Best Bitcoin IRAs and Cryptocurrencies IRAs

Updated:

Retirement Living takes an unbiased approach to our reviews. We may earn money when you click a partner link. Learn More

Read about the top four Bitcoin IRA companies and information on the different types of cryptocurrency.

- Great For Self-Trade Investors

- Low Fees

- 24/7 Investment Platform

iTrustCapital is an affordable self-trade investment platform used to buy and sell precious metals and cryptocurrencies.

- Great Client Implementation

- Free consultation

- Free cryptocurrency guide

Bitcoin Advizers is a Bitcoin and cryptocurrency IRA company, giving customers a safe and simple way to buy and sell Bitcoin. Confused about cryptocurrencies? Bitcoin Advizers’ offers a free consultation with a dedicated representative.

- Easy Self-Trading

- No account fees

- Free cold storage

Coin IRA facilitates Tax-Advantaged Cryptocurrency IRAs and Individual Non-IRA Trading accounts in which investors can self-trade or choose expert assistance.

- Great Self Trade

- No minimums

- Flat-rate fees

Broad Financial offers in Self-Directed Bitcoin IRAs and Solo 401(k)s with Checkbook Control. The platform enables account holders to invest in almost any alternative asset, with no minimums, no asset-based fees, and no need to go through a custodian.

- Great Security

- 5-layer security protects retirement investments

- Receive a free Ledger Nano with purchase

BitIRA was founded by Birch Gold Group, for a combined 100 years of experience with alternative assets. BitIRA helps investors through all phases of establishing and maximizing a cryptocurrency IRA.

Alto IRA

- Great Selection

- Buy and sell more than 150 coins

- Integrated with Coinbase

Alto IRA simplifies the process for investors with a simplified process. Rollover and existing IRA or create and fund a new one from a bank account. Customers have access to a large selection of coins, due to an integration with Coinbase.

- Great Rollover Options

- Contribute monthly with Saver IRA

- Up to 700 Million in insurance backing

BitcoinIRA is one of the first Bitcoin IRA companies to offer traditional and Roth IRA rollovers. Users can set up monthly contributions to grow their portfolio for as little as $100.

- Great Experience

- Low Minimum Investment

- Backed by Trusted Lear Capital

BlockMint offers experienced guidance and secure, easy-to-use tools that make the process of setting up a Cryptocurrency IRA easier. The minimum investment is $10,000. BlockMint works with a variety of digital coin offerings.

- Great High-value Insurance

- Combine precious metals and cryptocurrency

- Cryptocurrency insured up to $2 million

Regal Assets specializes in alternative asset IRAs and educates clients on using precious metals and cryptocurrency to diversify a retirement portfolio. The company also sells physical gold, silver, platinum and palladium held outside an investment account.

- Great Customer Service

- U.S.-based customer service

- Learn by making practice trades

My Digital Money combines an easy-to-use cryptocurrency trading platform with customer service agents who are ready to answer your call. You can always get help, from setting up a new account to learning about cryptocurrencies. My Digital Money protects assets with military-grade security and a $600 million insurance policy.

Bitcoin and other cryptocurrency IRAs are an investment and carry risk. Consumers should be alert to exaggerated claims for growth and income with little risk in any investment, including digital assets. As with any investment, you can lose money, and past performance is not a guarantee of future results. Consumers should also obtain a clear understanding of the fees associated with any investment before agreeing to invest.

Tips for a Wise Cryptocurrency IRA Buyer

A cryptocurrency IRA can be part of your retirement savings, particularly if you want a broadly diversified portfolio. But first, you need to understand the risks. The best Bitcoin IRA companies provide assistance with choosing the right cryptocurrency and trading digital assets in a tax-advantaged account.

Bitcoin, the first digital currency, was designed for secure, low-cost electronic transactions. Today there are thousands of digital currencies, and several are traded within cryptocurrency IRAs, commonly called Bitcoin IRAs. These retirement savings accounts have the same tax breaks other self-directed IRAs offer. You can also trade cryptocurrency in a Roth IRA if you prefer tax-free withdrawals.

Top Bitcoin IRA Tips

- Do you want to trade independently, or need step-by-step guidance? Choose a cryptocurrency IRA provider with services to match your Bitcoin investing style.

- A long-term strategy is best to offset fees, with greater potential for higher returns.

- Avoid so-called “IRS-approved” or “IRA-approved” crypto investments. These are scams.

We evaluated 22 of the most popular cryptocurrency IRA companies to find our top picks. We considered guidance provided to investors, trading platforms, security and ease of opening an IRA. iTrustCapital, Bitcoin IRA, Bitcoin Advizers, BitIRA, Coin IRA, Broad Financial and BlockMint are our best crypto IRA companies.

Cryptocurrency is a relatively new form of investment, so here are some things to think about.

What is a Cryptocurrency IRA?

Cryptocurrency IRAs, also called Bitcoin IRAs, are classified as self-directed IRAs. A custodian holds the assets securely and provides reporting to the IRS, but you choose the investments. An exception to the custodian requirement is a crypto IRA held within a limited liability company (LLC).

Your account manager or custodian can make trades for you, or you’ll use a secure platform to do your trading. Since you invest in cryptocurrency within a self-directed IRA, a professional will not tell you which coins to buy. Instead, you decide what cryptocurrency to buy and sell.

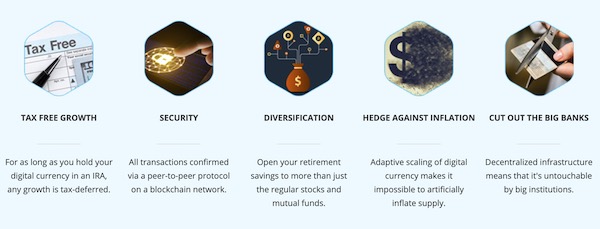

A cryptocurrency IRA is tax-sheltered like other self-directed IRAs. You don’t pay capital gains taxes until you start taking distributions during retirement. Your tax bracket should be lower at that time, providing a tax break.

Retirement Savings With a Cryptocurrency IRA

The number of retailers, banks and brokerages accepting cryptocurrency is rising, but the payment type is still very new. The promise of broader acceptance of Bitcoin and other virtual currency provides a potentially lucrative long-term investment. Short-term strategies can turn a quick profit, but this involves speculation best left to professionals to avoid substantial losses.

Cryptocurrency values can be exceptionally volatile, but risk typically flattens with subsequent trades over time. IRAs are intended for long-term investing, so a cryptocurrency IRA can be part of a diversified retirement savings plan.

Build your portfolio with traditional investments like stocks, bonds and mutual funds before adding cryptocurrency. It’s probably best to allocate a smaller portion of your retirement portfolio to a variety of cryptocurrencies.

| Cryptocurrency IRA Pros and Cons | |

|---|---|

| Pros | Cons |

| Institutional investors starting to buy Bitcoin and other digital currencies Tax-free growth High security of a blockchain network Value enhanced by a finite supply of each cryptocurrency Potential hedge against economic and market downturns | No FDIC deposit insurance or SIPC protection High fees for custodial services, optimal security and continuous platform development Digital currencies are among most volatile investments |

The Pros and Cons of Cryptocurrency Investing

We explain some of the advantages and overcoming the potential pitfalls of buying bitcoins below. You should work with a cryptocurrency IRA specialist to become fully educated. You’ll need to learn how cryptocurrency exchanges work; terms like blockchains, digital wallets and cryptography; and assorted security options.

Volatility: Cryptocurrency values are volatile because there’s no certainty that digital coin acceptance will eventually be the same as cash. However, more and more retailers, individuals and institutional investors like large brokerage firms are working with digital currency. The future looks positive for cryptocurrency.

Hackers: While it’s extremely rare, hackers have successfully drained cryptocurrency accounts in the past. Even if your coins stay safe, a hacked exchange can cause all crypto markets to dive within minutes. Cryptocurrency IRA providers build incredible security into their systems. You should be offered cold wallet storage and insurance to cover the value of your account.

Built-in security: Hacking has been uncommon because blockchain technology makes undetected tampering with transaction records nearly impossible. Private keys act as digital signatures, which become invalid if a transaction is altered. The invalidated key notifies the network to prevent loss.

Insurance: The U.S. government provides insurance for deposits and investments through the Federal Deposit Insurance Corporation and Securities Investor Protection Corporation. Cryptocurrency is not covered by the FDIC or SIPC. Most IRA providers specializing in digital assets offer high-value insurance to cover coins in the unlikely event of a breach. The amount of insurance varies between firms, so discuss this before you open an IRA account.

Economics: Bitcoin and other digital currency values are not tied to any commodity. The value is based entirely on people who are willing to own it. The supply of coins is limited for each type of currency, like Ethereum, Bitcoin, Ripple and others. Cryptocurrency is likely to retain its value in times of inflation or other economic influences, but to what degree is unknown.

Other Ways to Add Cryptocurrency to an IRA

If you’re not comfortable opening a cryptocurrency IRA, you can still buy investments offering exposure to digital currency.

- Bitcoin ETFs are exchange-traded funds offering a basket of cryptocurrencies at one market price. You can buy and sell ETFs throughout the trading day.

- A mixed cryptocurrency index fund or mutual fund can reduce risk, but read the prospectus to learn fund goals.

The downside to these options is that you don’t get to choose the specific blend of crypto held in your account. You can buy ETFs and index or mutual funds in a self-directed IRA.

You can reduce risk with a cryptocurrency fund, but you won’t control the investments.

Another way to profit from cryptocurrency indirectly is to buy stock in companies that benefit from a crypto boom. Use a self-directed IRA to buy stock in semiconductors or payment companies like PayPal and Square. The expanding crypto networks need fast processing power, and companies offering a way to make cryptocurrency payments are likely to grow.

Cryptocurrency IRA Costs

Some cryptocurrency IRA providers simplify costs by charging a one-time or monthly fee. The upfront cost usually covers everything but transactions. You may pay a per-transaction percentage. Arrangements with a monthly charge may be all-inclusive with no transaction fees. However, most cryptocurrency IRAs have these costs:

- Setup fee

- Monthly or annual storage fee

- Custodial or administrative fees

- Percentage each time you buy or sell digital currency

Fees vary from company to company. Compare services offered as well as costs. If you want a professional making your trades or providing one-to-one assistance, you’ll probably pay more. But the peace of mind you get will be worth the price until you become familiar with trading cryptocurrency.

Cryptocurrency Pricing. Source: Getty

Our Search for the Best Cryptocurrency IRA Companies

Choosing the right cryptocurrency IRA provider can have a significant impact on your retirement savings. We screened companies to find the best options. Our top picks provide resources for learning about the various currency types, exchanges, crypto market influences and security options. Education could involve discussions with an advisor, access to an extensive online library or both.

Our search for the best cryptocurrency IRA companies started with 22 firms. We narrowed our recommendations down to the seven using these steps:

- We evaluated company principles.

We searched for ethical cryptocurrency IRA companies that do not tell clients to invest in any particular coins. This removes any conflict of interest. However, advisors explain options that are right for each client’s goals while considering individual circumstances. Fees had to be readily available online, via chat or with a phone call.

- We compared services.

Our research for selecting the best cryptocurrency IRA companies included an evaluation of services. We looked for companies with new investor support and a hands-off approach for those who want to trade independently. We ensured each company on our list provided complete tax reporting services and secure storage options.

- We considered consumer reviews.

To narrow our search, we read consumer and expert reviews for the top Bitcoin IRA companies. We removed those with low ratings from consideration. We gave weight to companies with high marks for customer service or a unique electronic trading platform.

- We gathered information about fees and available cryptocurrency.

We evaluated each company to find those offering several types of cryptocurrency to clients. Not all cryptocurrency is fit for an IRA, so we filtered out those without this distinction. We chose companies that charged fair prices for service levels.

Any cryptocurrency companies that provided inadequate information about customer service policies were removed. Any companies advertising cryptocurrency as a get-rich-quick strategy were disqualified from our list.

Cryptocurrency and Bitcoin IRA Company Reviews

After our evaluation, our top picks for cryptocurrency IRA companies are: Bitcoin IRA, iTrustCapital, Bitcoin Advizers, Coin IRA, BitIRA, Broad Financial, Blockmint and Regal Assets. Each of these companies stood out from the rest in different ways.

Bitcoin IRA

Great Rollover Options |

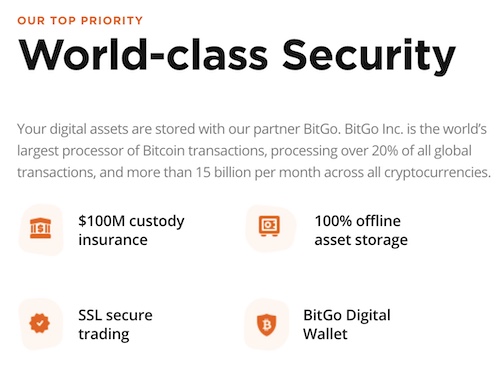

Bitcoin IRA coordinates exchanges, digital wallets and IRA custodians on behalf of retirement investors. The company oversees cryptocurrency IRA rollovers and provides a 24/7 trading platform. BitGo Trust offline segregated cold storage holds assets with the highest degree of security. Bitcoin IRA covers clients with a $100 million Lloyd’s of London insurance policy.

Screenshot: Bitcoin IRA Monthly Price Chart.

Bitcoin Saver IRA requires a minimum $100 per month contribution, opening cryptocurrency investing to just about anyone. The company also offers gold IRAs, and you can combine precious metals with digital currencies in your account.

Clients benefit from Bitcoin IRA’s cutting-edge trading platform and the ability to always contact a representative for help. Bitcoin IRA also provides an extensive online knowledge base with live currency prices, videos, e-books and tutorials.

To learn more, read our comprehensive Bitcoin IRA Review.

iTrustCapital

Great for Trading Platform |

iTrustCapital combines low fees with independent investing for IRA clients who buy and sell cryptocurrencies and gold. The company’s 24/7 trading platform executes orders in real time, and orders are settled within five minutes.

Screenshot: iTrustCapital Products

Most other Bitcoin IRA companies charge custodial, setup and additional fees. iTrustCapital simplifies account management and custodial costs with one monthly $29.95 fee. Beyond that, you pay per-transaction fees of 1% for cryptocurrency or $50 over spot for gold.

iTrustCapital was founded by industry leaders in the alternative investment IRA industry. The trading platform is entirely compliant with IRS standards.

To learn more, check out our comprehensive iTrustCapital Review.

If you are interested learning more about their services, visit the iTrustCapital website.

Bitcoin Advizers

Great Client Implementation |

Bitcoin Advizers representatives have enthusiasm for guiding people through the complexities of investing in cryptocurrency. Clients first discuss their needs, financial situation and feelings about crypto investing. Bitcoin Advizers then recommends the best cryptocurrency for their IRA.

Screenshot: Bitcoin Advizers Asset Value

Bitcoin Advizers emphasizes client education. The chief investment officer works alongside advisors to create the right investment strategy for each client. Advisors provide clear information and help with investment decisions at all times.

Clients receive in-depth annual reviews to revisit their cryptocurrency investing plan and retirement goals. The advisor helps with adjusting the plan and future decisions about buying and selling cryptocurrency.

To learn more, check out our comprehensive iTrustCapital Review.

If you are interested learning more about a cryptocurrency IRA, read our Bitcoin Advizers review or visit their website.

My Digital Money

Great Customer Service |

My Digital Money’s cryptocurrency trading platform and customer service ease the way to getting started with digital currencies. My Digital Money is developed for ease of use and provides military-grade security to protect your assets. You can trade within a crypto IRA or buy and sell using a cash account.

My Digital Money comes with concierge-style customer service. You can get help with just about any question, so you won’t feel lost whether you’re a new or advanced investor. The company promises someone will take your call, and you won’t wait for hours for a call back. My Digital Money customer service is located in California.

My Digital Money offers two automated trading tools, stop-loss orders and trigger orders:

- Stop-loss orders limit your losses if the value of a specific cryptocurrency goes down. You can set sell orders as a percentage or dollar amount. The cryptocurrency sells at the current market price if the limit is activated.

- Trigger orders are automatic orders established to take a profit. Set a trigger order to automatically sell when the value of a cryptocurrency reaches a higher price.

The Play Money feature allows you to place practice trades to test strategies or learn how the market responds to the news of the day without risking your capital.

My Digital Money charges a 0.75% custodial fee and 2.15% platform fee with each transaction. It’s free to set up an account, and you can use Play Money before you start investing. My Digital Money is available in all states.

To learn more, read our My Digital Money review or visit their website.

BitIRA Review

Great Security |

BitIRA offers the highest security while you trade cryptocurrency and for assets held in your digital wallet. BitIRA claims to provide the world’s most secure digital currency IRA. Five layers of protection include offline cold storage wallets, multifactor authorization, grade-5 guarded nuclear bunkers, $1 million insurance and Level II Cryptocurrency Security Standards (CCSS).

Screenshot: BitIRA Security.

BitIRA takes care of the investing process from start to finish. A digital currency specialist sets up your rollover IRA, executes trades and assists with choosing the best cryptocurrency blend. You retain complete control over your digital currency, while help is always available for selecting assets.

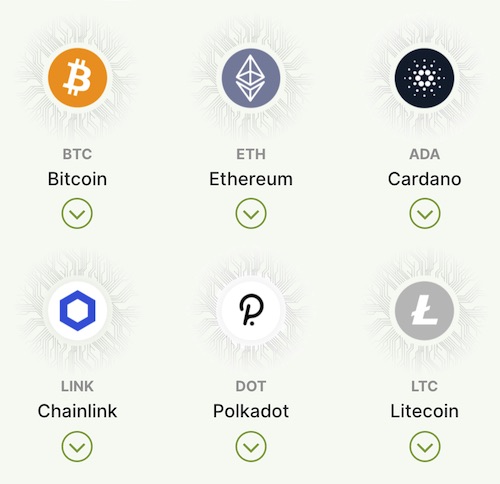

BitIRA offers seven cryptocurrencies: Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, Zcash, Stellar Lumens and Bitcoin SV. You’ll need a minimum of $20,000 to invest with BitIRA.

For more details about BitIRA, read our BitIRA Review.

If you are interested in contacting BitIRA you can visit their website.

Coin IRA

Convenient Options |

Formed in 2017, Coin IRA was one of the first companies to offer Cryptocurrency IRAs and maintains generally positive fee back from customers. Customers can take advantage of Coin IRA’s self-trading crypto platform to manage their IRA. Coin IRA provides the expertise to bridge communication between clients and exchanges, custodians and crypto wallets. Investors call an account professional to place buy or sell orders for Bitcoin and other cryptocurrencies.

Screenshot: Coin IRA Offered Cryptocurrencies.

Coin IRA walks investors through buying Bitcoin, Ethereum, Ethereum Classic, Chainlink, Dash, Litecoin, Stellar Lumens, Zcash and other cryptocurrencies. The company utilizes multiple open exchanges for crypto trading and partners with several wallet, storage and custodian companies.

Coin IRA’s website provides information about crypto IRA rules, benefits and current cryptocurrency pricing and a resource section. The resource page explains factors that affect cryptocurrency prices, a news section and real-time charts for Bitcoin, Ethereum and Litecoin.

To learn more, read our comprehensive Coin IRA Review.

Broad Financial

Flexible Checkbook IRAs |

Broad Financial provides self-directed IRAs with checkbook control. Checkbook control can be ideal for experienced investors who want the highest level of control over retirement investments. Broad Financial can set you up with an IRA that holds cryptocurrency, gold, real estate and various other assets.

Screenshot: Broad Financial Youtube Video

The setup fee for a Broad Financial account with checkbook control is $1,295. You’ll also pay $80 per quarter to maintain the IRA. The upfront cost is high, but you’ll save on trading fees and have real-time access to funds.

Frequent traders can save substantially on fees with a Broad Financial checkbook control account. Buy and sell orders require no custodian, and account funding options are via credit card, debit card or checkbook.

Broad Financial offers other types of IRAs, and Solo 401(k) accounts for self-employed investors. Clients can take loans from a Solo 401(k) account and use a checking account for flexible trading.

To learn more about, read our comprehensive Broad Financial Review.

BlockMint IRA

Lowest Minimum Investment |

BlockMint is part of Lear Capital, a company with over 20 years of experience in the alternative investment business. BlockMint offers expert guidance and secure tools to simplify setting up a cryptocurrency IRA.

Screenshot: BlockMint Live Pricing.

BlockMint’s website explains the three steps to establish and fund an account. The site also offers a guide to building cryptocurrency retirement savings and current industry news. You’ll also find real-time prices for Bitcoin, Ethereum and Litecoin.

The minimum investment in a BlockMint IRA is $10,000. When you buy cryptocurrency, you’ll pay BlockMint 15%, but you may qualify for a volume discount. Custodial transaction fees are 2.5% when you buy assets and 1% when you sell. The secure storage and maintenance fee is $195 annually, with a monthly storage fee equal to 0.05% of the account balance.

For more information, read our BlockMint review.

Regal Assets

Great High-value Insurance |

Regal Assets was the first in its industry to receive authorization to sell cryptocurrency within its Regal IRA. Clients can combine digital assets with gold and other precious metals within a Regal IRA. Choose from over 20 cryptocurrencies for your portfolio, with new options frequently made available.

Regal Assets

Regal Assets account executives thoroughly educate clients to select assets with confidence. You receive guidance and answers to all your cryptocurrency questions to build your portfolio.

Regal Assets works with global insurer Lloyd’s of London to insure cryptocurrency IRAs up to $2 million. This coverage protects retirement funds in the unlikely event of hacking or identity theft.

For more information, read our Regal Assets review.

Related Bitcoin IRA Resources

Readers of this home warranties guide also read these related articles and found them helpful.

Best Cryptocurrency Exchanges

We evaluated 45 top cryptocurrency exchanges to find those available to traders in the United States.

Best Bitcoin Wallets

We evaluated 82 bitcoin companies based on security, development, and ease of use to identify the best bitcoin wallets.

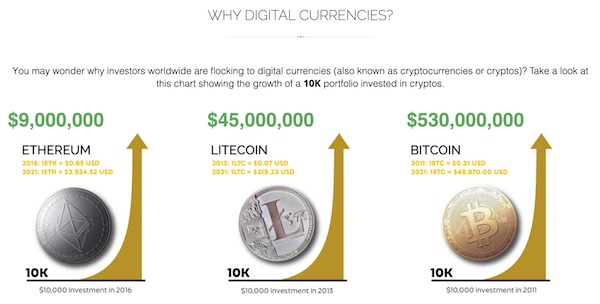

Bitcoin IRA Statistics

Bitcoin IRAs mix IRA tax advantages with high-risk investing. What can we learn about these retirement accounts by analyzing the available data?

Frequently Asked Questions about Cryptocurrency IRAs

How does a bitcoin exchange work with my cryptocurrency IRA?

Your cryptocurrency IRA uses an online platform called an exchange to bring buyers and sellers together. A bitcoin or cryptocurrency exchange is like a stock market, but with bid and ask prices for digital currency. A crypto IRA specialist can help you choose the best exchange based on security and other factors.

Is there a minimum number of coins required to buy bitcoin?

Cryptocurrency IRA companies require a minimum amount to open an account, but there’s typically no minimum number of coins to buy. At the time this guide was published, one bitcoin cost over $33,000. Fortunately, you can buy just one coin or a fraction of a bitcoin. Fractional shares are available for other cryptocurrencies as well.

What is a cryptocurrency IRA custodian?

An IRA custodian is an IRS-approved financial institution that provides tax reporting and other account management. The IRS requires annual reports for all IRAs, whether you take distributions or not. Most cryptocurrency IRA companies work directly with a custodian, so you do not have to choose one.

What does the IRS say about cryptocurrency IRAs?

At this time, the IRS has no specific cryptocurrency IRA regulations. However, the IRS considers cryptocurrency to be taxable property, making it eligible as an IRA investment.

How are assets stored in a cryptocurrency IRA?

Cryptocurrency storage is called a wallet. Your wallet consists of encryption software to protect your account information and keep track of your currencies. Cold wallets are the most secure. These are self-contained hard drives, much like a USB thumb drive, that hold account data and encryption.

Concluding Thoughts on Cryptocurrency IRAs

Bottom Line:

Consumers should take time to understand the rewards and risks of cryptocurrency.

Some financial professionals strongly advocate buying cryptocurrency, while others advise staying out of the Bitcoin market. However, investing in cryptocurrency could provide significant returns in the future and a hedge against losses when other markets fall. It’s wise to start with a small cryptocurrency IRA investment after you accumulate traditional retirement assets.

The Best Bitcoin IRA Companies

| Cryptocurrency IRA Company | Best For | |

|---|---|---|

| 1 | Bitcoin Advizers | Great Client Implementation |

| 2 | Coin IRA | Convenient Options |

| 3 | Broad Financial | Great Self Trade |

| 4 | iTrustCapital | Great For Trading Platform |

| 5 | BitIRA | Great Security |

| 6 | Alto IRA | Great Selection |

| 7 | Bitcoin IRA | Great Rollover Options |

| 8 | BlockMint | Great Experience |

| 9 | Regal Assets | Great High-value Insurance |

| 10 | My Digital Money | Great Customer Service |