once you turn 70. Purchase a $30,000 critical illness insurance policy, and the payout is $30,000 for any claim before you turn 70. After that time, you will receive $15,000.

Critical Illness Insurance Costs

The Society for Human Resource Management (SHRM) reports that critical illness insurance premiums remained steady or decreased over the past decade. You will need a medical exam for higher coverage but typically only need to answer a few questions for a lower benefit.

You’ll find samples of online quotes for critical illness insurance from three of our best providers below. Other companies did not offer online quotes.

The insured is a 55-year-old female nonsmoker living in Michigan. Breeze and Liberty Mutual include cancer coverage. Aflac provides cancer coverage at an additional cost and does not provide policy benefits over $20,000.

| Company | $10,000 | $20,000 | $50,000 |

|---|---|---|---|

| Breeze | $20 | $37.82 | $91.28 |

| Liberty Mutual | $20.22 | $40.45 | $101.13 |

| Aflac (no cancer coverage) | $27 | $44.10 | N/A |

| Aflac (with cancer coverage) | $70.14 | $121.72 | N/A |

The number of covered medical conditions affects the cost of critical illness insurance. A policy covering heart attack, cancer and stroke usually comes with a lower premium than a policy covering 20 illnesses or conditions.

Critical illness insurance premiums vary by state, your age and several other factors.

How Much Critical Illness Insurance is Enough?

Critical illness insurance covers the gap in your health insurance plan. The level of coverage you need depends on your insurance deductibles and out-of-pocket maximum. You also need to take into consideration your level of savings. However, insurance deductibles can go up from year to year, and circumstances could unexpectedly drain your savings account.

- The least amount of critical illness insurance to buy is enough to cover your current medical insurance deductible or out-of-pocket maximum.

- If you can afford more coverage for lost income, consider buying it.

- The next level is buying enough critical illness insurance to also pay for living and travel expenses you may incur while undergoing treatment.

If you’re still not sure how much critical illness insurance you should buy, speak to a financial advisor.

Our Search For The Best Critical Illness Companies

We evaluated the critical illness insurance marketplace.

To narrow our search, we first considered consumer and expert reviews for companies offering critical illness coverage. We removed those with a 3-star rating or less from consideration.We assessed the top critical illness insurance companies based on industry ratings and financial strength.

Buying insurance from a company that’s on shaky ground financially could leave you with no coverage and lost premiums. All of our picks for the best critical illness insurance companies have the stability required to weather economic storms.We shopped for critical illness insurance and followed the advice in this guide.

We focused on finding critical illness insurance companies based on our wise buyer standards. We looked for innovative products to meet the needs of all of our readers. We evaluated policy details and pricing.We placed a priority on transparency.

If a company failed to provide adequate information about critical illness insurance online, we excluded it from our search.

Critical Illness Insurance Company Reviews

After our evaluation, we chose our best critical illness insurance companies: Breeze, Aflac, Mutual of Omaha, Colonial Life Insurance, Liberty Mutual and AIG. Each of these companies stood out above and beyond the competition.

Breeze Critical Illness Insurance Review

Easy Application Process |

Breeze’s online critical illness insurance application is hassle-free and straightforward to use. The company’s proprietary digital technology speeds up the application, quoting and underwriting processes. Breeze’s use of artificial intelligence also keeps costs down. That savings gets passed on to the consumer.

Source: Breeze Critical Illness

Breeze offers up to $75,000 worth of critical illness cost coverage for these medical conditions:

- Heart attack

- Kidney failure

- Invasive cancer

- Coronary artery bypass surgery

- Angioplasty

- Advanced Alzheimer’s disease

- Stroke

- Major organ transplant

- Paralysis

- Noninvasive cancer

- Coma

Breeze is the only company we found offering critical illness coverage in $1,000 increments. In other words, you can buy a policy with a benefit of $17,000 or $51,000. Policies are available with a $5,000 to $75,000 benefit.

Assurity Life issues Breeze critical illness policies. Assurity ranks fourth highest of 15 companies in AM Best financial strength ratings.

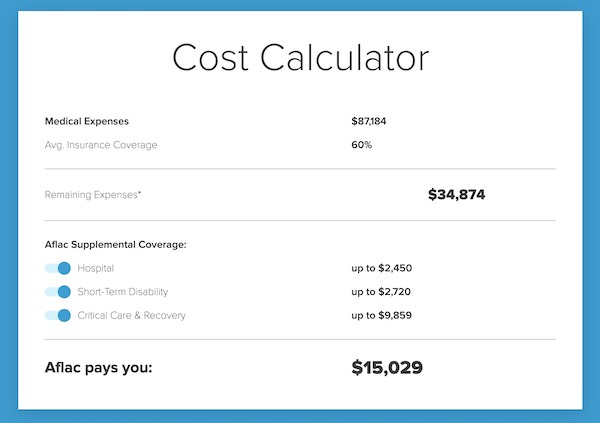

Aflac Critical Illness Insurance Review

Fast Payments |

Source: Aflace Critical Illness

Aflac’s lump sum critical illness insurance includes a number of riders and benefits. The company increases the cash benefit over time. This feature makes you eligible for a higher benefit if you don’t need your coverage until later in life.

Aflac critical illness coverage includes:

- Lump-sum payment upon diagnosis

- Policy value increases every year for up to 10 years

- Hospitalization Rider covering everything from ambulance costs to physical therapy

- Event Recovery Rider that pays a monthly benefit for three to six months

Aflac SmartClaim facilitates quick benefits payments via direct deposit. Log in online or use the Aflac mobile app to complete an online form. Upload required documentation using a scanner or take a picture on your phone.

Aflac critical illness insurance covers eight medical diagnoses. Cancer coverage is an add-on to the critical illness policy.

Mutual of Omaha Critical Illness Insurance Review

Great Flexibility |

Mutual of Omaha’s critical illness insurance is available with benefits from $10,000 to $100,000. You can buy a lifetime policy or a term policy for 10, 15, 20 or 30 years. Mutual of Omaha sells both individual and family critical illness policies.

Source: Mutual of Omaha Critical Illness

Mutual of Omaha critical illness insurance pays a 25% benefit for coronary artery bypass or angioplasty surgery. You’ll receive a 100% benefit for:

- Internal cancer or malignant melanoma

- Heart attack

- Stroke

- Alzheimer’s disease

- Major organ transplant

- Blindness

- Paralysis

- Deafness

- Kidney failure

If you die without using your Mutual of Omaha critical illness insurance, premiums you paid are returned to your heirs.

Colonial Life Critical Illness Insurance Review

Great Benefits Counselors |

Colonial Life critical illness insurance can help prevent the need to draw from your savings for expensive medical bills. This policy pays a benefit if you are diagnosed with a critical illness not adequately covered by your medical or disability insurance.

Source: Colonial Life Critical Illness

Colonial Life critical illness insurance pays 100% of the policy face value if you’re diagnosed with:

- Heart attack

- Stroke

- Major organ failure

- End-stage kidney failure

- Permanent paralysis due to a covered accident

- Coma

- Permanent blindness

- Occupational infectious HIV or hepatitis B, C or D

The policy pays 25% of face value for coronary artery bypass graft surgery.

Colonial Life benefits counselors can meet with you privately to discuss whether critical illness insurance fits with your financial goals. Discuss the benefit for recurring diagnoses with a counselor before you buy Colonial Life critical illness insurance.

Liberty Mutual Critical Illness Insurance Review

Great Customization |

Liberty Mutual customizes each critical illness policy, so consumers don’t pay for coverage they don’t need. Six coverage levels, ranging from $10,000 to $50,000, allow you to customize your policy to just the right benefit.

Source: Liberty Mutual Critical Illness

Liberty Mutual critical illness insurance covers diagnosis of cancer, heart attack or stroke or an organ transplant or coronary artery bypass surgery. A policy pays 100% benefit for:

- Stroke

- Heart attack

- Organ transplant

- Type 1 cancer

Liberty Mutual breaks cancer diagnoses down into two categories for critical illness coverage. Category 1 includes malignant tumors and the following blood cancers: lymphoma, leukemia and multiple myeloma.

Category 2 cancers are early-stage chronic lymphocytic leukemia, melanoma and prostate cancer and some noninvasive cancers. Category 2 cancers and coronary artery bypass surgery are covered at 25%.

AIG Critical Illness Insurance Review

Great High-value Benefit |

AIG takes a fresh approach to critical illness insurance to provide coverage up to $2 million. Quality of Life Insurance is available from AIG Direct. This policy provides financial support during a critical illness and a death benefit if you don’t use all available funds for critical care.

Source: AIG Critical Illness Insurance

AIG’s QoL coverage can extend beyond critical illness. You can also receive benefits if you are diagnosed with a chronic or terminal illness. Quality of Life Insurance benefits apply to:

- Major heart attack

- Coronary artery bypass

- Stroke

- Invasive and blood cancers

- Major organ transplant

- End-stage renal failure

- Paralysis

- Coma

- Severe burn

AIG Quality of Life Insurance combines critical illness benefits with a term or universal life insurance policy. Benefits are available in amounts from $100,000 to $2 million. Options include a policy that accumulates cash value, term insurance from 10 to 35 years and discounted coverage for your spouse and children.

Frequently Asked Questions about Critical Illness Insurance

Does critical illness insurance cover all severe medical diagnoses?

Coverage varies by policy, but critical illness insurance doesn’t pay for all medical conditions associated with extreme costs. The insurance covers many common serious illnesses.

Can critical illness insurance replace medical insurance?

No. Critical illness insurance benefits fill the financial gap left by health plan deductibles. These policies do not pay for treatments for chronic illnesses like diabetes or thyroid disease. You need health insurance to pay for accidents resulting in broken bones, preventive care, prescriptions and other medical costs.

Does critical illness insurance pay for a recurring covered illness?

Policies vary on whether critical illness insurance pays for one occurrence of a covered condition or multiple diagnoses. For example, some insurances pay a full benefit with the first diagnosis, then a partial benefit for each future diagnosis. Others provide a full payout regardless of the number of times you get the same diagnosis.

Do I have to document or report how I use a benefit payout from critical illness insurance?

No. You’ll receive a lump sum or monthly payment. Use the money to pay for anything. There is no expense reporting or submitting copies of bills or receipts.

Can I use critical illness insurance to pay for home remodeling?

Yes. You could use the benefit proceeds to pay for chairlift installation, travel, remodeling your home or anything else.

Concluding Thoughts on Critical Illness Insurance

Deciding if you should buy critical illness insurance depends on your family history and your other insurance coverage. Disability insurance covers some of the same risks but is more expensive and only pays out as long as you aren’t working. Critical illness insurance could make sense for you if multiple close family members suffered from one or more covered illnesses.

In recent years, medical insurance covers less and costs more. Critical illness insurance can be an affordable way to offset years of medical bill payments or bankruptcy.

| Critical Illness Insurance Company | Best For | |

|---|---|---|

| 1 | Breeze | Easy Application Process |

| 2 | Aflac | Fast Payments |

| 3 | Mutual of Omaha | Great Flexibility |

| 4 | Colonial Life | Great Benefit Counselors |

| 5 | Liberty Mutual | Great Customization |

| 6 | AIG | Great High-value Benefit |