Best Life Insurance for Seniors

Updated:

Retirement Living takes an unbiased approach to our reviews. We may earn money when you click a partner link. Learn More

Retirement Living compared 15 life insurance companies according to cost, coverage, and reputation. Here are the 10 best life insurance companies for seniors.

- Great marketplace

- Quickly compare offers from top companies

- High customer satisfaction

SelectQuotes online comparison tool is detailed and transparent, allowing seniors to evaluate offers from several providers at once. A dedicated agent can also help you decide.

ReliaQuote

- Great for term life policies

- High coverage amount

- Life insurance calculator

ReliaQuote has a life insurance calculator to help determine how much coverage you need. Sells term life policies only.

Everyday Life Insurance

- Great for tailored quotes

- Term and whole life insurance

- Policies available up to age 85

Everyday Life Insurance leverages advanced technology to match you with the best policy for you. Most customers don’t need to take a medical exam and approval odds are 80%.

AIG Direct

- Competitive pricing

- Custom plans available

- High coverage amounts

Some AIG plans do not require a medical exam, and you can also choose several term lengths. AIG offers guaranteed issue whole life insurance for those between the ages of 50 and 85.

New York Life

- Great reputation

- Lots of policy customizations

- Some plans have dividend options

New York Life is one of few providers that issue policies to applicants up to age 90. It also ranks highly for financial stability and customer satisfaction.

- Great cost estimates

- Quotes from top-rated companies

- Speak to a licensed expert

Policygenius offers term and whole life insurance quotes to help you compare over 10 top-rated life insurance companies like Lincoln Financial, MassMutual and Pacific Life. Get a cost range estimate online.

TruStage Life Insurance

- Great for all budgets

- Policies to fit any budget

- Instant decision feature

TruStage offers term and whole life insurance for seniors with no medical exam. The maximum age for buying a TruStage term life policy is 69, but you can renew your existing TruStage term life insurance up to age 80.

AAA Life Insurance Company

- Great for guaranteed coverage

- Guaranteed coverage available up to $25,000

- Discounts for AAA members

AAA Life Insurance Company offers several policies designed to help cover final expenses or burial costs. The company has whole life policies ranging from $5,000 to $75,000, and term and universal policies up to $5 million.

Guardian Life

- Great for older adults

- Apply online for term life policies

- High age limits

Issuing policies for more than a century, Guardian Life offers insurance policies in all 50 states. Coverage options include medical exam policies up to $5 million and a wide selection of riders.

Quotacy

- Easy comparison shopping

- Review and compare quotes

- Purchase directly

Quotacy partners with 25 insurance carriers, allowing seniors up to age 80 to compare life insurance options. No contact information is needed to provide a quote.

Our Experience Evaluating Life Insurance for Seniors

While evaluating the services, processes, and offerings of various life insurance companies, the Retirement Living editorial team found that it was easier to find quotes for term life policies than whole life policies. Insurance marketplaces like SelectQuote and Quotacy offered the most user-friendly online shopping experience because we could compare real quotes from multiple companies without speaking to an agent.

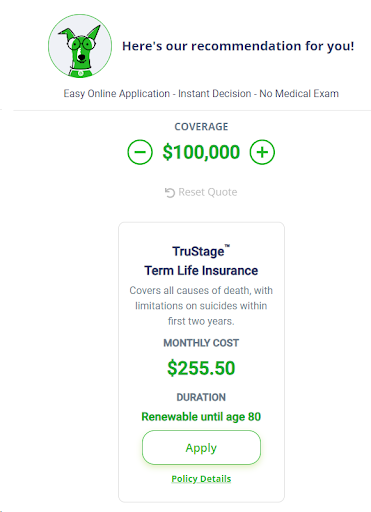

Although not a marketplace, our team thought the research and quote process from TruStage was the easiest of all direct carriers. (See screenshots of the quotes we received from Quotacy and TruStage below.) Policygenius was the only marketplace that required our contact information to speak to a representative.

Many of the providers on this list called or texted our editorial team to follow up with our requests for information. Depending on your preferences, this could either be overwhelming for seniors or helpful.

Everyday Life was the only life insurance provider that included easy-to-understand explanations on each quote page explaining why they wanted your information to generate a quote. And once they provided the quote, it included the reasoning behind their company and policy recommendations. We wish more marketplaces implemented this policy, as customers tell us that buying life insurance can be a confusing and time-consuming process without access to education.

Moving forward, we’d love to see more direct life insurance carriers provide online quote options, which would help ensure seniors compare options and learn about different policies before speaking with a representative to buy insurance. We’d also like to see insurance providers offer whole life quotes in addition to term life quotes.

Best Life Insurance Companies for Seniors, Reviewed

SelectQuote Review

Great marketplace

SelectQuote provides term and whole life insurance quotes through its partnered life insurance companies, which include Mutual of Omaha, Pacific Life and Prudential. The life insurance agency provides term life insurance quotes online, but you must speak with a licensed insurance agent to get whole life quotes. SelectQuote has a great rating on Trustpilot, earning 4.1 out of 5 stars after more than 10,000 reviews.

- Rating/reputation: A+

- Max issue age: 85

- Policy types: Term life and whole life insurance

- Coverage amount: up to $5 million

- Medical exam: Yes

To learn more, read our comprehensive SelectQuote review.

AIG Direct Review

Competitive pricing

AIG Direct offers a wide range of term and permanent life insurance policies that can meet most seniors’ needs—its guaranteed acceptance whole life policy is specifically designed for those aged 50 to 80 and includes coverage from $5,000 to $25,000. To provide a cost range, Retirement Living sourced a quote for a 10-year life insurance policy for a healthy, 65-year-old. AIG Direct quoted us a monthly premium ranging from $124 to $208 per month, though your premium will vary depending on age, health status, coverage amount, and policy type.

Term and whole life insurance quotes are available online, but you must provide your phone number and email address. Most life insurance policies require a medical exam, unless you purchase a simplified issue or guaranteed issue life insurance policy.

Although AIG Direct has a lower-than-average consumer complaint index compared to other life insurance companies, it is rated in the bottom five life insurers in the 2023 J.D. Power Individual Life Insurance Study.

- Rating/reputation: A+

- Max issue age: 80

- Policy types: Term life, whole life, guaranteed acceptance whole life, universal life insurance

- Coverage amount: up to $10 million

- Medical exam: Yes

TruStage Life Insurance Review

Great for all budgets

TruStage offers term and whole life insurance for seniors with no medical exam. Since there is no medical exam, you could get denied for term or whole life insurance, but you’ll find out right away thanks to TruStage’s instant decision feature. The maximum age for buying a TruStage term life policy is 69, but you can renew your existing TruStage term life insurance up to age 80.

CMFG Life Insurance Company, the issuer of most of TruStage’s life policies, has a lower-than-average consumer complaint score. TruStage is also highly rated on Trustpilot, earning 4.8 out of 5 stars after over 7,700 reviews.

- Rating/reputation: A+

- Max issue age: 80

- Policy types: Term, whole life, guaranteed acceptance whole life insurance

- Coverage amount: Up to $300,000

- Medical exam: No

New York Life Review

Great reputation

New York Life offers several types of term, whole and universal life insurance policies with many riders to customize your policy to your unique needs. Quotes aren’t available online and all New York Life policies are medically underwritten. New York Life has an above average J.D. Power rating, few consumer complaints and a superior AM Best financial strength rating.

- Rating/reputation: A-

- Max issue age: 90

- Policy types: Term, whole and universal life insurance

- Coverage amount: Varies

- Medical exam: Yes

ReliaQuote Review

Great for term life policies

ReliaQuote is a direct-to-consumer life insurance agency that allows you to review, compare and purchase term life insurance quotes directly on its website. The life insurance broker is partnered with top life insurers such as SBLI, Transamerica and Protective. As a broker, ReliaQuote is not rated by J.D. Power or the National Association of Insurance Commissioners and does not currently have any reviews on Trustpilot. No complaints have been filed with the Better Business Bureau.

- Rating/reputation: A+

- Max issue age: 80

- Policy types: Term life insurance

- Coverage amount: Up to $10 million

- Medical exam: Yes

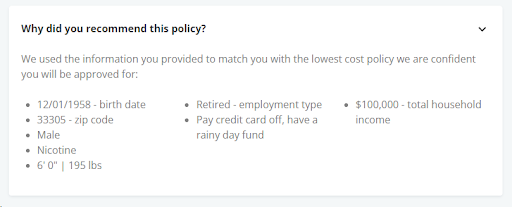

Everyday Life Insurance Review

Great for tailored quotes

Everyday Life Insurance is a full-service online insurance agency that will provide term and whole life insurance quotes for those aged 18 to 85, no contact information is required. The life insurance companies you’re matched with will depend on the details you provide.

Retirement Living compared senior life insurance quotes using the platform and got matched with TruStage life insurance. You can also speak with a licensed agent to learn more about what life insurance options are available for you.

One of the benefits of Everyday Life is that the quote is anonymous—no contact info is required. Plus, each quote includes brief explanations of why they recommend the policy.

- Rating/reputation: A+

- Max issue age: 85

- Policy types: Term life and whole life insurance

- Coverage amount: Up to $300,000

- Medical exam: Yes

Policygenius Review

Great cost estimates

Policygenius offers term and whole life insurance quotes to help you compare over 10 top-rated life insurance companies like Lincoln Financial, MassMutual and Pacific Life. Policygenius doesn’t provide quotes online, you must provide your personal information and contact information, plus consent, then get a call from a Policygenius licensed expert.

The quote feature did not include exact monthly premiums, but rather a cost range that is finalized after speaking with an agent. According to the website, monthly rates for 60-year-old female non-smokers average $107 to $354 for a term life policy, and $149 to $500 for 60-year-old male non-smokers.

The insurance broker has an excellent rating on Trustpilot with 4.6 out of 5 stars after over 5,000 customer reviews.

- Rating/reputation: A-

- Max issue age: 80

- Policy types: Term and whole life insurance

- Coverage amount: Up to $10 million

- Medical exam: Yes

To learn more, read our full Policygenius review.

AAA Life Insurance Company Review

Great for guaranteed coverage

Although most AAA Life Insurance policies are medically underwritten, you can still get guaranteed issue life insurance with no medical exam. There are a wide range of term, whole life and universal life insurance policies to choose from. Term quotes are available online, but if you’re not sure what’s best, it’s worth speaking with a AAA life insurance agent to discuss your options.

AAA Life Insurance Company has a lower-than-average consumer complaint rating and an excellent rating with Trustpilot, earning 4.7 out of 5 stars after over 750 reviews.

- Rating/reputation: A+

- Max issue age: 80

- Policy types: Term, whole and universal life insurance

- Coverage amount: Up to $5 million

- Medical exam: Yes

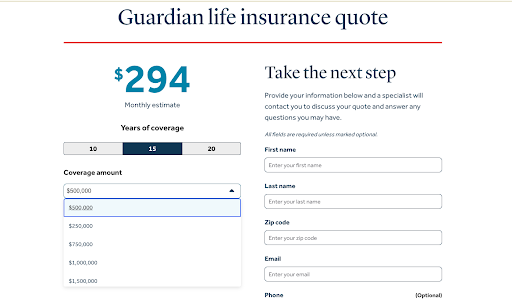

Guardian Life Review

Great for older adults

Guardian Life offers various term, whole and universal life policies that are either medically underwritten, simplified issue (health questions but no medical exam) or guaranteed issue. It offers term quotes online based on your age, gender, annual income and smoking status, but you have to speak with a Guardian agent to purchase life insurance. See below for a quote we sourced using their online calculator.

J.D. Power ranks Guardian Life just below the industry average, as is its customer complaint index.

- Rating/reputation: A

- Max issue age: 90

- Policy types: Term, whole and universal life insurance

- Coverage amount: Up to $5 million

- Medical exam: Yes

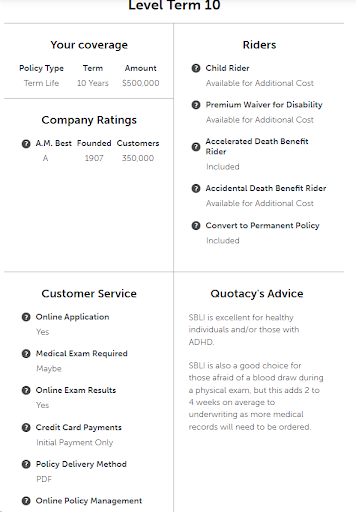

Quotacy Review

Easy comparison shopping

Quotacy offers term life insurance primarily, but you can also purchase whole and universal life insurance through its platform. The life insurance marketplace is partnered with over 25 life insurance companies. You can get free term life insurance quotes online without providing your personal information, but you’ll need to speak with a Quotacy agent to get permanent life insurance quotes.

For a male senior, Quotacy presented us with nine different term life insurance quotes ranging from $187 per month to $230 per month for a $500,000 policy with a 10-year term. For a female senior, that same plan costs $121 per month and $148 per month.

Quotacy is highly rated on Trustpilot, earning 4.9 out of 5 stars after almost 1,500 customer reviews.

- BBB rating: A+

- Max issue age: 80

- Policy types: Term life, whole life, guaranteed universal life insurance

- Coverage amount: up to $65 million

- Medical exam: Yes

Additional Companies

Leap Life was a life insurance broker offering online quotes; they are now a part of Policygenius. Health IQ exited the life insurance space and now focuses on selling quality Medicare insurance plans.

Our Research Methodology

We evaluated 15 life insurance companies and found the 10 best choices. We carefully considered cost, coverage, reputation, and our own experience evaluating insurance carriers.

Based on our expert consultations and research, we determined the following factors to be important for seniors when shopping for life insurance:

- Monthly premiums

- Higher age limits

- Nationwide availability

- Customization options, such as term limits and coverage amounts

- Policy types

- Medical exam and approval requirements

- Customer service

- Online user experience, such as online quote features and calculators

- Reputation, as determined by financial strength and consumer complaints

The Retirement Living editorial team prioritizes timely updates and edits to our buying resources, which ensures our readers are provided with the latest information. We routinely revise inaccurate information, cross-reference sources, and review our content to identify relevant changes.

How to Choose a Life Insurance Policy?

Life insurance is a long-term commitment. Even if you’re buying a term policy, you’ll have it for at least five or 10 years. A permanent life insurance policy will stay with you for life. So, knowing how to choose a life insurance policy can help you make the right decision.

| Pros | Cons |

|---|---|

| Can pay off debts so your loved ones don’t have to | Life insurance can be expensive if you’re not healthy |

| Funds a funeral you want without burdening family | The older you are, the more expensive life insurance is |

| Some policies can help fund your lifestyle or health needs while alive | You can be denied |

Consider Financial Responsibilities to Determine Coverage Amount

There are many ways to determine your coverage amount. Many of the life insurers we feature on our list of best life insurance companies for seniors offer calculators to help you figure it out. You can also use a formula, like the DIME formula, which calculates your debts, income, mortgage and education needs to determine your coverage.

But seniors usually don’t need coverage that accounts for education or income unless they want to help their spouse or partner supplement their retirement income should they pass on first.

When advising on the proper amount of life insurance coverage for seniors, I recommend pulling out a sheet of paper to outline what you want the policy to do for you and the costs associated with those tasks.

Here’s an example:

- Funeral: $10,000

- Mortgage: $50,000

- Supplement spouse’s retirement income: $1,000 per month for 5 years = $60,000

- Pay off final debts: $10,000

Next, determine which of these needs are temporary versus permanent. Your mortgage payment is temporary, but the other expenses are permanent. That means you might need two life insurance policies: a term life insurance policy to cover the mortgage and a permanent life insurance policy to cover the funeral, final debts, and retirement supplement. The choice is yours.

Term life insurance will be your cheapest option, but as a senior, you’re probably only eligible for 10 to 20 years of term coverage. With a shorter term period, you risk potentially outliving the policy with no way to cover those debts.

You also need to consider your life insurance budget. How much can you afford per month to pay for life insurance? The older you are, the more expensive life insurance is, even for term coverage.

Then, there’s your health. Any health conditions, even if they’re well maintained with medication, can affect your health rating with the life insurance company, making the policy more expensive.

Important

There’s a lot to consider as a senior looking for life insurance. It can be overwhelming, but the sooner you figure out your coverage needs and the type of policy that provides the best coverage, the better. Waiting until your next birthday could mean you pay even more for a policy.

Opt for No-Exam Life Insurance if Health Is a Factor

Healthy applicants usually get the cheapest life insurance premium with a medically underwritten life insurance policy. To determine your health rating, insurance companies will ask that you get your blood, urine, cholesterol, BMI, and other factors checked. The better your health, the cheaper your premium and overall costs throughout the policy’s duration.

If your health isn’t the best or you have a history of cancer or heart disease, for example, no-exam life insurance is the next best thing. No-exam life insurance is more expensive, but you won’t have to submit to a medical exam.

No-exam life insurance applications still require you to answer a detailed health questionnaire. The life insurance company might order an Attending Physician Statement and your medical, driving, prescription, and Medical Information Bureau (MIB) records.

With simplified issue life insurance, no Attending Physician Statement is required, and the health questionnaire is usually just “yes” or “no” questions the provider will use to approve or deny your application.

Compare Policy Terms and Conditions

There is no one-size-fits-all type of life insurance, and policies can vary widely by life insurance company. I recommend getting quotes from at least five life insurance companies and comparing them.

Make sure you’re honest about your health to get accurate quotes. Life insurance companies have different underwriting guidelines, so you want to see what health category they place you in. One company might consider you a standard health class while another places you in the preferred class, which is cheaper.

Make sure to read the fine print to see what causes of death won’t be covered and what happens if you can’t pay your premiums.

Determine Whether You Should Add a Rider

Riders are add-ons you can include in your policy that might cost extra. They vary by policy type and company. Here are two seniors should consider:

- Accelerated death benefits: This rider allows you to access part of the death benefit if you’re diagnosed with a chronic, critical, or terminal illness. Some riders can help you pay for nursing or hospice care.

- Long-term care riders: A long-term care rider can help cover the cost of a nursing home or in-home care.

Working with a knowledgeable licensed life insurance broker can help you determine which policy is best based on your coverage needs, health, and budget, especially if you’re buying cash value life insurance. Brokers are licensed with multiple companies. Agents are usually only licensed with one. You can also look for a fee-only life insurance consultant.

Types of Life Insurance for Seniors

There are multiple types of senior life insurance out there. Here are the three types that will fit most seniors’ needs.

Term Life Insurance: Least Expensive, but Temporary

Term life is the most affordable option available. It provides coverage for 5, 10, 15, or 20 years. The longer the term, the more it costs. Seniors 80 and over may not qualify for term life insurance coverage.

Some insurance companies offer a return of premium term life insurance, which returns your premium payments if you outlive the policy. They’re a lot more expensive and may not be worth the extra premium.

Whole Life Insurance: Permanent Coverage With a Savings Account

Whole life insurance offers a guaranteed death benefit, fixed premiums, and a cash value savings account with guaranteed interest rate growth.

Once you build up enough cash value — it can take years — you can take out a loan against the value. The loan accrues interest and will reduce the death benefit your life insurance beneficiary receives if you don’t pay it back.

Since whole life insurance offers lifelong coverage, it’s more expensive than term life. Some companies require full medical underwriting, while others offer no-exam or simplified issue coverage. However, remember that no-exam life insurance and simplified issue insurance tend to cost more.

Read more: Who Should Be Your Life Insurance Beneficiary?

Guaranteed Issue: The Last Resort and Most Expensive

If you’re in poor health, guaranteed issue whole life insurance — sometimes called final expense, burial insurance, funeral insurance, or senior life insurance — may be your only option. The application has no health questions, a medical exam is not required, and you’re guaranteed to be approved. Because you can’t be turned down, it’s the most expensive option, and coverage is usually capped at $25,000.

Keep in mind: Guaranteed issue insurance comes with a graded death benefit, which means your beneficiary won’t get paid the full death benefit if you die a nonaccidental death within the first two years after buying the policy. Instead, they’ll receive a refund of the paid premiums plus interest, which is usually 10%.

In these instances, it’s often better to take the money you’d pay into premiums and put it in a high-yield savings account to pay for your final expenses. Discuss your options with a financial advisor or insurance broker to ensure you make the right decision.

Other Permanent Life Insurance Options

There are many other permanent life insurance options available, including:

- Universal life insurance

- No-lapse guarantee universal life insurance

- Variable universal life insurance

- Variable life insurance

If you’re interested in one of these options, consider working with a life insurance consultant to discuss your options and determine what’s the best fit. Many of these policies depend on the stock market to build cash value. You can experience losses, and even have the policy lapse, if you don’t fund it properly. You’d be better off getting term life insurance and working with a financial advisor to invest the rest.

How Much Does Life Insurance For Seniors Cost?

Although it isn’t always easy to get cheap life insurance for seniors, affordable options are available, especially if you’re healthy. Keep in mind that premiums increase the older you are, so getting life insurance early can help you save.

Retirement Living sourced quotes for different types of life insurance for 65-year-old men and women from each provider on this list. Monthly premiums for life insurance for 65-year-old seniors cost between $123 and $971, though this varies significantly depending on policy type, health status, and coverage amount.

| SelectQuote rates | 65-year-old male | 65-year-old female |

|---|---|---|

| 10-year term, $500,000 | $188 | $123 |

| 15-year term, $500,000 | $255 | $166 |

| 20-year term, $500,000 | $379 | $259 |

To help identify average life insurance costs for seniors, we’ve shown rates from SelectQuote above and TruStage below.

| TruStage rates | 65-year-old male | 65-year-old female |

|---|---|---|

| 5-year renewable term $100,000 | $405 | $256 |

| 5-year renewable term $300,000 | $971 | $620 |

| Whole life insurance, $100,000 | $574 | $447 |

| Guaranteed acceptance whole life, $20,000 | $185 | $133 |

Multiple factors determine how much you’ll pay for senior life insurance, including your:

- Age

- Gender

- Health

- Tobacco status

- Choice of term or permanent life insurance

- Policy type

- Coverage amount

- Underwriting type (medical exam, no-exam, guaranteed issue, etc)

How to Buy Life Insurance

Once you’ve selected a life insurance provider, you’ll complete the following steps to get a life insurance policy:

- Prepare before the application by gathering all your doctor’s names, phone numbers, fax numbers, and office addresses. Have your prescription names and dosages handy. Write down any surgeries or procedures you’ve had with the date they were done, the reason, and the outcome. You’ll also need dates of diagnoses and treatments of any medical conditions in the last 5-10 years.

- Complete the application. Some life insurance companies offer online applications, but you might have to do it over the phone with an agent. It may only take a few minutes, but it can take a half hour or more if you have a lot of medical history.

- Get approval. If you need to complete a medical exam, schedule it while you’re still on the phone. If not, you may have to wait a few days to receive an email or phone call informing you if you’re approved or declined. This process is known as underwriting.

- Begin the waiting period. Approval can take several weeks, but once you’re approved, look over your policy carefully to make sure it’s the right policy type and coverage and that any extras, like riders, are included. Also, check the premium and your health rating to ensure accuracy.

FAQS About Life Insurance

Does Medicare offer life insurance for seniors?

No. Medicare offers medical and hospital insurance for seniors, but not life insurance. You or your surviving family members may be eligible for Social Security survivors benefits, a $255 lump-sum death payment.

What’s the oldest age you can get life insurance?

The oldest age you can get life insurance depends on the type of life insurance and the company. Term life insurance is usually only available if you’re under 75 or 80, and you might only be eligible for a shorter term of 10 years. Permanent life insurance may be available until age 90, but usually with a small death benefit of $25,000 or less.

How does net worth affect life insurance?

Some life insurance companies consider net worth when determining how much coverage they’ll provide. If you’re a high net-worth individual, you can use cash value life insurance to protect your business or family’s inheritance or use it as an investment strategy. Some life insurance policies may be a better investment and less volatile than the stock market. It’s important to work with a knowledgeable licensed life insurance agent and/or financial planner to determine the best combination of policies to meet your financial goals.

Can you get life insurance with pre-existing conditions?

You can get life insurance with pre-existing conditions, but it will probably be more expensive. Insurance companies base rates on your mortality risk, or how likely you are to die before your expected lifespan. For example, if you have a personal or family history of cancer, heart disease, or stroke, you’ll likely get a high-risk life insurance policy with a more expensive premium than someone who is expected to live to or beyond their life expectancy.

Conclusion

When comparing your options for senior life insurance, it’s important to shop around for quotes and choose a plan that includes adequate coverage for your needs now and in the future. Contacting the life insurance providers featured on this list is a great place to start.

Best Life Insurance for Seniors: Summary

| Life Insurance Company | Best For | |

|---|---|---|

| 1 | SelectQuote | Great marketplace |

| 2 | AIG Direct | Competitive pricing |

| 3 | TruStage Life Insurance | Great for all budgets |

| 4 | ReliaQuote | Great for term life policies |

| 5 | AAA Life Insurance Company | Great for guaranteed coverage |

| 6 | Everyday Life Insurance | Great for tailored quotes |

| 7 | Policygenius | Great cost estimates |

| 8 | Guardian Life | Great for older adults |

| 9 | New York Life | Great reputation |

| 10 | Quotacy | Easy comparison shopping |