Which States Tax Social Security Benefits in 2024? Three States Revise Their Rules

Updated:

Retirement Living takes an unbiased approach to our reviews. We may earn money when you click a partner link. Learn More

Tax day will be easier to bear for residents in Missouri and Nebraska — as of January 1, 2024, retirees no longer have to pay state income taxes on their Social Security benefits. (Residents here will still owe Social Security benefit taxes when they file their 2023 returns this year, but they won’t have to worry about this in future years.)

In West Virginia, legislatures in the House of Delegates unanimously passed a bill in March 2024 that would exempt Social Security payments for all earners from state income tax by 2026. The bill still needs Senate approval, but it would expand exemptions to all residents. West Virginia’s current exemption is income-dependent and only available to some.

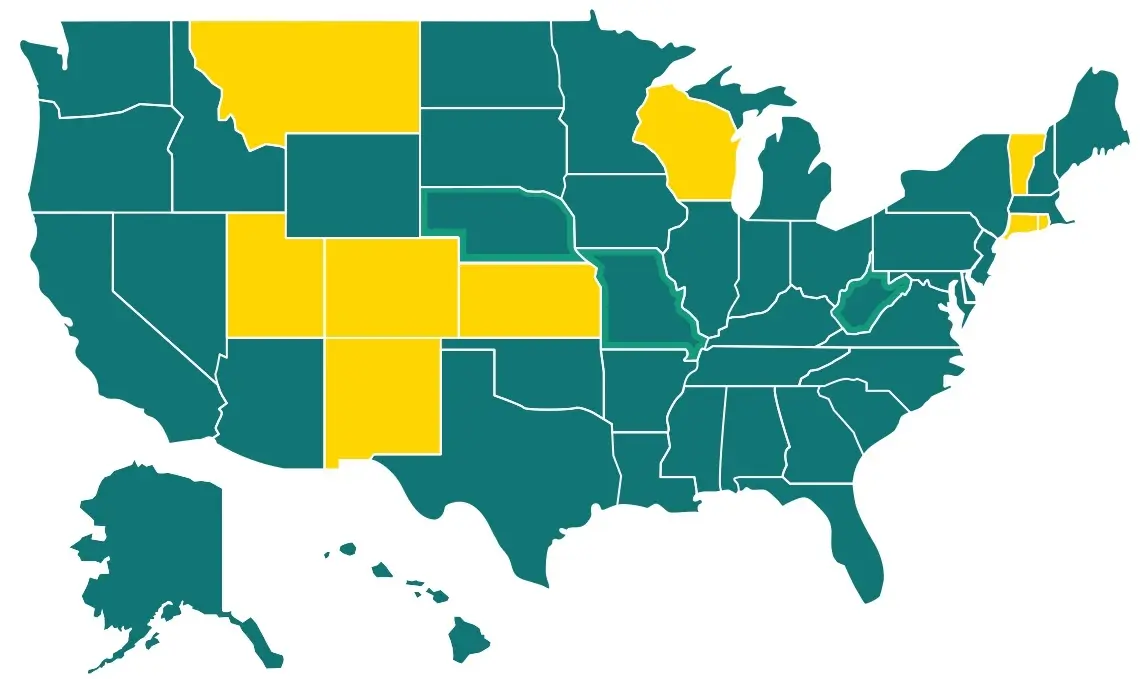

With these changes in motion, there are only 10 states left that still take a cut of their seniors’ Social Security checks. And as retirees struggle to keep up with the rising costs of inflation, such tax exemptions can help older residents stay afloat financially.

Navigating federal and state taxes on a tight budget is tough for many. The national average monthly Social Security benefit for retirees in 2024 is about $1,909, or just over $22,000 annually. The Administration’s cost-of-living adjustment for the year is just 3.2%.

Most states don’t tax Social Security benefits, and a handful don’t tax retirement income at all—but a few still do: Colorado, Connecticut, Kansas, Minnesota, Montana, New Mexico, Rhode Island, Utah, Vermont, and West Virginia. However, not every retiree living in these states will have to pay taxes on their benefits. Each of these 10 states offers income and age-based exemptions.

These States Still Tax Social Security Benefits

The following 10 states still tax the Social Security benefits of some retirees:

- Colorado: Retirees between 55 and 64 can deduct up to $20,000 in retirement income ($24,000 for those 65 and older). All income greater than that is taxed at 4.4%.

- Connecticut: If your income exceeds $100,000 for joint filers and $75,000 for singles, 25% of your benefits are taxed. Otherwise, income is subject to tax rates ranging from 3% to 6.99%.

- Kansas: If your income exceeds $75,000, your benefits are taxed at a rate between 3.1% and 5.7%, regardless of filing status.

- Minnesota: Taxes apply if your income exceeds $105,380 for joint filers or $82,190 for singles, though the state’s Social Security Subtraction rule allows for a small subtraction for retirees with incomes above the threshold. The tax will be eliminated completely in tax year 2024.

- Montana: If your income exceeds $32,000 for joint filers and 25,000 for singles, your benefits are taxed at a rate between 1% and 6%.

- New Mexico: If your income exceeds $150,000 for married couples or $100,000 for single filers, your benefits are taxed at a rate between 1.7% and 5.9%.

- Rhode Island: If you’re of full retirement age (currently 67) and have an income greater than $119,750 for couples or $95,800 for singles, your benefits are taxed at a rate between 3.75% and 5.9%.

- Utah: Benefits are taxed at a rate of 4.65%, though you qualify for a full credit if your income is less than $75,000 for couples and $45,000 for singles. Retirees who earn more are eligible for a credit that declines by 25 cents for every dollar above the income threshold.

- Vermont: Benefits are taxed if your income exceeds $65,000 for joint filers and $50,000 for singles.

- West Virginia: No tax for those making less than $100,000 filing jointly and $50,000 for a single person. The 2024 proposal, requiring approval from the Senate, would cut the tax for all residents by 35% in 2024, 65% in 2025, and eliminate it entirely by 2026.

FYI: You Could Still Owe Federal Taxes

Remember, the federal government taxes Social Security benefits, too. If your provisional income exceeds a certain amount, the IRS will tax your benefits, regardless of where you live. Your provisional income is your adjusted gross income (AGI), plus any nontaxable interest, and half your annual Social Security benefit. The thresholds for tax year 2023 are as follows:

| Filing Status | Provisional Income | Social Security Tax Rate |

|---|---|---|

| Single or Head of Household | Less than $25,000 | No Tax |

| Single or Head of Household | $25,000 – $34,000 | Up to 50% |

| Single or Head of Household | More than $34,000 | Up to 85% |

| Joint Filers | Less than $32,000 | No Tax |

| Joint Filers | $32,000 – $44,000 | Up to 50% |

| Joint Filers | More than $44,000 | Up to 85% |

If you fall within these thresholds, it means that 50% to 85% of your Social Security benefits are subject to ordinary income tax.

Read more: Social Security Tax Limits

Should You Move to a State Without Social Security Taxes?

Before moving to a state that doesn’t tax Social Security benefits, it’s important to study the entire tax picture and consider other quality-of-life metrics. States that don’t tax personal income usually make up for it in other ways, like with property and sales taxes. Cost of living, access to affordable healthcare, and housing costs also play a big part in your ability to afford retirement.

Talk with a financial advisor before making any interstate moves to determine how your tax burden will change depending on location, employment status, and retirement goals.

RetirementLiving tracks all state taxes on its Taxes by State resource. We also evaluated every tax type the IRS levies to identify the most tax-friendly states in the U.S.