Key Takeaways

- Hawaii, New Jersey, Colorado, New York, and Massachusetts are most likely to search online for “how to buy gold.”

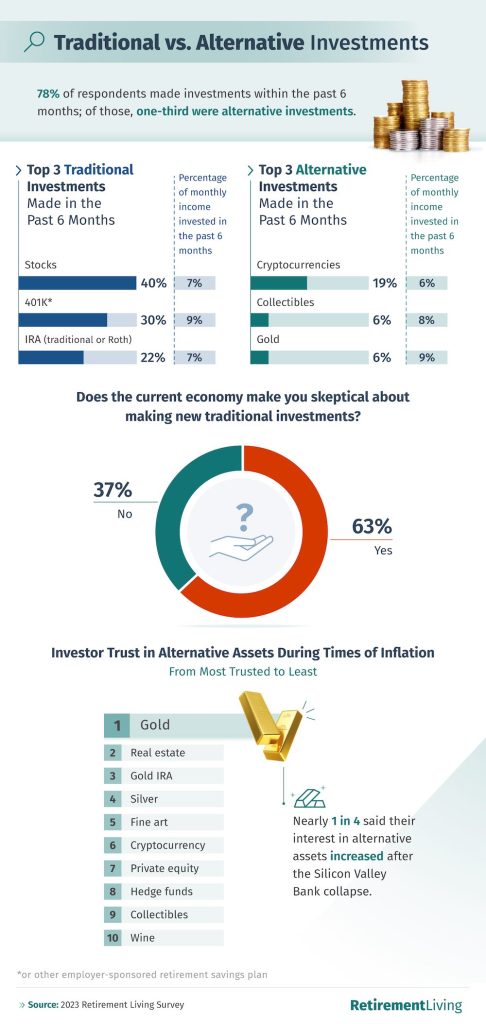

- Americans rank gold as the most trusted alternative asset during times of inflation.

- Nearly 1 in 4 said their interest in alternative assets has increased since the collapse of Silicon Valley Bank.

- 63% of Americans are skeptical of making new traditional investments with the current state of the economy; Gen Zers are the least skeptical.

Making the Right Investments

Inflation affects everything from the price of groceries to the housing market. Those keen on investing for retirement or other financial reasons might be apprehensive about investing in traditional assets. Stocks, bonds, and cash are highly influenced by inflation, but there are alternative investments available that aren’t as affected by inflation’s ebb and flow.

To better understand American investment habits in the current economy, we analyzed search volume data from the past 12 months and surveyed over 1,000 Americans. Let’s find out how many people are searching for alternative investment sources and where they trust their money.

Searching for Precious Metals

One popular option for alternative investments is precious metals. Receiving more attention as of late, precious metals are often considered nearly inflation-proof. To determine interest in this alternative investment, we analyzed online activity for search terms related to gold and silver investments and organized the data by state.

Use the dropdown menu below to view search volume data for seven search terms associated with gold and silver. The data analyzed covered searches from April 2022 through March 2023.

Precious Metals Showdown

Searches for “how to invest in gold and silver” have increased by 656% in the past 12 months.

People are intrigued by the idea of precious metals as inflation hedge investments. Searches for “how to invest in gold and silver” increased by 656% in the past 12 months, with residents in Hawaii, New Jersey, Colorado, New York, and Massachusetts being most likely to search for “how to buy gold.” The District of Columbia also showed significant interest in precious metals investments and would have made each of the top 10 search lists if districts and territories were included. Meanwhile, Wyoming, Delaware, and Vermont residents seemed most ready to take the investment leap, landing among the top 5 states searching for “gold dealer near me” and “silver dealer near me.”

Other types of precious metals investments are also taking the spotlight amid inflation. Searches for “self-directed precious metals IRA” increased 860% in the last year, while searches for “best cryptocurrency to buy” were down 72%.

Takeaway: With the rise in searches for precious metals investments, it seems people are looking for ways to diversify their portfolios and protect their holdings and retirement against falling values.

Investing During Uncertain Times

While searches for gold and silver are on the rise, search volume data doesn’t tell the whole story. To learn more about Americans’ investment patterns, we surveyed 1,027 people about their thoughts on traditional and alternative investments, as well as new investments they made within the past six months.

Traditional investments like stocks, bonds, and cash are subject to devaluation from inflation. On the other hand, alternative investments like gold, real estate, or fine art are less dependent on currency rates because their value is inherent. Certain alternative assets have historically shown stability amid inflationary environments, which may be why gold was ranked the most trusted alternative asset during times of inflation.

Considering the economic dependence of traditional investments, 63% of respondents were skeptical about making such investments in the current economy. Over three-quarters (78%) said they made investments within the past six months, but one-third of those were alternative investments, with cryptocurrency (19%) at the top of that list.

A closer look at respondent demographics showed a marked difference in investment thoughts and patterns among different genders and generations. Men were 91% more likely than women to have made alternative investments in the past six months, while women were 35% more likely to have felt skeptical about traditional investments in the current economy.

Among generations, Gen Z was least skeptical of new traditional investments, but 3 in 10 were even more interested in alternative investments. Millennials, meanwhile, were the most likely to have made alternative investments within the past six months, as almost half (43%) reported doing so.

One millennial survey participant, a 39-year-old female, shared her perspective on investing in alternative assets during times of high inflation, stating, “The uncertainty of the stock market makes it likely that I won’t make any money with traditional investing, and possible that I will even lose money. It’s important to diversify, and now is a good time to look into alternatives.”

Alternative investments have received a boost from more than just inflation. Since the Silicon Valley Bank collapse in March 2023, 1 in 4 respondents reported an increased interest in alternative investments.

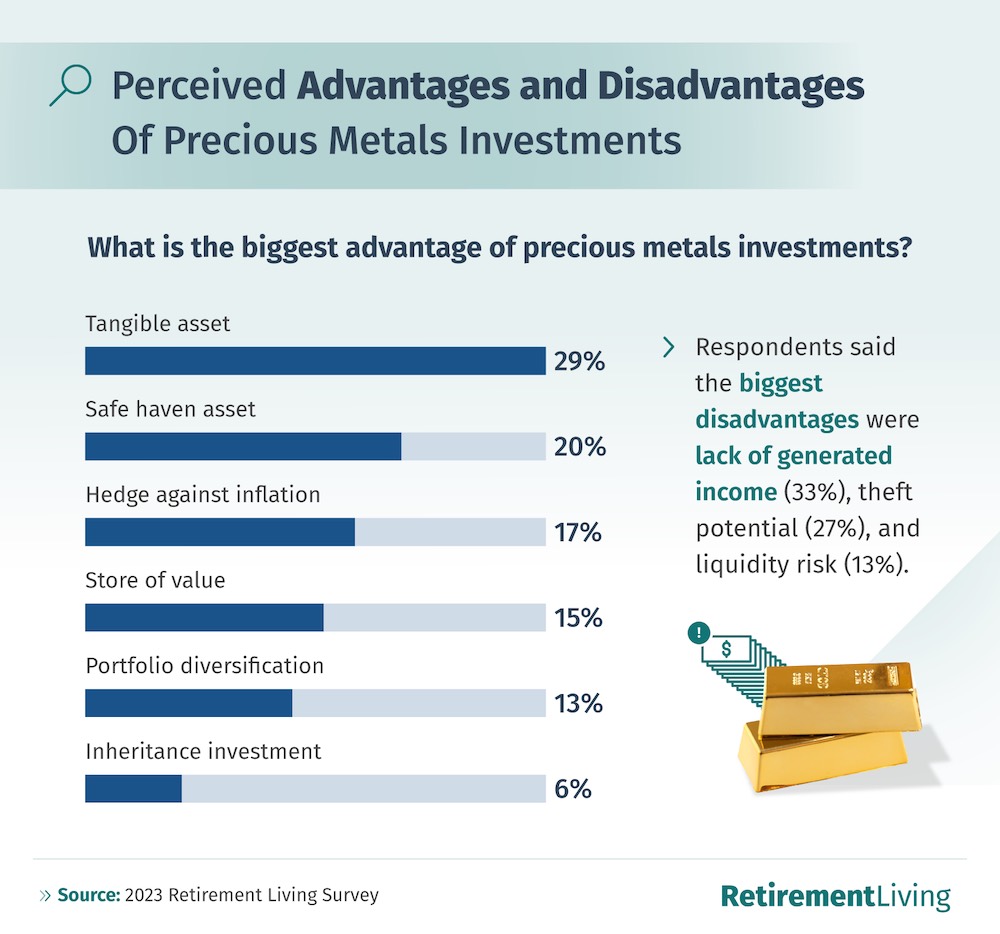

When asked what made them interested in precious metals, the biggest advantage for our survey participants was having a tangible asset (29%). Another 20% valued their status as a safe haven asset, and 17% trusted them as a hedge against inflation. On the downside, respondents expressed concern about the lack of generated income from precious metals (33%) and their vulnerability to theft (27%).

The Future of Investing

With inflation causing many Americans financial stress, diversifying investment and retirement accounts has become a priority. Traditional investments are more susceptible to devaluation from inflation, so people are considering alternative investments like precious metals and cryptocurrency. If you’re unsure where to invest, a financial advisor can help you find multiple avenues to keep your portfolio working for you in any economy. As you focus your financial goals on the future and invest for the long term, you can enjoy many returns as you live out a stable retirement.

Methodology

Search volume about investing in gold and silver was collected from April 2022 through March 2023. We also surveyed 1,027 Americans across different generations to explore their perceptions about investing amid inflation.

About Retirement Living

Retirement Living is your destination for resources to prepare for and maintain your retirement. We offer guides and information on investing and senior living and connect you to financial advisors who can help you to navigate this important step in your life.

Fair Use Statement

Know someone interested in alternative investment options? Feel free to share this article for noncommercial purposes, but provide a link back to this page so readers can access our full findings and methodology.