This State Could Soon Eliminate Income Tax: Find Out Which States Don’t Tax Income

Updated:

Retirement Living takes an unbiased approach to our reviews. We may earn money when you click a partner link. Learn More

With tax day right around the corner, Americans are preparing to fork over a good portion of their earnings to Uncle Sam. But if you live in a state with no income tax, your overall tax burden is much lower.

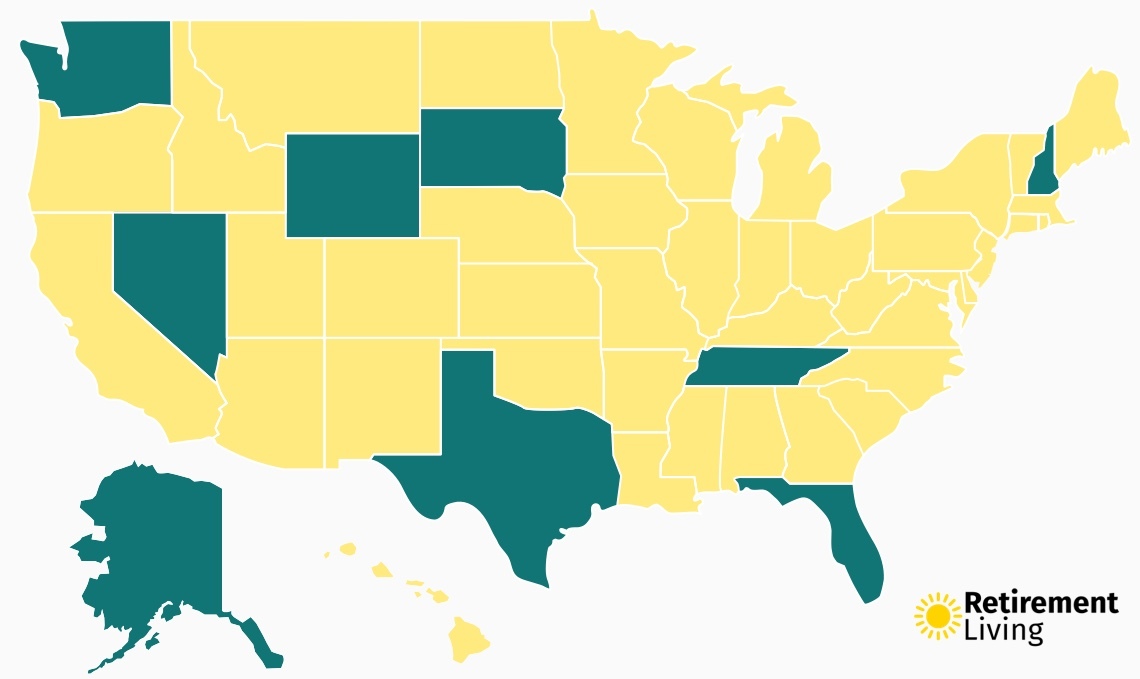

As of 2024, nine states do not levy a state income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. Could a tenth state soon be added to the list?

Oklahoma is “on a Path to Zero”

Governor Kevin Stitt and House Speaker Charles McCall propose removing the state income tax in Oklahoma. House Bill 2949 would create a flat-tax system with a rate of 4.4%. Over time, the personal income tax will decrease in small increments until it’s eliminated entirely under the bill.

This comes after signing a grocery tax cut into law in February 2024. Starting in August, Oklahoma shoppers will no longer pay state taxes on groceries, saving 4.5%. Up next are attempts to cut income taxes and rework the state’s tax structure to favor residents.

“We think we need to put Oklahoma on a path to zero,” Stitt said.

Under the current system, those in the top tax bracket pay a 4.75% rate on income over $7,200 for single filers and $12,200 for joint filers (married couples). This bill would lower the rate to 4.4% for those who earn more than $10,000 and joint filers and heads of households earn more than $20,000. Each year the rate will decrease by a percentage of a point until the rate is zero.

This is to keep up with neighboring states offering more favorable tax climates to residents, like Texas, which has no income tax, and Arkansas, Iowa, and Nebraska, which are also lowering their rates.

“If we don’t keep up with the states around us, we will get left behind.”

U.S. States With No Income Tax

Here is how the nine states that currently do not levy an individual income tax compare. If you’re a taxpayer in one of these states, you are not required to file a state income tax return.

Alaska

Alaska has no state income or sales tax. With an average effective property tax rate of 1.19% and no sales tax, Alaska is a paradise for budget-conscious adventurers. The total state and local tax burden on Alaskans, including income, property, sales, and excise taxes, is 5.06% of personal income, the lowest of all 50 states.

Florida

With its balmy weather and vibrant culture, Florida is a magnet for residents seeking tax relief. In addition to no personal income tax — including retirement income or social security benefits — Floridians enjoy an average effective property tax rate of 0.83%. However, a recent Retirement Living survey found that residents are now contending with a competitive housing market and prices, attributing to a higher cost of living overall.

Read more: States That Still Tax Social Security Benefits

Nevada

Thanks to a thriving tourism and gaming market, Nevada generates most of its revenue from sales and excise taxes. It relies heavily on tax revenue earned on everything from groceries and clothes to casinos and hotels. Nevada’s sin taxes on alcohol and gambling are also what helps enable it to forgo state income tax.

New Hampshire

While New Hampshire does not tax most earned income, it does impose a 3% tax on dividends and interest. This will phase out completely in 2025. At just 6.14%, the state’s overall tax burden is also lower than most. But revenue must come from somewhere. New Hampshire’s effective property tax rate is 2.18%, which is among the highest in the country.

South Dakota

South Dakota offsets its higher sales taxes on items such as tobacco, alcohol, and fuel with a 0% personal income tax rate. Retirees and workers alike can keep wages earned from all sources, including Social Security, pensions, and retirement plans. All in all, South Dakota is more tax-friendly than its northern neighbor.

Read more: States That Don’t Tax Retirement Pensions

Texas

Texans save big when it comes to taxes. The state’s aversion to personal income tax is so strong that it’s listed in the Texas constitution. Nearly half a million Americans have moved to Texas since July 2021, and the state is outpacing the nation in job growth. On the flip side, property tax is the nation’s seventh highest, and local sales taxes in some jurisdictions are quite steep.

Tennessee

Having fully phased out its personal income tax in 2021, Texas is one of the newest additions to the list of zero-income-tax states. Its overall tax burden is gloriously low — the fourth lowest in the nation. Housing costs are low, and the economy is booming, making Tennessee a tax-friendly retirement haven.

Washington

Washington doesn’t tax most forms of personal income, but it does levy a long-term capital gains tax rate of 7% on assets that were sold for a profit of $250,000 or more. In July 2023, Washington enacted the WA Cares Fund, which takes 58 cents per $100 from employees’ paychecks and funnels it into the state’s public long-term care program.

Wyoming

The least populated state in the U.S. is also one of the most affordable. Thanks to its no-income tax policy, Wyoming has the sixth-lowest tax burden in the country, 6.42%. Like Alaska, Wyoming generates much of its income from property, oil, sales, and excise taxes.

Should You Move to a State Without Income Tax?

If you live in a state with no personal income tax, you’ll get to keep a little bit more of your paycheck — your wages from Social Security, pensions, or retirement plans, such as 401(k)s or an individual retirement account (IRA) are yours to keep. And if you live in a state with high personal income tax rates like California, your financial incentives for moving are greater.

Here’s how taxes break down for the average American single worker with a salary of $70,000 in 2023:

- In California, where personal income is taxed at a gradual rate, you’d pay $3,066 in state income tax and your total estimated tax burden would be about $19,957.

- In Colorado, where personal income is taxed at a flat rate, you’d pay $2,471 in state income tax and your total estimated tax burden would be about $18,741.

- In Texas, where there is no personal income tax, your total estimated tax burden would be $19,503.

Remember, moving to a state without an income tax doesn’t mean you’ll be excused from paying other taxes. Taxpayers in these states are still subject to other types of taxes, including local, property and/or sales taxes. As you can see, once counting property taxes and sales taxes, Texas pays a similar amount in taxes as California, despite having no state income tax. Consult your financial advisor to determine how your tax burden will change depending on location, employment status, and retirement goals.

You must also consider other important financial and personal considerations. For example, some states have less affordable healthcare, fewer options for public transportation, higher crime, steeper housing costs, limited job opportunities, or minimal programs for senior care.

Bottom Line

While Alaska, Florida, Nevada, South Dakota, New Hampshire, Tennessee, Texas, Washington, and Wyoming don’t impose state income taxes, don’t go packing your bags just yet. There are a number of additional state taxes imposed outside of income tax; the best states for taxes are really determined on a case-by-case basis. You must weigh all taxes imposed based on your financial picture, plus the cost of living in each state — especially when planning for retirement.

RetirementLiving tracks all state taxes on its Taxes by State resource. We also evaluated every tax type the IRS levies to identify the most tax-friendly states in the U.S.