Betterment Review

Updated:

Retirement Living takes an unbiased approach to our reviews. We may earn money when you click a partner link. Learn More

Betterment offers automated technology to help you build wealth using goal-driven, personalized investing and diversification strategies. Customize your portfolios using low-cost ETFs, leveraging Betterment’s algorithms to match your risk tolerance and financial goals. The firm is one of the original robo-advisors but has grown its platform to include robust planning features and tools, as well as cryptocurrency investing.

Editorial Breakdown

Tools and Features

Fees

Investment Options

Ease of Use

Overall Rating

Bottom Line

Betterment is a true hands-off robo-advisor offering customizations, tax-loss harvesting, and goal-based investment strategies for investors of all types and budgets of all sizes.

One of the most recognized names in the robo-advisor space, Betterment offers low fees and no investment minimums for investors saving for a special financial goal. Its customizable portfolios are best suited for those who prefer goal-based investments. For retirees, Betterment can recommend an allocation and withdraw amounts based on how long you need your nest egg to last.

Not all robo-advisors allow you to buy fractional shares of exchange-traded funds (ETFs), but Betterment does. This opens the doors for people with a more modest budget to invest in shares that interest them and encourages more efficient tax-loss harvesting.

But the advantages don’t end there; Betterment comes with several other benefits and features. Choose one of two service tiers, both of which offer portfolio management, rebalancing, and planning tools to help minimize your tax impact.

Pros:

- Low account minimum and fees

- Several portfolio options with customization

- Cryptocurrency portfolios

- Robust goal, retirement, tax, and charitable-giving planning tools

Cons:

- No direct indexing

- Higher investment is required to access human advisors

Betterment Overview

| Feature | Details |

|---|---|

| Account Minimum | $0 ($10 is required to start investing) $100,000 account minimum for Premium |

| Fees | $4/month or 0.25% with $20,000 invested or recurring $250+ monthly deposits |

| Portfolio Mix | Choose among 13 portfolio options, including socially responsible, crypto, and technology portfolios, with some customization available |

| Accounts Supported | Individual and joint taxable, Roth IRA, traditional IRA, SEP IRAs, rollover IRAs, and trusts |

| Tax Strategy | Daily tax-loss harvesting, tax-coordinated portfolio, tax impact preview tool, charitable giving tool |

| Automatic Rebalancing | Yes; triggered at 3% drift |

| Cash Management | Yes; interest rate of 4.75% APY (variable) |

| Human Advisor | Unlimited guidance for Premium customers; advice packages starting at $299 for Investing account customers |

| Mobile App | Yes |

| Customer Service | Phone: Monday to Friday, 9 a.m. to 6 p.m. ET; email and chat also available |

How to Invest With Betterment

Betterment’s robo-advisor offering allows you to create an investment strategy based on financial goals you set up, such as retirement in five years, a car next year, a child’s education in 10 years, or a wedding in 12 years.

Betterment offers more options than most other robo-advisors—13 portfolios in total—which are used to build a portfolio based on your risk tolerance, goals, and time horizon.

For example, an emergency fund portfolio designed for short-term needs will hold more bonds than stocks, while a long-term retirement strategy might skew a portfolio more heavily toward stocks.

The Core portfolio is Betterment’s default selection, but you can choose from the following portfolio options:

- Core: A well-diversified mix of stocks and bonds with a focus on undervalued companies. The website advertises historical total returns of 125.6% at the time of publishing using an allocation of 70% stocks and 30% bonds.*

- Innovative Technology: A diversified mix of stocks and bonds with companies that support clean energy, semiconductors, robots, virtual reality, blockchain, and nanotechnology. Best for long-term investments. The website advertises historical total returns of -14.0% at the time of publishing.*

- Broad Impact: A diversified mix of stocks and bonds with companies that support social responsibility efforts, such as lower carbon emissions, ethical labor management, or greater board diversity. Best for long-term investments. The website advertises historical total returns of 33.2% at the time of publishing.*

- Climate Impact: A diversified mix of stocks and bonds with companies that have funded green projects and lower carbon emissions. Best for long-term investments. The website advertises historical total returns of 10.4% at the time of publishing.*

- Social Impact: A diversified mix of stocks and bonds with companies that support social equity and minority empowerment. Best for long-term investments. The website advertises historical total returns of 9.8% at the time of publishing.*

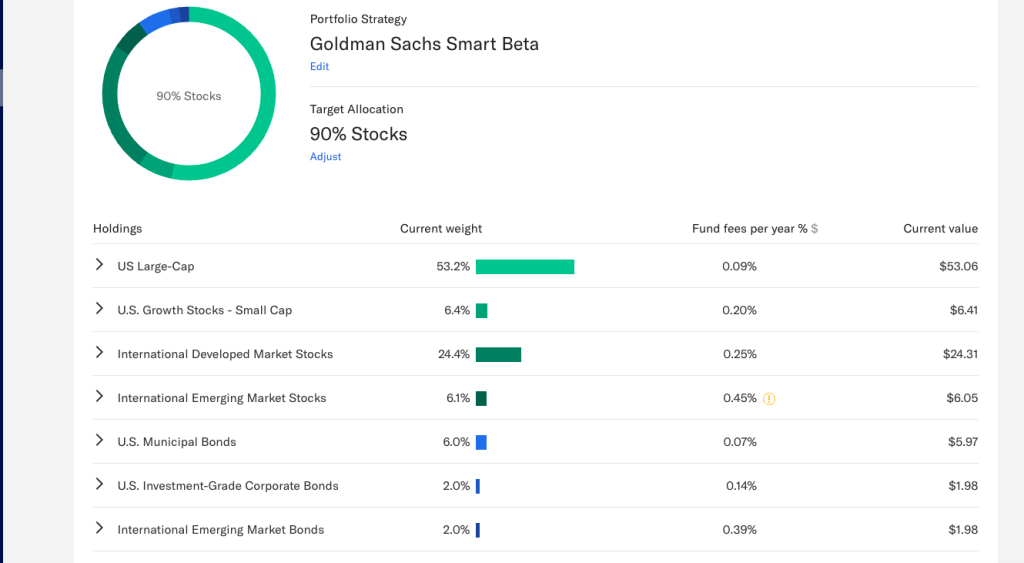

- Goldman Sachs Smart Beta: A mix of stocks and bonds chosen based on “Smart Beta” factors, or characteristics that suggest greater long-term growth potential. Customizable based on risk. The website advertises historical total returns of 38% at the time of publishing.*

- BlackRock Target Income: An all-bonds portfolio with less volatility. Customizable based on risk. The website advertises historical total returns of 7.8% at the time of publishing.*

- Universe: Invest in a diversified, broad classification of cryptocurrencies like Bitcoin, Ethereum, Dogecoin, Litecoin, and more.

- Bitcoin/Ethereum: Invest in the two largest cryptocurrencies. Asset ratios are approximately 70% Bitcoin and 30% Ethereum.

- Sustainable: Invest in environmentally-conscious cryptocurrencies. Highest asset ratio in Ethereum and Chainlink.

Experienced investors can also choose the Flexible portfolio option, which allows investors to customize the Core portfolio’s distribution of asset classes. With this option, you can access additional asset classes, including commodities, high-yield bonds, and REITs (real estate investment trusts).

*Investment returns listed above are a historical estimate based on a $50,000 initial investment. Actual returns will vary by starting balance, portfolio strategy, and risk tolerance, in addition to market conditions.

Additional Services

In addition to its investment portfolios, Betterment also offers a high-yield cash management/savings account option with a 4.75% APY at the time of publishing. You’ll also have the option to open a checking account, which comes with fee-free ATMs, a debit card, and FDIC insurance up to $2 million for an individual and $4 million for a joint account.

Like most advisors, Betterment offers tax minimization strategies to help keep your potential tax losses low. However, the firm does not offer direct indexing, which could be a downside for investors who prefer to customize their portfolios.

Lastly, a Betterment account unlocks access to robust planning tools that go beyond basic portfolio management. Our editorial team considers this one of the firm’s standout features, especially for retirees and older investors who can leverage a tax-impact tool and a charitable impact tool to minimize their tax payouts every April.

How to Set Up a Betterment Account

The main perk of a robo-advisor is its simple online investment management. To evaluate the experience, our editorial team created a Betterment account and found the setup process easy and straightforward.

It only took us one minute to set up the account with our name, address, and basic contact info. We also connected our bank accounts to fund the investments. (You’ll need to repeatedly confirm your identity and user authentication, so have your phone and email account handy)

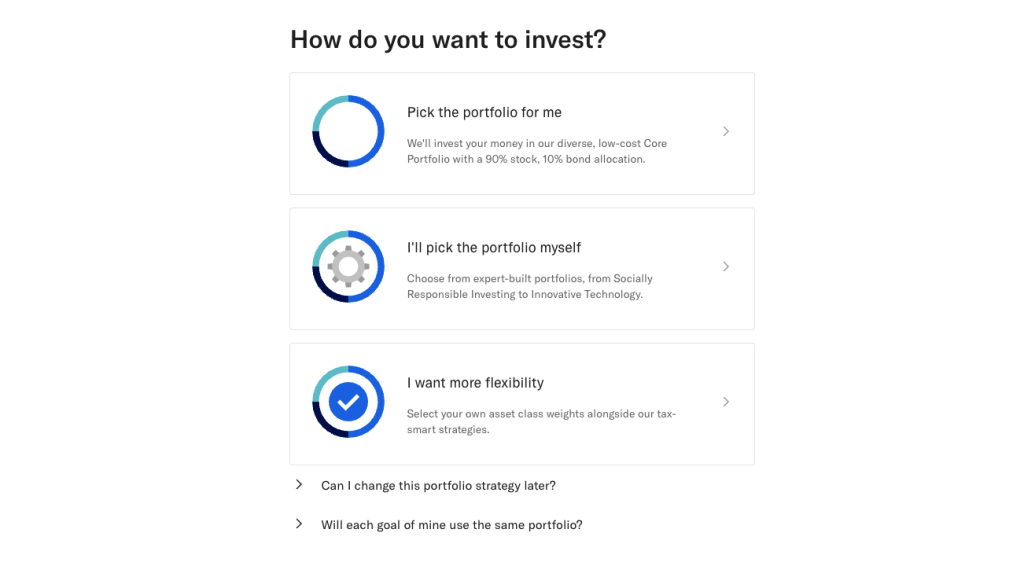

Next, we created our investment plan using Betterment’s step-by-step guidance. Like many robo-advisors, Betterment gave us three options to construct our portfolio based on the questions we answered about our risk tolerance, goals, and desired investment amount. We allowed Betterment to recommend a portfolio, as seen in the screenshot below.

From here, the process of funding our plan got a little murkier. We think a less experienced investor might appreciate more education at this step to explain the pros and cons of portfolios presented to us.

That said, the actual setup process was simple. Betterment presented us with four preset portfolio options: Core, Innovative Technology, Social Impact, and Goldman Sachs Smart Beta. Note that although Betterment offers 12 different pre-built portfolios, the firm recommended the best four for our situation.

We selected the Core portfolio, and Betterment automatically adjusted the ratio of stocks and bonds based on our risk tolerance. If we chose the Goldman Sachs Smart Beta plan, Betterment would have enrolled us in higher-risk stocks and bonds. See the example screenshot below.

Betterment Costs

Betterment is a solid choice for a low-cost robo-advisor. Its 0.25% management fee is close to the industry standard and cheaper than a traditional human advisor. For those with higher balances, the fees are reasonable; however, Betterment charges higher fees for clients with low balances.

Accounts with less than $20,000 will pay $4 per month instead of the 0.25% assets under management (AUM) fee. While a recurring deposit of $250 waives the $4 monthly fee, Betterment’s management fees could be steep for those with lower balances.

For example, a $10,000 balance would incur costs of $48 per year, or 0.48%, which is twice Betterment’s advertised rate for digital accounts.

| Fee Type | Digital Account | Premium Account |

| Account Minimum | $0 ($10 minimum to start investing) | $100,000 |

| Fees | 0.25% of AUM for accounts with at least $20,000 $4 per month for accounts with less than $20,000 0.15% of AUM for accounts over $2 million | 0.4% of AUM for accounts with at least $100,000 0.3% of AUM for accounts over $2 million |

In addition to the management fees above, you must also consider the following costs:

- 1% of AUM per month plus trading expenses for crypto accounts

- Expense ratios ranging from 0.05% to 0.24% for the Core portfolio, though these fees are standard across the industry and not unique to Betterment

- $299 to $399 for a call with a professional advisor

- $75 outbound transfer or closing fee

Keep in mind that Betterment’s fees are based on a percentage of your assets, not a flat rate, so these fees could increase over time as your investments grow. Other robo-advisors, like Charles Schwab, opt for a flat fee instead of an AUM structure, charging a higher fee that won’t change as your investments grow.

If you have larger investments, a flat-rate fee structure may be more affordable in the long run.

Betterment Complaints

Betterment’s Trustpilot profile is “unclaimed” at the time of publishing, and it has a 2.1-star rating. The firm is also not accredited by the Better Business Bureau, and its BBB account lists several recent complaints regarding surprise charges for unauthorized automatic investments.

While potential investors would be wise to consider these complaints when choosing a robo-advisor, it’s important to understand that automated investing is just that—recurring fees in exchange for repeat investments. We encourage investors to read all disclosures and agreements before funding any accounts with a robo-advisor.

All BBB complaints appear to have been resolved in a timely manner.

Our Experience With Betterment

Customer experiences with a robo-advisor will vary greatly depending on budget, goals, and prior investment experience. However, access to planning tools and educational resources benefits investors of all types and can often greatly affect your experience with robo-advisors.

To provide the most thorough review of Betterment’s robo-advisor service, Retirement Living’s editor set up an account using a $100 initial investment. Betterment offers more portfolio options than other robo-advisors (Vanguard only offers three compared to Betterment’s 13) and the firm recommended the four best options for us based on our goals. Having more portfolio options makes Betterment a great choice for a wide range of investor types with both short- and long-term goals.

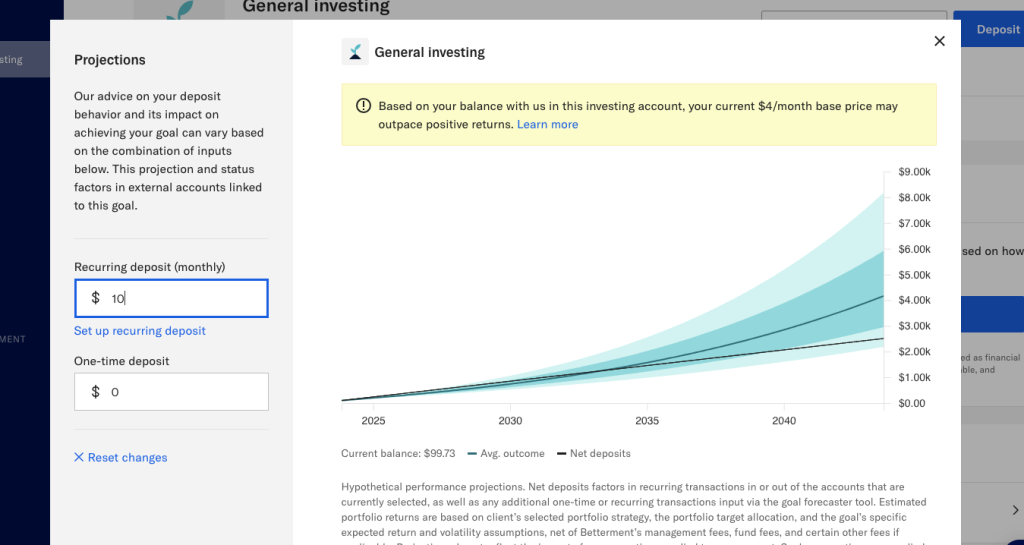

While we found the dashboard a little crowded and confusing, our favorite tool is the firm’s “projections” tool, which allows us to predict potential performance based on our inputs. The screenshot below shows that we could earn $8,173 off our initial investment of $100 by 2040 if we set up a recurring deposit of just $10 per month.

However, one of Betterment’s most distinctive features is its cryptocurrency product, which allows customers to buy a diversified portfolio of digital assets. Betterment has three crypto portfolios, while other robo-advisors have zero.

The firm also gets extra points from our editorial team for including a feature that encourages investors to put only 5% or less of their assets into crypto, a philosophy also commonly recommended by the financial experts on Retirement Living’s Expert Review Panel.

Finally, access to a financial advisor through Betterment can be costly compared to other robo-advisors who include this service with all investment portfolios. Ultimately, you’ll be on your own in choosing your investments and the asset allocations, so we recommend exploring Betterment’s portfolio performance tool to get a feel for each portfolio type’s historical and projected performance.

If access to a financial advisor is non-negotiable, we recommend looking into Schwab Intelligent Portfolios or M1 Finance.

FAQs About Betterment

How does Betterment help retirees?

If you’re nearing retirement or actively retired, Betterment will recommend portfolio allocations and withdraw amounts based on your retirement savings and how long you need it to last. The robo-advisor platform will factor in performance and inflation when offering this advice.

Does Betterment charge a monthly fee?

Betterment charges an annual management fee of 0.25% of your investment account balance if you have a balance over $20,000 or set up automatic deposits of $250 per month. For lower balances, Betterment charges a $4 monthly fee. The firm does not charge any fee to use its Cash Reserve or checking account.

How does Betterment keep my investments safe?

Investment accounts include $500,000 of Securities Investor Protection Corporation (SIPC) insurance for missing funds as a result of broker error. Betterment is also a FINRA member. Betterment user accounts are protected by website encryption, two-factor authentication for logging in, and protected password storage.

Can you work with a Betterment financial advisor?

To work with a Betterment financial advisor, you need to invest at least $100,000 in a premium plan. You can also buy an advice package that includes a consultation with an advisor for $299.

Is Betterment only in the U.S.?

Betterment is only available for U.S. customers, including Puerto Rico and the Virgin Islands. Americans living or working abroad cannot use the service, as the firm requires proof of a U.S. permanent address and bank account.

Conclusion

Based on our experience with the service, Betterment is one of the best robo-advisors for retirees, with a wealth of portfolio options suited to your goals. Features like tax-loss harvesting and account rebalancing are helpful, and the highly-rated app is easy to use, no matter your skill level with tech.