The VA home loan program is available from the U.S. Department of Veteran Affairs (VA) to make purchasing a home financially feasible for veterans and qualified service members. However, there are no guarantees as to the interest rate the VA-qualified private lenders offer with the program. There are several steps you can take to get the best rate possible from a lender.

Our list of six ways to get the best VA mortgage rates will help guide you through not only ways to get better interest rates, but also explain some of the behind-the-scenes reasons a lender considers when making an interest rate offer on a mortgage. By understanding these factors and a little planning, you can find the best available interest rate on a VA mortgage loan.

- Check and Repair Your Credit Score Before Home Shopping

A high credit score is a big help in getting the best VA mortgage rates available. However, the time to check your credit score, correct errors, and work to improve your credit is before you start shopping for a home, not after you have found your dream home and applied for a loan. There are several ways to check your credit score. For example, your credit card company may offer free credit reports, or you can use one of several reputable credit check websites. Plus, federal law entitles you to your credit reports once per year for free at annualcreditreport.com.

The credit bureaus that track credit are Equifax, Experian, and TransUnion. Your score can vary from bureau to bureau, so check all three. Credit scores are expressed in a number from 300 to 850. Scores of 780 or higher are considered very good or excellent depending on the credit bureau’s scale. A score under 600 requires some cleaning up to get better loan terms or to qualify for a loan at all. With a higher credit score, you will be approved for a loan faster and will likely be offered a lower interest rate.

Once you get your credit reports, it is essential to make sure the information is correct. While errors are not common, you may find a data entry error, on-time payments reported as late, or even accounts that opened in your name without your knowledge. If you see any errors, it is vital to have them corrected, which takes time. File a dispute backed up with documented proof of errors with each bureau that has incorrect information. Follow the procedures for the credit bureau and consider using the sample letter the FTC provides to help you make your case.

If your credit report is correct with a low score, you’ll need to take steps to improve your credit before you start looking for a VA mortgage loan. To improve your score you might have to:

-

Pay off some debt

-

Organize your finances to make payments a couple of days before the due date

-

Don’t open a number of new credit card accounts you don’t need for the sake of increasing your available credit.

-

Keep balances low on revolving credit like credit cards

You can close accounts with a balance, but you still will need to pay these off to raise your credit score. You should also reduce your credit utilization ratio, a percentage based on the amount you currently owe on credit card accounts divided by the total of each card’s credit limit. Taking steps to raise your credit score before you start home shopping pays off with access to better interest rates and other loans terms.

-

- Lower your Debt-to-Income Ratio Before Home Shopping

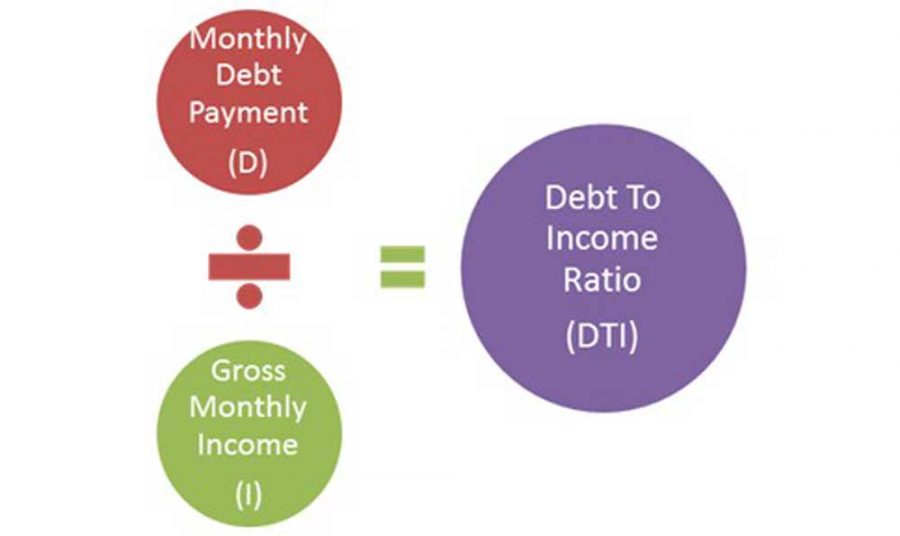

Part of what lenders consider before offering a mortgage loan is the debt-to-income ratio. You need to understand this ratio before shopping for a home so you can get a better interest rate.

Your debt-to-income ratio is the total of all monthly payments, not including utilities, divided by your gross monthly income (income before taxes and other deductions).

Debt to Income Ratio. Source: Advantage Credit Counseling

Debt to Income Ratio. Source: Advantage Credit Counseling- Some regulations limit the debt-to-income ratio you can have and still qualify for a mortgage, particularly a

qualified mortgage to 43 percent.

Lenders reward lower debt-to-income ratios with more attractive interest rates. If you have a high debt-to-income ratio, you will need to take the time to lower that ratio before shopping for a home and a mortgage. Pay down loans, consolidate debt into lower rate loans that you can pay off faster, and avoid taking out new loans if possible.

VA loans do not require a down payment, but making a down payment almost always works to your advantage. Making a down payment on a mortgage loan grants you immediate equity in the property and reduces your debt-to-income ratio because the amount of the mortgage will be lower. The bank or another VA-approved lender can then offer you a significantly better interest rate. A smaller loan amount could make payments more manageable on a shorter term with lower interest rates. VA loans do not include a private mortgage insurance (PMI) stipulation, so you don’t have to save the recommended 20 percent down payment that’s typical for a conventional home loan. However, a down payment often matters for getting a lower interest rate and subsequently, a lower monthly payment.

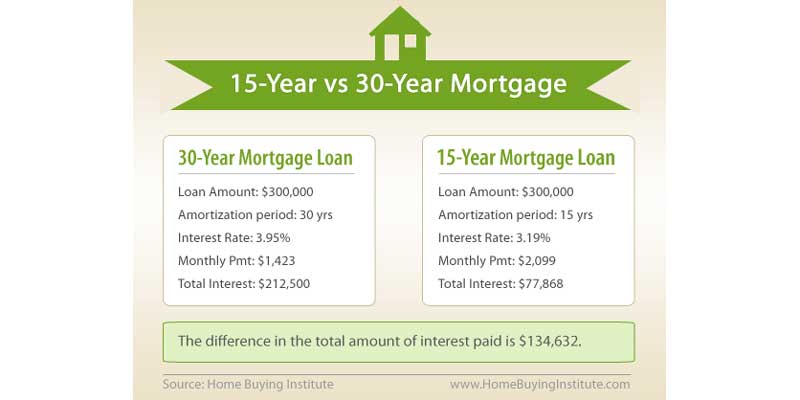

The length of your VA loan also affects the mortgage interest rate. The two most common mortgage loan lengths are 15 years and 30 years. While 30-year loans generally have the lowest payments, you will pay interest for a longer term, so they cost more over time. Fifteen-year mortgages carry a lower interest rate, and the difference could be a full percentage point or more depending on national interest rates, regional market conditions, and the health of your credit. Monthly payments on a 15-year mortgage are higher because you pay the loan off in half the time, but the lower interest rate leads to years of savings.

An adjustable rate mortgage (ARM) is not a loan solution for everyone but consider both ARMs and fixed-rate loans. An ARM loan has a fixed interest rate guaranteed for a few years then fluctuates depending on market conditions. The adjustable rate can vary drastically, but the fixed rate is lower than a 30- or 15-year loan. Some ARMs have a cap on how high the interest rate can go, which can be helpful for budgeting for payments. ARMs are generally not recommended unless you are planning on selling the home quickly or are prepared to pay fees associated with refinancing these loans.

“The difference between a fixed rate and an adjustable rate mortgage is that for fixed rates, the interest rate is set when you take out the loan and will not change. With an adjustable rate mortgage, the interest rate may go up or down.” – Consumer Financial Protection Bureau

A fixed-rate mortgage interest rate remains unchanged for the life of the loan. The payments are higher compared to the first years of an ARM, but there is no financial uncertainty for the future. Interest rates on fixed-rate mortgages are generally competitive, but ARM initial rates can be significantly lower. These loans are popular since most borrowers plan to stay in their homes longer and there are no fees for paying off the mortgage early.

When shopping for a mortgage lender, keep in mind that there are a variety of lenders participating in the VA loan program. You will start by getting qualified for the loan through the VA, but the VA does not issue mortgages. Instead, the VA backs, or guarantees, the loans to lessen the risk to approved private lenders. If you seek a mortgage through the VA loan program, you will find lenders on your own.

It doesn’t take much additional time to shop rates between lenders, and it’s the only way to find the lowest interest rates and closing costs. First, make a broad comparison of mortgage loans, then narrow your list down to three to five VA-approved lenders. Get quotes from each of these lenders and ask for a preapproval. Banks, credit unions and mortgage specialists can all be lenders approved via VA regulations. If you are having trouble finding a VA-approved lender or have any doubts about any lender, contact your regional VA loan office to speak to one of the VA loan specialists to find approved lenders serving your area.