GoldenCare Long-Term Care Insurance Review

GoldenCare specializes in the insurance needs of seniors with traditional long-term care insurance, hybrid insurance and critical illness plans. GoldenCare also carries Long-Term Care Partnership plans in most states. In addition to being established as a leading nationwide long-term care insurance broker, GoldenCare offers other insurance useful to retirees like Medicare Advantage or Medicare Supplement plans and identity theft coverage. The company sells long-term care (also known as LTC) insurance to consumers in the western U.S. as American Independent Marketing.

There are a large number of LTC insurance options. GoldenCare acts as a long-term care insurance broker, so working with them saves you time and money. You can get quotes from multiple long-term care insurance companies from an agent who does not represent just one company and can make affordability and your needs a priority.

Because GoldenCare offers such a diverse selection of LTC insurance plans and related products, we chose them as one of the best providers in our Long-Term Care Insurance Guide. Consumers use GoldenCare’s services to conveniently compare insurance companies, long-term care policies and other types of coverage with agents across the country.

Pros

- Research, shop and buy multiple plans from one provider

- Specializes in insurance for retirees

- Offers several LTC insurance options

Cons

- No way to compare plans on the website

GoldenCare Long-Term Care Plans

Long-term care is day-to-day medical or personal attention provided to anyone who is recovering from a medical procedure, is ill, or whose physical or mental capacity has diminished. Long-term care is often temporary, and most related services are quite expensive, so planning for the cost as you age makes sense.

Five long-term care insurance providers work with GoldenCare: Mutual of Omaha, Genworth, Transamerica, National Guardian Life, and United Security. GoldenCare helps you choose the best plan across these companies by discussing future care needs and comparing coverage options, prices, and plan requirements. GoldenCare’s long-term care insurance offerings cover care in a variety of settings, like nursing homes, assisted living facilities, home health care, and care provided by family or friends in your home.

GoldenCare Long-Term Insurance Costs

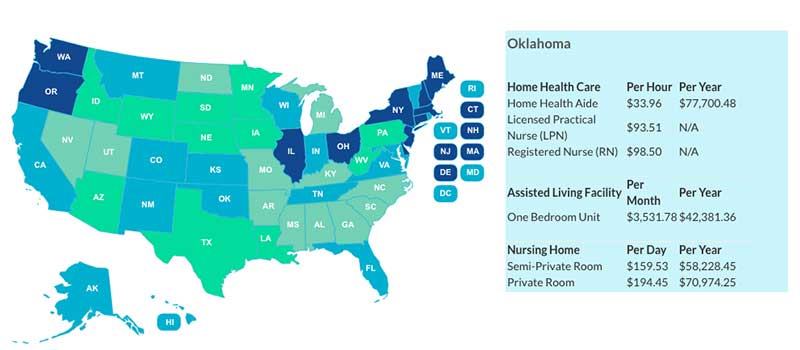

GoldenCare does not list pricing for long-term care insurance policies on their website, nor can you compare plans from their website. It does, however, provide an interactive map showing how much long-term care costs annually across the United States. This gives you an estimate of how much coverage you will need from a long-term care insurance policy. We’ve picked six states from different parts of the U.S. to show you an example of costs nationwide.

| State | Nursing Home Semi-Private Room |

Assisted Living One Bedroom Unit |

Home Health Aide |

|---|---|---|---|

| New York | $135,630.35 | $64,373.74 | $54,317.12 |

| Alabama | $71,821.05 | $41,717.16 | $51,228.32 |

| Minnesota | $93,272.10 | $35,039.48 | $73,696.48 |

| Texas | $56,786.70 | $50,397.72 | $68,159.52 |

| Arizona | $84,318.65 | $49,093.56 | $57,085.60 |

| Oregon | $100,531.95 | $50,210.04 | $59,304.96 |

GoldenCare Hybrid Long-Term Care Insurance

GoldenCare offers hybrid long-term care insurance plans through Minnesota Life/Securian, Guaranty Income Life, and OneAmerica/State Life. This type of policy provides insurance needed for care, and if unused, pays either an annuity lump-sum later or a death benefit to survivors if the insured never needs to use any long-term care services. Insurance industry trend analysts at LIMRA report hybrid LTC insurance premiums made up for 17 percent of all premiums in 2016 and policies linked to an annuity grew an average 23 percent year after year since 2011.

A particularly notable hybrid product GoldenCare offers is CareShield from Securian. This policy includes coverage for chronic or terminal illness care with a premium refund if you decide to discontinue coverage, or a death benefit to your family if you don’t use the care benefits.

GoldenCare State Long-Term Care Partnership Plans

Most states have Partnerships for long-term care programs to allow you to receive Medicaid benefits without selling all your assets. Combine a sufficient level of LTC coverage with a state partnership plan, and you can shield all of your assets from Medicaid’s spend-down rule.

Check with your state’s Department of Insurance to determine if this program is available and speak to a GoldenCare agent who is trained to assist with selecting from long-term care insurance plans that work hand-in-hand with your state’s partnership plan.

When you need long-term care, your partnership-qualified policy pays first. After your benefits are exhausted, you’re eligible to protect an amount of money in your estate equal to what your policy paid. State Partnership Plans basically pay dollar-for-dollar asset protection based on what your policy paid out.

GoldenCare Critical Illness Insurance

GoldenCare offers a collection of critical illness insurance plans from Guarantee Trust Life and Mutual of Omaha. These plans are an alternative for those who do not qualify for traditional long-term care insurance policies for any reason, such as pre-existing conditions. Critical care insurance pays a lump or monthly sum when the insured person is diagnosed with a qualifying illness or disease such as Alzheimer’s, cancer, kidney failure, stroke, or heart attack. You can use GoldenCare critical illness insurance to pay for any expenses or loss of income associated with a medical condition, including mortgage payments and modifying your home.

GoldenCare Complaints

Going by GoldenCare’s reviews across several consumer review websites, the company is rated highly. Accredited with the Better Business Bureau, the BBB gives GoldenCare an “A+” rating with only two customer complaints on file going back to 2016 and 2017. GoldenCare responded to clear up both issues. The company scores 4.75 out of 5 stars on ConsumerAffairs, with many of the verified reviewers speaking positively of the knowledge and help provided by the GoldenCare representatives. ConsumerAdvocate.org gives the company 9.6 out of 10 stars.

GoldenCare Long-Term Care Insurance FAQ

-

Why do I need GoldenCare long-term care insurance?

According to the U.S. Department of Health and Human Services, someone turning 65 today has a 70 percent chance of needing long-term care in the future. Even if you never set foot in a nursing home, full-time in-home care or assisted living arrangements could liquidate all retirement savings. Long-term care insurance is a safety net, and GoldenCare will help you choose the best coverage for your budget. -

Does GoldenCare have any discount programs for long-term care insurance?

There are some opportunities to save on an LTC policy from GoldenCare:- Discount for spouses or partners who apply for LTC through GoldenCare

- Include Shared Care on an LTC policy so your spouse can tap into your benefits when theirs are exhausted

- Federal tax deduction for premiums, and possibly a state deduction or credit

- You may be able to deduct the entire cost of LTC insurance from your taxes if you own a business

- Buy a limited pay policy where premiums are paid in full before you retire

-

What is an elimination period on a GoldenCare long-term care insurance policy?

An elimination or waiting period is the time between the first day you receive care and the day the policy begins paying for care. Think of this as an alternative to a deductible. You can choose from a variety of elimination periods between zero to 365 days before purchasing a policy from GoldenCare. -

Do GoldenCare long-term care policies cover mental illness?

Not all LTC policies cover mental illness unless the diagnosis is an organic reason for the condition. For example, a mental health condition caused by a concussion might be covered but depression without a specific cause may not. Most LTC insurance companies cover Alzheimer’s and dementia, but there may be additional conditions that must accompany the diagnoses before you are eligible for coverage. Discuss your concerns with a GoldenCare representative, who can ensure your policy provides the coverage you are likely to need. -

Will I ever be able to buy enough GoldenCare long-term care insurance if health care costs keep increasing?

Possibly. Healthcare costs showing no signs of slowing down. Nursing home costs rose 50 percent between 2004 and 2017. Some of the LTC insurance policies GoldenCare sells offer inflation protection, sometimes called benefit increase options. This protection may add 2.5 percent to 5 percent to your premium for 10 or 20 years, but you should discuss inflation protection with a GoldenCare representative while deciding on long-term care insurance.

Conclusion

People are living an average of 20 years after retiring, and the need for long-term care continues to rise. In most cases, traditional health insurance and Medicare do not cover LTC expenses, so long-term care insurance could be an essential part of your financial plan. GoldenCare works with a nationwide network of agents who help consumers find the best policy.