Monex Review

As a gold and precious metals marketplace, Monex Deposit Company helps buyers invest in gold, silver, platinum, and palladium coins and bullion. You can buy large or small volumes of metals, from one gold bullion to 100 silver coins. Its inventory includes some of the most popular and valuable global precious metal products.

In addition to its buying and selling services, Monex has several educational investment resources available for download. These can be helpful for investors looking to diversify their portfolios. For more personalized support, a Monex account representative can guide you through the buying and selling process. They will remain available to answer your questions.

Pros:

- Displays real-time spot and bid prices online

- Can sell to Monex even if you didn’t buy from them

- Lots of educational resources

- Online app

Cons:

- Website lacks detailed fee information

Gold and other precious metal IRAs are an investment and carry risk. Consumers should be alert to claims that customers can make a lot of money in these or any investment with little risk. As with any investment, you can lose money and past performance is not a guarantee of future performance results. Consumers should also obtain a clear understanding of the fees associated with any investment before agreeing to invest.

How to Buy Gold With Monex

To buy gold and other precious metals through Monex, first explore the website to shop all gold, silver, platinum, and palladium inventory. By listing the current ask and bid prices online, Monex makes buying precious metals quick and easy.

After you decide which products to invest in and how much to purchase, you’ll call an account representative to initiate the ordering process. On a recorded line, the representative will confirm the details of your purchase, including quantity and price point, and confirm your acknowledgment. Once paid, you can choose to ship your metals to your home or store them in a depository.

How to Sell Gold With Monex

Should you decide to sell your precious metals, a Monex representative will give you instructions on how to send your physical metals to Monex. Every precious metal investor can leverage the “Monex Buy Back Program,” whether or not you bought from the company originally.

Once the depository confirms receipt of your metals, Monex will authorize the purchase, and an account representative will call you on a recorded line to lock in a sale based on the current bid price. Sell charges apply. You’ll receive your disbursement funds within 48 hours.

Monex Costs

Monex lists the metal premium on the buy page, so you can easily compare the “ask” and “spot” prices before purchasing. Aside from displaying live precious metal pricing on its website, Monex keeps its other cost details, like premiums and transaction fees, private.

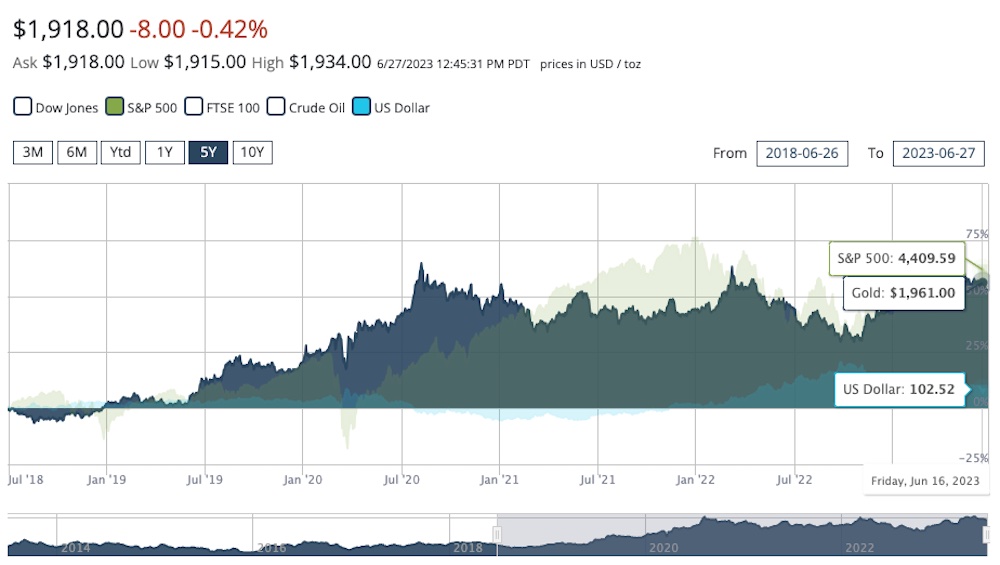

Gold, silver, and platinum spot prices fluctuate daily. For example, the spot price per gold ounce at the time this article was written was $1,965.00.

Monex charges a shipping fee of $20 per shipment, plus $1 per oz of metal for gold, platinum, and palladium bullion and coins. The fee for shipping silver is $85 per 1,000-ounce bar of silver.

| Gold American Eagle Coin | Ask: $2,089.50 Bid: $2,017.70 |

| Gold Canadian Maple Leaf Coin | Ask: $2,043.30 Bid: $1,973.10 |

| American Eagle Silver Coins | As low as: $3,634.08 |

*Price accurate at time of publishing

Monex Complaints

Monex is not accredited with the Better Business Bureau and its profile currently displays an alert for a government action involving business misconduct from July 2021. This case appears to be ongoing.

Elsewhere, Monex Deposit Company has a positive online reputation on verified sites like Trustpilot, where it boasts a 4.9-star rating and more than 2,900 reviews.

FAQs

Does Monex provide storage options?

No. Monex is just a precious metals marketplace for buying and selling. You can ship your metals to your home or a depository.

Can I keep the gold I buy from Monex in my home or a safe deposit box?

If you buy precious metals outside of an IRA, you can store your bars, bullion, or coins wherever you like. Although storing gold at home can be risky without proper protections, Monex will ship your metals to you in discreet packaging. These metals remain fully insured until you receive them.

Can you get a gold IRA with Monex?

Monex is not an IRA company or custodian. You’ll need to contact one of Monex’s recommended Trustee/Custodians and designate Monex as your precious metals dealer. Once you fund the account with the custodian, a Monex representative will help you buy and ship IRA-eligible precious metals.

When can you contact Monex?

Though the company maintains an 11-hour trading day, Monex’s customer service availability is unclear; call a representative for clarification.

Conclusion

Monex offers an easy, streamlined process to buy and sell gold online. Investors can also access key market insights and price charts via the mobile app. The company does not offer portfolio management services or gold IRAs. While investing in precious metals is generally considered a safe endeavor, we recommend reviewing the educational resources available for download online or chatting with a Monex account representative before making any purchases.