Haven Life Insurance Review

Haven Life Insurance provides on-demand quotes and applications for term insurance via computer, tablet or smartphone and is owned and backed by Massachusetts Mutual Life Insurance Company (MassMutual), a company with over 160 years of experience and an A++ financial strength rating from AM Best. Haven Life Insurance conducts all business online with MassMutual’s assurance of financial stability and trust.

Pros

- Easy, quick application process

- Instant decision

- Backed by A++ rated MassMutual

- Coverage up to $2 million

- If an exam is needed, you can check your results online

Cons

- Must be under 65 to be considered

- InstantTerm option is only for those under 45

- Policies not available to active military

Haven Life Insurance Products

Haven Life Insurance makes applying for term life insurance easy with an entirely-online application process. Anyone between the ages of 18 and 64 can apply as long as they aren’t in the process of joining the military or are currently on active duty. Haven Life Insurance policies are not for business or to replace another policy. Applicants under the age of 45 are insurable without a medical exam and can buy an InstantTerm policy immediately after a short application process. Coverage is available up to $2 million.

Haven Life offers term life insurance for 10, 15, 20 or 30 years with premiums that never increase throughout the life of the policy. After your policy expires, you have the guaranteed option to renew annually, but at a higher rate since you will be older. Should you become terminally ill, you have access to funds from the death benefit to help pay medical costs. Each policy is issued by MassMutual, ensuring reliable coverage.

In July 2018, Haven Life announced its use of artificial intelligence to help approve more online applications for coverage. The use of algorithms gives Haven Life the opportunity to create pertinent questions for those online applicants who are not citizens and those who have chronic illnesses or disorders to manage such illnesses as anxiety, diabetes, post-traumatic stress disorder, sleep apnea and obesity. The answers to these questions allow a Haven Life employee to work toward approving applicants.

How to Get Help for Haven Life Insurance

Just because the application process is online doesn’t mean you have to figure everything out for yourself when you’re looking into or applying for a policy on Haven Life Insurance’s website. If you have questions, Haven Life offers a comprehensive Term Life Insurance 101 guide on their site so you can learn about and compare types of life insurance as well as detailed information throughout the quote and application process. You are welcome to call, email or use the online chat feature, which connects you with a representative to have any questions answered. Keep in mind, your best coverage could be a combination of both term and permanent life insurance.

| Term Insurance | Permanent Insurance |

|---|---|

| Affordable rates | Heftier premiums |

| Covers children until financially independent | Part of a long-term financial strategy |

| Can help pay specific cosigned debts | Tax advantages |

| Best if retirement will be financially secure | Provides a cash value |

| Ends after a term of years | Carried throughout your lifetime |

Haven Life Insurance Rates

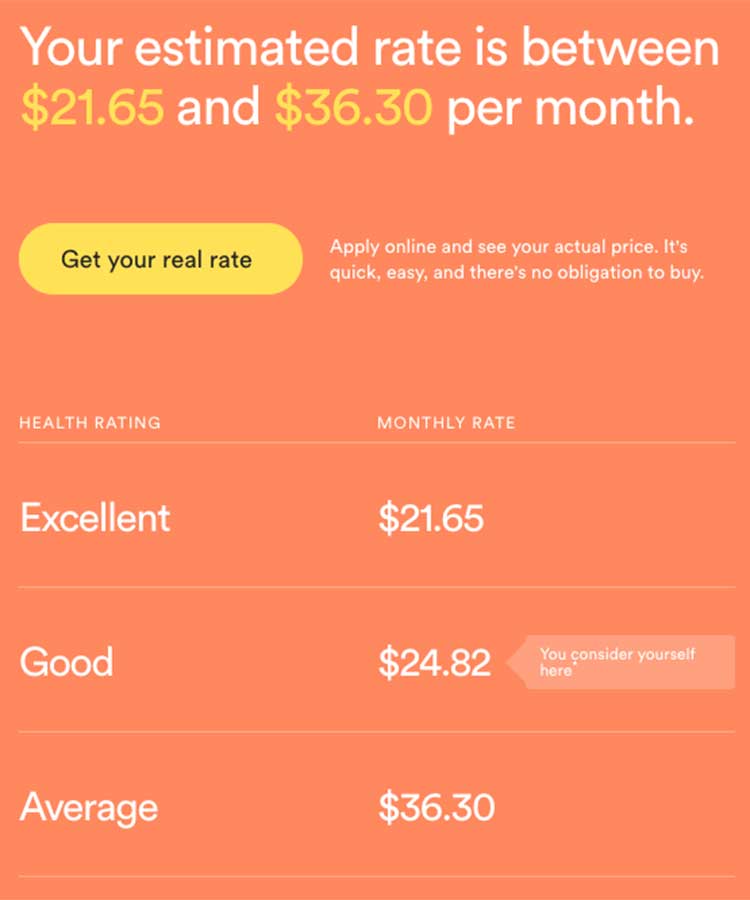

Chances are you will save on a policy with Haven Life, or find very competitive rates because the company doesn’t pay sales commissions. The following chart gives you an idea of the rates they offer.

| Policyholder (non-smoker, excellent health) |

Coverage | Term | Monthly Rate |

|---|---|---|---|

| Female, 28 | $300,000 | 20 | $13.29 |

| Female, 30 | $750,000 | 30 | $38.11 |

| Female, 40 | $500,000 | 30 | $27.40 |

| Male, 30 | $500,000 | 15 | $15.24 |

| Male, 40 | $1,250,000 | 20 | $67.47 |

How to Apply for and Buy Haven Life Insurance

To get a quote from the Haven Life Insurance website quickly, you don’t have to enter any personally-identifying information. You only provide the following:

- Age and gender

- Indicate whether your overall health is average, good or excellent

- If you use tobacco or other nicotine products

- Select the death benefit amount and whether you want a 10, 15, 20 or 30-year life insurance policy

If you aren’t sure what death benefit and term duration would suit your needs, you can click on “I’m not sure how much I need” after filling in your basic information. Then enter additional details to get a recommended coverage amount and term:

- Annual income from all sources

- Childcare costs until age 18

- Cost of a college education for children

- Health care costs for a non-working spouse

- Combined debt

- Expected funeral cost and final expenses

You will be given a quote at this point, along with an opportunity to read the life insurance policy. If you decide to buy the coverage, you will set up an online account with Haven Life and supply the final details:

- Purpose of the insurance policy (usually to protect yourself and your family)

- Birthdate, height, weight, citizenship, current address

- Employment information

- Your family’s health history

- Detailed health information

If you are under 45 years old, you will likely be immediately approved and will be able to buy the insurance. If you’re over the age of 45, you may be required to have a medical exam, which Haven Life makes as convenient as possible, at no cost to you. A trained paramedic will come to your home or another place of your choosing to complete the exam, or you can travel to an exam location. During the exam, your family’s medical history will be reviewed, your blood pressure, height and weight recorded, and blood and urine samples collected. The entire process takes about 20 minutes.

Haven Life Insurance Complaints

Reviewers at ConsumerAffairs appreciate Haven Life Insurance’s easy application process. One said the application process was “so smooth, intuitive …. this is how insurance should be.” Another noted how “you can adjust your term and amount and see price changes instantly before you decide.” Another appreciated how easy the at-home medical exam was, but noted that consumers should know that as of June 2018, the only option for monthly payments was via an ACH bank account and credit cards, and annual payments are not yet available. Mass Mutual Life Insurance Company has an A- rating with the Better Business Bureau, and Haven Life Insurance scored an A+ with the BBB.

Most complaints we saw mentioned having to give blood or take a medical or physical exam before getting a policy. Complaints also mentioned the length of time it took to get through underwriting was a month or more.

Haven Life Insurance Product-related Q&A

-

How much life insurance do I need with a Haven Life Insurance policy?

There are different ways of calculating how much life insurance you need. Read our comprehensive explanation for determining how much coverage you need, or you can try a couple of quick methods. The Wall Street Journal recommends that your policy be five to 10 times your household income. Alternatively, you can use the DIME formula – debt, income,

mortgage and education expenses added together to find the sweet spot of your ideal life insurance coverage amount.Haven Life Insurance has online tools available for you to figure your insurance needs and you can always contact a representative via phone, chat or email with questions.

-

What type of insurance does Haven Life sell?

Haven Life Insurance sells term insurance, which remains in effect for a term of 10, 15 or 20 years, and pays a lump sum to your loved ones if you die while the policy is active. Term insurance ends when your payments do, and you must maintain your premiums to keep the insurance. Term policies do not build any cash value as other types of insurance do. -

Can I apply with my spouse for a Haven Life Insurance policy?

Haven Life’s policies are for individuals only, though you and your spouse can apply separately. -

How much coverage can I buy from Haven Life Insurance?

If you are between the ages of 60 to 64, you can apply for as much as $1 million. If you are under 60, your coverage can go up to $2 million. If you are not a citizen of the United States, you may apply for any amount under $1 million. -

Is a Haven Life policy as complete as one I’d buy from an insurance agent?

Yes. With MassMutual providing the insurance policies and Haven Life Insurance providing a quicker way of applying by using technology, your policy will be of the same quality as if you bought it after discussing insurance for an hour or two with an agent.

Conclusion

Whether you want to be sure that your loved ones aren’t burdened by funeral costs and your final expenses, or you need to provide for your family should you die, make sure you get quotes from multiple insurance companies. Haven Life doesn’t make you enter contact information unless you decide to buy term insurance, so there’s no hassle if you choose not to finalize a policy. The average monthly cost of a Haven Life term policy backed by MassMutual is very affordable at $21.