States That Don’t Tax Retirement Pensions

Updated:

Retirement Living takes an unbiased approach to our reviews. We may earn money when you click a partner link. Learn More

When looking for the most tax-friendly states to retire in, you’ll want to think about everything from how income is taxed to the local sales tax rate to property taxes, if you plan to own a home.

Why should you be worried about income taxes if you’re retiring? Pensions, retirement account distributions, and Social Security benefits can all technically qualify as income—and thus may be eligible for taxation.

Luckily, there are a handful of states that don’t tax pensions. If you plan to live off a sizable pension in retirement, it might make sense to move to one of these states. Just make sure you’re considering other income, such as a 401(k), when making your decision, as states may have different rules regarding retirement distributions.

Our guide to pension taxes by state should help you narrow down your list.

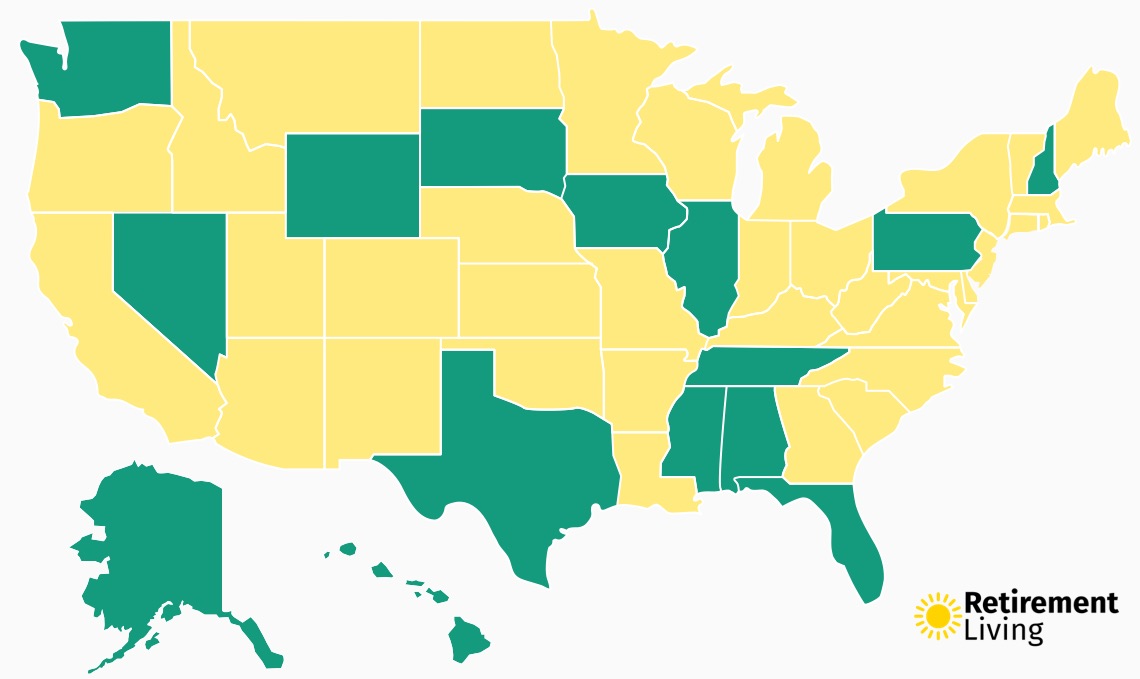

15 States Without Taxes on Pensions

In the U.S., seven states don’t tax income at all: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, and Wyoming. Two others—New Hampshire and Washington—only tax very specific earnings (dividends and interest in NH, but this will phase out after 2025; large capital gains in Washington).

But what about taxes on pensions? Fifteen states—these nine states plus Alabama, Hawaii, Illinois, Iowa, Mississippi, and Pennsylvania—are tax-free when it comes to pension payments. Let’s take a closer look.

1. Alabama

Alabama is a great state to move to in retirement. Not only does the state not tax government pensions and private pensions (if income comes from a defined-benefit retirement plan), but it also has one of the lower costs of living in the country. In addition, Alabama does not tax Social Security benefits and has some of the lowest property taxes in the country.

Read more about Alabama taxes.

2. Alaska

Alaska is one of the seven states without any income taxes, which means your pension—along with any other retirement benefits and Social Security benefits—are free from taxation. Given the state’s remote location, the cost of living tends to be higher in Alaska, and you’ll also have to deal with cold temperatures throughout most of the year

Read more about Alaska taxes.

3. Florida

Like Alaska, Florida does not have a state income tax. That means you can move here in retirement without worrying about your pension being taxed. Florida also does not impose income taxes on retirement distributions and Social Security benefits.

Read more about Florida taxes.

4. Hawaii

Hawaii has a progressive income tax system that grows from 1.40% to 11.00%, making it one of the states with the highest income tax rates. However, retirees don’t have to worry about the double-digit rate in Hawaii when it comes to pensions, as long as you didn’t make contributions to the plan.

However, Hawaii is less kind to 401(k) and IRA distributions; those are still taxable. Social Security benefits are not. Hawaii notably has the lowest property taxes in the country.

Read more about Hawaii taxes.

5. Illinois

Retiring to Illinois is a good choice if you have a government or military pension, as the state doesn’t tax this income. Your private pension also will not be taxed if it’s from an employee benefit plan. The same stipulations hold true for employer 401(k) and IRA plans. Social Security benefits are also tax free in Illinois.

Keep in mind, however, that Illinois has the country’s second-highest property tax rate, behind only New Jersey.

Read more about Illinois taxes.

6. Iowa

Any federal and military pensions are not considered taxable in the state of Iowa. And as long as you’re 55 or older, you won’t pay taxes on private qualified pension income. In addition, Iowa does not tax Social Security benefits or retirement distributions from 401(k)s and IRAs.

Read more about Iowa taxes.

7. Mississippi

Mississippi is the state with the lowest cost of living, making it a great spot to retire on a budget. Not only will you enjoy lower groceries, health care, and housing costs, but you also won’t have to worry about paying taxes on qualified pensions, as long as you haven’t retired early. IRAs, 401(k)s, and Social Security benefits are also tax exempt in Mississippi.

Read more about Mississippi taxes.

8. Nevada

Nevada is another state with no income taxes at all, which means you don’t need to worry about taxes on pensions, Social Security benefits, and retirement distributions. The effective sales tax rate is admittedly on the higher side in Nevada, but overall, the state is a great place to retire.

Read more about Nevada taxes.

9. New Hampshire

As mentioned above, New Hampshire doesn’t assess state taxes except on interest and dividends, and that will phase out after 2025. As far as pensions go, however, you have nothing to worry about. In fact, New Hampshire doesn’t tax pensions, retirement account distributions, or Social Security benefits.

Read more about New Hampshire taxes.

10. Pennsylvania

In Pennsylvania, retirees won’t have their pensions taxed as long as it comes from a qualified employer-sponsored plan. Similarly, you won’t pay taxes on 401(k) and IRA distributions, as long as you don’t retire early. Your Social Security benefits are also safe from taxation in Pennsylvania.

Read more about Pennsylvania taxes.

11. South Dakota

North Dakota may have income taxes, but South Dakota is totally immune. Because there’s no state income tax in South Dakota, you don’t have to worry about your pension being taxed, nor will there be taxes on Social Security benefits or retirement account distributions.

Read more about South Dakota taxes.

12. Tennessee

Tennessee is yet another state without income taxes (but be careful, sales taxes are higher than average here). With no income taxes, that means you won’t pay the state a cent on your pension income, nor will you owe taxes on 401(k)s, IRAs, and Social Security benefits.

Read more about Tennessee taxes.

13. Texas

Everything’s bigger in Texas, except your state income tax total. That’s because the Lone Star State doesn’t have any income taxes. This means your pension is free from taxation, as are any retirement accounts and your Social Security benefits.

Read more about Texas taxes.

14. Washington

While Washington state does have capital gains taxes above a certain threshold, there are otherwise no income taxes. For retirees, this makes Washington a great option, as there’s no concern about taxes on pensions, Social Security benefits, IRAs, and 401(k)s.

Read more about Washington taxes.

15. Wyoming

Finally, Wyoming is on the list of states with no income taxes. Once again, that means you won’t pay any state taxes on your pension in Wyoming. Also free from taxation are Social Security benefits and distributions from retirement accounts.

Read more about Wyoming taxes.

How Much Can You Save By Moving to a State That Doesn’t Tax Pensions?

If you’re planning to relocate in retirement to reduce the amount you pay in taxes, you’ll want to consider more than just your pension. States vary in how they tax retirement accounts like 401(k)s and government benefits like Social Security. In addition, states without income taxes often have higher sales tax rates and/or a higher overall cost of living.

That said, prioritizing a move to a state that doesn’t tax pensions could stand to save you some money. How much? We estimate that moving to a state without taxes on pensions could save you $982.56 a year (private pension) or $2,223.22 a year (government pension) on average.

How did we get that number? The Pension Rights Center reports that the median private pension in 2022 was $11,040; those with a government pension earned more than double each year at $24,980. A 2020 analysis of U.S. Census and Bureau of Economics data found that the average American pays 8.9% of their income in state taxes. Moving from nearly 9% to 0% yields these big tax savings on pensions.

These calculations are helpful to envision how much the average person might save, but your best bet is to work with a trusted financial advisor near you when planning your retirement plan.

FAQs

Do pensions count as earned income?

Pensions are not considered a form of earned income, but that doesn’t mean they aren’t taxable. Thirty-five U.S. states have some form of taxes on annual pension distributions.

How much will my Social Security be reduced if I have a pension?

If you have a government pension, your Social Security benefits are reduced by two-thirds. For instance, if you receive $300 a month from your pension, two-thirds of that ($200) will be deducted from the amount you’d otherwise earn in the form of Social Security benefits.