iTrustCapital Review

Buying gold or cryptocurrencies requires knowing IRS tax rules, and transacting either investment is not straight forward. iTrustCapital’s digital asset trading platform simplifies buying and selling cryptocurrencies and gold through a self-directed IRA. The company makes it easier to buy these alternative investments within a tax-advantaged retirement account. iTrustCapital also simplifies the fee structure associated with purchasing and storing gold and keeps overall costs low.

A recent Fidelity Digital Assets survey showed 36% of respondents invest in cryptocurrency, and that percentage is growing. Gold continues to be in demand as well. iTrustCapital eases the way to diversifying a retirement portfolio with these alternative assets.

Pros

- Transparent fees posted on website

- $1,000 account minimum

- No account setup fee

- No storage fees

Cons

- Limited cryptocurrencies available

Bitcoin and other cryptocurrency IRAs are an investment and carry risk. Consumers should be alert to claims that customers can make a lot of money in these or any investment with little risk. As with any investment, you can lose money and past performance is not a guarantee of future performance results. Consumers should also obtain a clear understanding of the fees associated with any investment before agreeing to invest.

Cryptocurrency & Bitcoin from iTrustCapital

iTrustCapital offers six cryptocurrencies for IRA investments. Bitcoin, Ethereum, XRP, LTC and EOS. Each digital currency has its advantages. Bitcoin is the most well-known, EOS works best for large scale applications and LiteCoin has a faster confirmation schedule.

You can discuss the different cryptocurrencies with an iTrustCapital representative if you need help determining which is best in your portfolio.

Buying Gold with iTrustCapital

Gold orders placed using iTrustCapital are executed through Kitco Metals Inc. Kitco is a premier precious metals retailer and a leading service and device supplier known for refining and analyzing minerals. The company is also involved in high-tech manufacturing processes.

iTrustCapital utilizes Tradewind’s technology for digitizing trading, settlement and ownership of precious metals. Tradewind combines world-class exchange technology with VaultChain blockchain technology tailored for precious metals.

Royal Canadian Mint stores your physical gold, and ownership is digitally recorded. You can visit the storage facility at any time to see your precious metals.

| Cryptocurrencies | Gold |

|

|

| 1% trade fee | $50 over spot |

How to Set Up an iTrustCapital Account

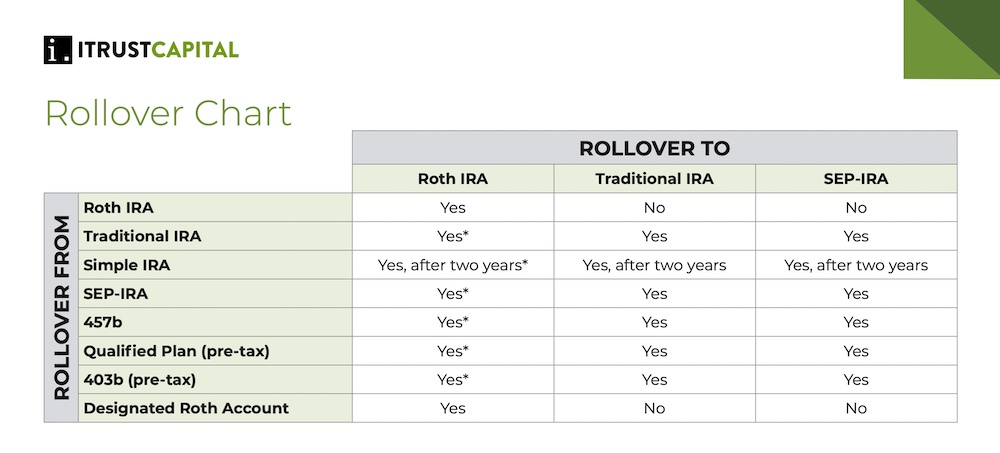

Start by setting up a free basic account with iTrustCapital on its website. You will be able to see what the platform looks like with this account. Next, schedule a call with a representative for help deciding if you should set up a traditional, SEP or Roth IRA.

Click the “Start Application” button and answer a few questions. You will need to upload a statement from the institution you will use to fund the IRA. You’ll choose a beneficiary, enter your credit card number and look over final documents before completing the application. Funds release to your account seven days after they clear with Sunwest Trust due to IRA regulations. iTrustCapital’s platform has enhanced its account security with two-factor authentication.

iTrustCapital IRA Costs

There are a variety of costs associated with buying gold from a traditional Gold IRA company. iTrustCapital has a simple fee structure for Cryptocurrency and Gold investments. Per-transaction fees are 1% for cryptocurrency transactions or $50 over spot for gold.

These fees cover all costs:

- Setting up an IRA with iTrustCustodial Services

- Funding your IRA with a transfer, rollover or cash contribution

- All tax reporting

- Unlimited secure institutional storage for gold

- Costs related to supporting and maintaining the iTrustCapital platform

iTrustCapital Complaints

iTrustCapital has a Trustpilot score of 4.9 out of 5 stars. Facebook Reviews yields a full 5 stars. The company has no Better Business Bureau rating, but the Business Consumer Alliance gives iTrustCapital its highest AAA rating. ScamAdvisor gives the company a “thumbs-up” trusted rating.

We found no complaints about iTrustCapital, and consumer reviews frequently complimented the company’s helpful and friendly representatives.

iTrustCapital Q&A

-

Can I convert my annuity to an iTrustCapital IRA?

If you hold your annuity within an IRA, you can transfer it to an iTrustCapital IRA. Otherwise, you can sell the annuity and use the funds to open an account.

-

Can I get a refund if I decide I don’t want an IRA with iTrustCapital?

Call or email customer support to cancel your iTrustCapital account at any time. Your fees will be refunded if you did not fund the account. If you have a balance, coordinate a transfer with a support representative. You pay nothing after the assets transfer out.

-

How do I know iTrustCapital will not get hacked?

iTrustCapital uses multiple security measures. Curv is one safeguard. The service provides an institutional-grade virtual wallet built on multiple authentication protocols used by the banking and military sectors.

-

Does iTrustCapital offer investment advice for gold or cryptocurrency?

An iTrustCapital account includes access to rudimentary price tracking charts. The company also provides a knowledge center with daily updates. These resources are suitable for basic information, but you will probably want to do additional research. iTrustCapital doesn’t provide financial advisors, but you can message or call with questions about your account or the platform.

-

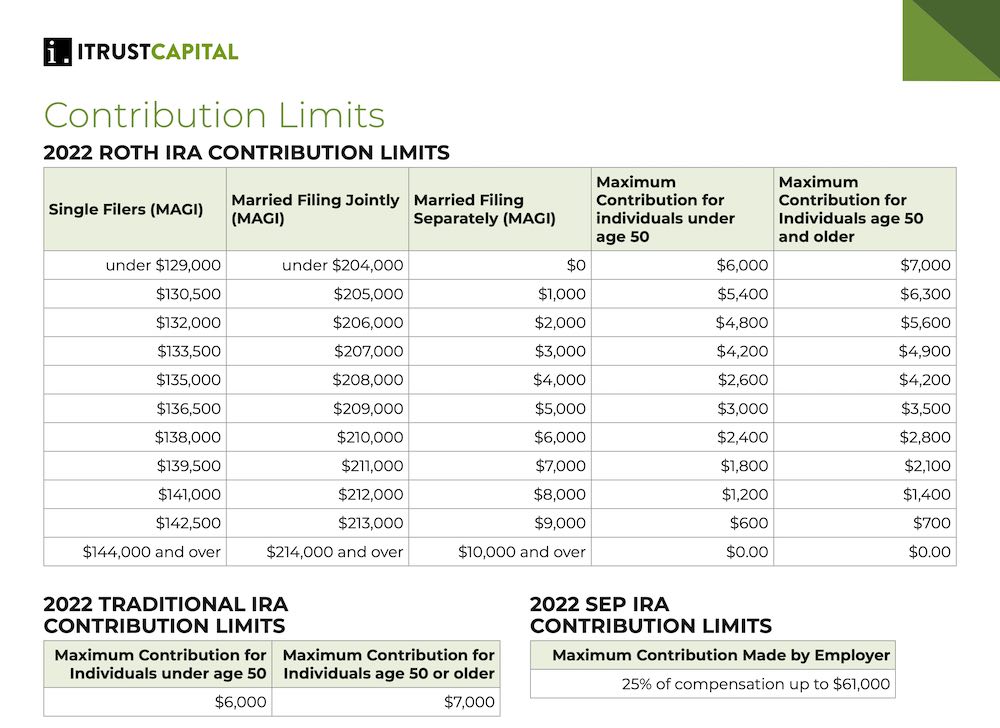

What is the maximum investment on an iTrustCapital IRA?

iTrustCapital places no cap on investments, but the IRS has limits published each year for IRA contributions. Once you set up your IRA, you can make investment transactions as much as you like. There is no limit on amounts 401(k), IRA, 403(b), TSP and other qualified account rollovers or transfers.

Conclusion

iTrustCapital simplifies investing in gold and cryptocurrency. Clients use the platform every day to buy and sell investments to diversify their retirement portfolios. Using iTrustCapital makes gold and cryptocurrency transactions easy, and the cost is affordable for most people.