We all hope our retirement years are filled with good health, recreation, and relaxation. Living independently and maintaining an active social calendar requires having enough money to pursue your desired lifestyle. Considering each state’s cost of living is essential to achieving lifestyle goals, and retiring to a tax-friendly state helps you to stretch your retirement income.

You might find one of the eight states with no income tax most attractive when deciding where to settle down. But don’t cross the other 42 states off your list just yet. For retirees, income tax is only part of the picture. State and local taxes, like sales and property taxes, could differ by the tens of thousands for some people. Fuel prices are a consideration, too. We’ve added gas and diesel taxes to our data metrics because we know that prices at the pump affect your wallet now more than ever.

To identify the most tax-friendly states for retirement, we considered these factors:

- Income tax

- Retirement, pension, and social security taxes

- Average tax on purchases

- Gas and diesel tax (the national average is $0.29 per gallon)

- Estate and inheritance tax

- Additional exemptions, deductions, and credits

- Property tax (real estate and vehicle)

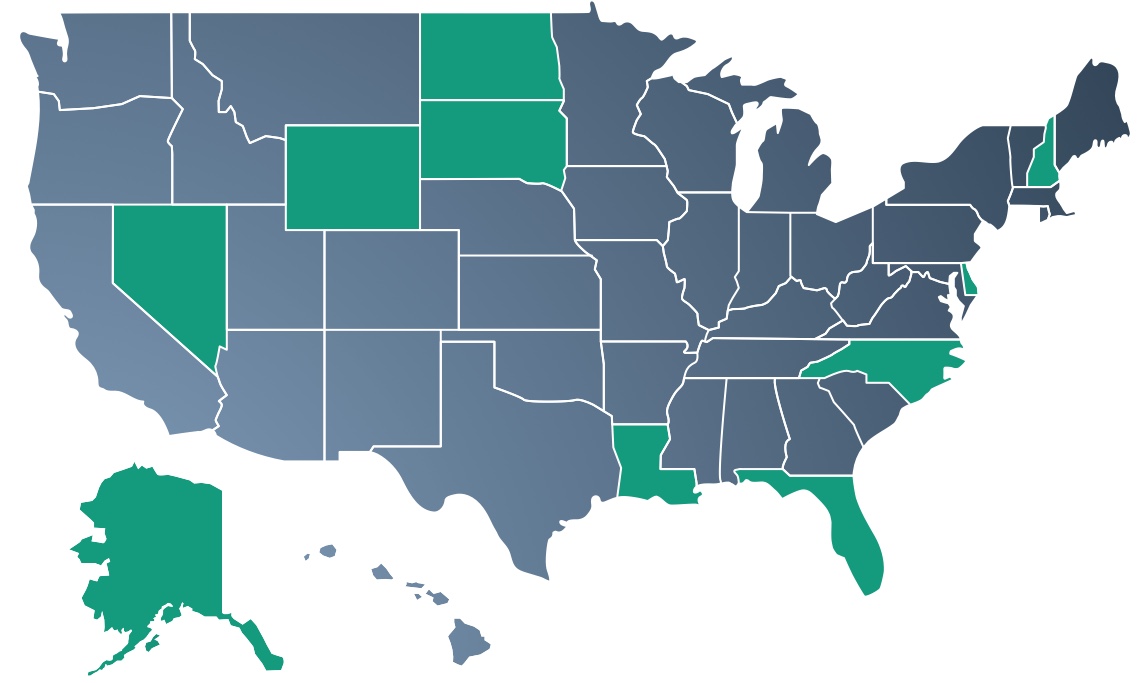

The 10 Most Tax-Friendly States For Retirement

#10: North Dakota

- State income tax: 2.9%

- Average state and local sales tax: 6.96%

- Social Security tax: None

- Retirement/Pension Tax: Partial/Partial

- Estate tax/Inheritance tax: None/None

- Gas/Diesel tax and fees: $0.23 per gallon

Even though North Dakota imposes an income tax, it’s relatively low for middle-income earners. And with no inheritance or estate taxes to worry about, the tax burden for seniors is modest compared to other states in the region.

North Dakota introduced a Social Security exemption in 2021; however, income from retirement accounts and pensions are taxable. Affordable property and gas taxes help counteract these income-related fees. Thanks to the state’s competitive housing prices, buying a home in The Peace Garden State could end up as an affordable decision.

Prepare for Retirement, With Curated News Delivered to Your Inbox

#9. North Carolina

- State income tax: 4.99%

- Average state and local sales tax: 6.98%

- Social Security tax: None

- Retirement/Pension Tax: Yes/Partial

- Estate tax/Inheritance tax: None/None

- Gas/Diesel tax and fees: $0.38 per gallon

North Carolina exempts all Social Security retirement benefits from income taxes, but other forms of retirement income are fully taxed (certain military pension exemptions apply). This means seniors with multiple income streams could incur a higher tax bill in The Tar Heel State.

Tax burdens for common purchases and property hover around national averages. Pair that with the lack of estate or inheritance taxes and we think that retirees should look favorably at North Carolina. Beaches and mountains, anyone?

#8: Nevada

- State income tax: None

- Average state and local sales tax: 8.23%

- Social Security tax: None

- Retirement/Pension Tax: None/None

- Estate tax/Inheritance tax: None

- Gas/Diesel tax and fees: $0.23 per gallon/$0.27 per gallon

Those who choose to retire in Nevada can take their pick of tax savings. For one, Nevada has no state income, estate, or inheritance tax, which helps retirees keep more of their money. Property taxes are well below the national average—they clock in as the seventh-best rate in the nation. A Nevadan with a home valued at $267,900 would pay just $1,614 each year in property taxes.

But a word of caution to anyone already packing their bags: sales taxes in The Silver State might sting a bit. They can reach as high as 8.23% in some communities, though groceries and prescription drugs are exempt. Low fuel fees mean that a trip to the Las Vegas strip won’t break the bank, but we can’t guarantee any savings at the slots.

Read more: States That Won’t Tax Your Pension

#7: Louisiana

- State income tax: 5.28%

- Average state and local sales tax: 9.55%

- Social Security tax: None

- Retirement/Pension Tax: Partial/None

- Estate tax/Inheritance tax: None/None

- Gas/Diesel tax and fees: $0.20 per gallon

Louisiana boasts a statewide median property tax rate that’s among the lowest in the country. In 2022, the already-reasonable income tax rates were lowered across the board, which makes The Pelican State even more homeowner-friendly.

Everyday purchases might make more of a dent in Louisiana, as groceries, clothing, and prescription drugs are subject to local taxes. But weigh that against low gas taxes and it’s easy to see why we think the state deserves a spot on this list.

Government income and military retirement plans are fully tax exempt. Plus, taxpayers 65 and older can exclude up to $6,000 of retirement income from pensions, annuities, and IRAs (up to $12,000 for joint filers).

#6: South Dakota

- State income tax: None

- Average state and local sales tax: 6.4%

- Social Security tax: None

- Retirement/Pension Tax: None/None

- Estate tax/Inheritance tax: None/None

- Gas/Diesel tax and fees: $0.28 per gallon

South Dakota residents get a free pass on income tax, which is great news for retirees. This means Social Security, pensions, and other forms of retirement income are also tax free. Residents of The Mount Rushmore State will appreciate a lower-than-average sales tax—especially compared to their neighbors to the north—but groceries and clothing do have sales tax.

Property taxes hover around the national average, with most homeowners paying 1.31% of their property’s value in taxes. A house valued at $167,100 typically incurs about $2,195 a year in taxes. However, qualifying seniors can leverage several of the state’s property tax credits to offset this cost.

Finally, we applaud South Dakota’s manageable gas and diesel taxes. Those hoping to explore the natural wonders in the area won’t pay more than the national average to fill up their vehicles.

#5: New Hampshire

- State income tax: None

- Average state and local sales tax: None

- Social Security tax: None

- Retirement/Pension Tax: None/None

- Estate tax/Inheritance tax: None/None

- Gas/Diesel tax and fees: $0.22 per gallon

Retirees should definitely place New Hampshire on their list of states with potential—it’s the only New England state that does not levy an income tax. State and local sales taxes and estate and inheritance taxes are also exempt. The 5% tax on dividends and interest is being phased out through 2027.

Still, retirees in The Granite State aren’t completely without burden. New Hampshire is not higher on our list because it boasts the third-highest property tax rates in the country. An average of 1.86% equates to $4,636 per year on a home valued at $249,700. Those aged 65 and older could qualify for additional exemptions.

#4: Florida

- State income tax: None

- Average state and local sales tax: 7.01%

- Social Security tax: None

- Retirement/Pension Tax: None/None

- Estate tax/Inheritance tax: None/None

- Gas/Diesel tax and fees: $0.25 per gallon/$0.19 per gallon

Florida residents have no estate, inheritance, or state income tax. The Sunshine State does not tax Social Security retirement benefits, pensions, or income from IRAs or a 401(k).

The average state and local sales tax in Florida climbs to 7.01%—but groceries and prescription drugs are exempt. Since gas fees are cheaper here than in most other states, retirees in Florida are also protected from sticker shock at the pump.

Florida property taxes are in line with the national average of 0.89%, and several exemptions are available for qualified seniors. The average Floridian would pay $1,914 per year in property taxes on a $215,300 home.

#3: Wyoming

- State income tax: None

- Average state and local sales tax: 5.22%

- Social Security tax: None

- Retirement/Pension Tax: None/None

- Estate tax/Inheritance tax: None/None

- Gas/Diesel tax and fees: $0.24 per gallon

With no state income tax, estate tax, or inheritance tax and a low sales tax, Wyoming is a smart financial destination for current or future retirees. Residents pay a scant sales tax that’s lower than almost every other state. Groceries and prescription drugs are also tax exempt, which helps cut back fees on everyday purchases.

Land lovers should take notice: Wyoming has one of the country’s lowest median property tax rates. A retiree with a home valued at $220,500 would pay $1,337 in property taxes. Most Wyoming residents pay 0.61% of the home’s value.

#2: Delaware

- State income tax: 6.60%

- Average state and local sales tax: None

- Social Security tax: None

- Retirement/Pension Tax: Partial/Partial

- Estate tax/Inheritance tax: None/None

- Gas/Diesel tax and fees: $0.22 per gallon

Delaware’s income tax rate could give retirees on a budget reason to pause, but The First State makes up for it in other ways. Social Security income is exempt, and residents 60 and older can exclude up to $12,500 of pension and other retirement income.

Delaware residents don’t pay sales taxes on any purchases they make, which is one of the main reasons it tops our list of tax-friendly states. Retirees will save at home, too. Property taxes are the sixth-lowest in the nation—payments on a $251,100 home are just $1,431 per year. Comparatively, taxes to gas up your car here are not much higher than in other states, and Delaware does not impose a vehicle property tax.

#1: Alaska

- State income tax: None

- Average state and local sales tax: 1.76%

- Social Security tax: None

- Retirement/Pension Tax: None/None

- Estate tax/Inheritance tax: None/None

- Gas/Diesel tax and fees: $0.09 per gallon

Our winning state imposes the smallest tax burden on retirees. Alaska has no state income, estate, or inheritance taxes. It also boasts a gloriously low average state and local sales tax. There is no statewide sales tax, but local communities do collect a percentage that varies by location. The Tax Foundation lists an average sales tax of 1.76% in Alaska, though this rate reaches 7.50% in some communities

On-the-go retirees will appreciate Alaska’s low gas tax. At just $0.09 per gallon, it’s the lowest in the country.

However, the median property tax is one of the highest in the country, with most residents paying 1.19% of the property’s market value. A retiree with a $270,400 home in Alaska can expect to pay $3,231 in property taxes. To offset these costs, Alaska gives residents who’ve lived in the state for one year an annual dividend check as part of the state’s oil earnings. In 2022, the payout totaled $3,284.

Data Sources

We compiled data from several sources to build this list. We also created a data metric to determine state rankings.

Income tax: Our income tax information comes from each state’s tax agency and a The Tax Foundation’s 2022 report. Using these two sources, we compiled the most up-to-date data available on state retirement income taxes, pension, and social security taxes.

Gas and diesel tax: Current gas taxes by state reference a 2022 report from IGEN, an excise tax platform.

Property tax: State property tax rates are from the most recent U.S. Census data (2020) and Wallet Hub’s 2022 calculations. The annual payment is derived using the median home value in each state.

Sales tax: State sales tax rates are from each state’s tax agency and Tax Foundation’s 2022 average combined sales tax rate. Combining state and local rates gives a more accurate estimate of what people in all areas of the state could day, as the rates can vary.