Veterans First Mortgage Review

Veterans First Mortgage specializes in VA loans for veterans and active service members. Veterans First Mortgage is part of Wintrust Mortgage, one of the top twenty lenders across the U.S. Eligible veterans can purchase or refinance a home with a VA loan from Veterans First Mortgage, with added benefits such as no mortgage insurance or down payment. This can make a purchasing a home much easier compared to traditional mortgage loans.

Pros

- 24/7 customer service

- Certificate of Eligibility (COE) request from the website

- Conventional loans and VA loans offered

Cons

- Limited number of branches, although not necessary to secure a VA loan

Veterans First Mortgage VA Loans

Veterans First provides personalized help for veterans and active service members who are navigating the VA loan system. Veterans First Mortgage employees are trained by vets to learn the differences and culture of each military branch. This training makes lending officers and other staff members able to understand the specific needs and hurdles of their customers.

Veterans First Mortgage offers VA purchase loans, VA Interest Rate Reduction Refinance Loans (IRRRL), and VA cash-out refinance loans, which we’ve outlined below in the chart. As is the case with all mortgages of this type, a VA funding fee is required and can be rolled into the mortgage or paid by the seller. VA loan limits fluctuate depending on where the mortgaged property is located.

| VA Loan Type | Loan Details | Cash Out |

|---|---|---|

| VA Purchase Loan | For purchasing a primary residence. Available to first-time homebuyers, those who paid off a VA loan, and those who want to buy a home and have filed to restore eligibility |

No |

| VA IRRRL or Streamline Loan | Refinance an existing VA loan into a mortgage with a lower interest rate, usually to reduce the monthly payment or the length of the mortgage |

No |

| VA Cash Out Refinance Loan | Refinance a conventional loan into a VA loan or get cash out of the equity in property currently mortgaged with a VA loan. Cash out amount subject to VA regulations |

Yes |

Veterans First Mortgage FHA and Conventional Loans

While a VA loan is the best option for most service members and veterans seeking to finance a home, sometimes the numbers work out better with conventional or FHA loans. Many VA mortgage lenders do not deal in these loans, so a potential borrower has to go through the application process again with another lender if a VA loan turns out to be less desirable than the alternatives.

An FHA loan requires only 3.5 percent down with limited closing costs, while those with a high credit score would likely benefit from a conventional mortgage. Veterans First Mortgage adds FHA and conventional home loans along with VA loans to its mortgage financing portfolio so applicants can easily compare all options.

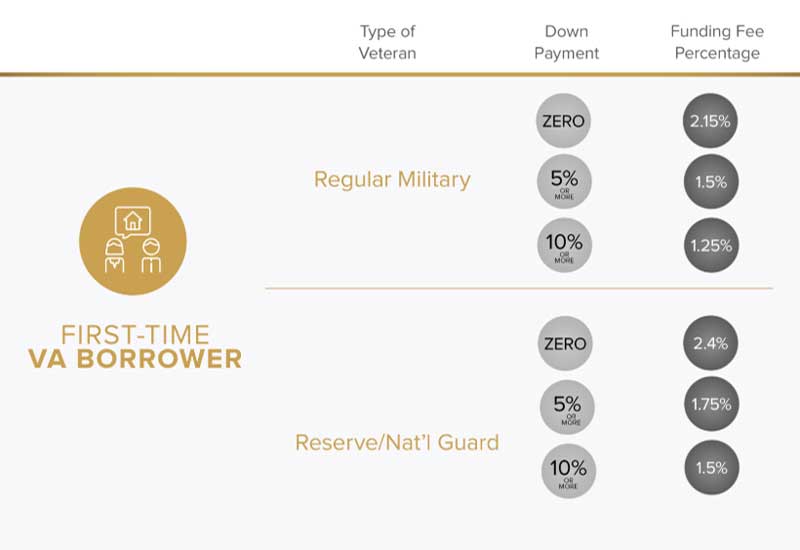

Calculating Your VA Funding Fee with Veterans First Mortgage

The VA funding fee is a charge required by the VA from most borrowers using a VA loan to help costs associated with the VA home loan program. Below you’ll see an example of how a first-time VA borrower who is regular military or Reserve/National Guard would calculate his or her VA funding fee.

Veterans First Mortgage VA Loans Foreclosure Avoidance

To help veterans take advantage of programs designed to help them avoid foreclosure, Veterans First Mortgage provides detailed information on the website for veterans who are having trouble making their VA loan payments. The Home Loan Assistance page outlines the programs available to avoid foreclosure with details about how to apply for assistance. Options for avoiding foreclosure include modifying the terms of the loan, temporarily suspending or reducing monthly mortgage payments, and repayment plans.

Veterans First Mortgage Community Support for Veterans

Veterans First Mortgage supports a variety of veteran-related organizations and projects across many communities and with events held at their headquarters. Some of the projects they have supported in the past include:

-

Fisher House Organization: Employees cook and serve meals for families staying at a local Fisher House while veterans receive treatment at VA medical facilities.

-

Operation Outreach: Employees donate to and prepare care packages for troops overseas. Over 1,000 packages sent to date.

-

Military with PTSD: Employees organized to support and participate in the Military with PTSD program.

-

Veterans Family Gift Shop: Salt Lake City employees annually support the gift shop to provide gifts to veterans and their families who are in need.

Veterans First Mortgage Complaints

Veterans First Mortgage has an A- rating with the Better Business Bureau (BBB) and has been an accredited company since 2012. Many positive reviews are published on the BBB site and Veterans First Mortgage addressed any problems customers posted. Wintrust Mortgage acquired Veterans First in January 2018 and holds an “A+” BBB rating.

While the reviews on ConsumerAffairs were mixed, Veterans First holds a 5-star rating on TrustPilot and 4.9 stars out of 5 on LendingTree.

Veterans First Mortgage FAQ

-

How do I start the loan process with Veterans First Mortgage VA loans?

To start the VA Loan process, fill out the online contact form or call to speak to a representative about your loan needs. Veterans First Mortgage will guide you through your first steps of qualifying for a loan and beyond. -

What VA loan rates can I expect from Veterans First Mortgage?

Mortgage interest rates vary depending on your finances and loan needs. The amount of the loan, your credit score, eligibility rating, debt to income ratio, and a few other factors determine the rate extended to you. Call Veterans First or fill out the contact form on their website to obtain a rate quote. The good news is that VA loan rates are competitive with or lower than conventional rates, and include money-saving advantages that other mortgages do not offer. -

How many times can I get a Veterans First Mortgage VA loan?

The answer is either once or multiple times. VA loan eligibility can be restored once to purchase a second house, and you can keep your first residence as income property if you pay off the first VA loan. Each time you sell the first home and pay off the first mortgage obligation, there is no limit on how many times you can have your VA loan eligibility restored for a new purchase. -

How can Veterans First Mortgage help me with refinancing my VA loan?

Because this lender knows all the ins and outs of VA mortgage lending, a loan officer can help you decide on the best way to proceed on a refinance. A Veterans First Mortgage representative will discuss whether or not you need to get cash out of a refinancing deal and if you are eligible for this option. You will also learn about the IRRRL process, which is particularly speedy. You will typically close on a VA loan refinancing with Veterans First within 30 days. -

Can Veterans First help my real estate agent understand VA loan restrictions?

Yes, support is available for your real estate agent. Veterans First Mortgage will help you and your real estate agent put together a sales contract that works in your best interest with the VA Option Clause. This clause protects you, the buyer, from losing earnest money should the sale fall through.

Conclusion

Veterans First Mortgage specializes in VA loans to help veterans and active service members easily access their financing benefits to buy a house. The veteran-trained employees understand the needs and challenges of veterans and their families when searching for a home loan, and the company stands behind its mission to serve vets through community support.