Retirement News

Latest News

7 Steps to Successful Senior Living Marketing

March 4, 2024As baby boomers opt for assisted living over traditional nursing homes, the potential marketing opportunities for assisted living are skyrocketing. From now until 2030, 10,000 baby boomers will hit retirement age daily! The tide is rising, and you can rise with it by successfully marketing your senior living community. Why is senior living marketing so […]

Best Cities to Retire in California

March 29, 2024Home » Retirement News Updated: In our roundup of the top 10 best cities to retire in, we noticed that not a single California city made the list. But the state did take up a sizeable number of spots on our list of the top 200 cities in America to retire and performed well in […]

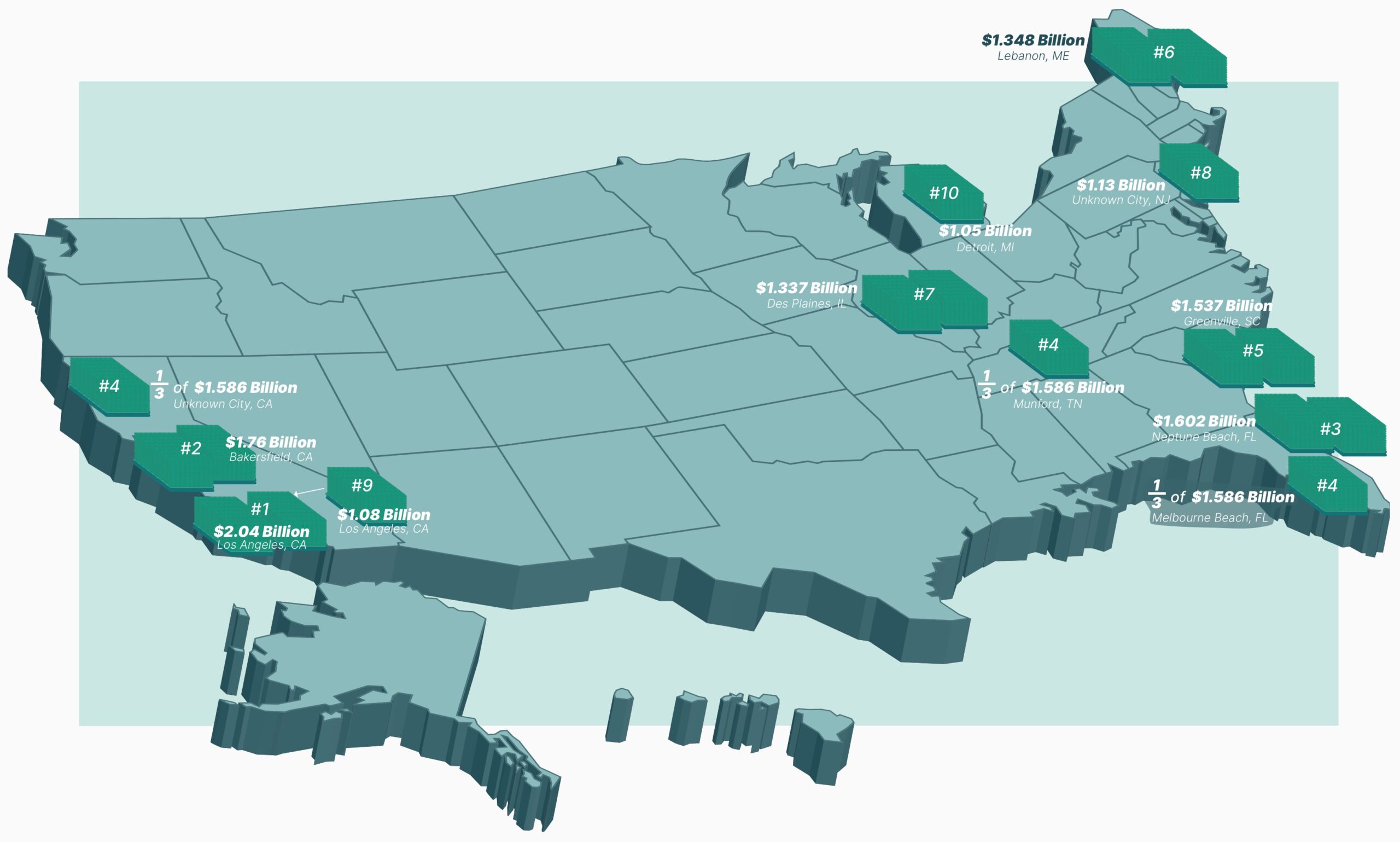

Winning Big: The Top 10 Mega Millions and Powerball Jackpots of All Time

March 27, 2024Home » Retirement Planning Updated: To date, the Powerball has ventured into billion-dollar territory five times and the Mega Millions six times—this includes the most recent Mega Millions prize, which hit $1.13 billion ($537.5 million estimated cash option). On March 26, 2024, a player in New Jersey snagged one of the biggest jackpot payouts ever. […]

Best Cities to Retire in Texas

March 20, 2024Home » Retirement News Updated: With warm weather, stunning nature, no state income taxes, thriving cities with plenty to do, and some of the best fishing and golfing in the entire country, Texas makes for a great state to move to in retirement. But Texas is also the second-largest state in the country, which means […]

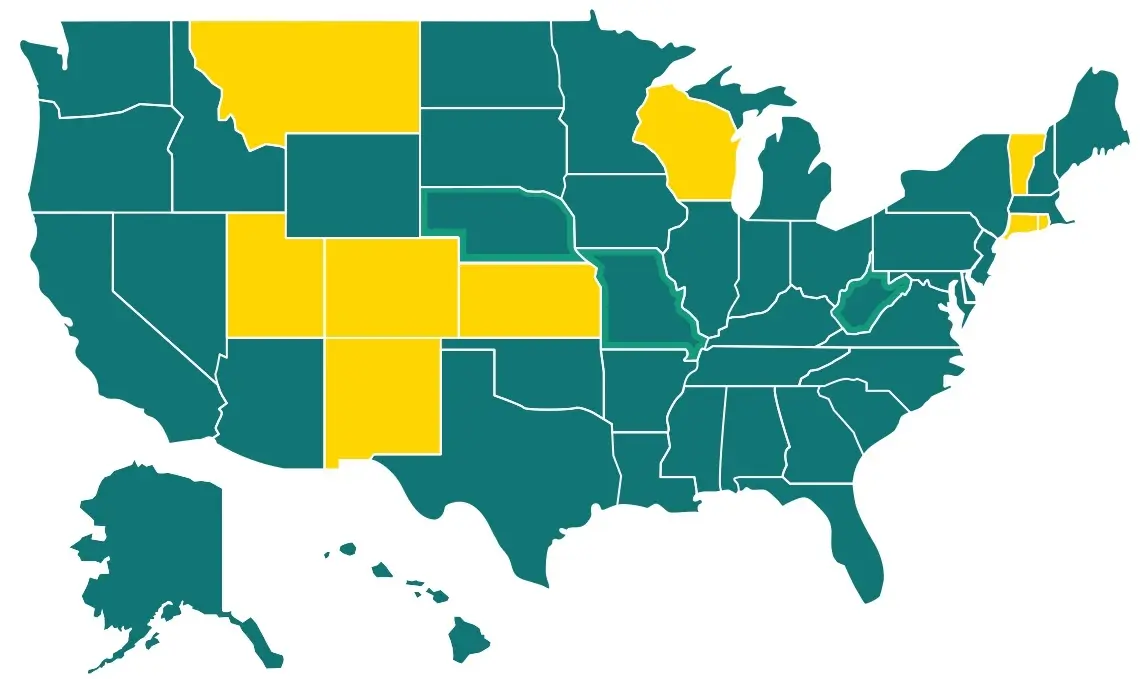

Which States Tax Social Security Benefits in 2024? Three States Revise Their Rules

March 14, 2024Home » Retirement News Updated: Tax day will be easier to bear for residents in Missouri and Nebraska — as of January 1, 2024, retirees no longer have to pay state income taxes on their Social Security benefits. (Residents here will still owe Social Security benefit taxes when they file their 2023 returns this year, […]

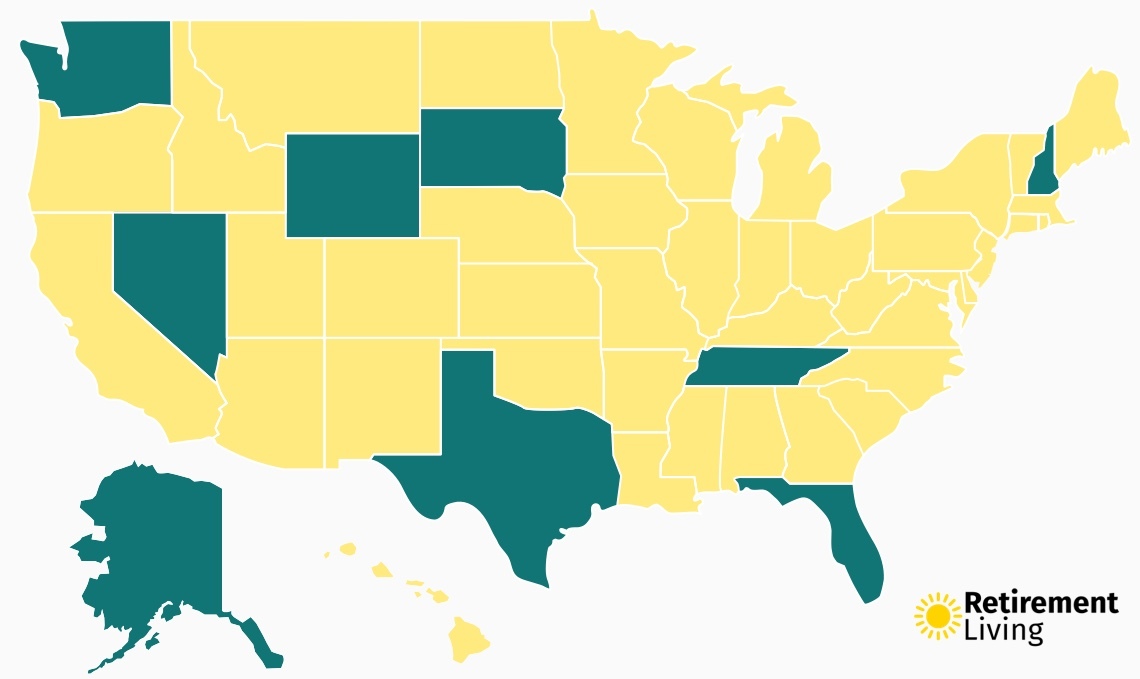

This State Could Soon Eliminate Income Tax: Find Out Which States Don’t Tax Income

February 29, 2024Home » Retirement News Updated: With tax day right around the corner, Americans are preparing to fork over a good portion of their earnings to Uncle Sam. But if you live in a state with no income tax, your overall tax burden is much lower. As of 2024, nine states do not levy a state […]

Best Cities to Retire in Florida

February 26, 2024Home » Retirement News Updated: Warm, sunny Florida is well-known as an ideal spot for retirement. There are no retirement taxes, no income taxes, and the climate is mild year-round. Homelessness and crime are relatively low in Florida, too, according to data from the FBI. In fact, the biggest trouble you may find when retiring […]